1. What is the projected Compound Annual Growth Rate (CAGR) of the Ride-hailing and Taxi?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ride-hailing and Taxi

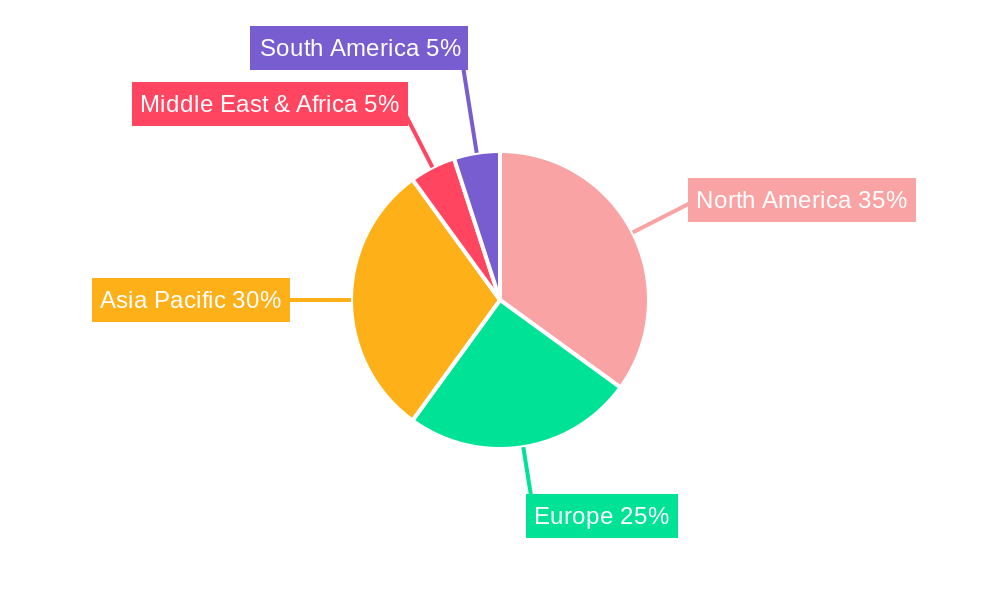

Ride-hailing and TaxiRide-hailing and Taxi by Type (/> Ride-hailing, Taxi), by Application (Years Old, 20-30 Years Old, 31-40 Years Old, 41-50 Years Old, >50 Years Old), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

