1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Analytics Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Retail Analytics Service

Retail Analytics ServiceRetail Analytics Service by Type (/> Merchandising Analysis, Pricing Analysis, Performance Analysis, Yield Analysis, Others), by Application (/> SMEs, Large Enterprises), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

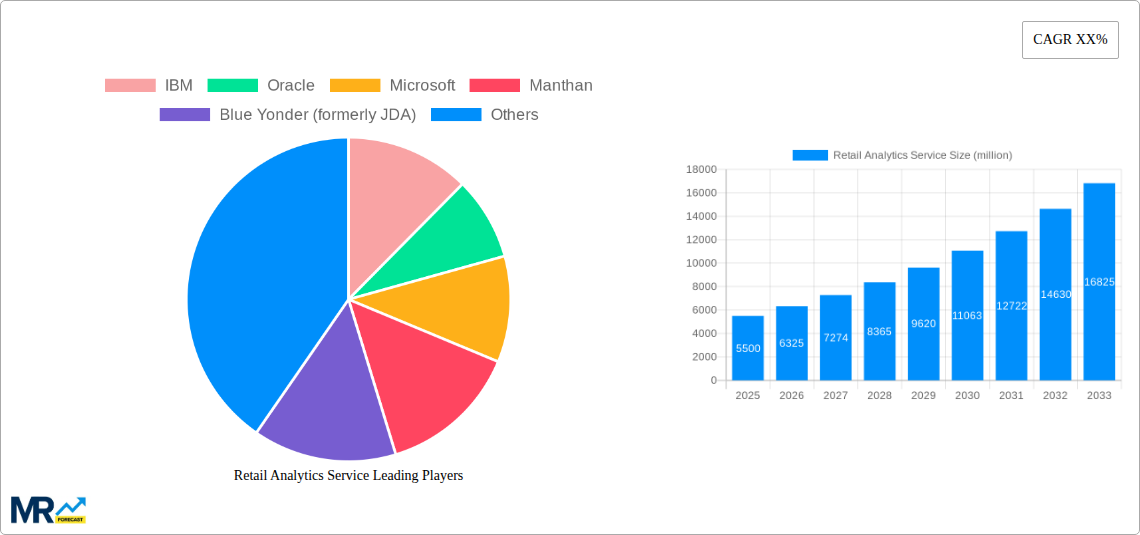

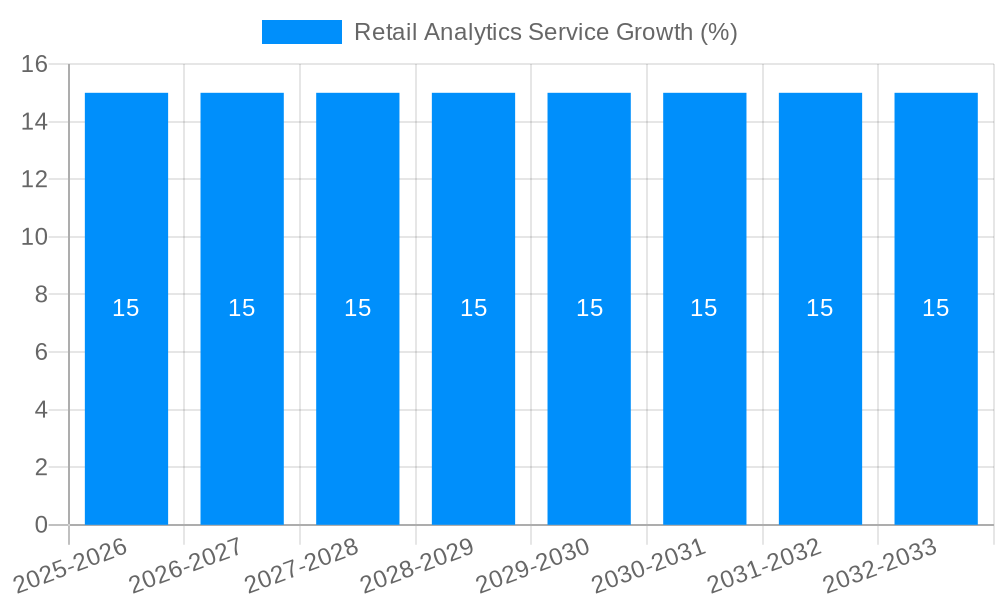

The global Retail Analytics Service market is poised for significant expansion, estimated at USD 5,500 million in 2025, with a projected Compound Annual Growth Rate (CAGR) of 15% through 2033. This robust growth is propelled by the increasing volume and complexity of retail data, necessitating advanced analytical tools to extract actionable insights. Key drivers include the growing demand for personalized customer experiences, optimized inventory management, and enhanced operational efficiency. Retailers are increasingly leveraging data analytics to understand consumer behavior, predict purchasing patterns, and tailor marketing campaigns, thereby driving sales and customer loyalty. The competitive landscape is marked by a strong focus on developing sophisticated AI-powered solutions and cloud-based platforms, enabling real-time analysis and predictive capabilities.

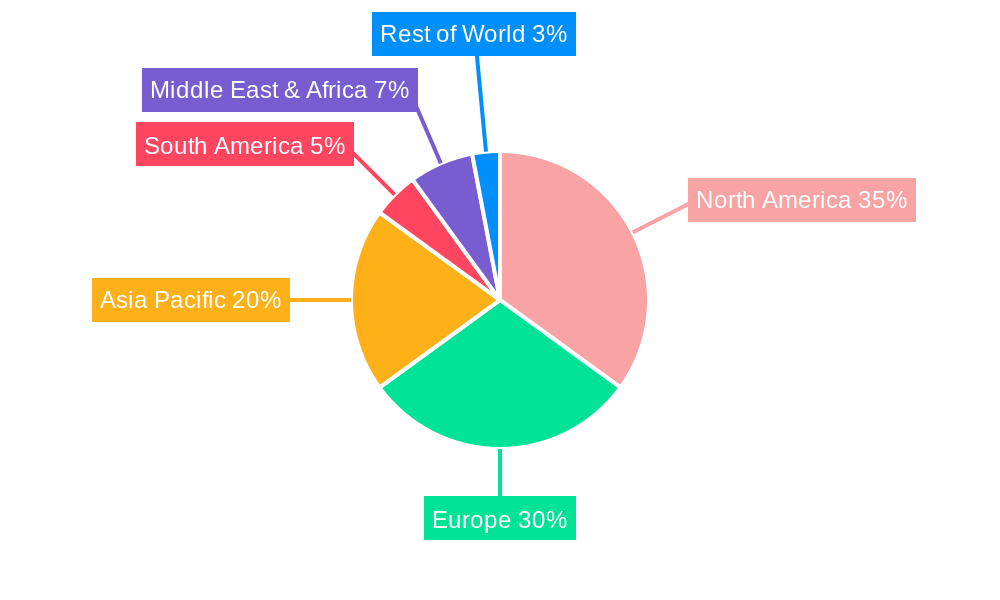

