1. What is the projected Compound Annual Growth Rate (CAGR) of the Rural Commercial Bank?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Rural Commercial Bank

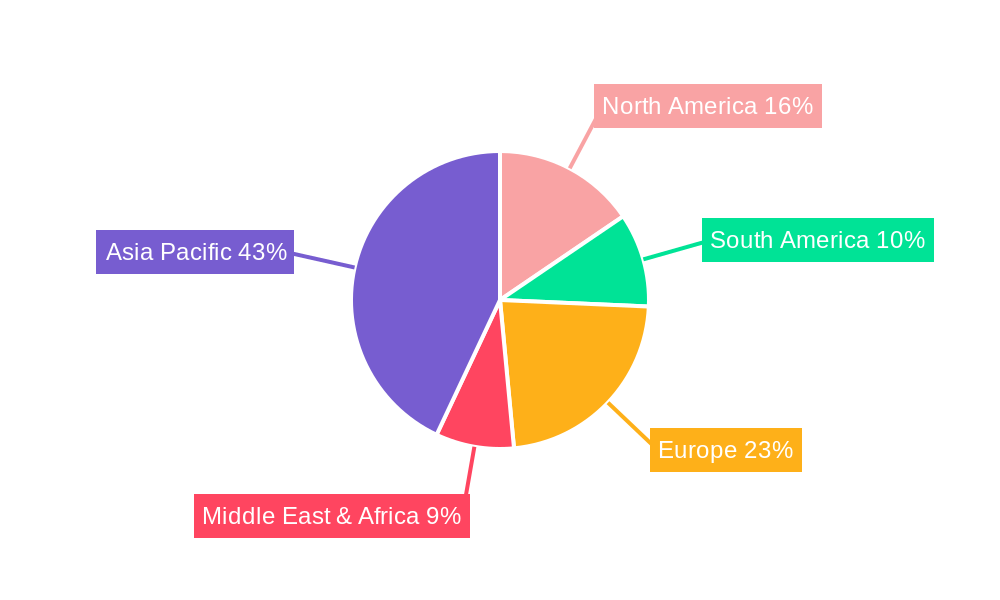

Rural Commercial BankRural Commercial Bank by Type (/> Cloud Based, Local Deployment), by Application (/> SMEs, Large Enterprise), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

