1. What is the projected Compound Annual Growth Rate (CAGR) of the Room Rental Platforms?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Room Rental Platforms

Room Rental PlatformsRoom Rental Platforms by Type (/> Hotel, Apartment, Civil Accommodation), by Application (/> Long-term Lease, Short-term Lease), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

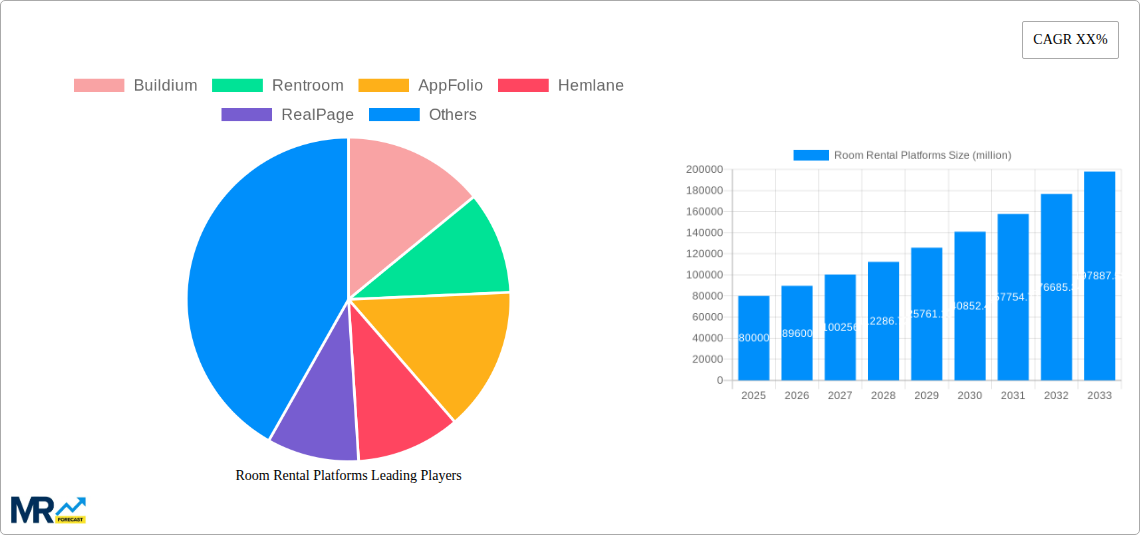

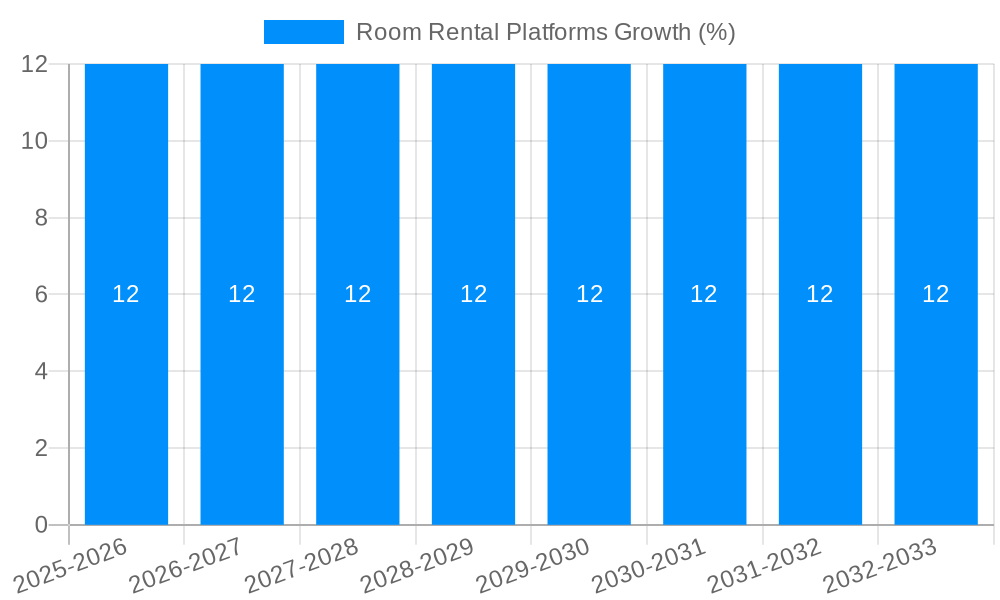

The global Room Rental Platforms market is poised for robust expansion, with an estimated market size of approximately $80 billion in 2025. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of around 12% during the forecast period of 2025-2033. The market's dynamism is fueled by a confluence of factors, notably the escalating demand for flexible and affordable accommodation solutions, particularly among younger demographics and digital nomads. The increasing adoption of smartphones and internet penetration globally has significantly lowered the barrier to entry for both renters and property owners, democratizing access to the rental market. Furthermore, the burgeoning tourism sector and the growing trend of remote work are creating sustained demand for both short-term and long-term rental options. The platform's ability to streamline the entire rental process, from discovery and booking to payment and communication, offers unparalleled convenience, further propelling market adoption. Key segments driving this growth include hotels and apartments for short-term leases, catering to the transient needs of travelers and temporary residents.

