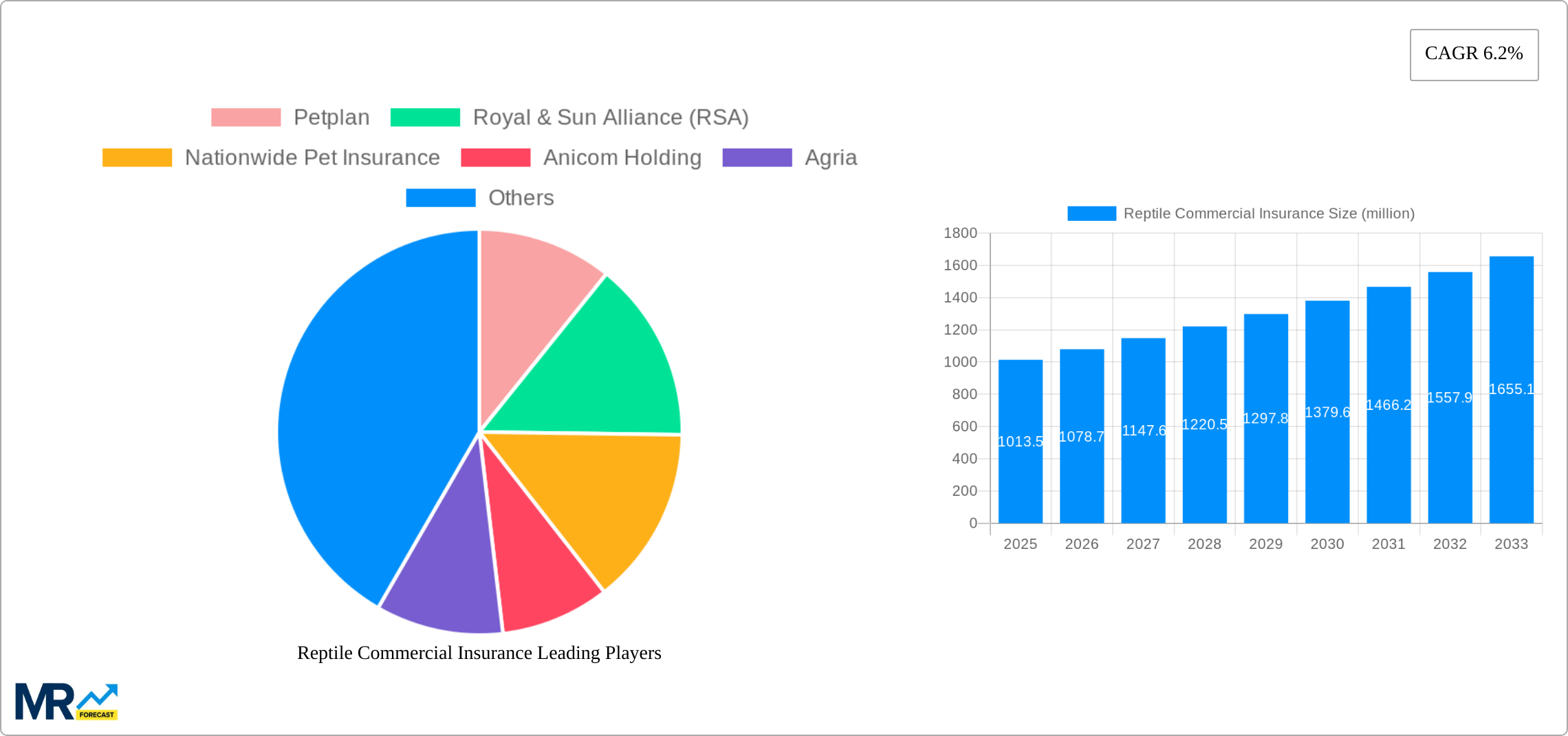

1. What is the projected Compound Annual Growth Rate (CAGR) of the Reptile Commercial Insurance?

The projected CAGR is approximately 6.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Reptile Commercial Insurance

