1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Bank Loyalty Program for Commercial User?

The projected CAGR is approximately 4.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Retail Bank Loyalty Program for Commercial User

Retail Bank Loyalty Program for Commercial UserRetail Bank Loyalty Program for Commercial User by Type (Subscription-based Program, Points Program, Others), by Application (Enterprise, Government, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

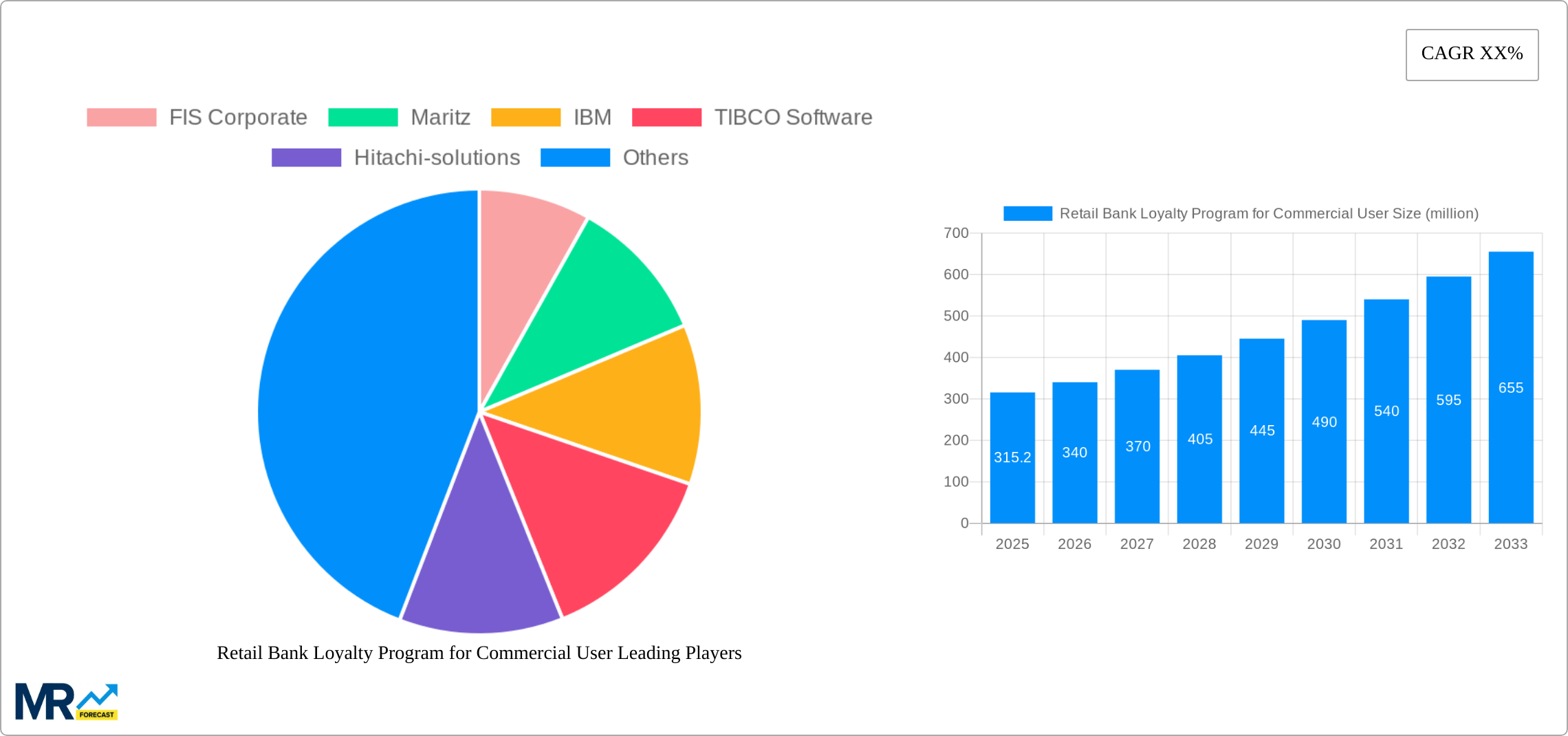

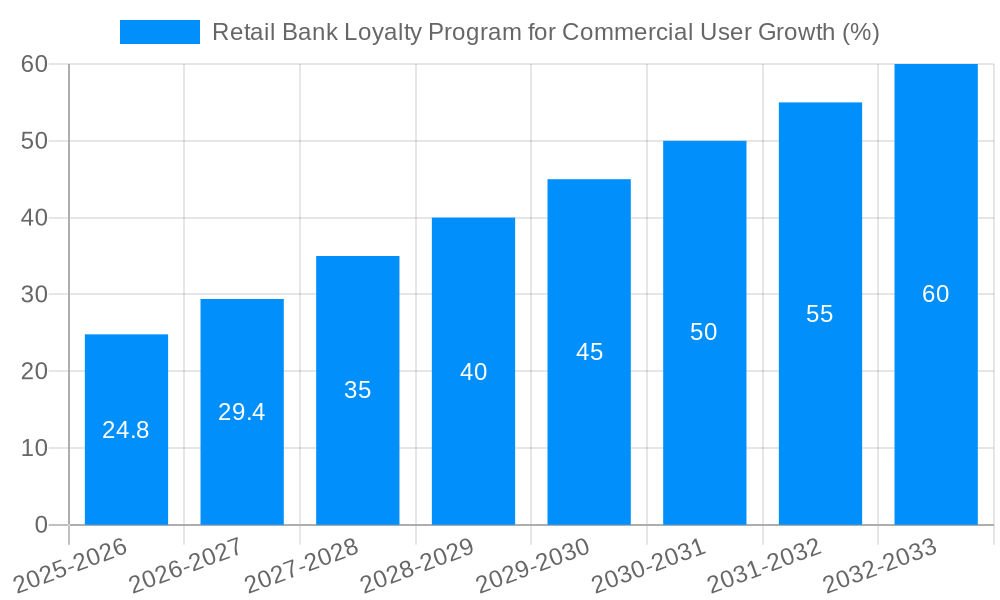

The global retail bank loyalty program market for commercial users is a dynamic sector poised for sustained growth. With a 2025 market size of $239 million and a projected Compound Annual Growth Rate (CAGR) of 4.0% from 2025 to 2033, this market reflects a growing need for banks to cultivate and retain valuable commercial clients. Key drivers include the increasing competition within the banking sector, pushing institutions to differentiate their offerings through personalized loyalty programs that reward high-value transactions and engagement. Furthermore, the adoption of advanced data analytics allows banks to tailor rewards and offers more effectively, enhancing customer loyalty and driving revenue growth. Program types are varied, ranging from subscription-based programs providing exclusive benefits to points-based programs offering redeemable rewards, catering to different commercial client needs and preferences. The enterprise segment currently dominates the market, given the scale of transactions and the strategic importance of retaining large corporate clients. However, government and other segments are witnessing increasing adoption, reflecting the broader appeal of loyalty programs across different commercial entities.

