1. What is the projected Compound Annual Growth Rate (CAGR) of the Residual Fuel Oil?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Residual Fuel Oil

Residual Fuel OilResidual Fuel Oil by Type (< 0.31%, 0.31% ~ 1.00%, > 1.00%, World Residual Fuel Oil Production ), by Application (Marine, Power Plants, Industrial Boilers, Others, World Residual Fuel Oil Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

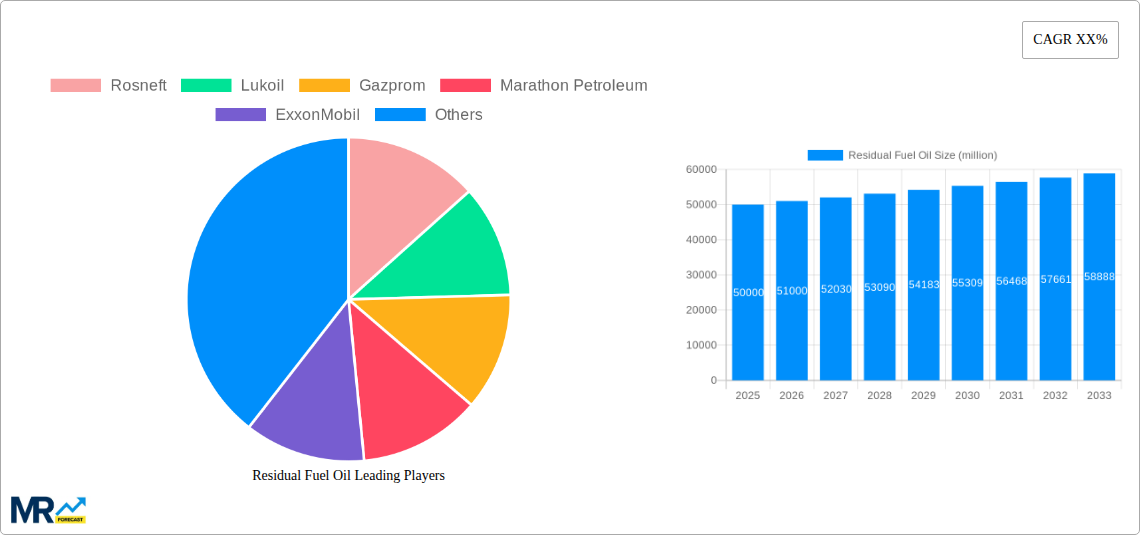

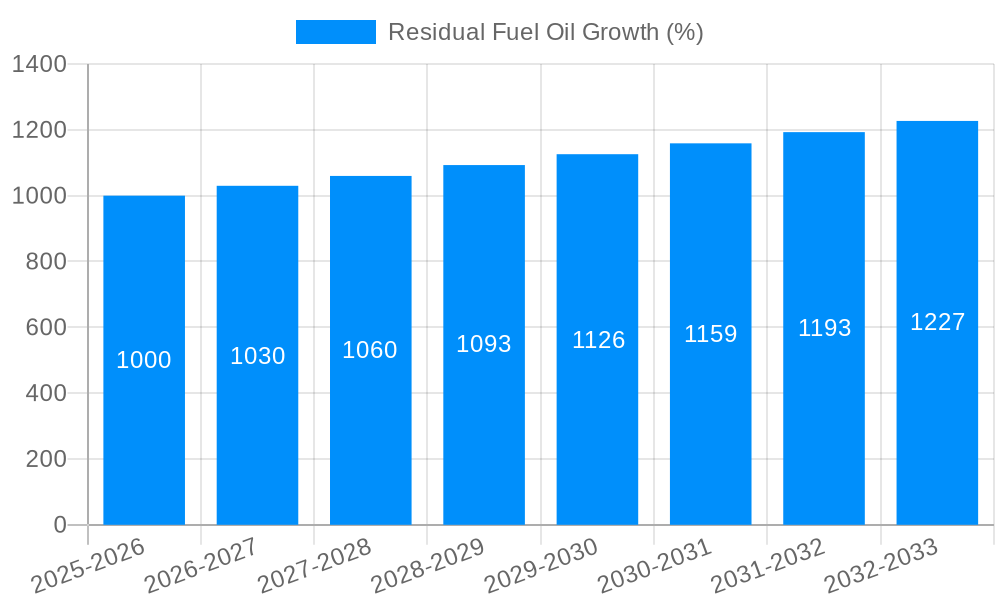

The global residual fuel oil (RFO) market is a mature yet dynamic sector, currently experiencing a period of moderate growth. While the overall market size is substantial (let's assume, based on typical industry figures and given the presence of major oil companies, a 2025 market size of $100 billion USD for the sake of this example), the Compound Annual Growth Rate (CAGR) is projected to be relatively modest, perhaps around 2-3% for the forecast period (2025-2033). This slower growth is attributable to several factors. Stringent environmental regulations, particularly concerning sulfur content (IMO 2020 and similar legislation), are significantly impacting demand, especially in the marine sector – a traditionally large consumer of RFO. The shift towards cleaner fuels like LNG and low-sulfur fuels is a major restraint. However, continuing demand from power plants, particularly in developing economies with older infrastructure, and industrial boilers provides a degree of market resilience. Furthermore, the fluctuating prices of crude oil, a key input cost, introduce volatility into the market. Market segmentation reveals significant variation; the >1.00% segment (likely representing larger-scale consumers) dominates, while the <0.31% segment is comparatively smaller, indicating a concentration of market share amongst larger players.

