1. What is the projected Compound Annual Growth Rate (CAGR) of the Road Freight Transport Service?

The projected CAGR is approximately 7.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Road Freight Transport Service

Road Freight Transport ServiceRoad Freight Transport Service by Application (/> Domestic, International), by Type (/> Full Truckload, Less-Than-Truckload), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

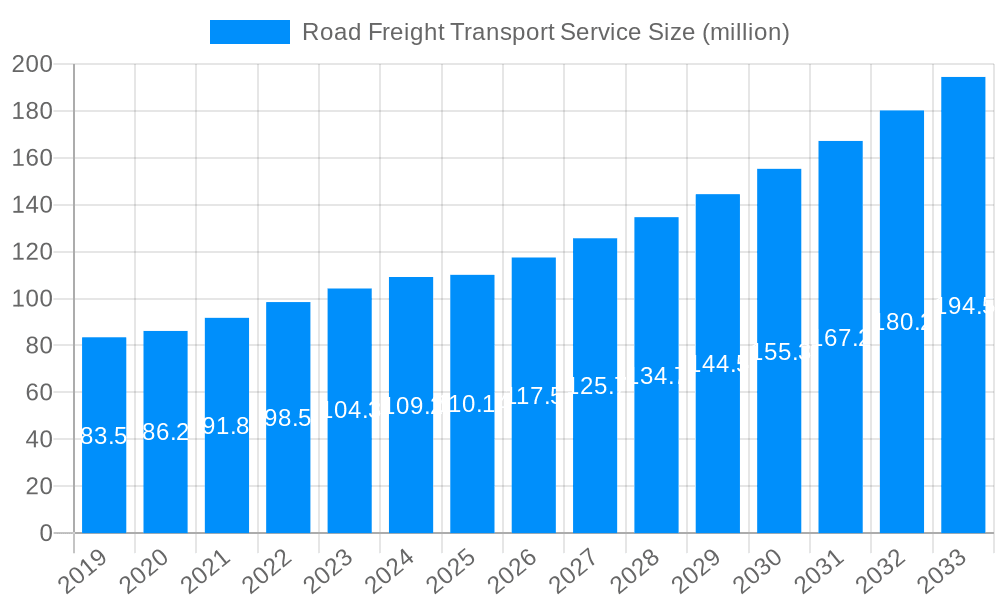

The global Road Freight Transport Service market is poised for substantial growth, projected to reach approximately $110.14 billion in 2025. Driven by an estimated Compound Annual Growth Rate (CAGR) of 7.3% over the forecast period extending to 2033, this expansion signifies a robust demand for efficient and reliable goods movement. Key growth enablers include the ever-increasing volume of e-commerce, necessitating faster and more flexible last-mile delivery solutions, and the continuous expansion of global trade, which relies heavily on road networks for intermodal connectivity and final delivery. Furthermore, technological advancements in fleet management, real-time tracking, and route optimization are enhancing operational efficiency and reducing costs for service providers, thereby stimulating market uptake.

