1. What is the projected Compound Annual Growth Rate (CAGR) of the Securities?

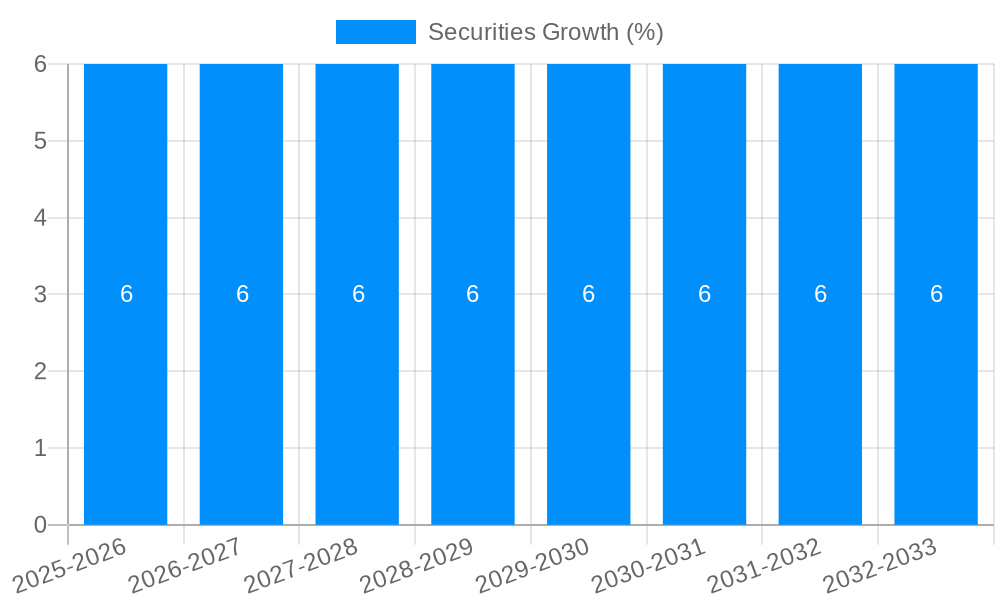

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Securities

SecuritiesSecurities by Application (Personal Investment, Institutional Investment), by Type (Currency Securities, Capital Securities), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

