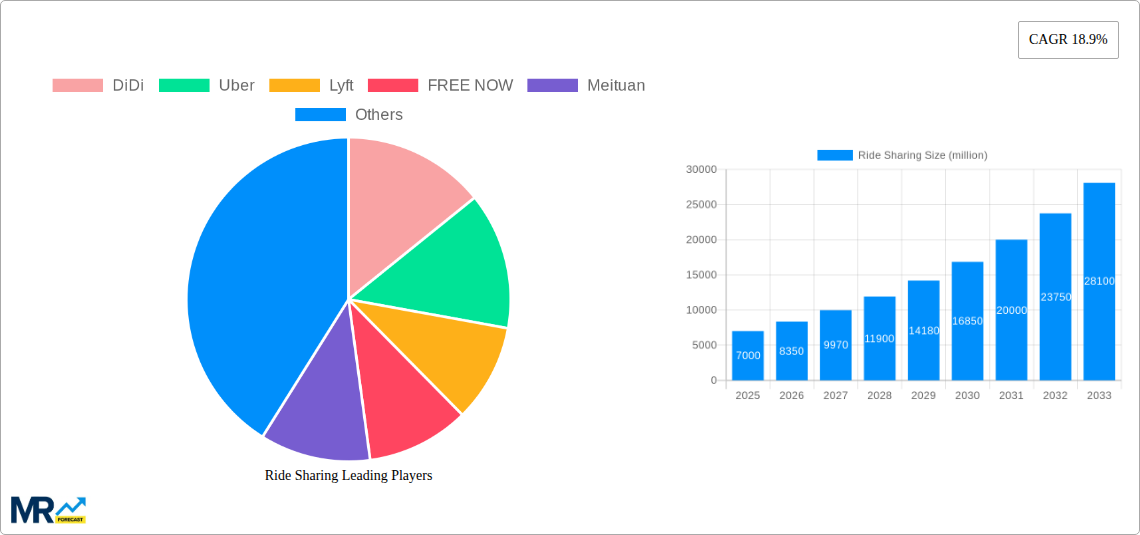

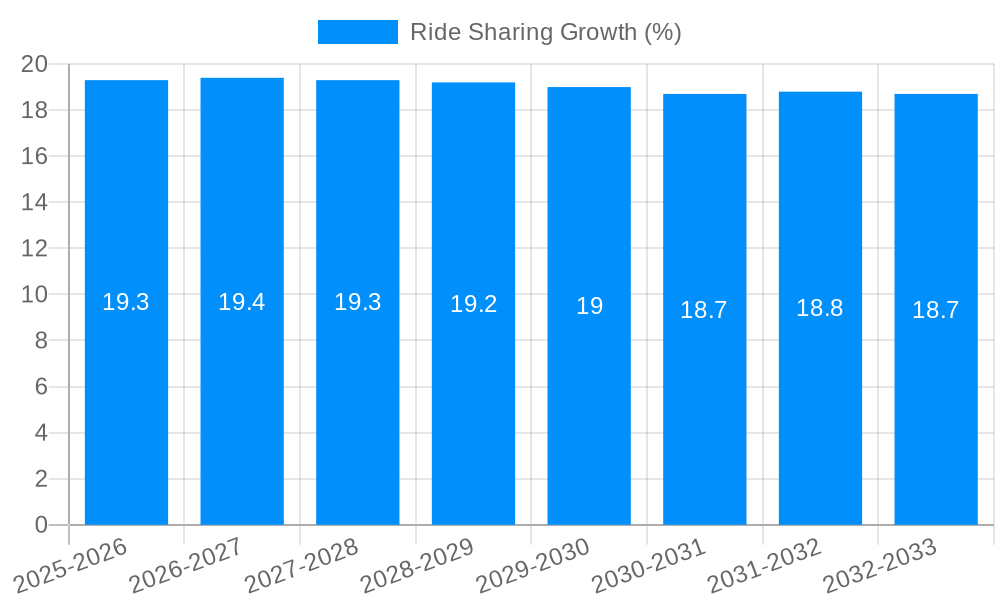

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ride Sharing?