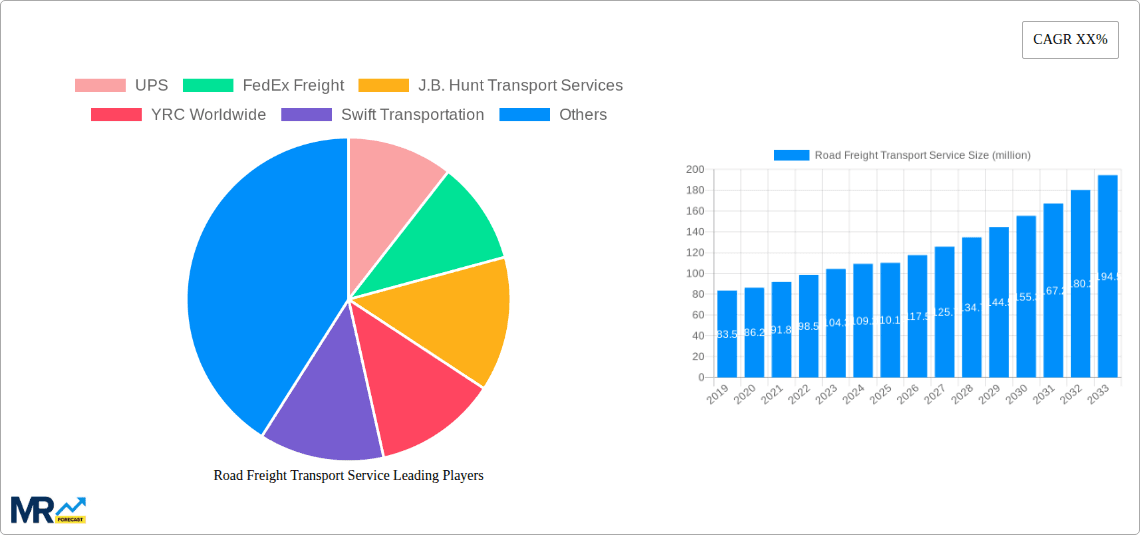

The market is segmented by application into Domestic and International services, with both demonstrating significant potential. Domestic freight transport benefits from the resurgence of localized supply chains and the growing demand for goods within national borders. International road freight, while facing regulatory complexities, is crucial for connecting adjacent economies and facilitating trade flows. The market also categorizes services by type: Full Truckload (FTL) and Less-Than-Truckload (LTL). FTL services cater to large, time-sensitive shipments, while LTL offers a cost-effective solution for smaller cargo. The competitive landscape is dominated by established players such as UPS, FedEx Freight, and J.B. Hunt Transport Services, who are actively investing in sustainable logistics and digital transformation to maintain their market leadership. However, emerging regional players and innovative logistics startups are also contributing to market dynamism.

This report offers an in-depth analysis of the global road freight transport service market, a vital artery of commerce, projecting its evolution from the historical period of 2019-2024 through to a comprehensive forecast extending from 2025 to 2033, with the base and estimated year set at 2025. We will explore the significant trends, driving forces, inherent challenges, and the strategic landscape that will shape this multi-billion dollar industry. The report provides a granular view of market dynamics, including key players, impactful developments, and a detailed segmental analysis, offering invaluable insights for stakeholders navigating this complex and dynamic sector.

The road freight transport service market is a colossal entity, estimated to be valued in the tens of billions of dollars, and is undergoing a significant transformation driven by a confluence of technological advancements, evolving consumer behaviors, and shifting global economic paradigms. Over the study period of 2019-2033, with a focal point on 2025, the industry is witnessing a pronounced shift towards greater efficiency, sustainability, and digitalization. We anticipate a substantial increase in investments in advanced logistics technologies, including artificial intelligence (AI) for route optimization, predictive maintenance for fleets, and real-time shipment tracking. The integration of Internet of Things (IoT) devices into commercial vehicles will further enhance operational visibility and safety. E-commerce growth, a persistent trend since 2019, continues to be a primary driver, demanding faster, more flexible, and cost-effective delivery solutions. This burgeoning demand necessitates an expansion of less-than-truckload (LTL) services, as smaller, more frequent shipments become the norm, alongside the continued strength of full truckload (FTL) for larger consignments. The industry is also grappling with the imperative to decarbonize, leading to a growing interest in alternative fuels, electric trucks, and more fuel-efficient fleet management strategies. Cybersecurity has emerged as a critical concern, as the increasing reliance on digital platforms makes freight operations more vulnerable to cyber threats. The need for robust data security and resilient supply chains will be paramount in the coming years. Furthermore, we foresee a growing emphasis on multimodal transportation solutions, where road freight acts as a crucial first and last-mile connector in integrated logistics networks, enhancing overall supply chain efficiency. The regulatory landscape, while often presenting challenges, also serves as a catalyst for innovation, pushing companies to adopt cleaner technologies and more ethical labor practices. The base year of 2025 is critical, as it represents a crucial juncture where many of these nascent trends are expected to gain significant traction, setting the stage for the market's trajectory through 2033. The continuous evolution of consumer expectations for speed and transparency, coupled with the industry's response to environmental concerns, will define the competitive landscape and operational strategies for decades to come.

