1. What is the projected Compound Annual Growth Rate (CAGR) of the Second-hand Luxury Business?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Second-hand Luxury Business

Second-hand Luxury BusinessSecond-hand Luxury Business by Type (Watches&Jewellery, Bags, Clothing, Others), by Application (Online, Offline), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

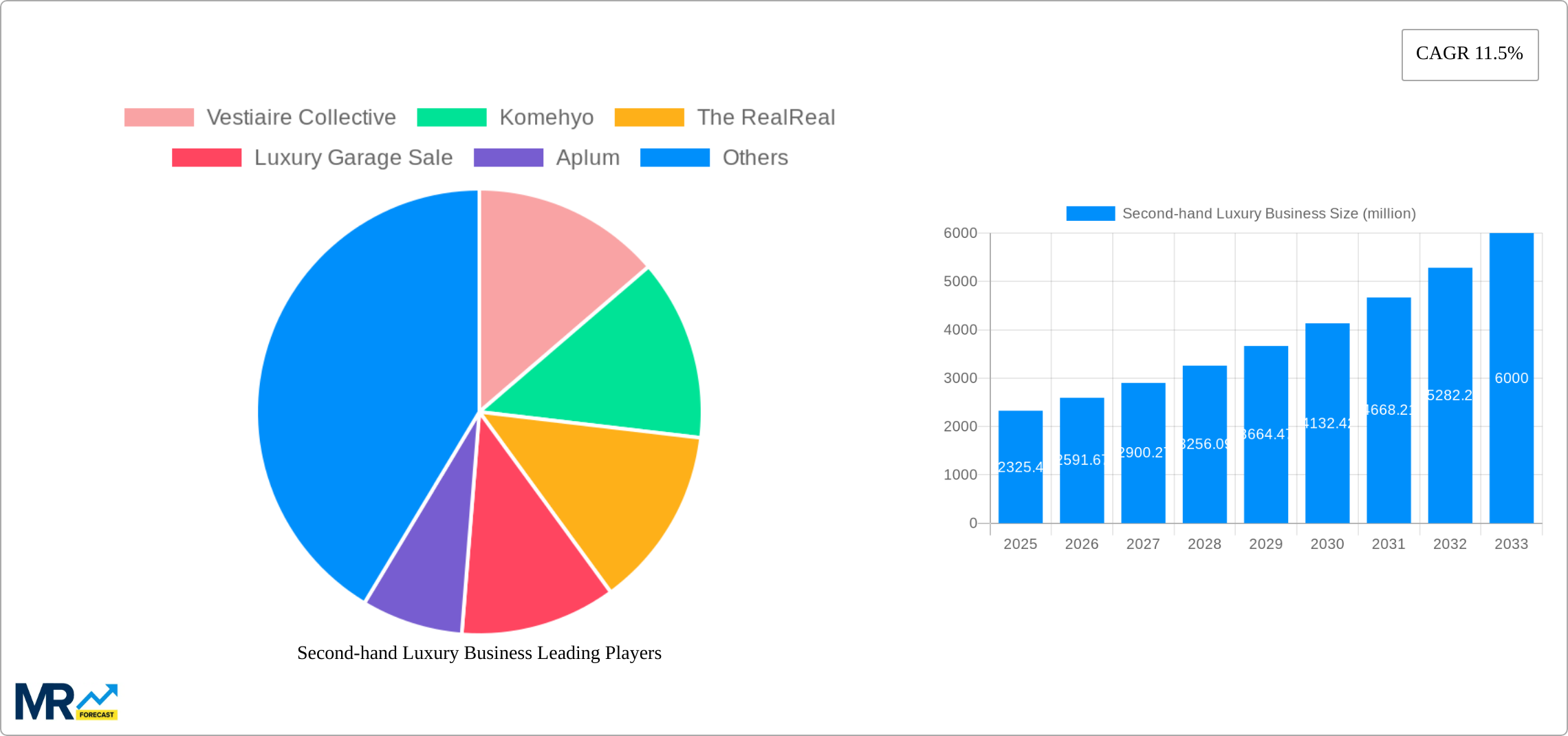

The secondhand luxury market, valued at $4,977.3 million in 2025, exhibits robust growth potential. Driven by increasing consumer awareness of sustainability, the desire for unique pieces, and the affordability offered by pre-owned luxury goods, this sector is experiencing a significant upswing. The online segment is a key driver, facilitating global reach and accessibility for both buyers and sellers. Popular platforms like Vestiaire Collective, The RealReal, and Poshmark cater to diverse consumer preferences, offering a curated selection of authenticated luxury items spanning watches & jewelry, bags, clothing, and other accessories. Geographic variations exist, with North America and Europe currently dominating the market due to established consumer bases and strong luxury retail infrastructure. However, Asia-Pacific is poised for significant expansion driven by rising disposable incomes and a burgeoning luxury consumer market. The market is segmented by product