The projected CAGR is approximately 18.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ride Sharing

Ride SharingRide Sharing by Type (Express Car, Special Car, Pooling Car), by Application (Age 18-24, Age 25-34, Age 35-44, Age 45-54, Age 55-64), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global ride-sharing market is experiencing robust expansion, projected to reach a substantial market size of USD 39,270 million by 2033, driven by an impressive Compound Annual Growth Rate (CAGR) of 18.9%. This remarkable growth is fueled by evolving consumer preferences for convenient, on-demand mobility solutions, particularly among younger demographics (18-34 years old) who are early adopters of digital platforms. The proliferation of smartphones and widespread internet connectivity has made ride-sharing apps an integral part of urban transportation, offering a viable alternative to traditional taxi services and private car ownership. Factors such as increasing urbanization, rising disposable incomes in developing economies, and a growing awareness of the environmental benefits of shared rides (reduced traffic congestion and emissions) further bolster market expansion. The market encompasses various service types, including express car services for quick commutes, specialized services catering to specific needs, and pooling options promoting cost-efficiency and sustainability.

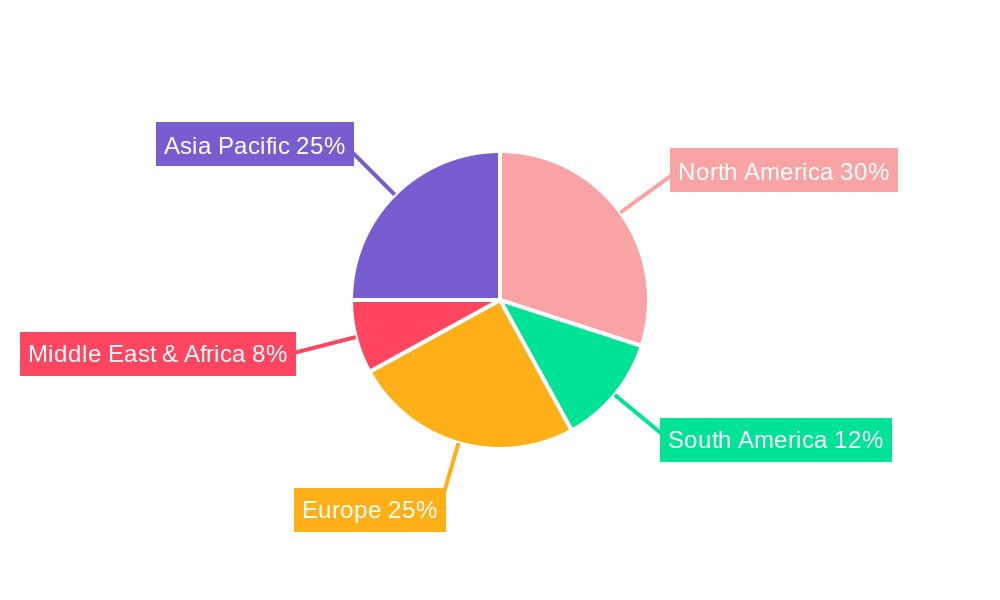

The competitive landscape is characterized by the presence of major global players like DiDi, Uber, and Lyft, alongside regional powerhouses such as Grab and Yandex, all vying for market dominance through technological innovation, strategic partnerships, and expansion into new geographic territories. Emerging trends point towards increased integration of ride-sharing with public transportation networks, the adoption of electric and autonomous vehicles in fleets, and a greater emphasis on safety features and driver welfare. While the market offers immense opportunities, potential restraints include evolving regulatory frameworks in different regions, intense price competition among providers, and the need for robust infrastructure to support a growing user base. Nevertheless, the inherent convenience, affordability, and adaptability of ride-sharing services position the market for sustained and significant growth across all major regions, with Asia Pacific and North America anticipated to be key growth engines.

The global ride-sharing market is on a trajectory of significant expansion, demonstrating robust growth from a historical period of 2019-2024 and projecting continued acceleration through 2033. The Base Year of 2025 serves as a crucial benchmark, with estimates for this year indicating a market valuation in the tens of millions of dollars, driven by increasing urbanization, evolving consumer preferences for convenience, and the pervasive adoption of smartphones. During the Study Period of 2019-2033, the market has witnessed a substantial shift from traditional taxi services to on-demand ride-sharing platforms, largely fueled by technological advancements and a growing demand for flexible transportation solutions. The Forecast Period of 2025-2033 is expected to see this trend intensify, with innovations in vehicle types and service offerings catering to a wider demographic.

