1. What is the projected Compound Annual Growth Rate (CAGR) of the Secondhand Apparel Rental?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Secondhand Apparel Rental

Secondhand Apparel RentalSecondhand Apparel Rental by Type (Clothing, Footwear, Accessories, Others), by Application (Online Retailers, Brick-And-Mortar Stores, Specialty Stores, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

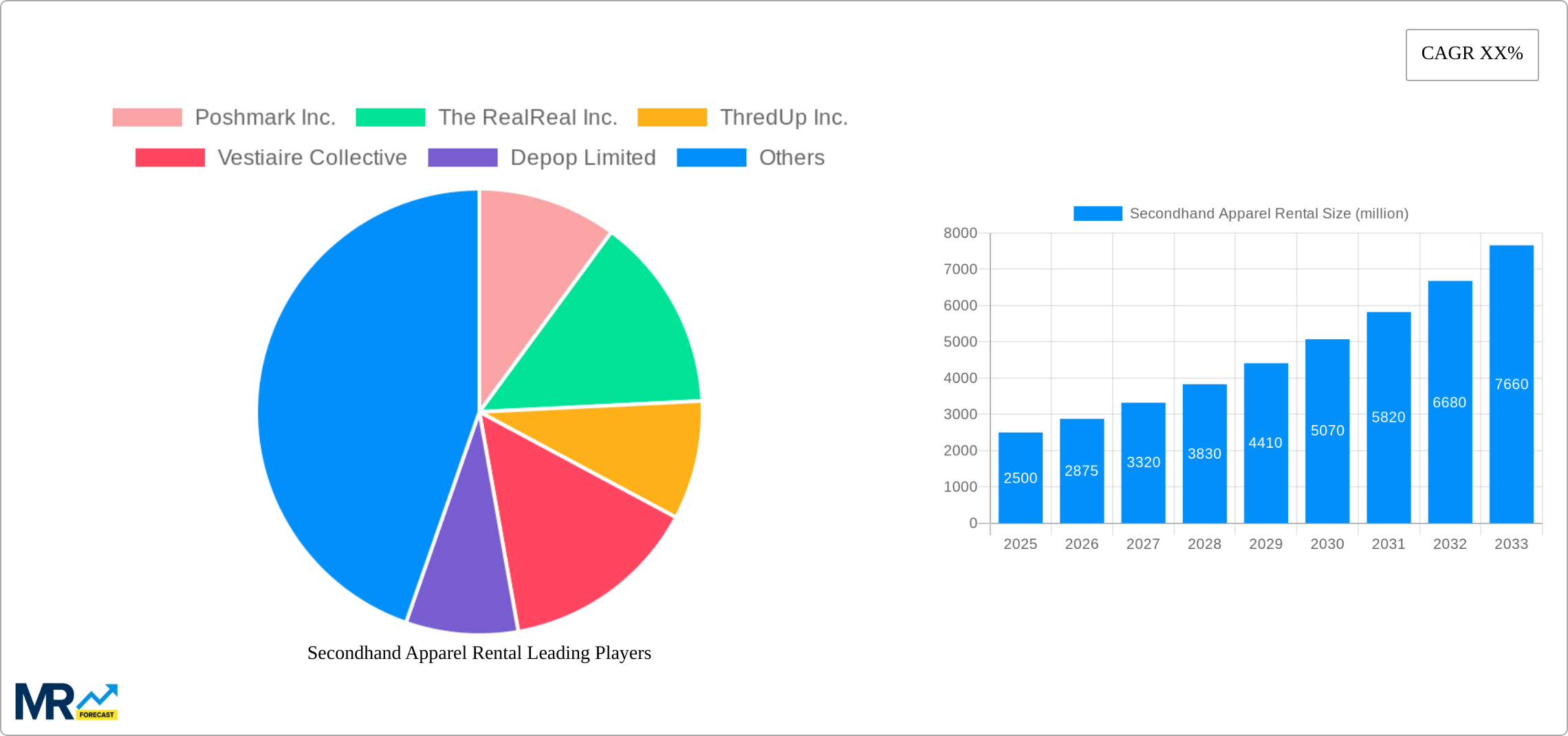

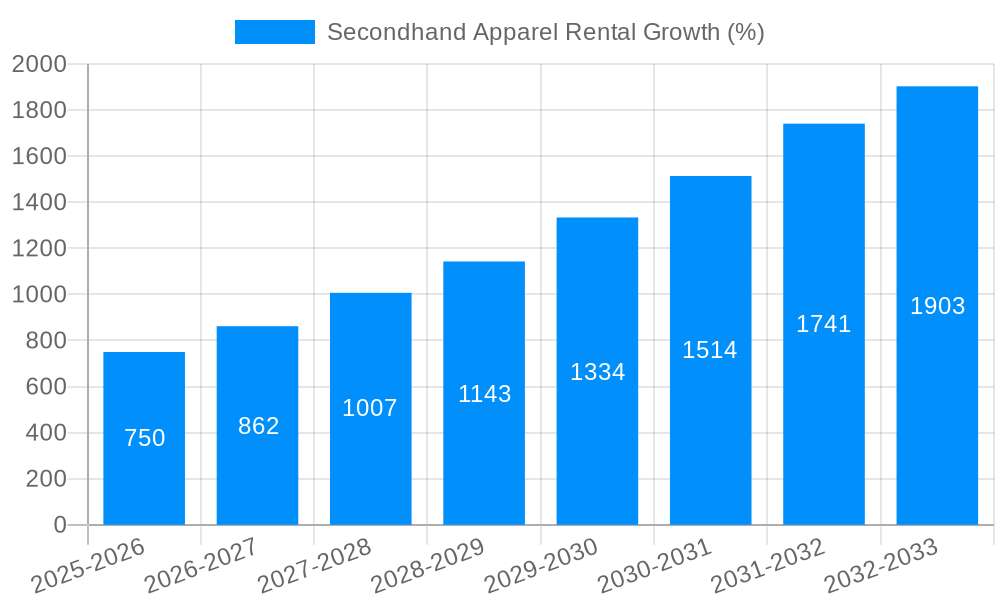

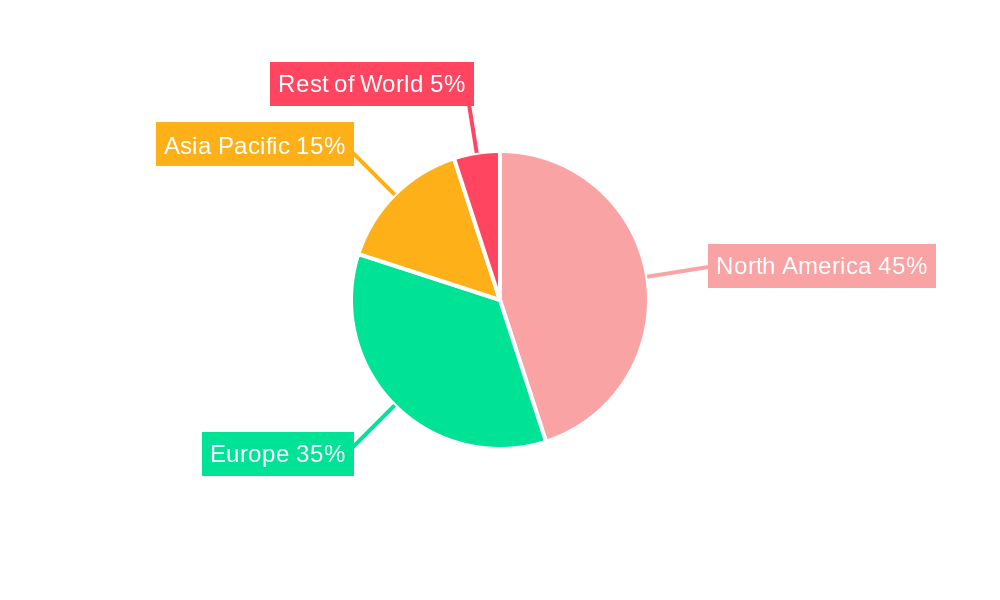

The secondhand apparel rental market is experiencing robust growth, driven by increasing consumer awareness of sustainability, a desire for unique fashion, and the affordability it offers compared to traditional retail. The market's expansion is fueled by several key trends, including the rise of online platforms connecting renters and owners, the increasing popularity of subscription services offering curated apparel selections, and the growing acceptance of pre-owned clothing as a stylish and ethical alternative. While precise market sizing data is unavailable, considering the significant growth in related sectors like secondhand clothing sales (estimated to reach hundreds of billions globally), and applying a conservative estimate for the rental segment's share (perhaps 5-10%), the market size in 2025 could be valued in the low billions of US dollars. A Compound Annual Growth Rate (CAGR) of 15-20% over the forecast period (2025-2033) seems reasonable given the current market momentum. Geographical distribution shows significant concentration in North America and Europe, driven by high disposable incomes and strong e-commerce infrastructure, though developing markets in Asia-Pacific exhibit high growth potential.