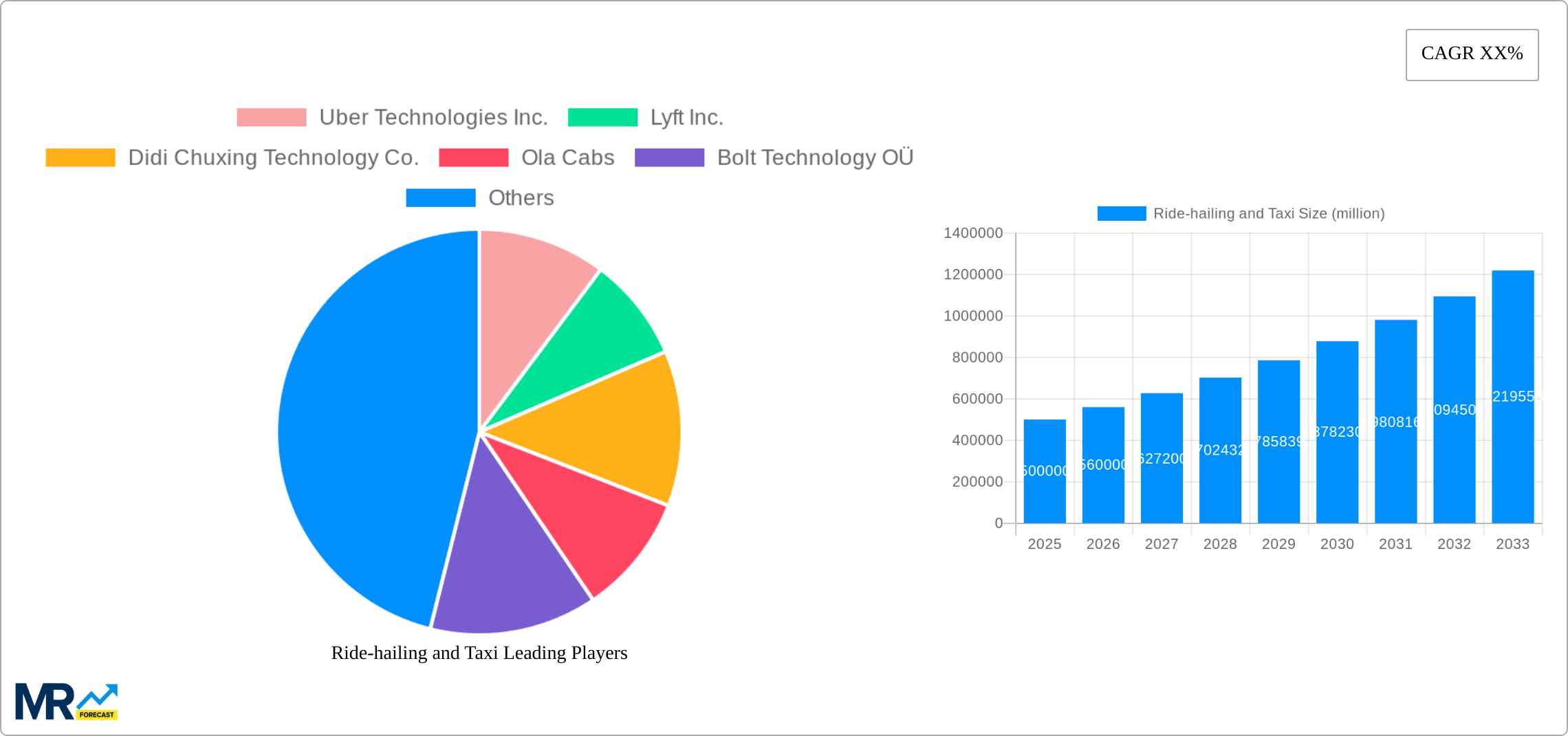

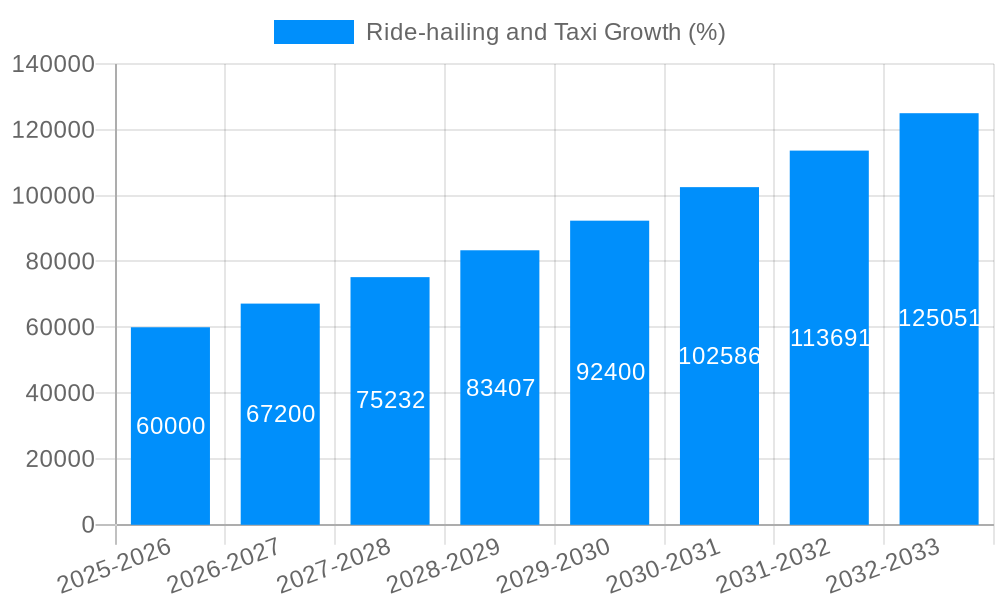

The ride-hailing and taxi market is experiencing robust growth, driven by increasing urbanization, smartphone penetration, and a preference for convenient and affordable transportation alternatives. The market's size, while not explicitly stated, can be reasonably estimated based on publicly available data from similar reports and company valuations. Considering the presence of major players like Uber and Lyft, along with significant regional variations, a global market size of approximately $500 billion in 2025 is a plausible estimate. A Compound Annual Growth Rate (CAGR) of 12% is projected from 2025 to 2033, indicating substantial expansion over the forecast period. This growth is fueled by the continuous integration of technology, expanding service offerings (e.g., food delivery, ride-sharing options), and government initiatives aimed at improving urban mobility. However, challenges remain, including regulatory hurdles in various regions, competition from public transportation, and concerns regarding driver welfare and safety. The market is segmented by ride-hailing versus traditional taxi services and by user demographics, reflecting the diverse user base and service preferences. North America and Asia-Pacific currently represent the largest regional markets, although emerging economies in other regions offer significant growth potential.

The competitive landscape is highly fragmented, with established global players like Uber and Didi Chuxing alongside regional leaders like Ola and Grab. Success hinges on factors such as technological innovation, efficient operations, strategic partnerships, and adapting to local market regulations. The expansion of services beyond basic ride-hailing, including delivery services, premium options, and loyalty programs, is a key trend. Future market growth will likely be influenced by advancements in autonomous vehicle technology, the increasing adoption of electric vehicles within the fleet, and the evolving regulatory environment. Companies need to balance profitability with customer satisfaction, and driver compensation, requiring a thoughtful approach to pricing strategies and operational efficiency to succeed in this dynamic marketplace.

The global ride-hailing and taxi market witnessed significant transformation during the historical period (2019-2024), experiencing a period of rapid growth followed by a period of consolidation and adaptation. The market, valued at approximately $XXX million in 2024, is projected to reach $YYY million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of ZZZ%. This growth is largely driven by increasing smartphone penetration, urbanization, and the rising preference for convenient and affordable transportation alternatives. However, the market faced disruptions