1. What is the projected Compound Annual Growth Rate (CAGR) of the RTD Flavoured Beverages?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

RTD Flavoured Beverages

RTD Flavoured BeveragesRTD Flavoured Beverages by Type (Tea, Coffee, Energy Drinks, Yogurt Drinks, Others), by Application (Supermarket, Tetra Pack, Tin Can, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

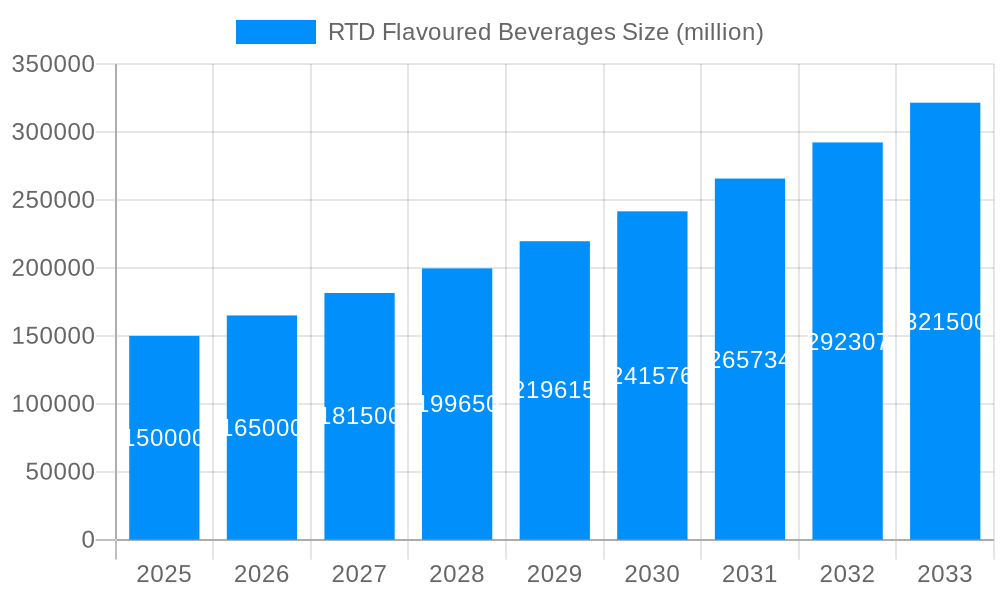

The Ready-to-Drink (RTD) flavored beverage market is experiencing robust growth, driven by shifting consumer preferences towards convenient, flavorful, and on-the-go options. This market, encompassing tea, coffee, energy drinks, yogurt drinks, and others, is projected to maintain a significant Compound Annual Growth Rate (CAGR) throughout the forecast period (2025-2033). The increasing demand for healthier alternatives, coupled with the rise of functional beverages enriched with vitamins, probiotics, and antioxidants, is a major contributing factor to this growth. The market segmentation by application, including supermarket sales and diverse packaging formats like Tetra Pak and tin cans, showcases the adaptability of RTD beverages to various distribution channels and consumer needs. Key players like Coca-Cola, PepsiCo, Nestle, and Danone are leading the market innovation, consistently introducing new flavors, formats, and functional ingredients to cater to evolving consumer preferences and maintain competitive advantage. The geographical distribution reveals strong market presence across North America, Europe, and Asia Pacific, with significant growth potential in emerging economies fueled by rising disposable incomes and urbanization. However, potential market restraints include increasing health consciousness leading to concerns about sugar content and artificial ingredients, along with the rising competition from other beverage categories.

Successful navigation of this market requires a multi-pronged strategy encompassing product diversification, targeted marketing campaigns, and strategic partnerships. Brands need to focus on creating healthier, functional, and sustainably packaged products to appeal to the increasingly health-conscious consumer base. Furthermore, capitalizing on the growing e-commerce sector and expanding into emerging markets presents lucrative opportunities for market expansion and sustained growth. Effective branding and marketing strategies that highlight unique flavors, health benefits, and convenience are essential to capturing a larger market share. The ongoing innovation in packaging materials and design, focused on sustainability and convenience, will also play a significant role in shaping the future of this dynamic market. Analyzing regional variations in consumer preferences will help companies tailor their offerings to specific markets and maximize returns. Overall, the RTD flavored beverage market holds a bright outlook, but success will hinge on companies adapting to changing consumer demands and maintaining innovative strategies.

The RTD (Ready-to-Drink) flavoured beverage market is experiencing dynamic growth, driven by evolving consumer preferences and innovative product launches. The period between 2019 and 2024 witnessed a significant expansion, with the market valued at several billion units by 2024. This upward trajectory is expected to continue throughout the forecast period (2025-2033), exceeding tens of billions of units by 2033. The increasing demand for convenient and flavorful beverages is a primary driver. Consumers, particularly millennials and Gen Z, are increasingly seeking healthier alternatives to traditional sugary drinks, leading to a surge in demand for functional beverages like flavored teas, infused waters, and energy drinks with added vitamins and antioxidants. The market is also witnessing a shift towards premiumization, with consumers willing to pay more for high-quality, naturally flavored, and ethically sourced ingredients. This trend is pushing manufacturers to develop innovative product formulations, packaging, and marketing strategies to capture this segment. Furthermore, the growing popularity of functional and health-conscious beverages is a major trend, with companies incorporating ingredients like probiotics, adaptogens, and superfoods into their product offerings. This caters to the increasing health-conscious population seeking beverages that provide added health benefits. The growing popularity of online channels and e-commerce platforms also significantly influences the market's reach and accessibility. The competition among major players is fierce, prompting continuous innovation and improvement to attract consumer loyalty and maintain a prominent market position. The market is expected to witness further consolidation in the coming years, with larger companies acquiring smaller players to expand their product portfolios and geographical reach. The overall trend showcases a bright future for the RTD flavored beverages market, fueled by innovative product development and ever-evolving consumer demands.