Segment-wise, online retailers are dominating the space, but brick-and-mortar stores and specialty boutiques are increasingly integrating rental options to cater to diverse consumer preferences. Clothing remains the largest segment, followed by accessories and footwear. While the market faces challenges such as managing logistics, maintaining the quality of rented apparel, and overcoming consumer concerns about hygiene, the overall outlook is optimistic. The increasing environmental consciousness among consumers and the market’s ability to adapt and innovate will ensure continued expansion. Companies such as Poshmark, The RealReal, and ThredUp are key players, while new entrants and innovative business models are continuously emerging, enhancing competition and further fueling market growth. The market's success hinges on effectively addressing sustainability concerns, improving the customer experience, and leveraging technology for streamlined operations.

The secondhand apparel rental market is experiencing explosive growth, projected to reach multi-million unit sales within the forecast period (2025-2033). Driven by increasing environmental consciousness, a desire for affordability and variety, and the influence of social media trends, consumers are increasingly embracing renting instead of buying new clothing. This report analyzes the market from 2019 to 2033, with 2025 serving as both the estimated and base year. Key market insights reveal a significant shift in consumer behavior, with millennials and Gen Z leading the charge towards sustainable and cost-effective fashion choices. The market's growth is not solely dependent on the burgeoning online platforms; brick-and-mortar stores are also actively integrating rental services, recognizing the lucrative potential. The diversity in the types of apparel being rented – clothing, footwear, accessories, and others – further fuels this expansion, catering to a broad spectrum of consumer needs. The historical period (2019-2024) shows a steady increase in market size, laying a strong foundation for the impressive growth anticipated in the coming years. This growth is not uniform across all segments. While online retailers dominate currently, physical stores are making inroads, and specialty stores focusing solely on rental