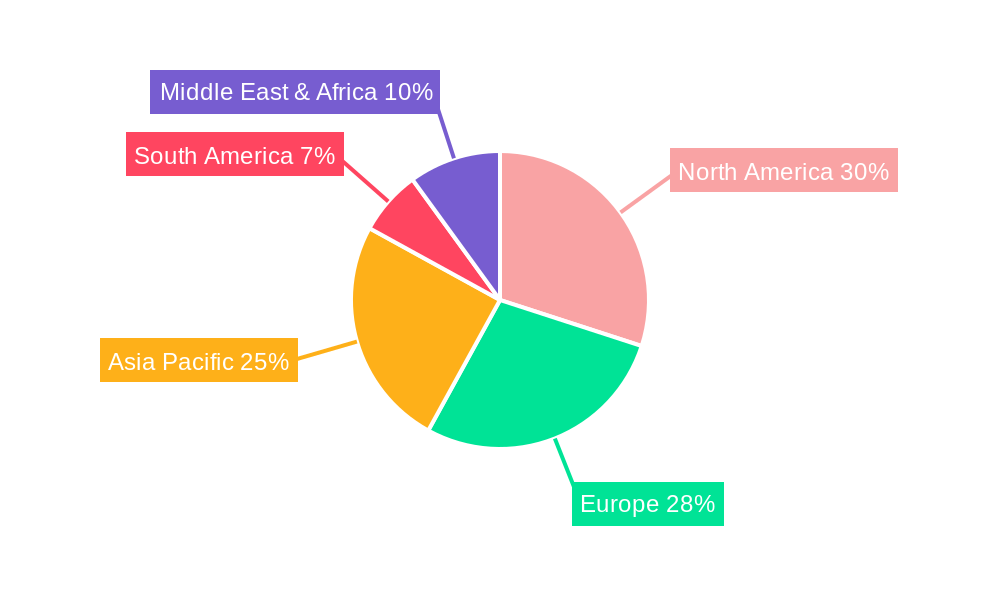

The market is characterized by significant innovation and strategic collaborations aimed at enhancing user experience and expanding service offerings. Key drivers include the shift towards the sharing economy, the convenience offered by online booking and management systems, and the increasing preference for personalized and cost-effective living arrangements over traditional hotel stays or long-term leases. However, the market also faces certain restraints, such as stringent regulatory frameworks in some regions concerning short-term rentals, potential issues with property quality and guest safety, and intense competition among established and emerging players. Despite these challenges, the continued evolution of technology, including AI-powered personalization and enhanced security features, is expected to mitigate these concerns. Geographically, the Asia Pacific region, with its vast population and rapidly developing economies, is anticipated to emerge as a significant growth engine, alongside the established markets of North America and Europe. The diversification of offerings, from individual rooms to entire apartments and even co-living spaces, will be crucial for sustained market leadership.

This report delves into the intricate world of room rental platforms, charting their evolution and projecting their trajectory through 2033. The study period, spanning from 2019 to 2033, with a base and estimated year of 2025, will meticulously analyze historical trends from 2019-2024 and forecast future developments over the 2025-2033 forecast period. We aim to provide a comprehensive overview, dissecting market dynamics, identifying pivotal growth drivers, and acknowledging the inherent challenges that shape this ever-evolving sector.

XXX The room rental platforms market is on an unprecedented ascent, driven by a confluence of shifting consumer preferences, technological advancements, and evolving economic landscapes. Over the historical period of 2019-2024, the market has witnessed robust growth, largely fueled by the increasing demand for flexible and affordable accommodation solutions. The COVID-19 pandemic, while initially disruptive, paradoxically accelerated certain trends, such as the embrace of remote work, which subsequently boosted demand for longer-term rentals and co-living spaces. The estimated market size in 2025 is projected to reach XXX million units, underscoring the significant penetration of these platforms.

The fundamental shift towards a sharing economy has deeply permeated the accommodation sector. Consumers, particularly millennials and Gen Z, are increasingly prioritizing experiences and value over traditional ownership models. This has translated into a burgeoning demand for varied accommodation types, from entire apartments and individual rooms within civil accommodations to specialized hotel offerings. The platform's ability to aggregate a diverse inventory and offer transparent pricing has been instrumental in attracting this demographic. Furthermore, the integration of advanced technologies, including AI-powered search algorithms, virtual tours, and secure payment gateways, has enhanced user experience and trust, further solidifying the market's expansion. The ease of booking, coupled with the potential for cost savings compared to conventional hotels or long-term leases, continues to be a powerful draw. Looking ahead, the forecast period (2025-2033) anticipates sustained, albeit potentially moderating, growth as the market matures and regulatory frameworks adapt. Innovation in areas like personalized recommendations and seamless property management solutions will be crucial for continued market leadership. The sheer volume of transactions, measured in millions of units, highlights the indispensable role these platforms now play in global travel and accommodation.