The market is segmented across various analytical types, with Merchandising Analysis, Pricing Analysis, and Performance Analysis being dominant segments. These segments are crucial for retailers to understand product performance, optimize pricing strategies for maximum profitability, and monitor overall business health. The application landscape is characterized by widespread adoption across both Small and Medium-sized Enterprises (SMEs) and Large Enterprises, each seeking to harness the power of data to gain a competitive edge. Geographically, North America currently leads the market, followed closely by Europe and the rapidly growing Asia Pacific region, driven by increasing digital transformation initiatives and a burgeoning e-commerce sector. Restraints, such as data privacy concerns and the need for skilled data analysts, are being addressed through evolving regulatory frameworks and investments in training and talent development.

This report delves into the dynamic and rapidly evolving Retail Analytics Service market, providing an in-depth examination of its trends, drivers, challenges, and future trajectory. Covering the extensive Study Period: 2019-2033, with a Base Year: 2025, and an Estimated Year: 2025, and a comprehensive Forecast Period: 2025-2033, this analysis also incorporates insights from the Historical Period: 2019-2024. We will explore the market's performance across various segments including Type: Merchandising Analysis, Pricing Analysis, Performance Analysis, Yield Analysis, Others and Application: SMEs, Large Enterprises, and highlight key industry developments.