services are also emerging as key players. The market’s success hinges on overcoming certain challenges, which we will discuss later in this report. Data from this study indicates a compound annual growth rate (CAGR) that substantially outpaces traditional apparel retail, highlighting the disruptive nature of the secondhand apparel rental market. The market is also becoming more sophisticated, with technology playing an increasingly important role in streamlining the rental process, from online platforms to inventory management and logistics.

Several factors contribute to the rapid expansion of the secondhand apparel rental market. Firstly, growing environmental awareness is pushing consumers towards more sustainable consumption habits. Renting clothes significantly reduces textile waste compared to fast fashion. Secondly, the rising cost of living, particularly among younger demographics, makes renting a financially attractive alternative to purchasing new clothing, offering access to a wider variety of styles without the commitment of ownership. Thirdly, the pervasive influence of social media platforms showcasing diverse styles and trends encourages consumers to experiment with different looks, fueling the demand for rental services. The ease of access provided by online platforms further boosts the market's growth. These platforms offer a curated selection of clothing items, simplified rental processes, and convenient delivery and return options, making renting apparel remarkably user-friendly. Moreover, the growing popularity of subscription services and the increasing adoption of sharing economy models contribute to the market’s rise. The successful integration of technology into various aspects of the rental process, ranging from inventory management to customer service, further streamlines operations and enhances the customer experience. This combination of sustainability, affordability, convenience, and trend-driven demand positions the secondhand apparel rental market for continued growth.