The relentless expansion of the room rental platforms market is being propelled by a potent combination of economic, social, and technological forces. A primary driver is the ever-increasing demand for flexible and cost-effective accommodation solutions. In an era characterized by economic uncertainties and the rise of the gig economy, individuals are seeking rental options that offer greater adaptability than traditional long-term leases. This has led to a surge in demand for short-term rentals, serviced apartments, and co-living spaces, all of which are readily available and easily bookable through these platforms. Furthermore, the digitalization of the travel and accommodation industry has been a significant catalyst. The widespread adoption of smartphones and high-speed internet has made it incredibly convenient for users to discover, compare, and book rooms from anywhere in the world. Online reviews and ratings have also fostered greater transparency and trust, empowering consumers to make informed decisions. The emergence of novel business models, such as peer-to-peer rentals and property management services integrated within platforms, has further broadened the appeal and accessibility of these services. The ease with which property owners and managers can list their available spaces and reach a global audience has contributed to a richer and more diverse inventory, thereby attracting a larger user base.

Despite the robust growth trajectory, the room rental platforms market is not without its significant challenges and restraints. Regulatory uncertainty and evolving legal frameworks pose a persistent hurdle. Many cities and countries are grappling with how to effectively regulate short-term rentals, leading to inconsistent rules regarding licensing, taxes, and zoning. This can create operational complexities for both platform providers and property owners. Another key challenge is maintaining consistent quality and guest satisfaction. While platforms offer a wide array of options, ensuring that every listed property meets a certain standard of cleanliness, safety, and amenities can be difficult to enforce consistently across a vast and diverse inventory. Issues such as last-minute cancellations, misrepresented listings, and guest-host disputes can damage brand reputation and deter future bookings. Intensifying competition is also a growing concern. As the market matures, new players emerge, and established platforms engage in aggressive pricing strategies and marketing campaigns to capture market share. This can lead to price wars and reduced profit margins. Furthermore, security and data privacy concerns remain paramount. Platforms handle sensitive personal and financial information, making them prime targets for cyberattacks. Ensuring robust data protection measures and maintaining user trust in the platform's security is critical for long-term sustainability.

The global room rental platforms market is characterized by distinct regional dynamics and segment preferences that contribute to its overall dominance. Among the key regions, Asia Pacific is poised to emerge as a dominant force, driven by several interconnected factors.

Within the Segments analysis, both Apartment and Civil Accommodation are expected to witness substantial growth, catering to different but equally significant market demands.

The Application segment of Long-term Lease is also projected to see significant growth, especially post-pandemic, with the rise of remote work and digital nomads seeking flexible yet stable living arrangements. This trend is further amplified by the need for more affordable housing options in urban centers.

Several key growth catalysts are propelling the room rental platforms industry forward. The increasing adoption of digital technologies, including AI-powered search, virtual tours, and seamless booking processes, significantly enhances user experience and accessibility. The growing trend of remote work and digital nomadism creates sustained demand for flexible and adaptable accommodation solutions globally. Furthermore, the rise of the sharing economy and a preference for experiential travel are encouraging consumers to opt for unique and localized lodging options over traditional hotels. The continuous expansion of mobile internet penetration across emerging economies further broadens the addressable market and makes these platforms accessible to a larger audience.

This report offers an exhaustive analysis of the room rental platforms market, providing invaluable insights for stakeholders. It delves into the intricate interplay of market trends, driving forces, and challenges that shape this dynamic industry. With a focus on the historical period of 2019-2024 and a detailed forecast extending to 2033, the report identifies key growth catalysts, including the rise of remote work and the sharing economy. It meticulously examines dominant regions and segments like Apartments and Civil Accommodation, highlighting their substantial contributions to market expansion. Leading players are identified, along with significant developments, offering a holistic view of the competitive landscape and future directions. This comprehensive coverage empowers businesses to make informed strategic decisions and capitalize on emerging opportunities within the global room rental ecosystem.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Buildium, Rentroom, AppFolio, Hemlane, RealPage, Total Management Group, HousingAnywhere, Rentberry, Spotahome, Nestpick, Uniplaces, Airbnb, Ziru, Boyu, Lianjia, Douban, Guanyu, Apartment List, Trulia, Zillow.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Room Rental Platforms," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Room Rental Platforms, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.