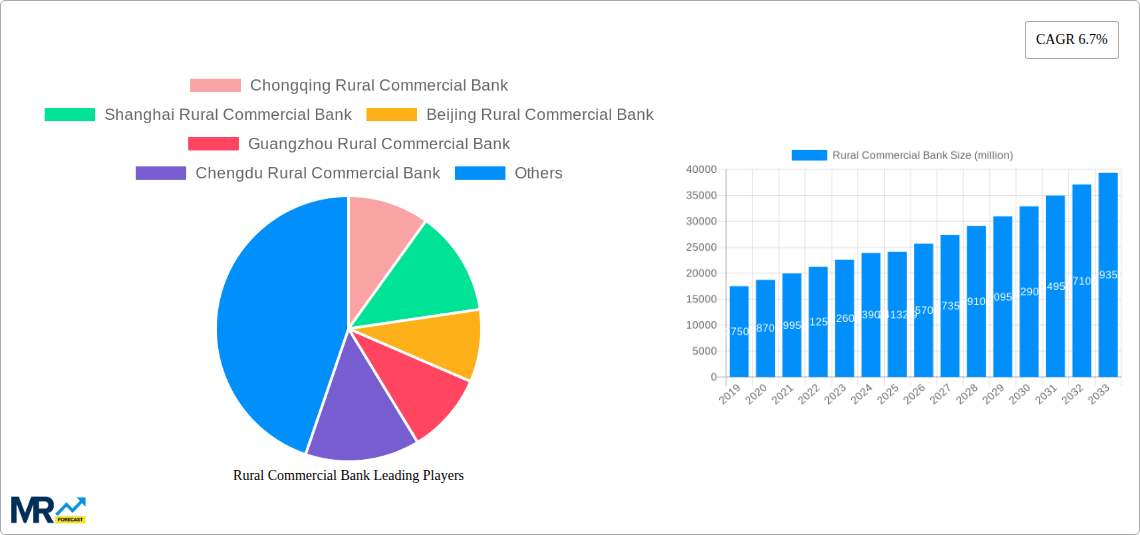

The Chinese Rural Commercial Bank (RCB) market, valued at $3,799.55 million in 2025, presents a significant opportunity for investors and stakeholders. Driven by increasing financial inclusion initiatives in rural areas, expanding digital banking adoption, and the growth of small and medium-sized enterprises (SMEs) in rural regions, the sector is poised for steady growth. The presence of numerous established players like Chongqing, Shanghai, and Beijing Rural Commercial Banks indicates a competitive yet fragmented landscape. These banks are strategically positioned to leverage the expanding rural economy, offering tailored financial services to meet the specific needs of rural communities and businesses. However, challenges remain, including infrastructure limitations in some areas, regulatory changes, and competition from larger commercial banks expanding their rural reach. The sector's future growth will likely depend on the successful implementation of digital strategies, effective risk management, and the ability to adapt to evolving customer demands. Strategic partnerships and innovations in financial technology (FinTech) will play a crucial role in driving future expansion.

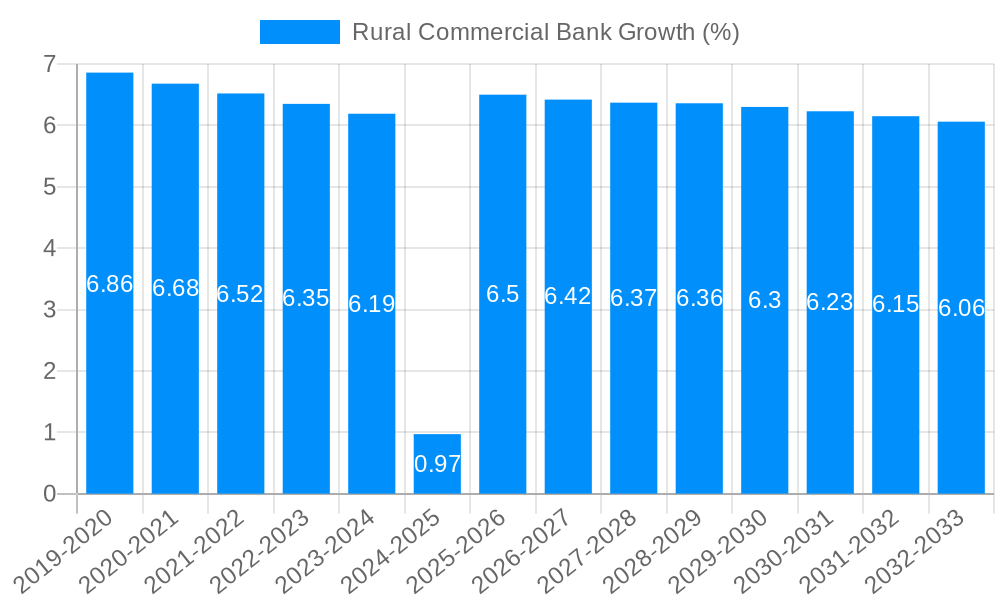

While precise CAGR data is unavailable, a reasonable estimation considering similar financial sectors and overall Chinese economic growth would place it between 5% and 8% annually over the forecast period (2025-2033). This projection anticipates a sustained but moderate growth trajectory, reflecting the interplay of positive drivers and inherent sector constraints. The RCB sector's evolution will heavily rely on continuous improvements in operational efficiency, risk mitigation, and customer service to maintain competitiveness within a dynamic and increasingly interconnected financial ecosystem. Focus on responsible lending practices and financial literacy programs will also be vital for long-term sustainability and market confidence.

The rural commercial banking sector in China experienced significant growth during the historical period (2019-2024), driven by increasing financial inclusion initiatives and the expanding rural economy. The market size, while not explicitly stated in the provided data, undoubtedly saw substantial increases in assets under management and transaction volumes. Key market insights reveal a shift towards digitalization, with a growing number of rural banks adopting fintech solutions to improve efficiency and reach underserved populations. This trend is expected to continue, accelerating financial inclusion in rural areas. Furthermore, increased government support in the form of subsidies and favorable regulatory policies has fostered a conducive environment for growth. However, challenges remain, including the management of non-performing loans (NPLs) and the need for continuous improvement in risk management practices. The estimated market size for 2025 indicates a continued positive trajectory, with projections for the forecast period (2025-2033) suggesting sustained expansion, albeit potentially at a moderated pace compared to the earlier, high-growth years. The competitive landscape is characterized by a mix of large and smaller players, with regional variations in market share and dominance. The projected growth is contingent upon successful navigation of the challenges discussed below, as well as ongoing adaptation to the evolving technological and regulatory landscape. The study period (2019-2033) encompasses a period of both significant expansion and adaptation for these banks, making for a complex but ultimately promising market analysis. The base year of 2025 provides a crucial benchmark for understanding the future trajectory of the sector.

