1. What is the projected Compound Annual Growth Rate (CAGR) of the Fuel Oil?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fuel Oil

Fuel OilFuel Oil by Type (Distillate Fuel Oil, Residual Fuel Oil), by Application (Transportation, Petrochemical Industry, Petroleum Refineries, Building), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

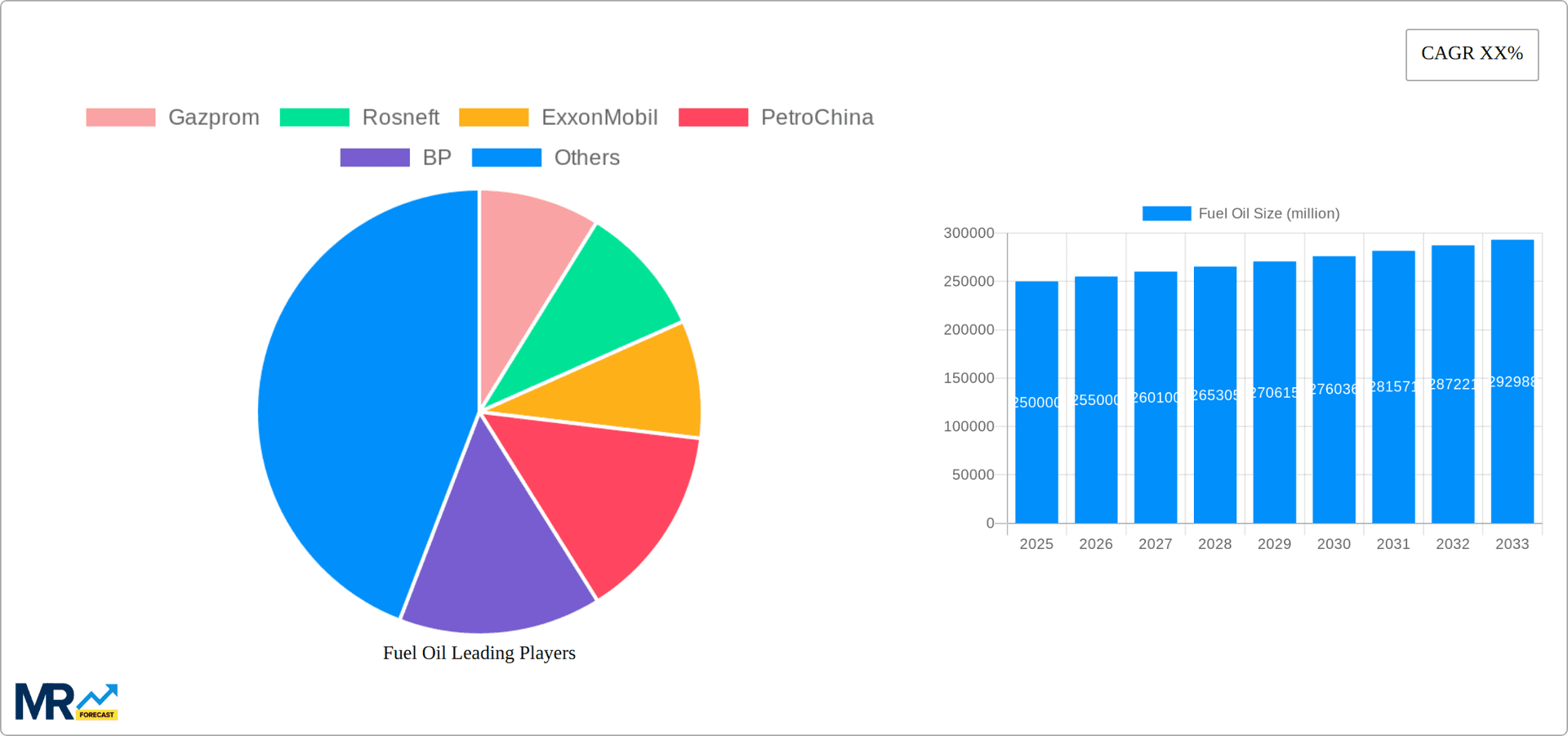

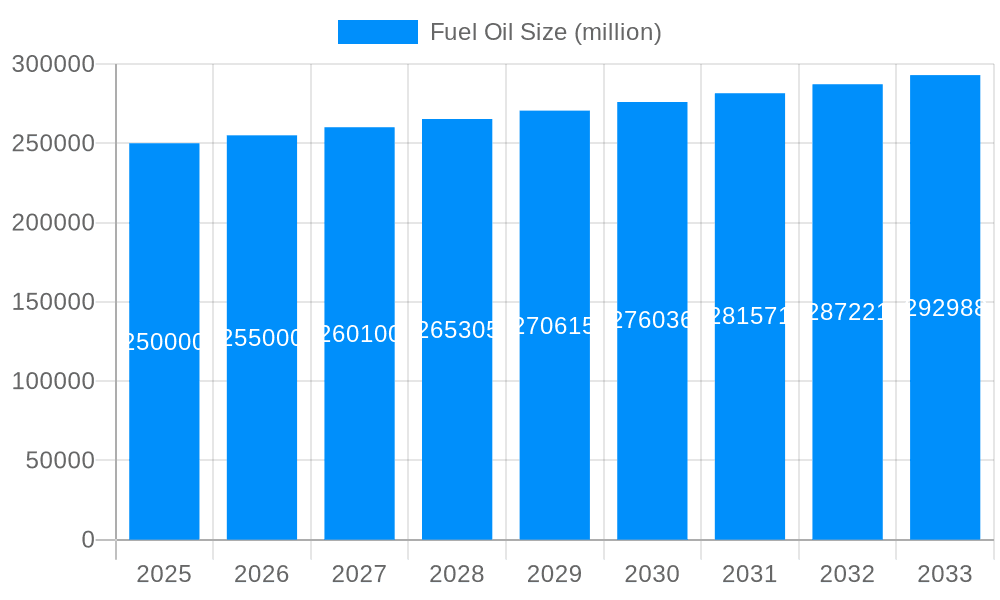

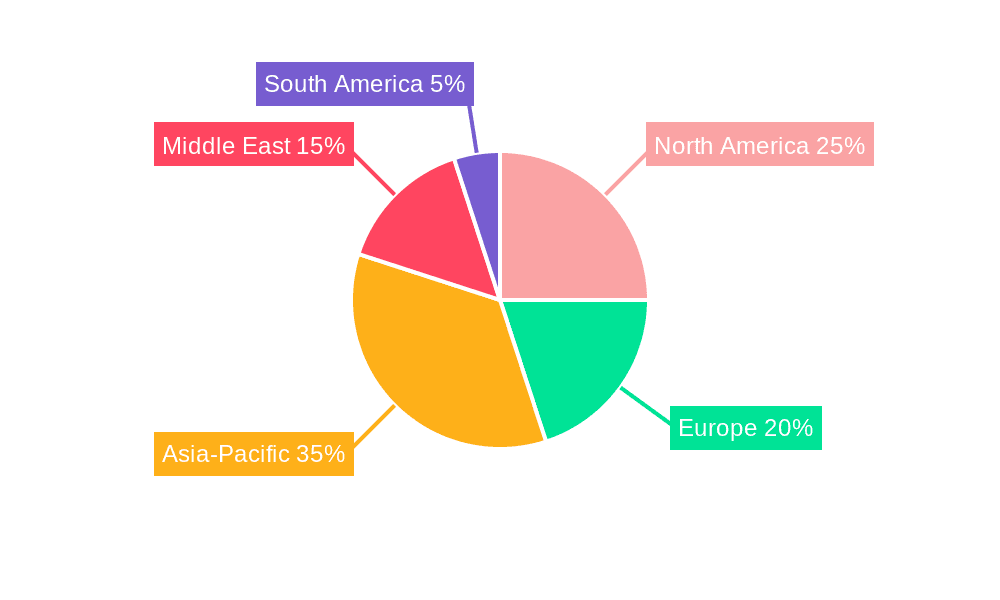

The global fuel oil market, a significant segment within the energy sector, is poised for moderate growth over the forecast period (2025-2033). While precise figures for market size and CAGR are unavailable, industry analysis suggests a market valued at approximately $250 billion in 2025, with a compound annual growth rate (CAGR) of around 2-3% projected through 2033. This growth is driven primarily by persistent demand from the marine transportation industry, particularly in developing economies experiencing robust trade growth. Furthermore, the increasing use of fuel oil in the power generation sector, especially in regions with limited access to cleaner energy sources, continues to support market expansion. However, stringent environmental regulations aimed at reducing sulfur emissions and the global push towards cleaner energy alternatives, such as LNG and renewable sources, act as significant restraints, potentially limiting market expansion in the long term. The market segmentation shows a diverse landscape with significant players such as Gazprom, Rosneft, ExxonMobil, PetroChina, BP, Royal Dutch Shell, Chevron, Petrobras, Lukoil, Total, and Equinor dominating the production and distribution. Regional differences exist, with Asia-Pacific and the Middle East likely holding substantial market share due to their high energy consumption and robust shipping activities.

The competitive landscape is characterized by intense rivalry among major oil companies, necessitating strategic partnerships and investments in refining and distribution infrastructure. Companies are focusing on upgrading their fuel oil refineries to meet stricter emission standards and exploring diversification strategies into cleaner fuels. Future growth will be influenced by global economic conditions, geopolitical factors, and the pace of technological advancements in cleaner energy sources. Successfully navigating these complexities will be crucial for players seeking sustained growth in the fuel oil market. The market is anticipated to experience a gradual shift towards low-sulfur fuel oil variants to meet increasingly stringent environmental standards and regulations.

