1. What is the projected Compound Annual Growth Rate (CAGR) of the Rewards-based Credit Card?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Rewards-based Credit Card

Rewards-based Credit CardRewards-based Credit Card by Application (/> Personal, Enterprise, Government, Others), by Type (/> Cash Reward, Points Reward, Travel Reward, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

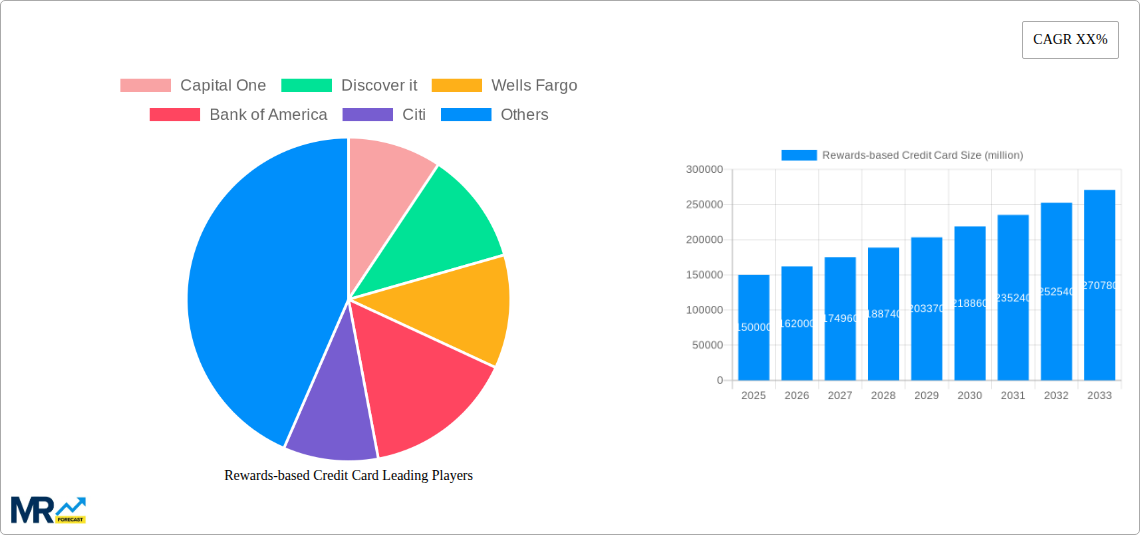

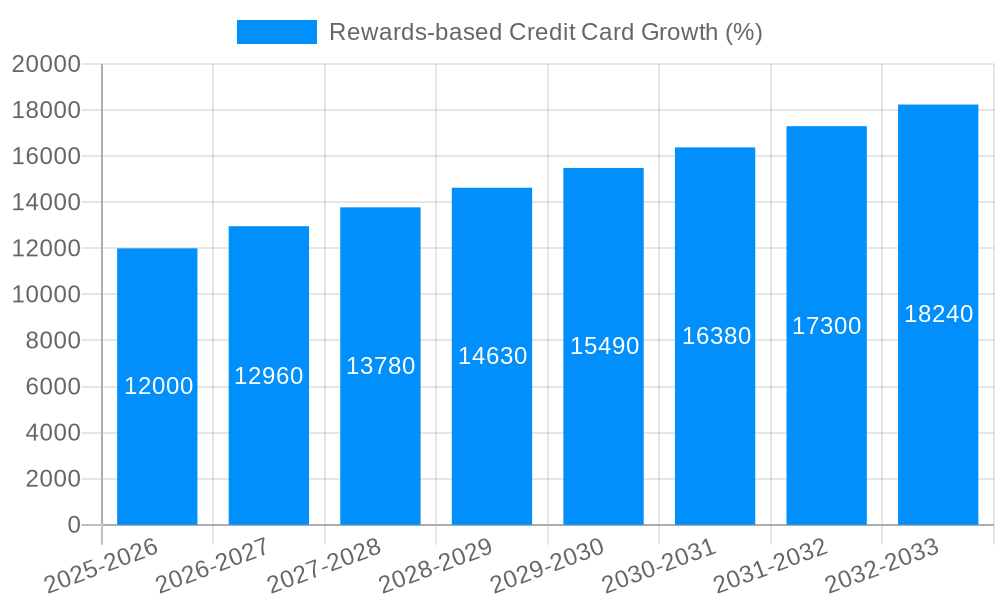

The rewards-based credit card market is experiencing robust growth, driven by increasing consumer spending, a preference for cashback and points programs, and the strategic initiatives of major financial institutions and niche players. The market, estimated at $150 billion in 2025, is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of 8% through 2033, reaching approximately $275 billion. This expansion is fueled by several key factors. Firstly, the increasing prevalence of e-commerce and digital transactions provides ample opportunities for rewards programs to integrate seamlessly into consumer purchasing habits. Secondly, the diversification of rewards offerings, beyond traditional cashback and airline miles, to include experiences, merchandise, and charitable donations, broadens the appeal to a wider demographic. Finally, competitive pressure amongst established players like Capital One, American Express, Chase, and Discover, along with the innovative offerings of fintech companies like Upgrade and Deserve, is driving innovation and enhancing the overall consumer experience. This competitive landscape is particularly active in the United States, which currently holds the largest market share.

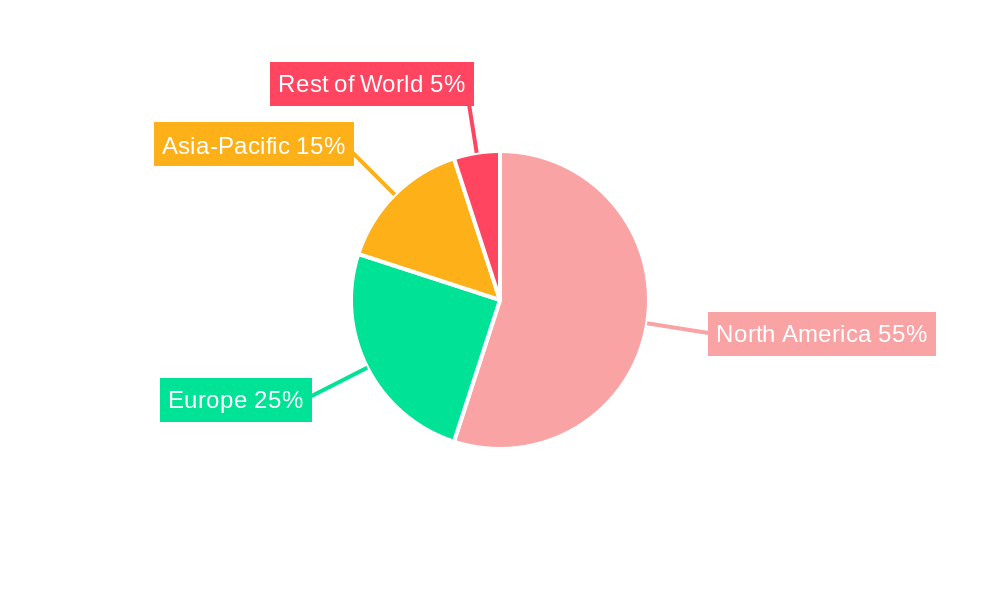

However, the market also faces some challenges. Increased regulatory scrutiny concerning credit card interest rates and responsible lending practices could impact profitability. Furthermore, the economic climate, inflation, and potential consumer spending reductions can influence demand. Despite these headwinds, the market is expected to remain resilient due to the deeply ingrained consumer preference for rewards programs