The global retail analytics service market is poised for substantial expansion, projecting to reach a valuation exceeding USD 75,000 million by 2033. This impressive growth trajectory is underpinned by a confluence of transformative trends that are reshaping the retail landscape. A paramount trend is the increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) algorithms, which are empowering retailers to move beyond traditional descriptive analytics towards predictive and prescriptive insights. This allows for more accurate demand forecasting, personalized marketing campaigns, and optimized inventory management, ultimately leading to enhanced customer experiences and increased profitability. The proliferation of data sources, including point-of-sale (POS) systems, e-commerce platforms, social media, and IoT devices, is fueling the demand for sophisticated analytics solutions. Retailers are actively seeking ways to consolidate and analyze this vast amount of data to gain a holistic view of their operations and customer behavior.

Furthermore, the burgeoning e-commerce sector continues to be a significant driver. With the acceleration of online shopping, retailers are leveraging analytics to understand online customer journeys, optimize website performance, and personalize product recommendations. The integration of cloud-based analytics platforms is also a notable trend, offering scalability, cost-effectiveness, and easier access to advanced analytical tools for retailers of all sizes. This shift towards cloud solutions is democratizing access to powerful analytics, enabling even Small and Medium-sized Enterprises (SMEs) to compete with larger players. In the Base Year: 2025, the market is estimated to be valued at approximately USD 25,000 million, indicating a robust foundation for future growth. By Estimated Year: 2025, this valuation is expected to solidify, setting the stage for the substantial expansion anticipated in the subsequent forecast period. The emphasis on customer centricity is another critical trend, with retailers using analytics to understand individual customer preferences, predict purchasing behavior, and deliver tailored experiences that foster loyalty and drive repeat business. This data-driven approach to customer engagement is becoming a non-negotiable for survival and success in the competitive retail environment. The increasing sophistication of fraud detection and loss prevention strategies, powered by advanced analytics, also contributes to the market's positive outlook, as retailers aim to minimize financial losses and protect their brand reputation.

The retail analytics service market is experiencing a powerful surge, primarily propelled by the unyielding demand for enhanced operational efficiency and a deeper understanding of consumer behavior. Retailers are recognizing that in today's hyper-competitive environment, gut feelings are no longer sufficient. The advent of big data, coupled with increasingly accessible and powerful analytical tools, has created an unprecedented opportunity to harness information for strategic decision-making. The rise of e-commerce and omnichannel retail strategies has significantly amplified the volume and complexity of data generated by customer interactions. Analyzing this data is crucial for optimizing online storefronts, personalizing customer experiences, and ensuring seamless transitions between online and offline channels. This has led to a substantial increase in the adoption of advanced analytics solutions aimed at tracking customer journeys, segmenting audiences, and predicting purchasing patterns.

Furthermore, the relentless pursuit of profitability is a major driving force. Retailers are leveraging analytics to identify opportunities for margin improvement through optimized pricing strategies, effective promotional planning, and efficient inventory management. Understanding product performance, identifying slow-moving items, and forecasting demand with greater accuracy are critical for minimizing waste and maximizing revenue. The competitive imperative to stay ahead of rivals is also pushing retailers to invest in analytics. Those who can leverage data to understand market trends, anticipate competitor moves, and respond swiftly to changing consumer preferences are better positioned for success. The drive towards personalization, fueled by data analytics, is another key propellant. Consumers now expect tailored experiences, and retailers are investing in analytics to deliver personalized product recommendations, targeted marketing messages, and customized offers, thereby enhancing customer satisfaction and loyalty.

Despite the robust growth potential, the retail analytics service market faces several significant challenges and restraints that could impede its full realization. A primary hurdle is the data quality and integration issue. Retailers often struggle with disparate data systems, inconsistent data formats, and incomplete datasets, making it difficult to derive meaningful and reliable insights. The sheer volume and velocity of data can also overwhelm existing infrastructure and analytical capabilities, requiring substantial investment in technology and skilled personnel. Talent shortage is another critical constraint. There is a scarcity of data scientists, analysts, and IT professionals with the expertise to effectively implement, manage, and interpret complex retail analytics solutions. This skill gap can lead to underutilization of invested technologies and delayed ROI.

