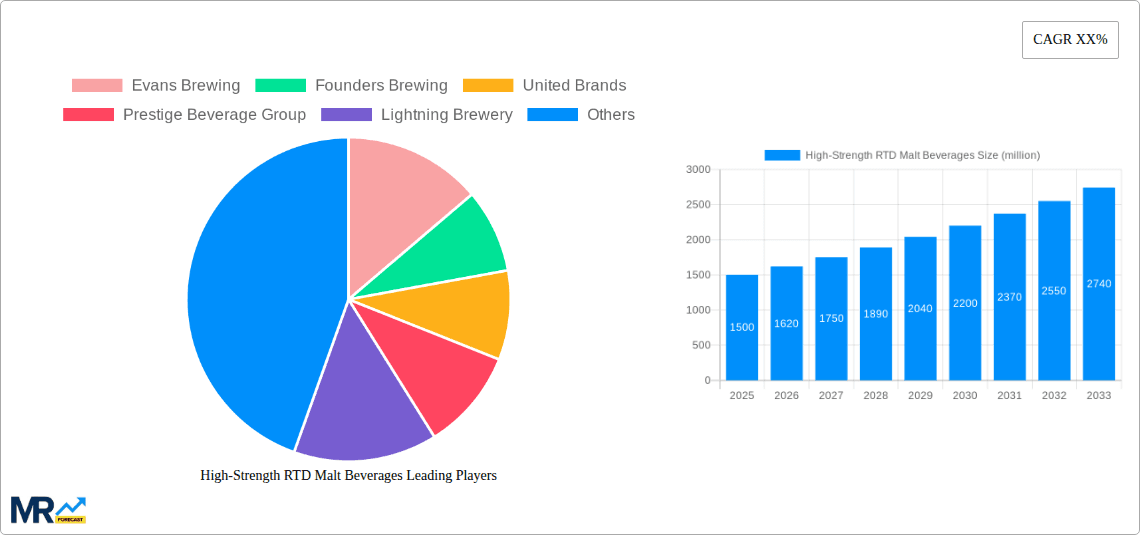

1. What is the projected Compound Annual Growth Rate (CAGR) of the High-Strength RTD Malt Beverages?

The projected CAGR is approximately 6.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

High-Strength RTD Malt Beverages

High-Strength RTD Malt BeveragesHigh-Strength RTD Malt Beverages by Application (Hypermarket/Supermarkets, Convenience Stores, Independent Drink Stores, Specialty Retail Stores, Others), by Type (Cans, Bottles), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The High-Strength Ready-to-Drink (RTD) Malt Beverage market is experiencing robust growth, driven by shifting consumer preferences towards convenient, flavorful, and alcoholic beverages. The market's expansion is fueled by several key factors, including the increasing popularity of pre-mixed cocktails, a growing demand for premium alcoholic options, and the rise of craft and specialty malt beverages. This segment benefits from a younger demographic seeking convenient and social drinking experiences. While specific market size figures are not provided, based on comparable market trends in the RTD cocktail and craft beer sectors, we can reasonably estimate the 2025 market size at approximately $1.5 billion USD, with a Compound Annual Growth Rate (CAGR) of 8-10% projected through 2033. This growth trajectory is supported by innovative product launches, strategic partnerships between established beverage companies and craft breweries, and expanding distribution channels. However, regulatory changes surrounding alcohol content and marketing restrictions could act as potential restraints, impacting market expansion. Competitive dynamics are fierce, with both large multinational corporations and smaller, niche craft brewers vying for market share.