Despite its promising growth trajectory, the secondhand apparel rental market faces several challenges. Maintaining the quality and hygiene of rented garments is paramount, requiring robust cleaning and sanitation processes. Damage and loss of inventory represent significant financial risks for rental businesses. Effective inventory management and logistics are crucial for providing a seamless customer experience. Building trust and ensuring transparency regarding the condition and history of rented items are vital to overcoming consumer apprehension. Competition from established fast fashion brands and other e-commerce players is intensifying. Furthermore, managing returns and ensuring prompt delivery can be operationally complex and expensive. The market also needs to address potential legal issues related to liability for damaged or lost goods, and regulatory frameworks governing hygiene and sanitation may need adaptation for this unique market. Finally, the challenge of accurately assessing the market value of used garments and establishing a sustainable pricing model continues to be a hurdle for many rental businesses. Overcoming these challenges will be key to unlocking the full potential of this rapidly evolving sector.

The secondhand apparel rental market demonstrates significant regional variations, with developed economies exhibiting higher adoption rates. North America and Europe are currently leading the market, primarily due to higher levels of environmental awareness, disposable income, and access to technology. However, Asia-Pacific is poised for substantial growth, fueled by a burgeoning middle class and increasing internet penetration.

Key Segments:

Online Retailers: This segment currently dominates, due to its convenience and scalability, reaching a wider audience compared to traditional brick-and-mortar stores. Online platforms offer a more diversified selection of apparel across various styles and brands. The ease of browsing, selecting, and managing rentals online enhances the overall consumer experience. Millions of units are projected to be rented through online platforms in the coming years.

Clothing: This constitutes the largest segment within the market, reflecting the ubiquitous nature of clothing in daily life. The variety of clothing types, styles, and brands available for rent contributes significantly to the popularity of the segment. The ease of renting different outfits for various occasions makes clothing rental particularly attractive.

Millennials and Gen Z: This demographic group actively drives market growth, exhibiting a strong preference for renting due to their environmentally conscious values and budget-friendly preferences. They are also heavy users of social media, further driving the trend.

Paragraph Summary: The dominant players are found in North America and Europe due to the higher environmental consciousness, disposable incomes, and technological advancement. However, the Asia-Pacific region is expected to show significant growth in the coming years. The online retail segment holds the majority share, with clothing as the most sought-after category, driven by the preference of younger demographics (Millennials and Gen Z) for sustainable and affordable fashion.

Several key factors are accelerating the growth of the secondhand apparel rental industry. Increased environmental awareness among consumers is driving the demand for sustainable fashion choices. The rising cost of living is making apparel rental an attractive alternative to purchasing new clothes. Technological advancements, such as improved online platforms and streamlined logistics, are enhancing the rental experience. Social media's influence on fashion trends encourages consumers to experiment with different styles without significant financial commitment. The expanding adoption of subscription services further fuels market growth, offering convenience and cost predictability for customers. Finally, the growing popularity of the sharing economy and circular economy models aligns perfectly with the concept of apparel rental, supporting its widespread acceptance.

This report provides a comprehensive overview of the secondhand apparel rental market, encompassing market size estimations, key trends, driving factors, challenges, and future growth projections. The study delves into detailed segment analysis, highlighting regional variations and the role of leading players. By combining historical data with future forecasts, this report offers valuable insights for businesses seeking to navigate this dynamic and rapidly growing market. The findings provide a strategic roadmap for stakeholders, enabling informed decision-making in this evolving landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Poshmark Inc., The RealReal Inc., ThredUp Inc., Vestiaire Collective, Depop Limited, ASOS plc, Tradesy Inc., Grailed Inc., Vinted, Heroine, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Secondhand Apparel Rental," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Secondhand Apparel Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.