Reptile Commercial InsuranceReptile Commercial Insurance by Type (Lifetime Cover, Non-lifetime Cover, Others), by Application (Turtle, Snake, Lizard, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

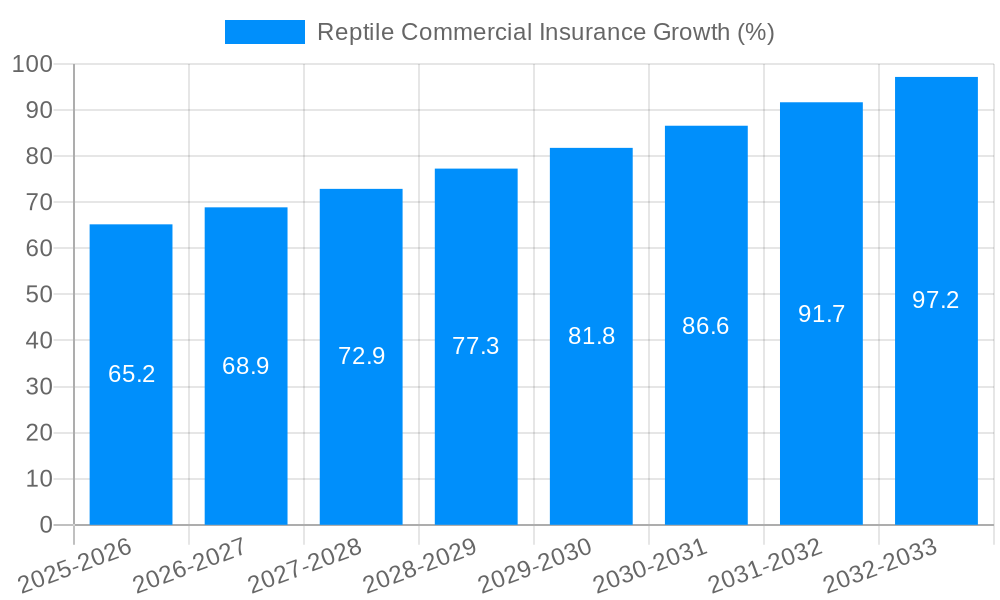

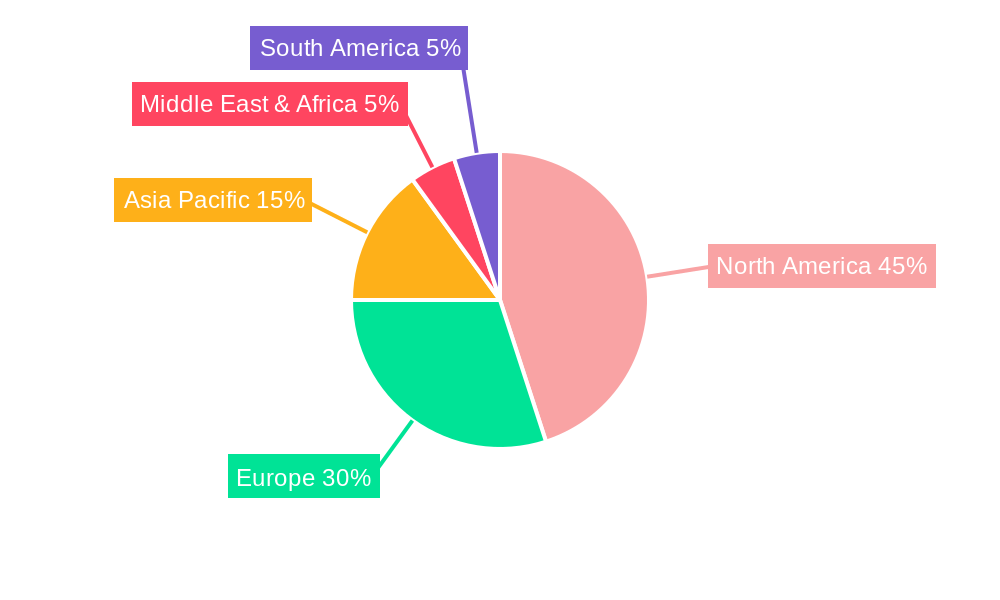

The global reptile commercial insurance market, valued at $1013.5 million in 2025, is projected to experience robust growth, driven by increasing reptile ownership, rising awareness of reptile health concerns, and a growing demand for specialized veterinary care. The market's Compound Annual Growth Rate (CAGR) of 6.2% from 2019 to 2024 suggests a continued upward trajectory, with the forecast period (2025-2033) poised for significant expansion. Key market segments include lifetime and non-lifetime coverage, catering to diverse owner needs and risk profiles. Application-wise, turtle, snake, and lizard insurance dominate, reflecting the popularity of these species as pets. Leading players like Petplan, RSA, Nationwide, and Trupanion are shaping market dynamics through innovative product offerings and expansion strategies. The increasing availability of online platforms and telehealth services is also likely to fuel market growth by making insurance access more convenient and efficient. Geographic analysis indicates strong performance in North America and Europe, driven by higher pet ownership rates and established insurance markets, while emerging economies in Asia-Pacific show promising growth potential. Regulatory frameworks regarding exotic pet ownership and insurance coverage will continue to be a factor influencing market development.

The market's growth is further fueled by several factors. Firstly, increasing disposable incomes in developed and emerging economies enable more pet owners to afford specialized insurance. Secondly, the rising sophistication of reptile veterinary care necessitates comprehensive insurance plans to mitigate substantial treatment costs. Thirdly, proactive legislative actions in certain regions to protect exotic animal welfare can inadvertently incentivize reptile insurance adoption. However, limitations exist; high premiums for specialized reptile care can restrict accessibility, and the relatively niche nature of this market compared to traditional pet insurance poses a challenge for widespread expansion. Furthermore, the availability of qualified reptile veterinarians, particularly in some regions, could influence market growth trajectory. Despite these constraints, the increasing demand for responsible reptile ownership and the inherent value of protecting these animals' health will continue to propel market growth in the coming years.

