1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Inventory Management Software?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Retail Inventory Management Software

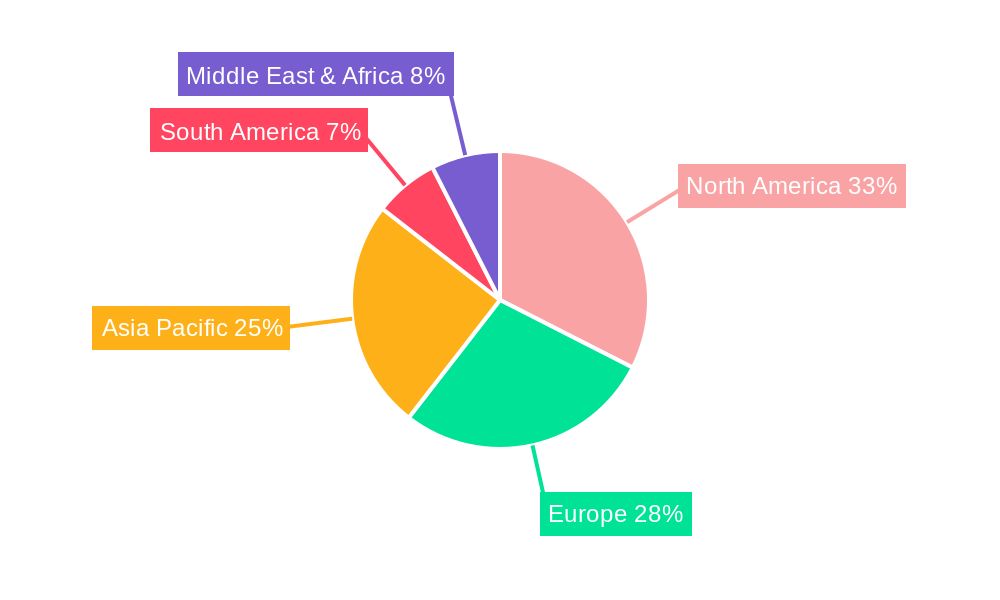

Retail Inventory Management SoftwareRetail Inventory Management Software by Application (/> SMEs, For Large Businesses), by Type (/> Cloud-based, On-premise), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

