1. What is the projected Compound Annual Growth Rate (CAGR) of the Restaurant Digital Ordering Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Restaurant Digital Ordering Service

Restaurant Digital Ordering ServiceRestaurant Digital Ordering Service by Application (Fast Casual Restaurant, Regular Restaurant), by Type (Reservation and Booking Service), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

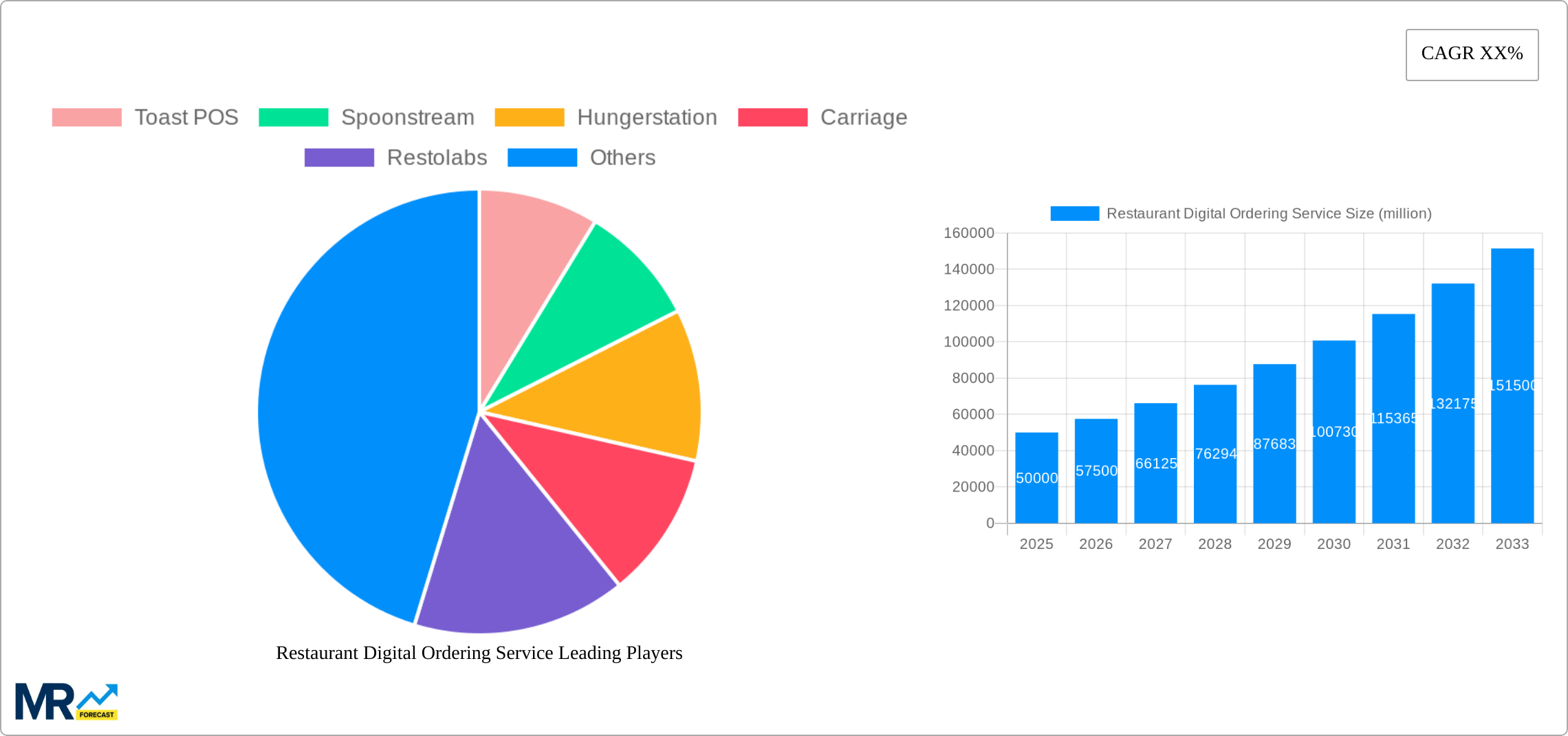

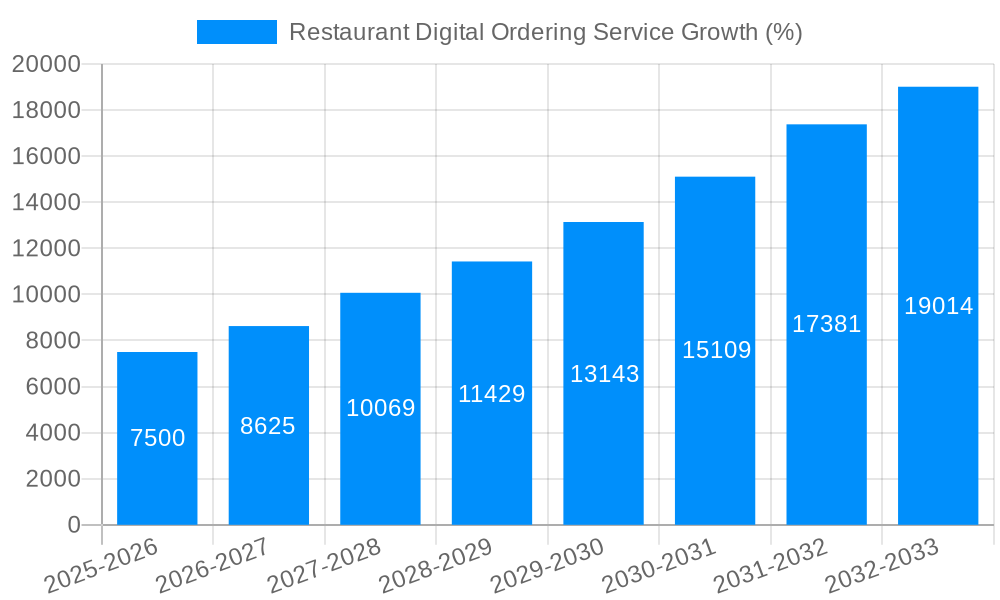

The global restaurant digital ordering service market is experiencing robust growth, driven by the increasing adoption of smartphones and the rising demand for convenient and contactless dining experiences. The market, estimated at $50 billion in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching approximately $150 billion by 2033. This expansion is fueled by several factors, including the proliferation of food delivery apps, the integration of online ordering systems into restaurant websites, and the growing popularity of online table reservations. Fast-casual restaurants are leading the adoption of digital ordering systems, followed by regular restaurants, reflecting a broader shift towards enhanced customer experience and operational efficiency. The market is segmented by application (fast-casual, regular restaurants) and type (reservation & booking services, online ordering). Key players like Toast