and the ability of credit card companies to adapt and innovate. The continued expansion into new segments, such as specialized rewards cards targeting specific demographics (travel, dining, etc.), and the growing adoption of digital banking technologies, will further support market growth in the coming years. The global nature of this market, with significant presence in North America and Europe, also presents opportunities for expansion into emerging markets.

The rewards-based credit card market experienced phenomenal growth during the historical period (2019-2024), exceeding $XXX million in estimated revenue in 2025. This surge reflects a fundamental shift in consumer behavior, with cardholders increasingly prioritizing rewards programs over traditional banking services. The market's dynamism is driven by intense competition, compelling issuers to constantly innovate and offer increasingly lucrative rewards structures. This includes a move beyond simple cashback to encompass travel points, merchandise, experiences, and even charitable donations. The proliferation of co-branded cards, partnerships between financial institutions and popular brands (like Amazon or Delta), has further amplified market expansion, catering to niche interests and expanding the total addressable market. We are witnessing a trend towards personalization, with algorithms tailoring reward programs to individual spending habits. This sophisticated approach enhances customer loyalty and drives card usage, translating into higher revenue streams for issuers. Furthermore, the rise of digital banking and mobile payment technologies has streamlined the application and management processes, making rewards cards more accessible than ever. The forecast period (2025-2033) predicts continued growth, with projections of reaching $XXX million, driven by the factors outlined above and the ongoing expansion of the global digital economy. The increasing adoption of buy-now-pay-later (BNPL) schemes alongside traditional rewards cards may introduce new competitive dynamics but overall, the outlook remains exceptionally positive for the rewards-based credit card market.