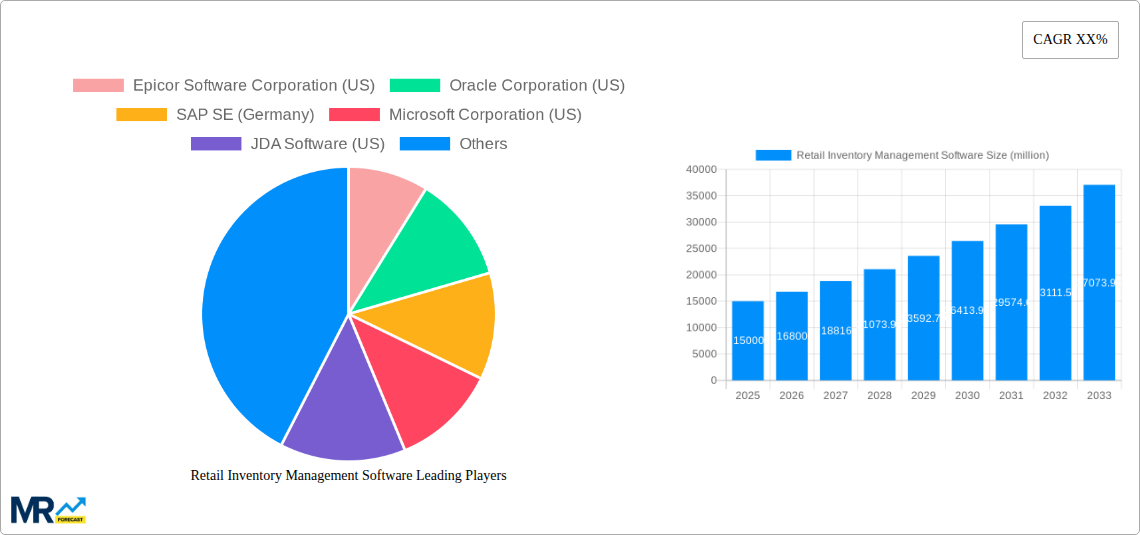

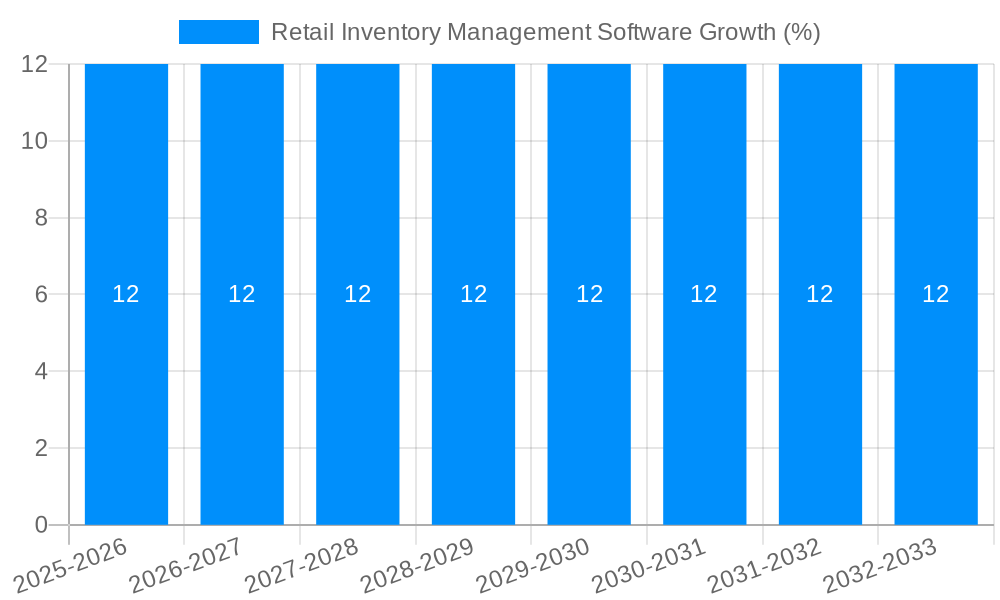

The global Retail Inventory Management Software market is poised for significant expansion, projected to reach an estimated market size of approximately $15,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 12%. This impressive growth trajectory is fueled by the escalating need for enhanced operational efficiency, reduced stockouts and overstocking, and improved customer satisfaction within the retail sector. Small and Medium-sized Enterprises (SMEs) are increasingly adopting these solutions to streamline their inventory processes and compete effectively, while large enterprises leverage advanced features for comprehensive supply chain visibility and optimized stock levels across multiple channels. The shift towards cloud-based solutions is a dominant trend, offering scalability, accessibility, and cost-effectiveness, thereby democratizing access to sophisticated inventory management tools. This migration is driven by the inherent flexibility and reduced IT overheads associated with SaaS models, enabling businesses to adapt quickly to changing market demands and technological advancements.

The market's expansion is further propelled by the burgeoning e-commerce landscape, which necessitates sophisticated real-time inventory tracking and fulfillment capabilities. As retailers grapple with the complexities of omnichannel strategies, demand for integrated inventory management systems that can synchronize stock across online and offline channels is surging. Key drivers include the imperative to minimize carrying costs, prevent inventory obsolescence, and enhance the accuracy of sales forecasts through data-driven insights. While the market exhibits strong growth potential, certain restraints, such as the initial implementation costs and the need for employee training, can pose challenges for some businesses. However, the demonstrable return on investment through improved efficiency and reduced losses is increasingly outweighing these initial hurdles, solidifying the indispensable role of advanced retail inventory management software in today's competitive retail environment.