Several potent forces are collectively propelling the road freight transport service market forward, ensuring its continued growth and adaptation. Foremost among these is the insatiable appetite for e-commerce. As online shopping becomes increasingly ingrained in daily life, the demand for efficient and timely delivery of goods across domestic and international borders escalates. This surge in consumer-driven transactions translates directly into higher volumes for road freight. Secondly, globalization, despite occasional geopolitical headwinds, continues to foster a complex web of international trade. Road freight plays an indispensable role in facilitating this trade, serving as a critical link in global supply chains, connecting ports, distribution centers, and final destinations. The inherent flexibility and accessibility of road transport make it indispensable for cross-border movements. The development and widespread adoption of advanced technologies are also major catalysts. From sophisticated route optimization software powered by AI to the increasing deployment of telematics and connected vehicle technologies, these innovations are driving unprecedented levels of efficiency, reducing operational costs, and enhancing service reliability. This technological infusion is not merely incremental; it represents a paradigm shift in how freight is managed. Furthermore, economic growth in emerging markets, coupled with ongoing industrial development in established economies, generates a consistent demand for the movement of raw materials, intermediate goods, and finished products. This underlying economic buoyancy provides a stable foundation for the road freight sector's expansion. The increasing trend towards just-in-time (JIT) inventory management by businesses, aiming to minimize warehousing costs and optimize cash flow, further amplifies the need for agile and responsive road freight services, particularly for less-than-truckload shipments.

Despite its robust growth trajectory, the road freight transport service market is not without its significant hurdles and constraints. One of the most persistent challenges is the issue of driver shortage. An aging workforce, demanding working conditions, and a lack of new entrants into the profession create a chronic scarcity of qualified truck drivers, leading to increased labor costs and service delays. This human capital deficit is a substantial impediment to scaling operations. Another major constraint stems from the escalating operational costs. Fluctuations in fuel prices, the increasing cost of vehicle maintenance and insurance, and the growing burden of regulatory compliance all contribute to higher expenses for freight companies. These cost pressures can impact profitability and necessitate the passing on of increased rates to customers. Infrastructure limitations also present a considerable challenge. Congested roadways, aging bridges, and insufficient parking facilities for trucks lead to longer transit times, increased fuel consumption, and driver fatigue. Investment in and maintenance of road infrastructure often lag behind the growing demands of freight movement. Environmental regulations, while necessary for sustainability, can also act as a restraint. The transition to cleaner vehicles and stricter emissions standards requires substantial capital investment in new fleets and the development of alternative fueling infrastructure, which can be a slow and costly process. Furthermore, the intense competition within the road freight sector, with numerous established players and new entrants, can lead to price wars and squeezed profit margins, particularly for smaller operators. Cybersecurity threats are an emerging but significant restraint, as disruptions to digital logistics platforms can have cascading effects on the entire supply chain.

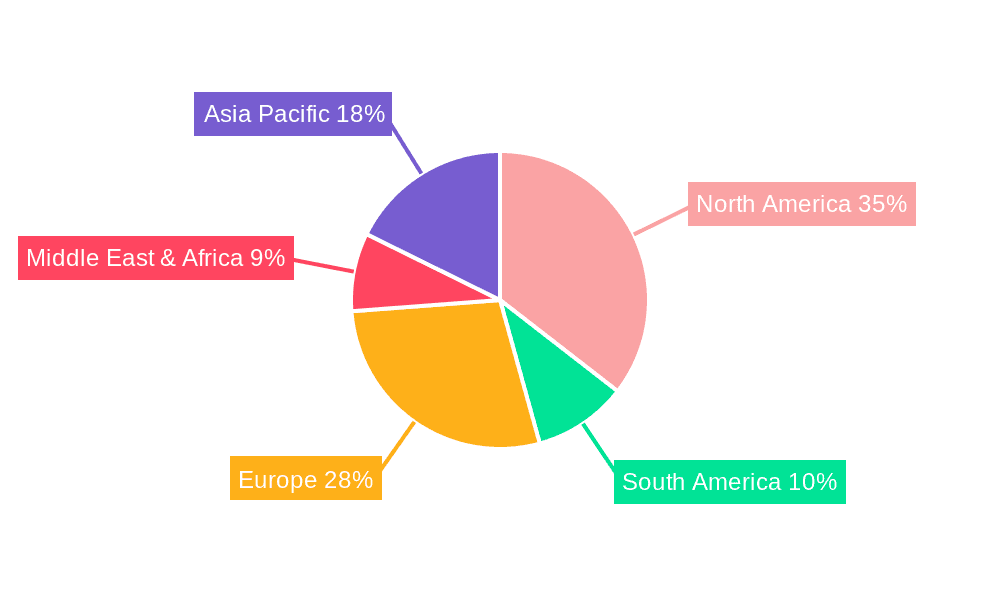

Analyzing the road freight transport service market reveals distinct regional strengths and segment dominance, with North America and the Domestic application segment poised to hold significant sway.