Several key factors are fueling the growth of the RTD flavoured beverage market. Firstly, the rising demand for convenient and on-the-go beverages is a major driver. Busy lifestyles and increasingly mobile populations have created a strong need for ready-to-consume options that can be easily integrated into daily routines. Secondly, the increasing health consciousness among consumers is driving the demand for healthier alternatives to traditional sugary drinks. This has led to the development and popularity of beverages containing natural ingredients, less sugar, and functional benefits such as added vitamins, antioxidants, or probiotics. Thirdly, the diversification of flavours and product offerings has significantly broadened the appeal of RTD beverages. Manufacturers are constantly innovating to create unique flavour combinations and cater to evolving consumer preferences, expanding beyond traditional soda and juice options. Finally, successful marketing and branding strategies, particularly those that target specific demographics like millennials and Gen Z with targeted social media campaigns and influencer marketing, significantly contribute to market growth. The market is also benefiting from advanced packaging solutions that enhance the product's shelf life and overall appeal. This combination of convenience, health awareness, flavour innovation, and effective marketing creates a powerful synergy that is propelling the RTD flavoured beverage market to new heights.

Despite the promising growth, the RTD flavoured beverage market faces certain challenges. Intense competition among established players and new entrants creates a highly competitive landscape, requiring constant innovation and marketing efforts to maintain market share. Fluctuating raw material prices, particularly for fruits, sweeteners, and other key ingredients, can significantly impact production costs and profitability. Stringent regulatory requirements and health concerns related to sugar content and artificial additives pose challenges to product formulation and marketing. Consumer preferences are also dynamic and ever-evolving; adapting to these changes and predicting future trends are crucial for sustaining growth. Moreover, the growing environmental concerns related to packaging waste and sustainability require manufacturers to adopt eco-friendly packaging solutions and reduce their carbon footprint, adding to the operational cost. The rise in health consciousness also presents a challenge of balancing flavour profiles and desirable health benefits, which often involves a difficult trade-off in the production process. Successfully navigating these challenges requires manufacturers to adopt agile strategies, focusing on product diversification, sustainable practices, and consumer-centric approaches.

The RTD flavoured beverage market is geographically diverse, with significant variations in consumption patterns and market dynamics. However, several regions and segments consistently show robust growth potential.

Key Regions:

Dominant Segments:

In-Depth Analysis: The Asia-Pacific region's dominance is due to a confluence of factors: a young and growing population, rising disposable incomes, and a fast-paced lifestyle that necessitates convenient beverage options. Within this region, specific countries like China and India are exhibiting particularly strong growth due to their large populations and rapidly expanding middle classes. The tea segment's dominance is attributed to the cultural significance of tea in many Asian countries, combined with growing awareness of its health benefits (antioxidants, etc.). The supermarket segment's continued dominance reflects the importance of established retail channels for reaching a broad consumer base. However, emerging online channels and direct-to-consumer models are expected to carve a significant niche for themselves in the coming years.

The RTD flavoured beverage industry is poised for continued growth, propelled by several key catalysts. These include the increasing demand for convenient and on-the-go beverages, a growing health-conscious population seeking healthier alternatives, continuous product innovation and diversification of flavors, strategic partnerships and collaborations to expand market reach, and aggressive marketing strategies targeting specific demographics. These factors, along with favorable economic conditions in many key markets, contribute to a positive outlook for the industry's future.

This report provides a comprehensive overview of the RTD flavoured beverages market, encompassing detailed analysis of market trends, driving forces, challenges, key regions and segments, and leading players. The report covers historical data from 2019-2024, an estimated market value for 2025, and future forecasts through 2033. It provides valuable insights for businesses involved in the production, distribution, and marketing of RTD flavoured beverages, as well as investors seeking opportunities in this dynamic market. The report includes detailed market sizing data (in millions of units), giving a precise understanding of the present and future market potential. It is an essential resource for strategic planning and decision-making within the RTD flavoured beverages industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Coca Cola, Diageo, Brown-Forman, Bacardi, Pepsi, Danone, LOTTE, Keurig Dr Pepper, Nestle, Vivid, Smirnoff, Asahi Group Holdings, Pernod Ricard, Halewood Wines & Spirits, SHANGHAI BACCHUS LIQUOR, Suntory Holdings, Manchester Drinks, Anheuser-Busch, Campari Group, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "RTD Flavoured Beverages," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the RTD Flavoured Beverages, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.