This report offers a definitive analysis of the global Retail Inventory Management Software market, forecasting its trajectory from a base year of 2025 through to 2033. Leveraging a robust study period spanning 2019 to 2033, with particular focus on the historical performance from 2019-2024 and the estimated outlook for 2025, this comprehensive document delves into the intricate dynamics shaping this vital sector. The report quantifies market opportunities and challenges, projecting a substantial market size and significant growth potential. It provides actionable insights for stakeholders by dissecting key trends, driving forces, inherent challenges, and dominant market segments. Furthermore, it identifies crucial growth catalysts and profiles the leading players within this competitive landscape, accompanied by a detailed overview of significant developments.

The global Retail Inventory Management Software market is poised for a period of robust expansion and strategic evolution, driven by an intensifying focus on operational efficiency and enhanced customer experiences. Throughout the study period (2019-2033), we anticipate a significant shift towards integrated solutions that seamlessly connect inventory data with sales, marketing, and supply chain operations. This trend is fueled by the sheer volume of units managed across the retail spectrum, with businesses grappling with millions of individual SKUs and the imperative to optimize their stock levels. From a base year of 2025, the market is projected to witness a substantial increase in adoption, particularly among Small and Medium-sized Enterprises (SMEs) who are increasingly recognizing the critical role of sophisticated inventory management in their survival and growth. The proliferation of e-commerce has further amplified the need for real-time inventory visibility, forcing retailers to move beyond manual tracking and embrace automated systems. This demand is translating into a surge in cloud-based solutions, which offer scalability, flexibility, and cost-effectiveness, becoming the preferred choice for many businesses seeking to manage millions of units efficiently. On-premise solutions, while still relevant for certain large enterprises with stringent data security requirements, will see a more moderate growth trajectory. The increasing complexity of supply chains, characterized by a vast number of sourcing locations and distribution channels, necessitates advanced software capabilities. This includes features such as demand forecasting, automated reordering, and sophisticated stock allocation across multiple channels. Retailers are also looking for solutions that can provide deeper insights into inventory performance, enabling them to identify slow-moving items, optimize product placement, and minimize stockouts, ultimately safeguarding revenue streams and customer loyalty. The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms within inventory management software is another prominent trend, promising to revolutionize how retailers predict demand, manage stock, and mitigate losses associated with obsolete or excess inventory. This technological infusion will empower businesses to manage millions of units with unprecedented accuracy and foresight.

The rapid ascent of the Retail Inventory Management Software market is being propelled by a confluence of powerful forces, fundamentally reshaping how retailers operate and compete. A primary driver is the escalating pressure to optimize operational efficiency and minimize costs. In an era where margins are continually squeezed, businesses are aggressively seeking ways to reduce waste, avoid overstocking, and prevent stockouts that lead to lost sales and dissatisfied customers. The sheer volume of units that retailers manage, often numbering in the millions, makes efficient inventory control not just a desirable feature but an absolute necessity for profitability. Furthermore, the explosive growth of e-commerce and the omnichannel retail landscape have created an imperative for real-time inventory visibility across all sales channels. Consumers today expect seamless purchasing experiences, whether online, in-store, or through mobile apps, and this necessitates accurate, up-to-the-minute information about stock availability. The increasing complexity of global supply chains, with more diverse sourcing and distribution networks, further compounds the need for robust inventory management software. Retailers are tasked with tracking goods across multiple geographic locations, managing lead times, and mitigating the risks of disruptions, all of which demand sophisticated software solutions. The demand for enhanced customer experiences also plays a significant role. Customers expect accurate product availability information and timely deliveries. Inventory management software that enables precise stock tracking and efficient order fulfillment directly contributes to higher customer satisfaction and loyalty, thereby driving repeat business and positive brand perception. The ongoing digital transformation across the retail sector, coupled with a growing awareness of the competitive advantages offered by advanced technology, is encouraging even smaller businesses to invest in these solutions.