due to the COVID-19 pandemic, which impacted ridership significantly in 2020 and 2021. The subsequent recovery has been uneven, with certain regions recovering faster than others. The rise of micromobility options (e-scooters, e-bikes) presents both a challenge and an opportunity, with some ride-hailing companies integrating these services into their platforms. Furthermore, the increasing focus on sustainability and the adoption of electric vehicles within the industry are reshaping the landscape, prompting companies to invest in green initiatives and attract environmentally conscious customers. The competitive landscape is characterized by intense rivalry among established players like Uber and Didi, alongside the emergence of regional and niche players catering to specific market needs. Regulatory changes and evolving safety standards also play a significant role, influencing operational costs and business models. The forecast period (2025-2033) is expected to witness continued growth, albeit at a potentially slower pace compared to the preceding period, as the market matures and reaches a state of greater equilibrium. Market segmentation by age group and service type (ride-hailing vs. taxi) will provide valuable insights into consumer preferences and inform future business strategies.

Several factors contribute to the continued expansion of the ride-hailing and taxi market. Firstly, the ubiquitous availability of smartphones and data connectivity facilitates seamless booking and payment processes, making these services highly accessible to a broad range of users. Urbanization trends, characterized by increasing population density in cities worldwide, fuel demand for efficient and convenient transportation solutions. Ride-hailing apps offer a flexible alternative to car ownership, especially attractive to younger generations and individuals who prioritize convenience over the costs and responsibilities of vehicle possession. The competitive pricing strategies employed by many companies, often supplemented by promotional offers and loyalty programs, contribute significantly to their appeal, particularly among price-sensitive consumers. Furthermore, the rise of the gig economy has facilitated a relatively easy entry point for drivers, creating a large and readily available pool of labor. Technological advancements, such as the integration of artificial intelligence (AI) for route optimization and improved safety features, enhance both driver and passenger experiences. Finally, the expanding adoption of electric vehicles by ride-hailing platforms is responding to growing environmental concerns and government regulations promoting sustainable transportation. These combined forces drive market growth, although challenges remain in regulating the industry and addressing issues such as driver compensation and safety.

