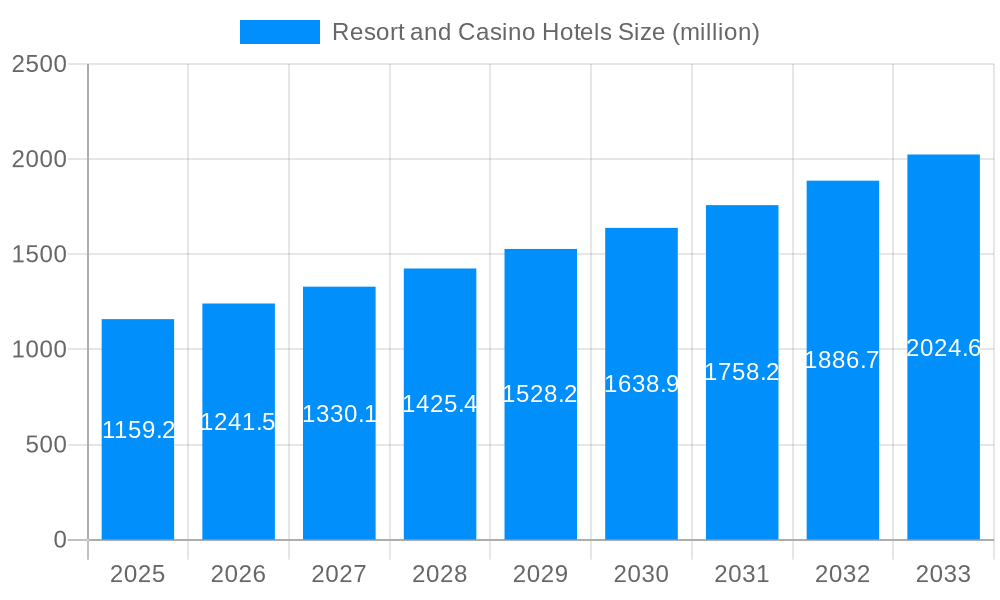

1. What is the projected Compound Annual Growth Rate (CAGR) of the Resort and Casino Hotels?

The projected CAGR is approximately 5.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Resort and Casino Hotels

Resort and Casino HotelsResort and Casino Hotels by Application (Tourist, Gambler, Others), by Type (Land-based Resorts and Casino Hotels, Sea Resorts and Casino Hotels), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global resort and casino hotel market, valued at $816.2 million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 5.1% from 2025 to 2033. This expansion is fueled by several key factors. Increased disposable incomes in emerging economies are leading to higher travel and leisure spending, significantly boosting demand for luxury accommodations and entertainment experiences. The rising popularity of integrated resorts, offering a diverse range of amenities beyond gambling, such as shopping, dining, and spa services, further enhances the market appeal. Technological advancements, including online booking platforms and personalized customer experiences, are also contributing to growth. Furthermore, strategic investments and expansions by major players like Caesars Entertainment and MGM Resorts are strengthening the market's infrastructure and capacity. However, factors such as economic downturns, stricter gambling regulations in certain regions, and increasing competition from alternative entertainment options pose potential restraints to market growth. The market segmentation reveals a significant portion attributed to the tourist segment, highlighting the crucial role of leisure travel in driving demand. Land-based resorts and casino hotels currently hold a larger market share compared to sea-based counterparts, although the latter is anticipated to witness substantial growth in the forecast period, driven by rising interest in cruise-based tourism and luxury maritime experiences.