Several key factors are propelling the growth of the rural commercial banking sector. Government initiatives aimed at boosting rural economies and promoting financial inclusion are significant drivers. These initiatives often include direct financial support, infrastructure development, and policies encouraging lending to rural businesses and individuals. The expanding rural economy itself, spurred by factors like agricultural modernization and the rise of rural entrepreneurship, creates a larger pool of potential customers for rural banks. Technological advancements, particularly in mobile banking and fintech, are enabling greater reach and efficiency, facilitating financial services access in remote areas. This reduces the cost of operations and allows for tailored financial products to specific rural needs. Moreover, the increasing adoption of digital payment systems and e-commerce in rural areas is boosting transaction volumes and creating new revenue streams for rural commercial banks. The consolidation and mergers of smaller rural banks have led to improved operational efficiency and stronger capital bases, increasing their competitiveness and resilience. The overall favorable macroeconomic environment, particularly in China, further contributes to the sector's growth trajectory. These factors collectively create a synergistic effect, bolstering the growth and expansion of rural commercial banking.

Despite the positive trends, several challenges and restraints hinder the growth of rural commercial banks. High non-performing loan (NPL) ratios remain a significant concern, particularly in regions with underdeveloped infrastructure or volatile agricultural economies. Managing credit risk effectively is crucial for maintaining financial stability. Competition from larger, more established banks and increasingly prevalent fintech companies poses a threat to market share. Rural banks need to adapt and innovate to remain competitive. Limited access to advanced technology and skilled human capital in some rural areas can restrict operational efficiency and service quality. Furthermore, the regulatory environment, while supportive, can also present complexities and compliance challenges, demanding continuous adaptation from the banks. The infrastructure limitations in certain rural areas can restrict access to banking services, impacting customer reach and potentially impacting profitability. Finally, the economic volatility inherent in the agricultural sector, a significant part of the rural economy, can significantly impact the financial health of rural banks, hence necessitating prudent risk management strategies.

The Chinese rural commercial banking sector is geographically diverse, with varying levels of development across provinces. While precise market share data is not provided, the following regions and banks are likely to be prominent players:

Provinces with robust agricultural economies and industrial growth: Provinces like Guangdong, Jiangsu, Shandong, and Henan are expected to contribute significantly to market growth due to their relatively developed rural economies and large populations.

Banks with strong regional presence: Banks like Chongqing Rural Commercial Bank, Shanghai Rural Commercial Bank, Beijing Rural Commercial Bank, and Guangzhou Rural Commercial Bank are likely to hold significant market share within their respective regions due to established networks and customer bases.

Banks with successful digital transformation strategies: Banks that have successfully integrated fintech solutions and expanded their digital banking offerings are expected to gain a competitive advantage by reaching a wider customer base and improving operational efficiency. This applies to several of the listed banks, as they have shown signs of prioritizing digital transformation.

In terms of segments, the focus on supporting Small and Medium Enterprises (SMEs) in rural areas will be crucial for continued growth. Lending to agricultural businesses and providing financial services to rural households are other key segments that will drive future expansion. The increasing demand for financial inclusion products tailored to the specific needs of rural populations will also shape the market’s trajectory. The success of these banks largely depends on their ability to adapt to the changing needs of their rural clientele and leverage emerging technologies to reach remote areas effectively.

The continuous expansion of the rural economy, coupled with government support for financial inclusion and technological advancements in digital banking, are key growth catalysts. These factors are fostering increased financial literacy, expanding access to credit, and improving the efficiency of financial transactions in rural areas, driving overall growth within the sector.

(Note: Website links were not provided, and creating them would require extensive research and potential verification.)

A comprehensive report on the rural commercial banking sector would provide a detailed analysis of market size, growth trends, key players, and challenges. It would offer valuable insights into the evolving competitive landscape and identify opportunities for future growth. This deep dive will help investors, stakeholders, and industry professionals make informed decisions and plan for future market dynamics.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Chongqing Rural Commercial Bank, Shanghai Rural Commercial Bank, Beijing Rural Commercial Bank, Guangzhou Rural Commercial Bank, Chengdu Rural Commercial Bank, Dongguan Rural Commercial Bank, Shenzhen Rural Commercial Bank, Qingdao Rural Commercial Bank, Jiangnan Rural Commercial Bank, Guangdong Shunde Rural Commercial Bank.

The market segments include Type, Application.

The market size is estimated to be USD 3799550 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Rural Commercial Bank," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Rural Commercial Bank, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.