The landscape is characterized by a dynamic interplay of established giants and emerging players, each vying for market share through strategic partnerships, aggressive marketing, and the continuous refinement of their service portfolios. The Express Car segment has consistently shown strong performance, reflecting the demand for quick and efficient point-to-point travel. Concurrently, the Pooling Car segment is gaining traction as sustainability and cost-effectiveness become increasingly important considerations for a growing segment of the population. The Application segment reveals a distinct pattern of adoption across age groups, with Age 18-24 and Age 25-34 representing the early adopters and most frequent users, largely due to their digital nativity and reliance on mobile-first solutions. However, the Age 35-44 demographic is also showing a notable increase in engagement, driven by the convenience and time-saving benefits of ride-sharing for commuting and social activities. As the market matures, we anticipate a broadening appeal across all age brackets, including older demographics seeking accessible and reliable transportation. The integration of ride-sharing with public transport networks and the emergence of micro-mobility solutions are further shaping the evolving trends, promising a more integrated and sustainable urban mobility ecosystem. The economic impact of ride-sharing extends beyond mere transportation, influencing local economies through job creation for drivers and supporting ancillary businesses. The market's resilience, even in the face of global economic fluctuations, underscores its fundamental value proposition in modern society.

The meteoric rise of the ride-sharing industry is propelled by a confluence of powerful drivers that resonate deeply with contemporary societal needs and technological advancements. Foremost among these is the pervasive proliferation of smartphones and the widespread availability of high-speed internet, which form the bedrock of on-demand mobility platforms. These technologies have democratized access to transportation, enabling users to book a ride with just a few taps on their screens, thereby eliminating the need for traditional hailing or pre-booking. The increasing urbanization across the globe is another significant catalyst. As more people flock to cities, the demand for efficient and convenient transportation solutions intensifies. Ride-sharing platforms adeptly fill this void, offering an alternative to congested public transport and the prohibitive costs associated with private vehicle ownership in densely populated areas. Furthermore, the growing emphasis on sustainable living and the desire to reduce carbon footprints are increasingly influencing consumer choices. Ride-sharing, particularly through its pooling options, presents a more environmentally conscious alternative to individual car usage, appealing to a segment of the population that prioritizes eco-friendly practices. The economic benefits for both consumers and providers are also substantial. For users, ride-sharing often provides a more affordable and flexible option compared to traditional taxis or car ownership, especially for short to medium distances. For drivers, it offers a flexible income-generating opportunity, allowing them to set their own hours and work as independent contractors. This dual economic advantage fosters widespread adoption and sustained engagement with the platforms.

Despite its impressive growth, the ride-sharing sector is not without its considerable challenges and restraints that can impede its forward momentum. Regulatory uncertainties remain a persistent concern across many jurisdictions. Governments worldwide are grappling with how to effectively regulate ride-sharing services, leading to varying legal frameworks, licensing requirements, and insurance mandates that can create an uneven playing field and introduce operational complexities for companies. Driver welfare and labor rights are also a contentious issue. The classification of drivers as independent contractors rather than employees has led to ongoing debates about fair wages, benefits, and working conditions, potentially leading to legal battles and strikes that can disrupt service availability. Safety and security concerns, though actively addressed by platforms, continue to be a factor impacting user trust. Incidents of harassment or accidents, however rare, can damage a platform's reputation and deter potential users. Intense competition within the market also presents a significant restraint. The presence of numerous players, including global giants and regional contenders, leads to aggressive pricing strategies, high marketing expenditures, and a constant need for innovation to differentiate services. This can squeeze profit margins and make it challenging for newer entrants to gain a foothold. Lastly, the susceptibility to external shocks, such as pandemics or economic downturns, can severely impact demand for ride-sharing services. The COVID-19 pandemic, for instance, led to a sharp decline in ridership due to lockdowns and travel restrictions, highlighting the vulnerability of the industry to unforeseen global events.