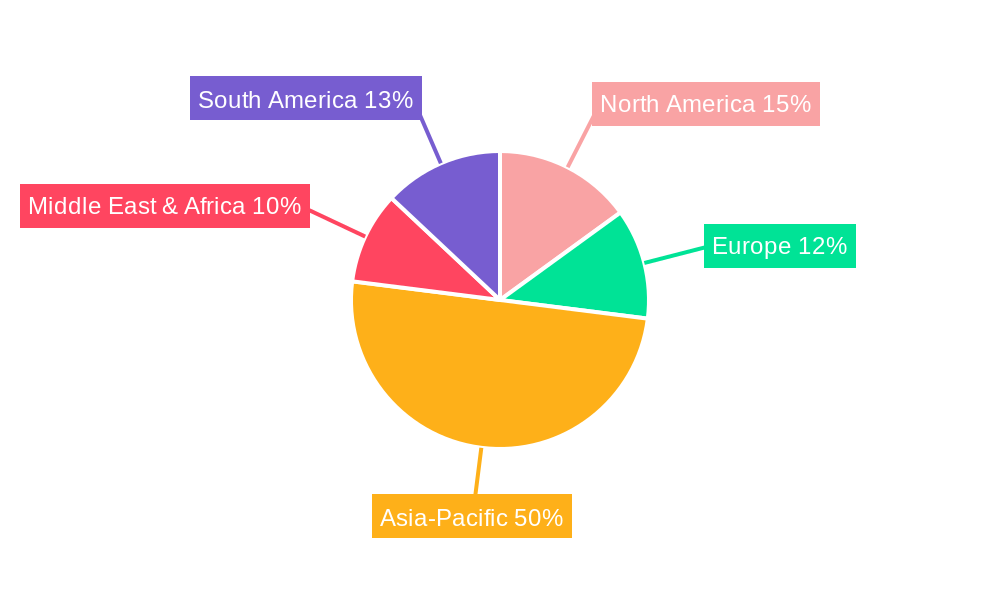

Despite the challenges, opportunities remain for RFO producers. Technological advancements aimed at reducing sulfur content and emissions could extend the lifespan of RFO in certain applications. Regional variations are significant; robust demand in Asia-Pacific (particularly China and India) partially offsets the slowdown in other regions. Major players like Rosneft, Lukoil, and ExxonMobil hold significant market share, but smaller regional players also cater to specific niche markets. Continued investment in refining infrastructure and strategic partnerships will be critical for companies navigating this evolving landscape. The market's future will largely depend on the pace of global decarbonization efforts and the adaptability of RFO producers to meet changing regulatory requirements and consumer preferences.

The global residual fuel oil (RFO) market, valued at XXX million units in 2024, is projected to experience [mention growth rate, e.g., a steady growth] throughout the forecast period (2025-2033). This growth, however, is expected to be somewhat tempered by stringent environmental regulations and the increasing adoption of cleaner alternatives. The historical period (2019-2024) witnessed fluctuating market dynamics influenced by global economic conditions and fluctuating crude oil prices. The base year of 2025 serves as a crucial benchmark for future projections. Key market insights reveal a shifting landscape, with a noticeable decline in demand from certain traditional sectors like marine transport due to the implementation of stricter sulfur emission caps (IMO 2020). This shift has created both challenges and opportunities for producers. While the demand from the marine sector has been affected, industrial applications, particularly in developing economies, continue to provide a degree of stability. Furthermore, the market is experiencing a noticeable shift towards higher-quality RFO grades (with sulfur content < 0.5%), reflecting the ongoing efforts to mitigate environmental impact. The production distribution across various sulfur content categories (<0.31%, 0.31%-1.00%, >1.00%) is also expected to undergo a considerable change, with a projected increase in the share of lower sulfur content RFO. The market shares of major players like Rosneft, Lukoil, and ExxonMobil are subject to considerable fluctuation influenced by geopolitical factors and production output. The estimated value for 2025 provides a crucial foundation for evaluating the potential growth trajectories within this dynamic market. The report's comprehensive analysis of production, consumption, and trade patterns across key regions provides invaluable insights for stakeholders seeking to navigate the complexities of this evolving market. Specific projections for various segments and regions are provided in the subsequent sections of this report. The forecast period provides a comprehensive analysis of the potential evolution of the market under various assumptions.