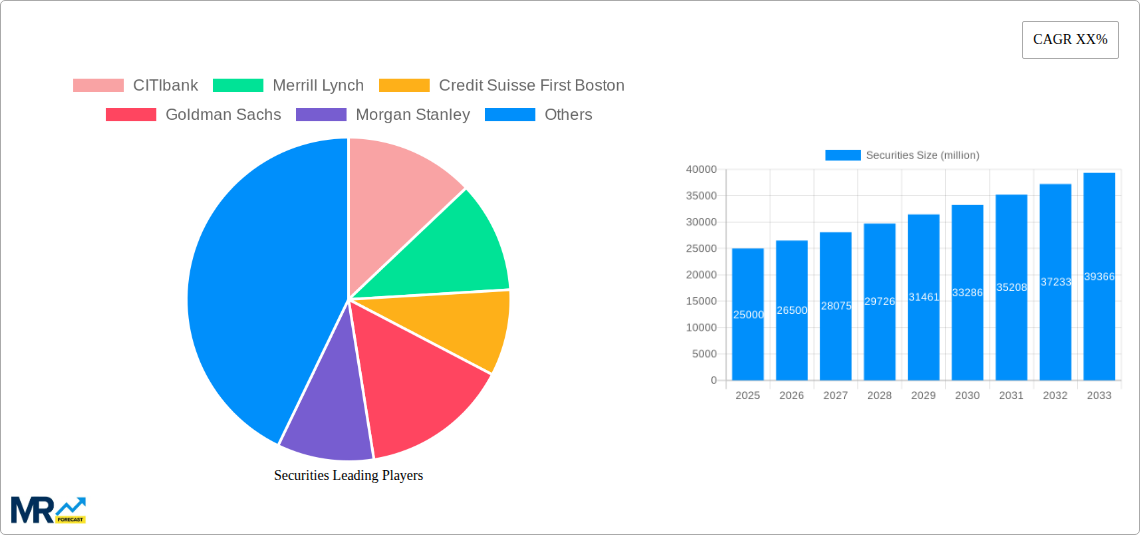

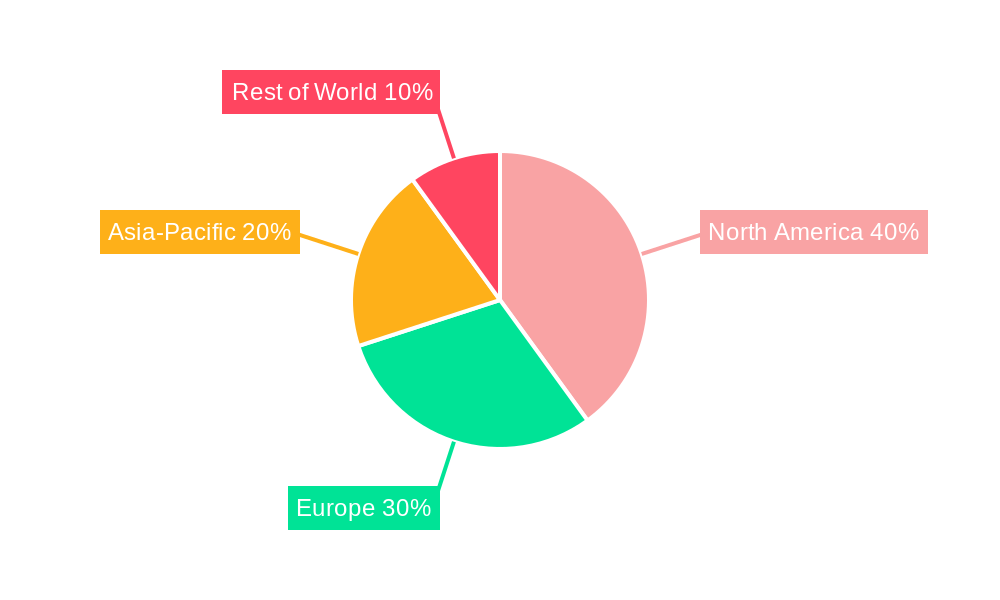

The global securities market, encompassing investment banking, brokerage services, and trading activities, is a dynamic and substantial sector. While precise figures for market size and CAGR are unavailable, we can infer substantial growth based on the involvement of major global financial institutions like Citibank, Goldman Sachs, and J.P. Morgan, indicating a market valued in the trillions. The presence of prominent Asian firms like CITIC Securities and Huatai Securities highlights the market's global reach and expansion into rapidly developing economies. Drivers for growth include increasing global investment, technological advancements enabling high-frequency trading and algorithmic strategies, and the rise of sophisticated investment products catering to diverse investor needs. Trends like the increasing adoption of fintech solutions, regulatory changes impacting market structure, and fluctuating interest rates significantly influence market performance. However, restraints include geopolitical instability, regulatory scrutiny, and cyclical economic downturns that can impact investor confidence and trading volumes. Segmentation within the market is likely multifaceted, potentially including equity trading, fixed income, derivatives, and wealth management services, each with its own growth trajectory. The period from 2019 to 2024 represents a baseline period from which future growth is projected, with 2025 acting as the base year for future forecasts extending to 2033.

The forecast period (2025-2033) offers significant opportunity for growth within specific segments. The expansion of online brokerage services and the increasing popularity of passive investment strategies (e.g., ETFs) suggest a shift in how investors engage with the market. Moreover, emerging markets present significant untapped potential, driving expansion for both established and emerging players. Successful companies will be those adept at navigating regulatory complexities, adapting to technological disruptions, and delivering innovative solutions that cater to evolving investor demands. The competitive landscape, populated by both established giants and ambitious newcomers, necessitates continuous innovation and a keen understanding of global market dynamics to thrive.