Moreover, the cost of implementation and maintenance of advanced analytics solutions can be a significant barrier, particularly for Small and Medium-sized Enterprises (SMEs). The initial investment in software, hardware, and training can be substantial, and ongoing maintenance and upgrade costs can further strain budgets. Data privacy and security concerns are also paramount. With increasing regulations and growing consumer awareness about data protection, retailers must navigate a complex landscape of compliance requirements, ensuring the ethical and secure handling of customer data. The fear of data breaches and the potential reputational damage associated with them can lead to cautious adoption of new technologies. Finally, resistance to change within organizations can be a formidable restraint. Adopting a data-driven culture requires a shift in mindset and processes, which can be met with skepticism or inertia from employees accustomed to traditional methods. Overcoming these challenges will be crucial for unlocking the full potential of retail analytics services.

The retail analytics service market is characterized by dynamic regional and segment-specific dominance, with certain areas and offerings exhibiting superior growth and adoption rates. North America, particularly the United States, is poised to continue its reign as the leading region. This dominance is attributed to several factors, including the early adoption of advanced technologies, a highly developed retail infrastructure, a large concentration of large enterprises, and a robust e-commerce ecosystem. The region’s proactive approach to leveraging data for competitive advantage, coupled with significant investments in AI and ML, solidifies its position. Furthermore, the strong presence of major retail players and technology providers fosters innovation and drives demand for sophisticated analytics solutions. The market size in North America is estimated to be over USD 15,000 million in 2025, projecting significant growth through the forecast period.

Within the segments, Large Enterprises are expected to be the dominant application segment. These organizations typically possess the financial resources, existing infrastructure, and the strategic imperative to invest heavily in comprehensive retail analytics solutions. Their complex operations, vast customer bases, and the need for detailed performance tracking across multiple channels make them prime candidates for sophisticated analytics. This segment's market size is projected to exceed USD 45,000 million by 2033.

Moreover, the Merchandising Analysis type segment is anticipated to exhibit substantial growth and potentially lead the market. In the current retail environment, optimizing product assortments, understanding product performance, managing inventory effectively, and making data-driven decisions about product introductions and discontinuations are critical for success. Merchandising analytics directly addresses these pain points, enabling retailers to maximize sales, minimize markdowns, and enhance customer satisfaction by offering the right products at the right time. The market size for Merchandising Analysis is estimated to reach over USD 20,000 million by 2033, driven by the ongoing need for efficient product lifecycle management and assortment optimization.

The Forecast Period: 2025-2033 will witness a continued surge in the adoption of advanced analytical techniques within these dominant segments. Retailers in North America, through their large enterprises, will increasingly leverage AI and ML for predictive merchandising and personalized pricing strategies. This will further entrench their market leadership. Emerging economies in Asia-Pacific are also showing accelerated growth, driven by the rapid expansion of their retail sectors and increasing digital penetration, though North America's established ecosystem provides a significant advantage in the immediate to medium term. The interplay between sophisticated merchandising strategies and the purchasing power of large enterprises will define the market's growth trajectory.

The retail analytics service industry is experiencing a significant upswing driven by several key catalysts. The escalating adoption of AI and Machine Learning technologies is paramount, enabling predictive insights into customer behavior and demand forecasting. The burgeoning e-commerce sector and the consequent explosion of customer data necessitate sophisticated analytics for personalization and operational optimization. Furthermore, the increasing focus on omnichannel strategies requires seamless data integration and analysis across various customer touchpoints.

This report provides an exhaustive analysis of the Retail Analytics Service market, offering a holistic view of its current state and future potential. The study encompasses the entire Study Period: 2019-2033, with a deep dive into the Historical Period: 2019-2024, a precise Base Year: 2025, and an Estimated Year: 2025, followed by a robust Forecast Period: 2025-2033. It meticulously examines key segments including Type: Merchandising Analysis, Pricing Analysis, Performance Analysis, Yield Analysis, Others and Application: SMEs, Large Enterprises, alongside significant Industry Developments. The report details market trends, identifies driving forces, and highlights challenges, offering invaluable insights for stakeholders to navigate this evolving landscape and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include IBM, Oracle, Microsoft, Manthan, Blue Yonder (formerly JDA), MicroStrategy, SAP, Bridgei2i, SAS Institute, Qlik, SPS, Tableau, Nielsen, HCL Technologies, ShopperTrak, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Retail Analytics Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Retail Analytics Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.