POS, Spoonstream, Hungerstation, Carriage, Restolabs, Talabat, ChowNow, and Delivery Hero are shaping the market landscape through technological innovation and strategic partnerships. While challenges such as data security concerns and the need for robust technical infrastructure exist, the overall market outlook remains highly positive.

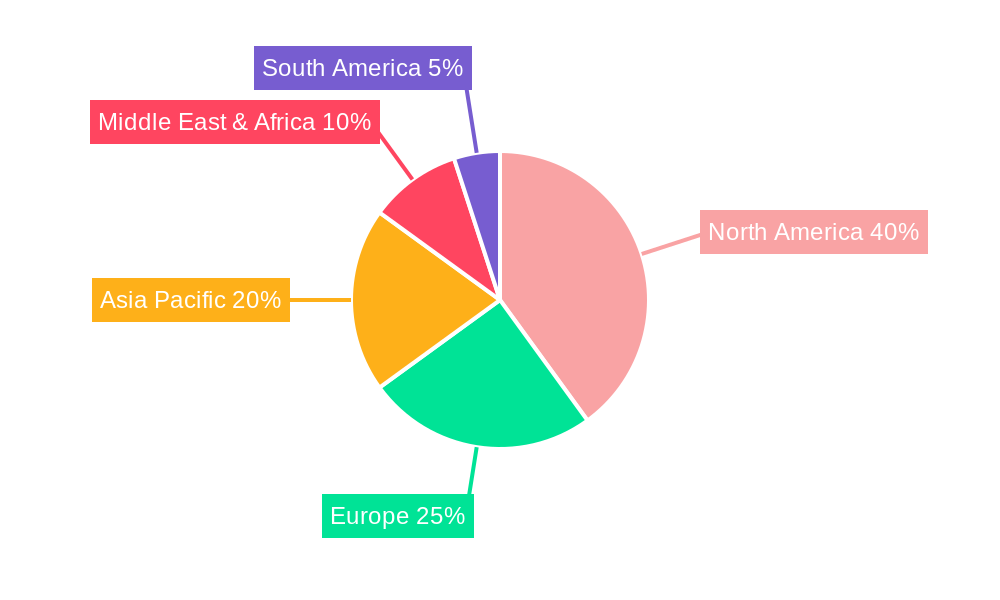

The geographical distribution of the market reflects varying levels of digital adoption across regions. North America and Europe currently hold significant market shares, driven by high smartphone penetration and established digital infrastructure. However, Asia Pacific is projected to exhibit the fastest growth, fueled by increasing internet and smartphone usage, along with a burgeoning middle class with rising disposable incomes. The Middle East and Africa are also poised for substantial growth, driven by a young and tech-savvy population. Competition within the market is intensifying, with existing players investing in advanced features like AI-powered recommendations and personalized offers to enhance customer engagement and loyalty. Furthermore, the integration of digital ordering systems with loyalty programs and CRM systems is expected to drive further market expansion in the coming years. The restaurant digital ordering service market represents a significant opportunity for technology providers, restaurants, and investors alike.