type (watches & jewellery, bags, clothing, others) and sales channel (online, offline), allowing for targeted market penetration strategies. The competitive landscape is dynamic, with both established players and emerging marketplaces vying for market share. Strategic partnerships, technological advancements in authentication, and the expansion into new geographic markets will be crucial for success in this rapidly evolving sector.

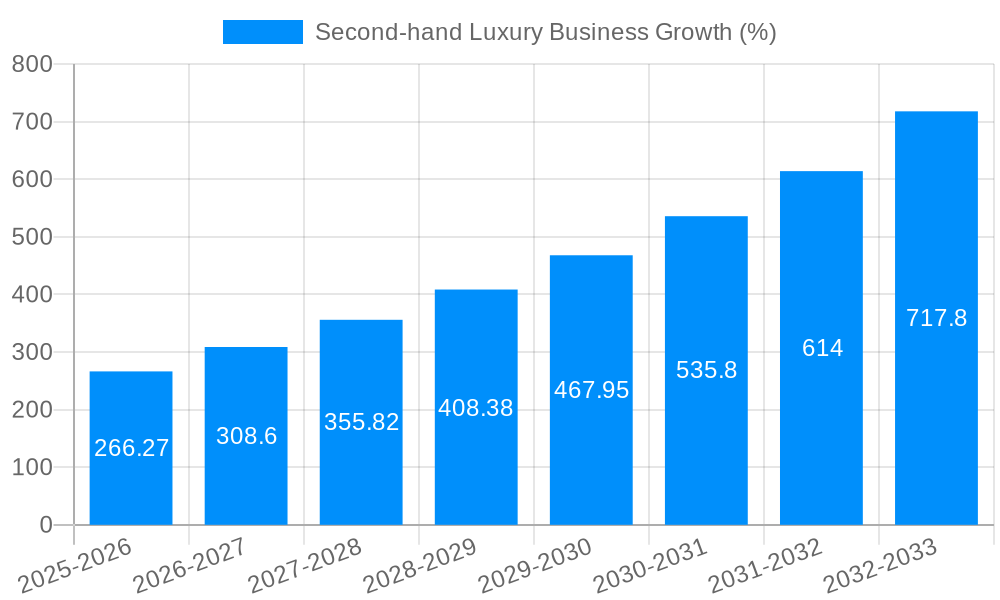

The projected Compound Annual Growth Rate (CAGR) – while not explicitly provided – is likely to be in the range of 15-20% for the forecast period (2025-2033), considering the current market dynamics and predicted growth in the luxury goods resale sector globally. This growth will be fueled by continued advancements in e-commerce, robust authentication processes gaining consumer trust, and increased focus on sustainable consumption patterns. Challenges include maintaining authenticity verification systems, managing logistics across borders, and competing with counterfeit products. However, given the significant growth in the broader luxury goods market and the rising appeal of sustainable consumption, the secondhand luxury market is well-positioned for substantial long-term growth. Strategic investments in technology, marketing, and logistics will be key differentiators in securing market dominance.