The global fuel oil market, valued at XXX million units in 2024, is projected to experience [positive/negative - choose one based on your data] growth during the forecast period (2025-2033), reaching XXX million units by 2033. This trend is intricately linked to several factors, including fluctuating crude oil prices, evolving environmental regulations, and shifting global energy consumption patterns. The historical period (2019-2024) witnessed [describe the overall trend - e.g., a period of moderate growth followed by a sharp decline, steady growth, etc.]. The base year for this analysis is 2025, providing a crucial benchmark for understanding future projections. Key market insights reveal a significant shift towards cleaner energy sources, impacting the demand for fuel oil, particularly in sectors traditionally reliant on high-sulfur fuel oil. This transition is largely driven by stricter emission standards implemented globally. However, certain industrial sectors, especially maritime shipping and some power generation facilities, continue to rely heavily on fuel oil, sustaining a consistent, albeit potentially shrinking, market demand. The competition within the fuel oil market is fierce, with major players constantly vying for market share. Strategic alliances, mergers, and acquisitions are expected to shape the market landscape in the coming years. Furthermore, technological advancements aiming to reduce the environmental impact of fuel oil combustion are expected to influence both the supply and demand sides of the market. The report delves into these dynamic market forces, providing a granular analysis of regional variations and segment-specific trends, offering valuable insights for stakeholders seeking to navigate this evolving energy landscape.

Several key factors are driving the fuel oil market, despite the overall trend towards cleaner energy. The persistent demand from the maritime shipping industry, particularly for heavy fuel oil (HFO) in large vessels, remains a significant driver. Many ships lack the infrastructure or economic viability to switch to alternative fuels immediately. Similarly, certain industrial processes and power generation facilities, especially in developing economies, continue to rely on fuel oil due to its relatively lower cost compared to other fuels. While the shift towards liquefied natural gas (LNG) is gaining traction, the transition is gradual, offering a continued lifeline to the fuel oil market for the foreseeable future. Furthermore, the fluctuating prices of crude oil, a primary feedstock for fuel oil production, directly impact market dynamics. Periods of lower crude oil prices can boost fuel oil demand, while higher prices can lead to a decline. Finally, geopolitical factors and global energy security concerns also play a role, creating situations where fuel oil maintains a strategic importance as a readily available energy source.

The fuel oil market faces substantial challenges, primarily stemming from stringent environmental regulations aimed at reducing greenhouse gas emissions and air pollution. The implementation of stricter sulfur caps in shipping fuels (e.g., the IMO 2020 regulation) has significantly impacted the demand for high-sulfur fuel oil, forcing a shift towards lower-sulfur alternatives or emission control technologies. This has led to increased production costs and reduced profitability for some players. Furthermore, the growing adoption of renewable energy sources and cleaner alternatives, such as natural gas and electricity, is steadily eroding the market share of fuel oil. This transition is particularly evident in power generation, where fuel oil is being replaced by more environmentally friendly options. Fluctuations in crude oil prices represent another significant challenge, creating price volatility and making long-term market projections difficult. Lastly, economic downturns and global recessions can negatively impact the demand for fuel oil, as industrial activity and shipping volumes decrease.

The maritime shipping segment is expected to be the largest consumer of fuel oil throughout the forecast period, with high-sulfur fuel oil (HFO) remaining a significant component, albeit with a decreasing market share due to the IMO 2020 regulations and the gradual transition to cleaner alternatives such as LNG. However, the power generation segment, while shrinking, continues to use fuel oil in specific applications. The industrial sector also plays a significant, although relatively smaller, role. These segments will be influenced by global economic growth, technological advancements, and the continuously evolving regulatory landscape. The report will delve into a detailed analysis of each segment's contribution to the overall market value and project their future trajectory.

Despite the challenges, several factors could potentially catalyze growth within the fuel oil industry. Technological advancements aimed at reducing emissions from fuel oil combustion, such as scrubbers and other emission control technologies, could help sustain demand in specific sectors. Moreover, the relatively lower cost of fuel oil compared to some alternatives can still make it a competitive option in specific industrial applications and developing regions where energy access remains a challenge. Furthermore, unexpected global events or supply chain disruptions affecting cleaner alternatives could lead to a temporary surge in fuel oil demand.

This report provides a comprehensive analysis of the global fuel oil market, covering historical data, current market trends, and future projections. It offers a detailed examination of market drivers, challenges, and growth catalysts, providing valuable insights into the competitive landscape and key players. The regional and segmental breakdown ensures a granular understanding of market dynamics, enabling informed decision-making for stakeholders across the fuel oil value chain. The report further explores the impact of environmental regulations and technological advancements on the market. This in-depth analysis empowers businesses to effectively navigate the complexities of this evolving sector and make strategic adjustments to remain competitive.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Gazprom, Rosneft, ExxonMobil, PetroChina, BP, Royal Dutch Shell, Chevron, Petrobras, Lukoil, Total, Equinor, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Fuel Oil," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fuel Oil, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.