The ride-sharing market is poised for continued dominance by specific regions and segments, with Asia Pacific emerging as a powerhouse driven by its vast population, rapid urbanization, and burgeoning middle class. Within this region, countries like China, India, and Indonesia are leading the charge, propelled by the presence of strong local players and a high propensity for mobile-first solutions. The Express Car segment is particularly dominant across these rapidly developing economies. This segment caters to the immediate need for efficient and readily available transportation in densely populated urban centers, where traffic congestion makes other modes of transport less viable. The demand for quick point-to-point journeys, whether for daily commutes, social outings, or business appointments, fuels the consistent growth of Express Car services. Companies like DiDi and Meituan in China, and Grab and Go-jek in Southeast Asia, have heavily invested in optimizing their Express Car offerings, leveraging advanced algorithms for dispatch and efficient route planning to ensure rapid pick-ups and timely arrivals. This segment's dominance is further bolstered by its relative affordability and convenience, making it accessible to a wide spectrum of the population.

Beyond the Express Car segment, the Age 18-24 demographic in Asia Pacific represents a significant and growing user base. This generation, often referred to as digital natives, is highly comfortable with technology and readily embraces ride-sharing as their primary mode of transportation. Their lifestyle, characterized by a strong social presence and active engagement with urban life, necessitates flexible and on-demand mobility. Platforms that cater to this age group often offer attractive pricing, loyalty programs, and integration with social media, further solidifying their dominance. The Age 25-34 demographic is also a key contributor to the market's growth in this region, driven by increasing disposable incomes and a desire for convenience in their professional and personal lives. Their willingness to opt for ride-sharing over car ownership, especially in congested cities, further cements the market's expansion. The robust adoption of smartphones and the increasing penetration of mobile internet are fundamental enablers for both the Express Car segment and the younger age demographics to thrive. The ongoing development of smart city initiatives and improvements in digital infrastructure across Asia Pacific are expected to further accelerate the growth of these dominant segments.

The Pooling Car segment also holds significant potential for future growth, particularly in urban areas where environmental consciousness and cost-saving are becoming increasingly paramount. As cities grapple with traffic congestion and air pollution, government incentives and public awareness campaigns are likely to push more consumers towards shared mobility solutions. Companies are actively investing in optimizing pooling algorithms to ensure efficient matching of riders with similar routes, thereby enhancing the attractiveness and reliability of this segment. The technological advancements in fleet management and real-time tracking further contribute to the seamless operation of pooling services.

The ride-sharing industry is experiencing accelerated growth, fueled by several key catalysts. The increasing urbanization worldwide is a primary driver, creating a perpetual demand for efficient and accessible transportation within congested cities. Furthermore, the continuous evolution of smartphone technology and the widespread availability of affordable mobile data plans have made on-demand ride booking seamless and ubiquitous. The growing environmental consciousness among consumers is also a significant factor, driving demand for ride-pooling options as a more sustainable alternative to private car ownership. Finally, the flexible income-generating opportunities for drivers, coupled with evolving government regulations that are becoming more accommodating in certain regions, are creating a favorable ecosystem for sustained expansion.

This report provides an exhaustive analysis of the global ride-sharing market, spanning the Study Period of 2019-2033, with the Base Year of 2025 serving as a pivotal point for projections. The report delves into the intricate dynamics of market trends, identifying key growth drivers and significant challenges that shape the industry's trajectory. It offers in-depth segmentation by ride type, including Express Car, Special Car, and Pooling Car, and by application demographics, such as Age 18-24, Age 25-34, Age 35-44, Age 45-54, and Age 55-64, providing granular insights into user behavior and market penetration. Furthermore, the report meticulously examines industry developments, highlighting significant advancements and strategic moves by leading companies like DiDi, Uber, Lyft, FREE NOW, Meituan, Grab, Yandex, Go-jek, Dida Chuxing, Ola Cabs, BlaBlaCar, Via, and Wingz. Through a combination of statistical data, market forecasts, and expert analysis, this report aims to equip stakeholders with the comprehensive understanding necessary to navigate the evolving landscape of the ride-sharing industry and capitalize on emerging opportunities within the Forecast Period of 2025-2033.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 18.9%.

Key companies in the market include DiDi, Uber, Lyft, FREE NOW, Meituan, Grab, Yandex, Go-jek, Dida Chuxing, Ola Cabs, BlaBlaCar, Via, Wingz, .

The market segments include Type, Application.

The market size is estimated to be USD 39270 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Ride Sharing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ride Sharing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.