The global reptile commercial insurance market is witnessing a period of significant growth, driven by increasing reptile ownership, heightened awareness of reptile health issues, and the rising value of exotic pets. The market, currently valued at several million dollars (exact figures would need market research data), is projected to experience robust expansion throughout the forecast period (2025-2033). While the historical period (2019-2024) showcased steady growth, the estimated year 2025 signifies a pivotal point, with market expansion accelerating due to several factors detailed in subsequent sections. Key market insights reveal a rising preference for lifetime cover policies, particularly among owners of higher-value reptiles like certain species of snakes and lizards. This trend is fueled by the increasing cost of veterinary care for reptiles, which can reach tens of thousands of dollars for complex procedures. The market is also seeing a shift towards more comprehensive coverage options, including hospitalization, surgery, and emergency care, alongside routine wellness plans. Geographical variations exist, with developed nations showing higher adoption rates due to increased pet ownership and higher disposable incomes. However, emerging markets are showing promising growth potential as awareness of reptile insurance and access to such products increases. The competitive landscape is moderately fragmented, with both large multinational insurers and specialized pet insurance providers actively participating. The industry is also adapting to evolving consumer preferences and technological advancements, such as online platforms for policy purchase and claims processing, contributing to increased market accessibility and efficiency. This analysis, based on data from 2019 to 2024 and projections through 2033, indicates a future where reptile commercial insurance plays an increasingly vital role in responsible reptile ownership and the broader pet insurance sector.

Several key factors are propelling the expansion of the reptile commercial insurance market. The rising popularity of exotic pets, including reptiles, is a major contributor. More individuals and businesses are choosing to own reptiles, be it for personal enjoyment, conservation efforts, or commercial breeding. This increased ownership directly translates into a larger potential customer base for insurance providers. Concurrently, the escalating costs associated with reptile veterinary care are acting as a significant driver. Reptile illnesses and injuries can be expensive to treat, often requiring specialized expertise and advanced medical technologies. Insurance provides a financial safety net, allowing owners to afford necessary medical care without facing crippling financial burdens. This is especially important for commercial breeders who depend on the health of their animals for their business's profitability. The evolving regulatory landscape is also playing a role. Increased awareness of animal welfare is leading to stricter regulations in certain regions, potentially increasing the demand for insurance as a means of compliance. Finally, improved insurance product offerings, including more comprehensive coverage options and user-friendly online platforms, are making reptile insurance more accessible and attractive to potential customers. These combined forces are creating a favourable environment for the continued growth of this niche market.