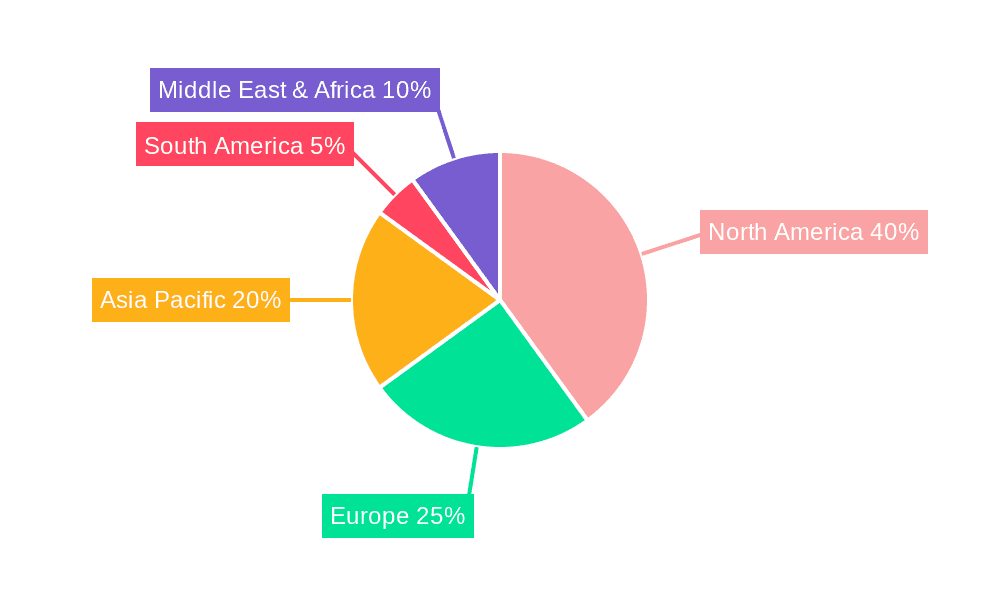

The regional distribution of the resort and casino hotel market showcases North America as a dominant player, largely due to established gambling hubs like Las Vegas and Atlantic City. However, the Asia-Pacific region, particularly China, is predicted to demonstrate significant growth potential, fueled by a burgeoning middle class and increasing government support for tourism infrastructure development. Europe, with its established tourism industry and various casino resorts, will also continue to contribute meaningfully to the market’s overall expansion. South America and the Middle East & Africa regions represent emerging markets with increasing opportunities for growth, as these regions see improvements in tourism infrastructure and a rise in disposable income. The competitive landscape is marked by the presence of several established industry giants. These companies are actively engaged in mergers and acquisitions, expansion strategies, and innovation initiatives to maintain a competitive edge and capture larger market share. The continuous evolution of customer preferences and technological advancements will necessitate constant adaptation and innovation within the industry to secure future success.

The global resort and casino hotel market, valued at $XXX million in 2024, is projected to reach $XXX million by 2033, exhibiting a robust CAGR of X% during the forecast period (2025-2033). This growth is fueled by a confluence of factors, including the increasing disposable incomes in emerging economies, a rising preference for leisure travel and entertainment experiences, and the continuous innovation within the industry itself. The historical period (2019-2024) witnessed significant fluctuations, primarily due to the impact of the COVID-19 pandemic, which severely disrupted travel and tourism globally. However, the market demonstrated a remarkable recovery post-pandemic, driven by pent-up demand and the implementation of robust safety protocols by leading operators. The base year 2025 shows a strong rebound, setting the stage for consistent growth throughout the forecast period. The market is witnessing a shift towards integrated resorts offering diverse experiences beyond gambling, encompassing luxury accommodations, fine dining, entertainment venues, and spa facilities, catering to a broader spectrum of tourists. Technological advancements, such as mobile payment systems and personalized gaming experiences, are also driving market expansion. Competition among major players like Caesars Entertainment, MGM Resorts, and Las Vegas Sands is fierce, leading to continuous improvements in services and amenities to attract and retain customers. The market is also witnessing the emergence of new players and innovative business models, particularly in the online gaming sector, which presents both opportunities and challenges for traditional land-based casinos. Further diversification into non-gaming revenue streams will be crucial for sustained growth and resilience in the face of future uncertainties.