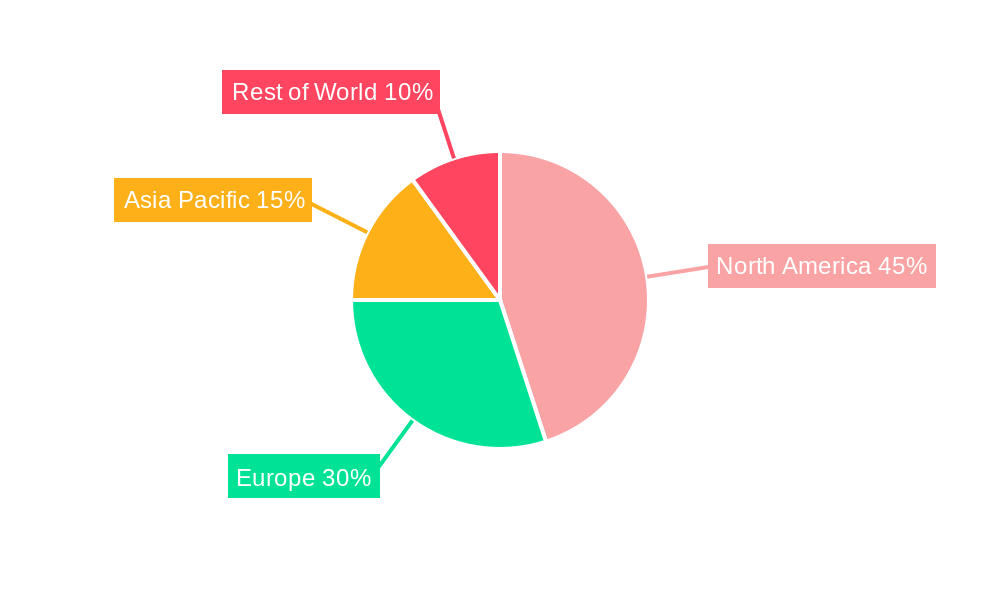

Growth is expected to be driven by technological advancements, with companies like FIS Corporate, Maritz, IBM, and TIBCO Software leading the charge in providing sophisticated loyalty program management solutions. The integration of these solutions with existing banking systems streamlines program administration and provides valuable customer insights. However, challenges remain, primarily concerning the cost of implementing and maintaining such programs and the need for robust data security measures to protect sensitive customer information. Geographic distribution indicates strong performance in North America and Europe, with significant growth potential in emerging markets within Asia Pacific, particularly in India and China, as these economies experience increasing financial inclusion and the rise of digital banking. The competitive landscape is characterized by both established players and emerging technology firms, fostering innovation and driving the market's evolution towards more sophisticated and personalized loyalty schemes.

The retail bank loyalty program market for commercial users is experiencing robust growth, projected to reach multi-million dollar valuations by 2033. Driven by increasing competition and the need for enhanced customer retention, banks are investing heavily in sophisticated loyalty programs to attract and retain high-value commercial clients. The historical period (2019-2024) saw a gradual uptake, but the forecast period (2025-2033) anticipates a significant surge, with the estimated year 2025 marking a pivotal point in this expansion. This growth is fuelled by technological advancements enabling personalized experiences, data-driven insights for program optimization, and seamless integration with existing banking systems. The shift towards digital banking further accelerates this trend, making loyalty programs a crucial component of the overall digital customer experience strategy. Program types are diversifying, moving beyond simple points-based systems to encompass subscription-based models and other value-added services, tailored to the specific needs and preferences of commercial clients, including bespoke financial incentives and preferential access to premium services. The market is also witnessing an increase in the adoption of advanced analytics and AI to understand customer behavior, identify high-value segments, and optimize program effectiveness. This allows banks to maximize ROI and deliver truly personalized loyalty programs that resonate with their commercial clientele. The rising adoption of cloud-based solutions and the development of innovative loyalty platforms are also major contributors to market expansion. Moreover, the increasing focus on building strong customer relationships and enhancing brand loyalty is a key driver of the market’s growth. Companies are recognizing the lifetime value of a loyal commercial client and are willing to invest in programs that ensure long-term engagement.

Several key factors are driving the growth of retail bank loyalty programs for commercial users. The intense competition within the banking sector necessitates differentiation strategies, and loyalty programs provide a powerful tool to attract and retain commercial clients. These programs enhance customer engagement, strengthen customer relationships, and improve customer lifetime value. Technological advancements, particularly in data analytics and personalized marketing, enable banks to create more targeted and effective loyalty programs. The increasing adoption of cloud-based solutions and APIs facilitates seamless integration with existing banking systems and other customer relationship management (CRM) tools. Furthermore, the growing demand for personalized banking experiences and the desire for tailored financial incentives drive commercial clients to favor banks offering comprehensive loyalty programs. Finally, regulatory changes and compliance requirements in several regions are also prompting banks to implement robust loyalty programs to ensure transparency and fair practices in their customer interactions. The shift towards digital banking channels necessitates digital loyalty program solutions, further boosting the market growth.