The second-hand luxury market experienced explosive growth between 2019 and 2024, exceeding expectations and establishing itself as a significant sector within the broader luxury industry. Driven by a confluence of factors – increased consumer awareness of sustainability, the desire for unique pieces, and the affordability offered by pre-owned luxury goods – the market demonstrated a Compound Annual Growth Rate (CAGR) well above the overall luxury goods market. By 2025, the market valuation is estimated to reach a staggering XXX million, a testament to its burgeoning popularity. This growth isn't confined to a single demographic; millennials and Gen Z are actively participating, attracted by both the financial savings and the curated, unique experiences offered by the pre-owned luxury market. The online segment, fueled by robust e-commerce platforms specializing in authenticated luxury goods, contributed significantly to this expansion. However, the offline market, particularly through established brick-and-mortar stores and consignment shops, maintains a strong presence, providing an element of tactile experience and trust that many consumers value. The market's diversity is further underscored by its varied product categories; handbags, watches, and jewelry continue to be leading segments, but the rising demand for pre-owned clothing and other luxury items indicates a broadening of consumer interest and market opportunities. The forecast period (2025-2033) projects continued robust expansion, with the market poised to reach even greater heights driven by technological advancements, evolving consumer preferences, and innovative business models. The report comprehensively analyzes these trends, providing detailed insights into market dynamics and future projections.

Several key factors are driving the remarkable growth of the second-hand luxury business. Firstly, the increasing awareness of sustainability and responsible consumption is profoundly influencing consumer behavior. Buying pre-owned luxury items extends the lifecycle of high-quality goods, reducing waste and minimizing the environmental impact associated with new production. Secondly, the pre-owned market offers considerable cost savings compared to purchasing new luxury goods, making luxury accessible to a wider consumer base. This affordability is particularly attractive to younger generations. Thirdly, the uniqueness and exclusivity associated with second-hand luxury items appeal to discerning consumers seeking one-of-a-kind pieces with a story. The potential to discover rare or vintage items unavailable elsewhere adds to the allure. Furthermore, technological advancements, particularly the rise of sophisticated authentication technologies and user-friendly online platforms, have greatly enhanced consumer trust and confidence in the second-hand luxury market. These platforms offer convenient access to a broad selection of authenticated goods, removing geographical limitations and streamlining the purchasing process. Finally, the emergence of innovative business models, such as subscription services and rental programs, are creating new avenues for engagement and driving market expansion. These dynamic forces are collectively fueling the rapid and sustained growth of the second-hand luxury market.

Despite the robust growth, several challenges and restraints exist within the second-hand luxury business. Authentication remains a crucial concern, as counterfeits can significantly damage consumer trust and brand reputation. Maintaining the authenticity and integrity of the goods requires rigorous verification processes, increasing operational costs and complexity for businesses. Furthermore, effective inventory management presents a challenge; accurately pricing and managing a diverse range of items, with varying market values and condition, requires expertise and sophisticated systems. Competition within the market is fierce, with both established players and new entrants vying for market share. This necessitates continuous innovation in terms of customer experience, technology, and branding to maintain a competitive edge. Logistics and shipping are also important considerations, especially for cross-border transactions. Ensuring secure and reliable shipping for high-value items, while adhering to international regulations, can be complex and costly. Finally, building and maintaining consumer trust is paramount. This requires not only robust authentication processes, but also clear and transparent return policies, excellent customer service, and a strong brand reputation. Addressing these challenges effectively will be critical for sustained success within the second-hand luxury market.