Despite the promising growth trajectory, the Retail Inventory Management Software market faces several formidable challenges and restraints that could temper its expansion. A significant hurdle is the initial cost of implementation and integration, particularly for SMEs who may have limited budgets. While cloud-based solutions offer more accessible entry points, the overall investment in software, hardware, training, and ongoing maintenance can still be substantial when managing millions of units. For larger enterprises, the complexity of integrating new inventory management systems with existing legacy infrastructure, such as ERP systems, can be a time-consuming and expensive undertaking, often leading to delays and budget overruns. Data accuracy and integrity remain a perennial concern. The effectiveness of any inventory management software is entirely dependent on the quality of the data it receives. Inaccurate stock counts, manual data entry errors, and a lack of standardized data input procedures can lead to flawed insights, poor decision-making, and ultimately, significant financial losses. The sheer volume of units handled by retailers exacerbates this issue, making even minor inaccuracies impactful. Another significant restraint is the resistance to change and the need for skilled personnel. Adopting new software often requires employees to learn new processes and adapt to different workflows. Resistance to change, lack of adequate training, and the scarcity of skilled IT professionals who can effectively manage and leverage these complex systems can hinder adoption and effective utilization. Data security and privacy concerns, especially with cloud-based solutions, are also a significant consideration for many retailers, particularly those handling sensitive customer or proprietary product information. Ensuring compliance with various data protection regulations adds another layer of complexity. Finally, the rapid pace of technological advancement can lead to a short shelf-life for certain software solutions, forcing businesses to consider frequent upgrades and replacements, which can be a financial burden.

The global Retail Inventory Management Software market is anticipated to witness significant dominance from Cloud-based solutions across various regions and segments, driven by their inherent flexibility, scalability, and cost-effectiveness. This segment is poised to capture a substantial market share due to its ability to cater to the dynamic needs of retailers, from SMEs to large enterprises, particularly in managing millions of units.

Dominant Segments:

Type: Cloud-based Solutions: This segment is expected to exhibit the most rapid growth and command the largest market share.

Application: SMEs (Small and Medium-sized Enterprises): While large enterprises have traditionally been early adopters, SMEs are increasingly recognizing the indispensable value of sophisticated inventory management.

Dominant Region (Hypothetical Example): North America

North America is projected to be a leading region in the Retail Inventory Management Software market, driven by a mature retail sector, high adoption rates of technology, and a strong presence of key market players.

The Retail Inventory Management Software industry is experiencing a significant surge in growth, primarily catalyzed by the pervasive adoption of e-commerce and omnichannel retail strategies. The need for real-time, accurate inventory visibility across all sales channels to meet customer demands for instant gratification is paramount. Furthermore, the increasing complexity of global supply chains, coupled with the sheer volume of units managed by retailers, compels businesses to invest in automated solutions. The drive for operational efficiency, cost reduction, and enhanced customer experiences are also key growth enablers, pushing even SMEs to embrace sophisticated software for managing millions of SKUs.

This report provides an unparalleled depth of insight into the Retail Inventory Management Software market. It meticulously analyzes market size, projected growth, and key trends, offering a 360-degree view of the industry. From dissecting the driving forces and understanding the challenges to identifying dominant regions and segments, the report equips stakeholders with the knowledge to navigate this dynamic landscape effectively. Furthermore, it highlights crucial growth catalysts and offers detailed profiles of leading players, alongside a chronological breakdown of significant developments, ensuring a comprehensive and actionable understanding of the market's present and future.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Epicor Software Corporation (US), Oracle Corporation (US), SAP SE (Germany), Microsoft Corporation (US), JDA Software (US), Netsuite (US), Fishbowl (US), inFlow Inventory Software (Canada), IBM Corporation (US), Totvs S.A (Brazil), Retalix Ltd (Israel), Quintiq (Netherlands).

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Retail Inventory Management Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Retail Inventory Management Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.