The resort and casino hotel industry's expansion is fueled by several key drivers. Firstly, the burgeoning global tourism sector significantly contributes to the industry's growth. Increased disposable incomes, particularly in developing economies, are enabling more people to afford luxury travel and entertainment experiences. Secondly, the ongoing development of integrated resorts, offering a diverse range of amenities beyond gambling, attracts a wider customer base. This diversification strategy reduces reliance on gaming revenue alone and caters to the changing preferences of modern travelers. Thirdly, technological advancements play a crucial role, with innovations like mobile payment systems, personalized gaming experiences, and virtual reality enhancing customer engagement and attracting younger demographics. Fourthly, favorable government regulations and supportive policies in certain regions create a conducive environment for investment and expansion. Lastly, the industry's ability to adapt and innovate, responding to changing consumer preferences and emerging trends, is a critical factor driving its sustained growth. The post-pandemic recovery further underlines the resilience and adaptability of the sector, highlighting its long-term growth potential.

Despite the significant growth potential, the resort and casino hotel industry faces several challenges. Stringent regulations and licensing requirements can restrict market entry and expansion, particularly in certain jurisdictions. Economic downturns and fluctuations in global financial markets can significantly impact tourism spending and revenue generation. Increasing competition among established players and the emergence of new entrants create pressure on pricing and profitability. The industry is also susceptible to external factors such as geopolitical instability and natural disasters, which can disrupt operations and impact visitor numbers. Additionally, concerns about responsible gambling and social responsibility are gaining momentum, leading to stricter regulations and increased scrutiny of industry practices. Maintaining a strong reputation for ethical conduct and customer safety is crucial for long-term success. Finally, managing operational costs, including labor expenses and energy consumption, while maintaining high service standards, presents an ongoing challenge for operators.

The Asia-Pacific region, particularly Macau and Singapore, is expected to continue dominating the global resort and casino hotel market during the forecast period. Macau's status as the world's largest gambling hub and Singapore's strategic location and highly developed tourism infrastructure significantly contribute to this dominance.

Macau: Its concentration of mega-resorts and high-roller clientele ensures substantial revenue generation.

Singapore: Its reputation as a sophisticated and luxurious travel destination coupled with well-established gaming regulations makes it a leading market player.

The Gambler segment is projected to maintain its leading position, driven by the continued popularity of casino gaming and the increasing number of high-roller players. However, the Tourist segment is also showing robust growth, reflecting the increasing importance of non-gaming amenities and attractions within integrated resorts. This underscores the success of diversification strategies adopted by major players.

Land-based Resorts and Casino Hotels: This segment is expected to remain dominant throughout the forecast period, although the rising popularity of online gaming might slightly impact its growth rate.

Sea Resorts and Casino Hotels: While smaller in scale compared to land-based counterparts, this segment offers unique experiences and caters to a niche market, contributing to the overall market growth.

The increasing focus on integrated resorts, combining luxury accommodation, diverse entertainment options, and sophisticated gaming facilities, caters to the evolving preferences of both gamblers and tourists, further bolstering the market’s growth trajectory.

The resort and casino hotel industry is experiencing a surge in growth due to several key factors. The expansion of integrated resorts, offering a wider range of amenities and experiences beyond gambling, is a major catalyst. Technological advancements such as mobile payments and personalized gaming experiences enhance customer engagement. Moreover, the increasing disposable incomes globally, particularly in emerging markets, fuel higher spending on leisure travel and entertainment, further propelling the industry's growth. Finally, favorable government policies and regulations in certain regions create a supportive environment for investment and expansion, contributing significantly to the sector's expansion.

This report provides a comprehensive analysis of the resort and casino hotel market, covering key trends, growth drivers, challenges, and leading players. The report offers detailed insights into market segmentation, regional performance, and future growth projections, equipping stakeholders with the information they need to navigate this dynamic industry effectively. The study period from 2019-2033 provides a holistic view of the market’s evolution, while the forecast period from 2025-2033 focuses on projecting future trends and growth prospects. The report's findings are essential for businesses, investors, and policymakers seeking to understand and capitalize on the opportunities within the resort and casino hotel sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.1%.

Key companies in the market include Caesars Entertainment, MGM Resorts, Las Vegas Sands, Wynn Resorts, Galaxy Entertainment, Melco Resorts & Entertainment, SJM Holdings, Penn National Gaming, Boyd Gaming, .

The market segments include Application, Type.

The market size is estimated to be USD 816.2 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Resort and Casino Hotels," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Resort and Casino Hotels, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.