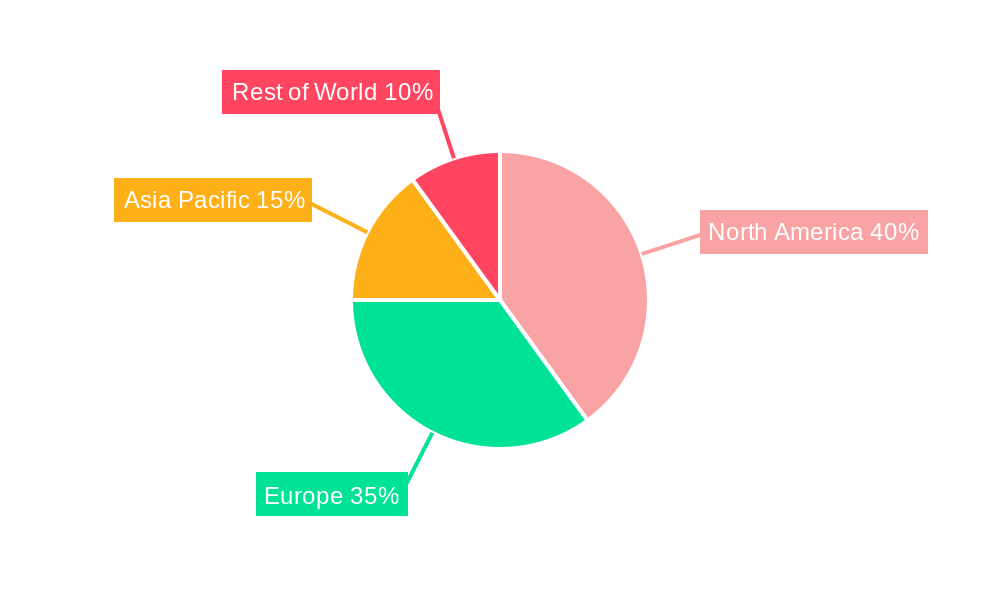

The second-hand luxury market demonstrates substantial regional variations in growth and preference. While specific figures are proprietary to the full report, we can highlight some key tendencies.

Online Segment Dominance: The online segment, fueled by platforms like Vestiaire Collective, The RealReal, and Secoo, is experiencing exponential growth across various regions, particularly in North America, Europe, and Asia. The convenience, accessibility, and global reach offered by online platforms are significantly driving market expansion. The ability to reach a wider customer base without geographical limitations has given online platforms a clear competitive advantage.

Handbags and Watches Leading: Within the product categories, handbags and watches consistently rank among the most popular and valuable segments. These items often hold their value well and are coveted by collectors and fashion enthusiasts. The high resale value of luxury handbags and watches contributes to their sustained popularity in the second-hand market.

Geographic Variations: North America and Europe traditionally hold leading market shares, driven by established luxury consumer bases and well-developed infrastructure for buying and selling pre-owned luxury goods. However, Asia is rapidly emerging as a significant growth area, fueled by increasing affluence, changing consumer preferences, and a strong appetite for both new and pre-owned luxury items. Emerging markets in other regions also demonstrate increasing interest in the second-hand luxury sector.

The Rise of the "Circular Economy": The growing consumer awareness of sustainability and the circular economy is significantly influencing consumer purchasing behavior, with many actively choosing to buy pre-owned luxury items to reduce their environmental impact and promote sustainable fashion. This shift in consumer sentiment contributes to the continued expansion of the second-hand luxury market globally.

Several factors will further propel the growth of the second-hand luxury market. Technological advancements in authentication, improved online marketplaces, and enhanced logistics will enhance consumer trust and convenience. The increasing emphasis on sustainability and responsible consumption will continue to draw environmentally conscious consumers. Further market penetration in emerging economies with growing affluent populations will unlock significant new revenue streams. Finally, innovative business models, such as rental and subscription services, will broaden market access and further fuel growth.

This report provides a detailed and comprehensive analysis of the second-hand luxury business, encompassing market trends, driving forces, challenges, regional performance, key players, and future growth projections. The report leverages extensive market research and data analysis to offer invaluable insights for businesses operating within or planning to enter this dynamic and rapidly evolving market. The detailed segmentation and forecasting provide a comprehensive understanding of the market's current state and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Vestiaire Collective, Komehyo, The RealReal, Luxury Garage Sale, Aplum, Secoo, What Goes Around Comes Around, Tradesy, Fashionphile, Poshmark, Hardly Ever Worn it, Sellier Knightsbridge, Cudoni, .

The market segments include Type, Application.

The market size is estimated to be USD 4977.3 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Second-hand Luxury Business," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Second-hand Luxury Business, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.