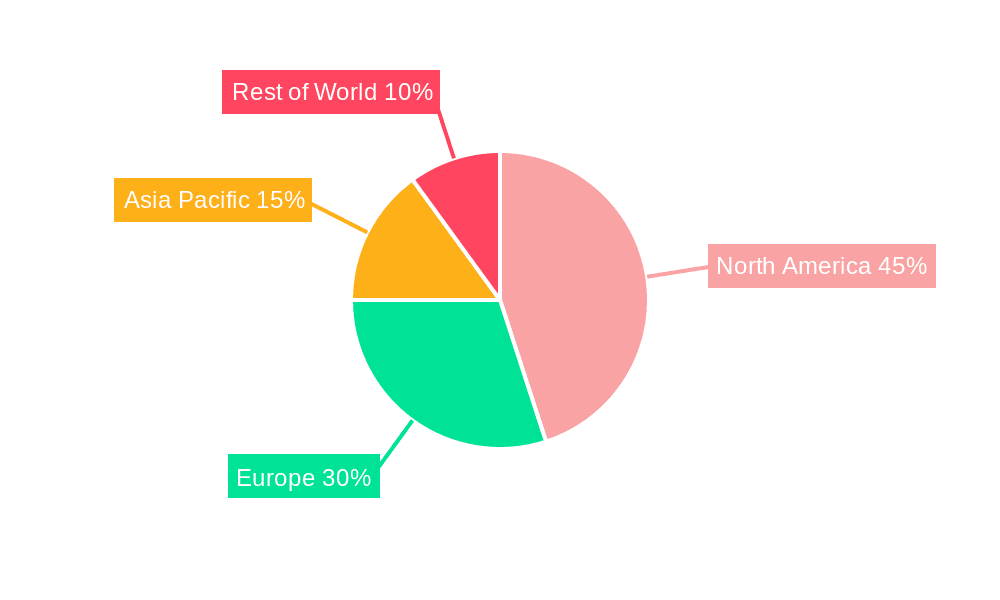

The success of High-Strength RTD Malt Beverages hinges on ongoing innovation and brand building. Companies like Evans Brewing, Founders Brewing, and others are strategically focusing on unique flavor profiles, premium ingredients, and attractive packaging to stand out in a crowded marketplace. Regional variations in consumer preferences and regulatory landscapes are also influencing market development. North America and Europe are expected to hold significant market share, followed by Asia Pacific and other regions. This segment's growth trajectory will likely be influenced by factors including the evolving consumer taste palates, economic conditions, and the effective marketing strategies of competing brands. Continued diversification of product offerings, coupled with targeted marketing campaigns focused on key demographics, will be crucial for brands aiming to achieve strong market penetration and sustainable growth.

The high-strength ready-to-drink (RTD) malt beverage market is experiencing explosive growth, driven by evolving consumer preferences and innovative product offerings. The market, valued at several billion units in 2025, is projected to witness significant expansion throughout the forecast period (2025-2033). This surge is fueled by a confluence of factors, including the increasing popularity of convenient, portable alcoholic beverages, a growing demand for premium and craft options, and successful marketing strategies targeting younger, more affluent demographics. The historical period (2019-2024) saw substantial market penetration, laying the foundation for the current boom. Key insights reveal a strong preference for unique flavors, a rising interest in healthier alternatives (though still within the high-strength category), and the success of brands effectively communicating their product's quality and experience. The market is becoming increasingly sophisticated, with brands investing heavily in premium packaging and marketing to stand out in a competitive landscape. The shift toward premiumization is particularly evident, with consumers showing a willingness to pay more for high-quality ingredients and distinct flavor profiles. The competitive landscape is dynamic, with both established players and new entrants constantly vying for market share through product innovation and aggressive marketing. Analysis of consumer trends indicates a strong correlation between increasing disposable income and the growth of the high-strength RTD malt beverage market. Furthermore, strategic partnerships and collaborations are becoming increasingly important for brands seeking to expand their reach and access new distribution channels. The ongoing evolution of consumer tastes necessitates continuous innovation in flavor profiles, packaging, and marketing strategies to maintain market relevance and competitiveness.

Several key factors are driving the impressive growth trajectory of the high-strength RTD malt beverage market. Firstly, the convenience factor is undeniable. These beverages offer ready-to-consume portability, appealing to busy consumers seeking quick and easy alcoholic options. This is particularly important for social settings and outdoor activities. Secondly, the rise of premiumization is a major driver. Consumers are increasingly willing to pay more for higher-quality ingredients and unique flavor profiles, pushing brands to focus on crafting sophisticated and distinctive products. The craft beverage trend, which emphasizes small-batch production and artisanal ingredients, is a significant contributor to this premiumization. Thirdly, effective marketing and branding play a crucial role. Successful brands have effectively targeted younger demographics with creative marketing campaigns that emphasize lifestyle and experience rather than solely focusing on product attributes. This resonates particularly well with digitally savvy consumers. Finally, the expansion of distribution channels, including online retailers and specialized stores, has broadened the market’s reach and made these beverages more accessible to a wider consumer base. These factors are interconnected and synergistically fueling the market's phenomenal growth, ensuring its continued expansion in the coming years.