The restaurant digital ordering service market experienced explosive growth between 2019 and 2024, driven primarily by the COVID-19 pandemic and the subsequent surge in demand for contactless dining options. This trend shows no sign of slowing; our research projects a market valued at several billion dollars by 2025, with a Compound Annual Growth Rate (CAGR) exceeding X% throughout the forecast period (2025-2033). Key market insights reveal a clear shift in consumer behavior, with a significant portion of restaurant orders now originating from online platforms. This digital transformation has impacted various segments, from fast-casual restaurants leveraging streamlined ordering apps to upscale establishments integrating online reservation systems. The competitive landscape is dynamic, with established players like Toast POS and Delivery Hero competing with regional giants such as Hungerstation and Talabat, and innovative startups constantly emerging. The increasing sophistication of these platforms, incorporating features like personalized recommendations, loyalty programs, and seamless payment integration, is further fueling market expansion. Consumers are increasingly drawn to the convenience, speed, and often, cost-effectiveness of online ordering, pushing restaurants to prioritize their digital presence to maintain competitiveness. This has led to significant investment in technology and infrastructure across the restaurant industry, fostering collaboration between restaurants, tech providers, and delivery services. Future growth will be shaped by factors including the evolution of mobile technology, the increasing adoption of AI-powered features, and the continued expansion of online payment options. The integration of digital ordering with other aspects of the restaurant experience, such as customer relationship management (CRM) and marketing, will play a crucial role in driving further market expansion and profitability. The market size is expected to reach several tens of billions of dollars by 2033, showcasing the enduring impact of digital transformation on the food service industry.

Several factors are propelling the growth of the restaurant digital ordering service market. Firstly, the increasing penetration of smartphones and internet access globally has dramatically increased consumer access to online platforms. This allows consumers greater convenience and choice when ordering food, leading to higher adoption rates. Secondly, the COVID-19 pandemic acted as a significant catalyst, accelerating the shift towards contactless dining and delivery services. Restaurants that quickly adapted to digital ordering systems were better positioned to survive the lockdowns and restrictions. Thirdly, the continuous improvement and development of digital ordering platforms, incorporating features like advanced order management systems, personalized recommendations, and seamless integration with payment gateways, enhances the overall user experience and encourages wider adoption. The emergence of innovative technologies such as AI-powered chatbots for customer service and predictive analytics for demand forecasting further optimize operational efficiency and enhances the overall customer journey. Lastly, the rising popularity of food delivery services and the expanding reach of third-party aggregators is a major contributor. These platforms offer restaurants access to a wider customer base, creating a win-win situation for both restaurants and consumers. This interconnected ecosystem fuels competition and encourages innovation within the digital ordering space, ultimately benefiting the entire market.

Despite the significant growth potential, the restaurant digital ordering service market faces several challenges. Firstly, the high initial investment required for restaurants to adopt and implement digital ordering systems can be a barrier, particularly for smaller establishments with limited resources. This investment encompasses not only software and hardware but also training for staff and ongoing maintenance. Secondly, maintaining a seamless and user-friendly online ordering experience is crucial. Technical glitches, slow loading times, and poor website design can lead to customer dissatisfaction and loss of business. Competition from both established players and emerging startups is intense, requiring restaurants to continuously innovate and adapt to stay competitive. Furthermore, managing order fulfillment efficiently can be challenging, particularly during peak hours. Issues such as inaccurate order preparation, delayed delivery times, and difficulties with customer service can impact reputation and satisfaction. The security of customer data and payment information is also a critical concern, requiring robust security measures to prevent fraud and maintain customer trust. Finally, regulatory compliance varies across different regions, creating additional complexities for businesses operating in multiple jurisdictions. Navigating these regulatory landscapes is critical to ensuring long-term sustainability.

The fast-casual restaurant segment is poised to dominate the market within the application type category throughout the forecast period. Fast-casual establishments typically have younger, tech-savvy customer bases who readily embrace digital ordering solutions. This segment offers high growth potential due to its ability to easily integrate with third-party delivery platforms and its relatively lower cost of implementation.

The fast-casual segment's dominance stems from several factors:

The restaurant digital ordering service industry is experiencing significant growth, fueled by the convergence of several key factors. The increasing prevalence of mobile devices and high-speed internet connectivity has made ordering food online significantly easier and more convenient for consumers. This is further amplified by evolving consumer preferences, with a shift towards seamless digital experiences across various aspects of daily life. Innovative technologies, including AI-powered chatbots and predictive analytics, are not only improving the customer experience but also streamlining restaurant operations, boosting efficiency, and reducing operational costs. The emergence and expansion of cloud-based solutions make implementing digital ordering systems more accessible and affordable for businesses of all sizes, driving market penetration and broadening its reach.

This report provides a comprehensive analysis of the restaurant digital ordering service market, covering historical data (2019-2024), the current market landscape (2025), and detailed forecasts extending to 2033. The research encompasses market sizing, segmentation analysis by application type (fast-casual and regular restaurants), technology type, and key regional markets. It delves into the driving forces and challenges affecting market growth, profiles leading players, and identifies significant industry developments. The report offers valuable insights for businesses, investors, and stakeholders seeking a deeper understanding of this rapidly evolving sector. This comprehensive analysis provides a foundation for strategic decision-making and informed investment strategies within the dynamic restaurant digital ordering service market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Toast POS, Spoonstream, Hungerstation, Carriage, Restolabs, Talabat, ChowNow, Deliveryhero, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Restaurant Digital Ordering Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Restaurant Digital Ordering Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.