Despite the significant growth potential, the ride-hailing and taxi industry faces several challenges. Stringent regulations and licensing requirements vary across different regions, impacting operational costs and market entry for new players. Competition is fierce, especially among the major global players, leading to price wars and pressure on profitability. Driver compensation and working conditions remain contentious issues, with ongoing debates around fair wages, benefits, and worker classification. Safety concerns, including passenger and driver safety, are of paramount importance and require continuous investment in technological and procedural improvements. Fluctuations in fuel prices and the increasing adoption of electric vehicles impact the operational costs of ride-hailing companies. Furthermore, the industry is susceptible to economic downturns, as disposable income levels directly affect demand for non-essential services. The emergence of autonomous vehicles, while promising long-term efficiency, also poses disruption risks to existing driver-based models. Navigating these challenges effectively is crucial for the sustainable growth of the industry.

Dominant Regions: North America (particularly the US) and Asia (particularly China and India) are projected to dominate the market due to their large populations, high smartphone penetration, and robust technological infrastructure. These regions also witness significant levels of urbanization and a growing preference for ride-hailing services.

Dominant Segment: Ride-hailing: The ride-hailing segment is poised for continued dominance due to its affordability, convenience, and technological advancements such as real-time tracking, fare estimations, and cashless payment options. The taxi segment, although established, faces increasing competition from the more technologically advanced and flexible ride-hailing alternatives.

Dominant Age Group: 20-30 Years Old: This demographic is a key driver of growth. Individuals in this age bracket are generally more tech-savvy, comfortable with app-based services, and prioritize convenience and affordability. However, other age groups are gradually adopting ride-hailing services, indicating the broader market appeal of these platforms.

The North American market benefits from high disposable incomes and a large, digitally-savvy population. The Asian market, while facing certain infrastructural challenges, experiences massive growth fueled by rapid urbanization and increasing smartphone penetration, especially in densely populated urban centers. While ride-hailing has made considerable inroads, the traditional taxi market retains a significant share, particularly in regions with less developed tech infrastructure or where regulations favor established taxi services. The significant growth among the 20-30 age group will lead the way as technology evolves and ride-sharing services adapt to meet emerging demands. Competition among the different segments requires adaptation and technological investment to capture market share.

Several factors are poised to accelerate growth in the ride-hailing and taxi industry. These include increased investments in technology to enhance safety and user experience, the expansion of electric vehicle fleets to address environmental concerns, the integration of autonomous vehicles (although facing technological and regulatory hurdles), and the development of innovative business models such as subscriptions and loyalty programs. Further expansion into underserved regions and the tapping of emerging markets presents significant opportunities for growth. The development of specialized services like delivery and logistics, often integrated within existing platforms, diversifies revenue streams and provides another avenue for expansion.

This report offers a detailed analysis of the ride-hailing and taxi industry, providing a comprehensive overview of market trends, drivers, challenges, and key players. It presents valuable insights into market segmentation, regional variations, and future growth prospects, empowering businesses to make informed strategic decisions. The report also examines the impact of technological advancements, regulatory changes, and evolving consumer preferences on the industry's trajectory. Furthermore, it provides a comprehensive forecast for the ride-hailing and taxi market, enabling stakeholders to anticipate future market dynamics.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Uber Technologies Inc., Lyft Inc., Didi Chuxing Technology Co., Ola Cabs, Bolt Technology OÜ, Grab Holdings Inc., Gett, Yandex N.V., Cabify España S.L.U., Meituan Inc., Hailo, Easy Taxi, LeCab, Bitaksi, GoCatch, Ingogo, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Ride-hailing and Taxi," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ride-hailing and Taxi, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.