Despite its rapid growth, the high-strength RTD malt beverage market faces several challenges and restraints. One significant concern is the potential for increased regulatory scrutiny and stricter alcohol control measures in various jurisdictions. Governments may introduce stricter regulations concerning alcohol content, marketing restrictions aimed at responsible consumption, and increased taxation, potentially impacting profitability and market growth. Another challenge is the intense competition within the market. With numerous established players and new entrants constantly emerging, brands must continuously innovate and differentiate their offerings to maintain a competitive edge. Maintaining consistent product quality and supply chain efficiency while managing escalating production costs also poses a significant challenge, especially in light of global economic uncertainty and fluctuating raw material prices. Furthermore, fluctuating consumer preferences and emerging trends necessitate agile adaptation from brands to ensure that their products remain appealing and relevant to their target market. The prevalence of health concerns surrounding alcohol consumption and a growing consumer awareness of healthy living practices also represents an ongoing challenge that requires brands to carefully balance marketing strategies with responsible consumption messaging.

The high-strength RTD malt beverage market displays significant regional variations in consumption patterns and growth rates. Several key regions and segments are projected to lead the market's expansion during the forecast period:

North America: The US market is a dominant force, driven by strong consumer demand, established distribution networks, and a vibrant craft beverage culture. Canada also contributes significantly to the North American market’s growth.

Europe: Western European countries, particularly those with established craft brewing traditions and a high disposable income, exhibit strong growth potential. The market in the UK and Germany is especially notable.

Asia-Pacific: Emerging markets in countries like China, Japan, and Australia are showcasing rapid expansion, albeit from a smaller base. Rising disposable incomes and changing consumer preferences contribute to the rising demand.

Segments: The premium segment, focusing on high-quality ingredients and innovative flavors, is expected to experience disproportionately high growth compared to standard or value-priced options. Flavored varieties, such as those infused with fruit or spices, are also proving particularly popular, outpacing the growth of traditional malt beverage flavors. This reflects the broader trend in the beverage industry towards offering more diverse and sophisticated options to cater to increasingly discerning palates. The market is seeing an increased demand for organic and naturally sourced ingredients in the premium segment, signaling a growth area that aligns with broader consumer trends towards healthier lifestyle choices.

The projected dominance of these regions and segments is underpinned by several factors including socio-economic conditions, cultural preferences, and the effectiveness of marketing strategies tailored to local consumer preferences. The dynamic nature of the market, however, suggests that continued monitoring of consumer trends and evolving market dynamics is essential for accurate future projections.

Several factors are acting as catalysts for growth in the high-strength RTD malt beverage industry. The rising disposable incomes in key markets are allowing consumers to spend more on premium and convenient alcoholic beverages. Simultaneously, successful marketing campaigns are creating strong brand awareness and driving demand amongst younger demographics. Finally, continuous product innovation, focusing on exciting new flavors and formats, is capturing consumer interest and attracting new customers into the market. These factors are working in synergy to accelerate market growth in the coming years.

This report provides a comprehensive overview of the high-strength RTD malt beverage market, offering detailed insights into market trends, drivers, restraints, and growth forecasts. It examines leading players, significant developments, and regional variations within the sector, making it a valuable resource for industry stakeholders seeking a detailed understanding of this rapidly evolving market. The report provides invaluable data for strategic decision-making, market entry strategies, and competitive analysis within the high-strength RTD malt beverage sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.5%.

Key companies in the market include Evans Brewing, Founders Brewing, United Brands, Prestige Beverage Group, Lightning Brewery, Geloso Beverage Group, Stout Brewing, Phusion Projects, Coney Island Brewing, Minhas Craft Brewery, Bugsy Brewing, .

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "High-Strength RTD Malt Beverages," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the High-Strength RTD Malt Beverages, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.