Several key factors are propelling the robust growth of the rewards-based credit card market. Firstly, the intensifying competition among issuers—from established players like Capital One and American Express to newer entrants like Upgrade and Deserve—forces innovation in reward programs. This translates into better offers for consumers, including higher cashback rates, more valuable travel points, and more personalized experiences. Secondly, the increasing prevalence of digital banking and mobile applications simplifies card application and management, making them readily accessible to a wider demographic. Thirdly, strategic partnerships between financial institutions and popular brands create co-branded cards appealing to specific consumer segments. This approach effectively leverages brand recognition and loyalty, driving card adoption. Fourthly, the evolving expectations of consumers play a crucial role. Today's consumers are more discerning and value tangible benefits, making rewards programs a key differentiator when choosing a credit card. Finally, sophisticated data analytics allows issuers to personalize rewards offers based on individual spending patterns, fostering engagement and increasing card usage. These factors, acting in concert, create a powerful impetus for sustained growth within the rewards-based credit card market throughout the forecast period.

Despite the considerable growth potential, the rewards-based credit card market faces certain challenges and restraints. Increasing regulatory scrutiny and stricter lending standards may curb the expansion of credit card offerings and limit the ability of issuers to offer excessively generous reward schemes. Furthermore, the rising cost of acquiring new customers through marketing and promotions can significantly impact profitability. Fluctuations in interest rates can also affect the overall attractiveness of credit cards, especially if rewards programs become disproportionately expensive for issuers to maintain. Maintaining a balance between attractive reward programs and responsible lending practices is crucial to avoid regulatory penalties and maintain consumer trust. The potential for increased credit card debt among consumers poses another risk, potentially leading to decreased consumer spending and negatively impacting the overall market. Finally, the emergence of alternative payment methods, such as BNPL services, presents a competitive threat, potentially diverting some customers away from traditional credit cards.

The North American market, particularly the United States, is expected to dominate the rewards-based credit card market throughout the study period (2019-2033). This dominance stems from the high levels of credit card penetration, established financial infrastructure, and the considerable spending power of consumers.

United States: This region showcases a high concentration of major credit card issuers, fostering intense competition and leading to innovative reward structures that attract and retain customers. The technologically advanced banking infrastructure aids in the widespread adoption of digital credit card management tools, contributing to the market's growth.

Segments: The premium segment (cards with high annual fees and extensive perks) is predicted to witness significant growth, driven by increasing disposable income among affluent consumers. Co-branded cards (tied to popular brands like travel programs or retailers) also show robust growth potential, capturing consumer loyalty through valuable rewards aligned with individual interests. The travel rewards segment specifically shows huge potential due to the increase in post-pandemic travel and desire for luxurious experiences.

The market’s growth is also driven by:

The rewards-based credit card industry is experiencing a surge due to several catalysts. Technological advancements enable personalized rewards and seamless digital experiences, improving customer satisfaction. Strategic partnerships between financial institutions and retailers or travel companies create attractive co-branded cards that cater to specific consumer needs and preferences. Furthermore, the increasing adoption of mobile payment technologies makes using rewards cards more convenient, thus expanding their reach to new customers.

This report provides a comprehensive analysis of the rewards-based credit card market, encompassing historical data, current market trends, and future growth projections. It identifies key drivers and restraints, profiles leading players, and explores emerging opportunities in the sector. The detailed segmentation and regional analysis offer valuable insights for businesses, investors, and policymakers seeking to understand and capitalize on this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Capital One, Discover it, Wells Fargo, Bank of America, Citi, US Bank, Chase, Upgrade, American Express, Aspiration, Truist, World of Hyatt, Amazon, Alliant, Delta, Aeroplan, Deserve, Petal, ANZ, National Westminster Bank, First Citizens Bank, RBC, Huntington Bank, Barclaycard, Bankwest, FCCU, PenFed, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Rewards-based Credit Card," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Rewards-based Credit Card, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.