The global securities market, valued at $XXX million in 2025, is poised for significant growth during the forecast period (2025-2033). The historical period (2019-2024) witnessed fluctuating growth driven by a complex interplay of macroeconomic factors, technological advancements, and regulatory changes. The base year of 2025 provides a crucial benchmark to understand the trajectory of this dynamic market. While traditional securities trading remains a cornerstone, the increasing adoption of fintech solutions, algorithmic trading, and the rise of digital assets are reshaping the landscape. The market's performance in the coming years will heavily depend on the global economic climate, investor sentiment, and the evolving regulatory environment. Geopolitical uncertainties continue to present significant headwinds, influencing investor risk appetite and impacting trading volumes. Furthermore, the increasing sophistication of market participants and the proliferation of alternative investment strategies are contributing to a more competitive and complex securities market. This report delves into the specific trends observed across various segments, highlighting the drivers, challenges, and key players that are shaping the future of securities trading. The integration of artificial intelligence and machine learning in high-frequency trading and risk management presents both opportunities and challenges. Finally, the growing emphasis on Environmental, Social, and Governance (ESG) factors is increasingly influencing investment decisions and shaping corporate behavior, thereby impacting the securities market significantly.

Several factors contribute to the growth of the securities market. Firstly, the increasing global interconnectedness fosters cross-border investment and trading, expanding market size and liquidity. The rising adoption of digital technologies, particularly in areas like algorithmic trading and blockchain-based solutions, enhances efficiency and reduces transaction costs. This makes trading more accessible and cost-effective, attracting a wider range of investors. Moreover, the growing awareness of financial planning and the need for diversified investment portfolios are pushing individuals and institutions towards securities as a means of wealth creation and risk mitigation. The regulatory environment, while sometimes imposing constraints, also fosters market stability and trust, attracting investors. Finally, the evolution of sophisticated financial instruments and derivatives allows investors to manage risks effectively, facilitating higher participation in the market. These combined forces are pushing the securities market towards unprecedented levels of growth and sophistication. The development of more efficient and transparent trading platforms, coupled with increased access to market information, continues to fuel this momentum.

Despite the positive growth trajectory, the securities market faces significant challenges. Increased regulatory scrutiny aimed at protecting investors and maintaining market integrity can lead to higher compliance costs for market participants. Geopolitical instability and economic downturns create volatility, impacting investor confidence and trading activity. Cybersecurity threats pose a constant risk, with the potential for data breaches and market manipulation. Furthermore, the rapid pace of technological innovation necessitates continuous adaptation and investment to remain competitive. The complexity of modern financial instruments and the evolving regulatory landscape demand significant expertise and resources, creating a barrier to entry for smaller players. Finally, competition is fierce, with established players and new entrants constantly vying for market share. These challenges require strategic planning and adaptation from market participants to navigate the complexities of the securities industry successfully.

Dominant Segments:

The combined impact of technological advancements, regulatory changes, and economic growth will continue to shape the dominance of these regions and segments in the coming years. Increased investor sophistication and the ongoing shift towards passive investment strategies will also significantly influence the landscape.

The securities industry is experiencing growth spurred by several key catalysts. Increased adoption of digital platforms and automated trading systems has significantly reduced transaction costs and improved efficiency. Simultaneously, the rising popularity of passive investment strategies like ETFs provides diversified exposure and affordability for a broader investor base. Finally, the expanding regulatory framework fosters investor confidence and protects against market manipulation. These factors synergistically contribute to the sector's vibrant growth trajectory.

This report provides a comprehensive overview of the securities market, analyzing historical trends, current market dynamics, and future growth projections. It identifies key drivers, challenges, and opportunities, providing valuable insights for industry stakeholders, investors, and regulators. The report offers detailed information on market segmentation, leading players, and significant developments, offering a complete understanding of this rapidly evolving market. It considers both macro and micro factors influencing the industry and forecasts future trends with a high degree of accuracy.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include CITIbank, Merrill Lynch, Credit Suisse First Boston, Goldman Sachs, Morgan Stanley, J.P.Morgan, LEHMAN BROTHERS, Bear Stearns Cos., Deutsche Bank, CITIC Securities, Guotai Junan Securities, Huatai Securities, Cms China, GF Securities.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Securities," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Securities, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.