Despite the positive growth outlook, the reptile commercial insurance market faces several challenges. The relatively niche nature of the market presents difficulties in terms of profitability. The number of insured reptiles is lower than other domestic animals, and the costs of veterinary care are often unpredictable and potentially substantial. This presents a significant underwriting challenge, demanding sophisticated risk assessment models. Another challenge is the lack of standardized veterinary practices for reptiles across different geographical regions. This variation in care protocols makes it difficult to develop uniform insurance policies and to accurately predict claim costs. Moreover, access to specialized veterinary care for reptiles can be limited, especially in certain geographical areas, potentially increasing the cost of claims or delaying treatment. Further complicating the situation is the higher mortality rate of certain reptile species compared to more commonly insured pets like dogs and cats. This higher risk profile must be carefully considered in premium pricing and policy design. Educating potential customers about the benefits and availability of reptile insurance remains an ongoing challenge. Limited awareness can suppress market growth and hinder the adoption of insurance products.

Lifetime Cover Dominates: The lifetime cover segment is projected to hold the largest market share throughout the forecast period. Owners of higher-value reptiles, particularly those involved in breeding or commercial ventures, increasingly prioritize the long-term protection offered by lifetime policies. This segment's growth is driven by the unpredictable and often substantial costs associated with reptile healthcare throughout their lifespan. The potential for lifelong medical complications justifies the higher premium costs associated with lifetime cover.

United States: The US is expected to dominate the market due to the high number of reptile owners, significant disposable income, and a well-developed pet insurance sector. The presence of numerous specialist reptile veterinarians and the broader acceptance of pet insurance contribute to this dominance.

European Union: The EU will also experience significant growth, fueled by rising reptile ownership across various countries. However, market penetration might vary depending on the specific country's pet insurance culture and veterinary infrastructure.

Asia-Pacific: The Asia-Pacific region is poised for considerable expansion, driven by a burgeoning middle class with higher disposable incomes and increased awareness of pet healthcare. However, regulatory frameworks and the availability of specialized veterinary care might pose initial challenges.

Snake Application: The snake application segment is likely to have a larger market share compared to others (turtles, lizards) due to the higher value and often more specialized care requirements of many snake species.

The paragraph above is an overview. More detailed market research data is required to specify exact market share percentages for each segment and region.

The reptile commercial insurance industry is fueled by several catalysts. The rising cost of reptile veterinary care necessitates insurance to offset unexpected expenses. Increased reptile ownership, especially among commercially oriented breeders and specialized keepers, drives demand. Technological advancements, such as online platforms and improved data analytics, contribute to more efficient and accessible insurance offerings. Finally, enhanced awareness campaigns about the benefits of reptile insurance amongst reptile owners are vital for market expansion.

(Note: Links to company websites were not provided in the initial prompt. Adding these requires a separate search for each company.)

This report provides a comprehensive analysis of the reptile commercial insurance market, covering historical performance, current trends, and future projections. It highlights key drivers and challenges, examines the competitive landscape, and identifies key segments and geographic markets. This detailed overview allows for better understanding of market opportunities and risks, crucial for investors, insurers, and businesses within the reptile industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.2%.

Key companies in the market include Petplan, Royal & Sun Alliance (RSA), Nationwide Pet Insurance, Anicom Holding, Agria, ipet Insurance, Trupanion, Direct Line Group, Crum & Forster, Pet Assure, PICC, HWP Insurance, .

The market segments include Type, Application.

The market size is estimated to be USD 1013.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Reptile Commercial Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Reptile Commercial Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.