Despite the promising outlook, the retail bank loyalty program market for commercial users faces several challenges. The high initial investment required to design, implement, and manage a comprehensive loyalty program can be a significant barrier for smaller banks. The complexity of integrating loyalty programs with existing banking systems and data infrastructures poses another hurdle. Maintaining program relevance and engaging users over time requires continuous innovation and adaptation to evolving customer expectations. Measuring the return on investment (ROI) of loyalty programs can be challenging, necessitating robust analytics and reporting capabilities. Furthermore, the need to comply with data privacy regulations and maintain customer data security adds to the complexity of managing loyalty programs. The risk of fraud and abuse within the loyalty program framework is another critical concern that necessitates careful planning and robust security measures. Finally, successfully motivating commercial users, whose needs are diverse and often complex compared to individual customers, requires a deep understanding of their specific requirements and the development of highly tailored programs.

The North American and European markets are expected to dominate the retail bank loyalty program market for commercial users throughout the forecast period (2025-2033). These regions are characterized by a high concentration of major banking institutions with a strong focus on customer relationship management and technological advancements. Within the segments, the Enterprise application segment is projected to hold the largest market share. Large corporations and multinational businesses demand sophisticated loyalty solutions integrated with their existing financial systems, often incorporating multiple features like tiered reward structures, bespoke financial incentives and preferential access to financial products. These sophisticated requirements justify the higher investment costs associated with enterprise-level solutions.

North America: High adoption of digital banking, advanced analytics, and a focus on personalized experiences drive the region's dominance. Significant investments by major banks in loyalty program infrastructure further contribute to this trend.

Europe: The presence of large, established banks and a regulatory environment promoting customer protection are key factors driving growth. This region also sees increased adoption of subscription-based programs designed to provide consistent and valuable services to commercial clients.

Enterprise Application Segment: The complexity of managing financial relationships for large corporations necessitates robust and highly customizable loyalty solutions. The higher value of these commercial clients justifies the investment. The potential for substantial returns on investment and enhanced customer retention makes it the most attractive segment for banks.

The Points Program type continues to hold a significant market share, but the trend is towards diversification. Subscription-based programs, offering consistent value and predictable returns, are showing strong growth. The other segments, including government institutions and smaller-scale businesses, are expected to expand at a slower rate, lagging the enterprise segment.

The convergence of several factors is fueling the expansion of the retail bank loyalty program market for commercial users. The increasing adoption of digital technologies, particularly in data analytics and personalized marketing, plays a crucial role. The rising demand for personalized customer experiences and the push for better customer engagement are also key drivers. The development of innovative loyalty platforms, which provide better integration with existing banking systems and CRM tools, is another significant growth catalyst. Finally, the growing need to improve customer retention and build stronger customer relationships further boosts the demand for advanced loyalty programs.

This report offers a detailed analysis of the retail bank loyalty program market for commercial users, providing comprehensive insights into market trends, driving factors, challenges, and growth opportunities. It includes a thorough examination of key market segments, geographic regions, and leading players. The report leverages advanced market research methodologies to deliver reliable forecasts and valuable insights for businesses operating in this dynamic sector, helping them to make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.0%.

Key companies in the market include FIS Corporate, Maritz, IBM, TIBCO Software, Hitachi-solutions, Oracle Corporation, Aimia, Comarch, Exchange Solutions, Creatio, Customer Portfolios, Antavo, .

The market segments include Type, Application.

The market size is estimated to be USD 239 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Retail Bank Loyalty Program for Commercial User," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Retail Bank Loyalty Program for Commercial User, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.