Several factors are driving the residual fuel oil market, despite the challenges posed by environmental regulations. Firstly, the ongoing industrialization in developing nations, particularly in Asia, fuels considerable demand for RFO in power generation and industrial processes. These regions often have a higher reliance on less expensive fuel sources, making RFO a viable option for their energy needs. Secondly, RFO remains a comparatively cost-effective fuel source compared to other alternatives, especially in regions with less stringent environmental regulations or where access to cleaner fuels is limited. This price advantage remains a significant driving force, especially in the short-term. Thirdly, although facing pressure from cleaner alternatives, the existing infrastructure supporting RFO usage – including power plants, industrial boilers, and shipping infrastructure – provides a degree of inertia. Converting this infrastructure to utilize cleaner fuels often presents significant financial and logistical hurdles, maintaining demand for RFO for an extended period. Finally, the production capacity of RFO as a byproduct of crude oil refining remains substantial, particularly amongst major oil producers. This readily available supply continues to support its market presence, even with declining overall demand. However, the market is not immune to external forces. Fluctuations in crude oil prices directly impact the price of RFO, influencing demand in price-sensitive markets.

The residual fuel oil market faces significant headwinds, primarily stemming from increasing environmental concerns and regulations. The implementation of stricter sulfur emission standards, notably the IMO 2020 regulations for marine fuels, has drastically impacted demand from the shipping industry. This shift towards cleaner marine fuels, such as low-sulfur fuel oil (LSFO) and liquefied natural gas (LNG), continues to be a major challenge for the RFO sector. Furthermore, the global push towards decarbonization and the increasing adoption of renewable energy sources (solar, wind) pose long-term threats to the RFO market. These trends are shifting the energy landscape towards cleaner alternatives, reducing the overall demand for fossil fuels like RFO. In addition, government policies aimed at reducing greenhouse gas emissions (GHGs) are increasingly restricting the use of RFO in many applications. Carbon taxes and emission trading schemes also add to the cost of utilizing RFO, impacting its competitiveness. The long-term sustainability of the RFO market is thus heavily dependent on adaptation and innovation within the industry. The need to find ways to utilize RFO in a more environmentally friendly manner will be crucial for the industry's long-term survival.

Asia-Pacific Region: This region is projected to dominate the RFO market throughout the forecast period due to its rapid industrialization and energy demands. Countries like China and India, with their significant industrial sectors and power generation requirements, contribute significantly to this regional dominance. The large scale of existing infrastructure relying on RFO in these countries further reinforces this projection.

Segment: >1.00% Sulfur Content: While the share of this segment is projected to decline due to increasingly stringent regulations, it will still hold a significant portion of the market, particularly in regions with less stringent environmental regulations or less developed infrastructure. Its cost advantage will continue to provide a demand base, at least in the near term.

Application: Power Plants: The use of RFO in power generation, particularly in developing economies, remains a strong application area. The large existing fleet of power plants using RFO provides a substantial demand base. However, this is expected to gradually decline as newer, cleaner power generation sources are implemented.

Application: Industrial Boilers: Similar to power plants, industrial boilers across various manufacturing sectors (cement, steel, etc.) continue to rely on RFO. This remains a significant application area for the foreseeable future, although the market share might reduce with technological improvements and stricter regulations.

The overall market dominance of the Asia-Pacific region and the continued importance of the >1.00% sulfur segment and power plant and industrial boiler applications indicate a need for strategic adaptation within the RFO industry. A transition towards less polluting alternatives and higher-quality RFO grades will be key to adapting to a changing market landscape. Moreover, investment in technologies to reduce emissions from RFO usage might offer a path to extend the market lifespan for this traditional fuel source.

Despite the challenges, several factors could catalyze growth within the RFO industry in the medium to long term. Technological advancements in refining and processing could allow for the production of higher-quality RFO with reduced sulfur content, thereby extending the lifespan of existing RFO infrastructure. Furthermore, developments in emission control technologies can mitigate the environmental impact of RFO utilization, improving its sustainability. Focused investments in these areas can create new growth opportunities within the industry while mitigating the negative impacts of its usage.

This report offers a detailed analysis of the global residual fuel oil market, providing invaluable insights for stakeholders. The comprehensive coverage includes historical data, current market dynamics, future projections, and an assessment of key drivers and restraints. The report also identifies key players, regional variations, and various industry developments that are impacting the future of the market. This in-depth analysis provides the necessary information for informed decision-making in this evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Rosneft, Lukoil, Gazprom, Marathon Petroleum, ExxonMobil, BP, Chevron, Royal Dutch Shell, Qatar Petroleum, Sinopec, CNPC, CNOOC, Cepsa, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Residual Fuel Oil," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Residual Fuel Oil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.