North America, particularly the United States, is a powerhouse in road freight. The sheer scale of its economy, coupled with a vast and well-developed highway network, makes road transport the backbone of its domestic commerce. The extensive presence of major logistics hubs, coupled with the high volume of goods moved to support a robust consumer market, positions North America as a dominant force. The continued growth of e-commerce in this region, fueled by major online retailers and a tech-savvy population, ensures a sustained demand for efficient last-mile and middle-mile delivery solutions, heavily reliant on road freight. Moreover, the presence of several of the world's largest freight companies, including UPS, FedEx Freight, J.B. Hunt Transport Services, Swift Transportation, and Schneider National, headquartered in North America, signifies its leadership in infrastructure, technology adoption, and operational expertise. These companies have invested billions in their fleets and logistics networks, solidifying the region's dominance.

Within the application segments, Domestic road freight transport is expected to continue its reign. The majority of goods consumed within a country are moved by road, making domestic freight a consistently high-volume and critical component of the overall market. This is particularly true for economies with large landmasses and significant internal consumption. The complexity of managing a domestic supply chain, from the collection of raw materials to the final delivery of consumer goods, relies heavily on the versatility and accessibility of road transport. This segment benefits from less regulatory complexity compared to international shipments and often sees faster turnaround times. The demand for domestic freight is closely tied to industrial production, retail sales, and consumer spending, all of which remain strong drivers of economic activity. The base year of 2025 and the subsequent forecast period to 2033 will see this domestic segment continue to expand, driven by ongoing urbanization, shifts in manufacturing locations, and the perpetual need to move goods within national borders. While international freight is crucial for global trade, the sheer volume and frequency of domestic movements ensure its leading position in terms of market value and operational scale.

In terms of Type, both Full Truckload (FTL) and Less-Than-Truckload (LTL) segments are vital and experiencing distinct growth patterns. FTL services, which involve the dedicated use of an entire truck for a single shipment, are fundamental for moving large quantities of goods efficiently over longer distances. This segment is driven by manufacturers, large distributors, and retailers who require consistent and large-volume transportation. The reliability and cost-effectiveness of FTL for bulk shipments ensure its continued importance. Conversely, the LTL segment is experiencing accelerated growth, directly attributable to the rise of e-commerce and the increasing prevalence of smaller, more frequent deliveries. LTL services consolidate smaller shipments from multiple customers onto a single truck, offering a more economical solution for businesses that do not have enough freight to fill a full truck. The flexibility and cost-efficiency of LTL make it indispensable for a broad range of businesses, from small online retailers to larger enterprises seeking to optimize their supply chain for smaller order volumes. The interplay between these two segments, serving different needs within the freight ecosystem, ensures their combined dominance in the road freight transport landscape.

The road freight transport service industry is propelled by several key growth catalysts. The persistent and expanding influence of e-commerce, demanding faster and more efficient delivery, is a primary driver. Furthermore, ongoing globalization and international trade necessitate robust road freight networks for the movement of goods between borders and ports. Technological advancements, including AI-powered optimization and the proliferation of connected vehicles, are enhancing operational efficiency and reducing costs. Finally, continued economic growth in various regions, leading to increased manufacturing and consumption, directly translates to higher demand for freight services.

This report provides an all-encompassing view of the road freight transport service market, extending from the historical context of 2019-2024 to a forward-looking projection up to 2033, with a critical focus on the base year of 2025. It delves into the intricate interplay of driving forces such as escalating e-commerce demand and globalization, while simultaneously dissecting the significant challenges posed by driver shortages and rising operational costs. The analysis extends to identifying key regional and segment dominances, highlighting the strategic importance of markets like North America and segments like domestic and LTL services. Furthermore, the report meticulously details the significant developments and growth catalysts that are shaping the future of this multi-billion dollar industry, offering stakeholders a robust understanding of the competitive landscape and the strategic imperatives for future success.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.3%.

Key companies in the market include UPS, FedEx Freight, J.B. Hunt Transport Services, YRC Worldwide, Swift Transportation, Schneider National, ArcBest, Estes Express Lines.

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Road Freight Transport Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Road Freight Transport Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.