1. What is the projected Compound Annual Growth Rate (CAGR) of the Real Estate Rental?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Real Estate Rental

Real Estate RentalReal Estate Rental by Type (Online, Offline), by Application (Residence, Non-residential Buildings), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

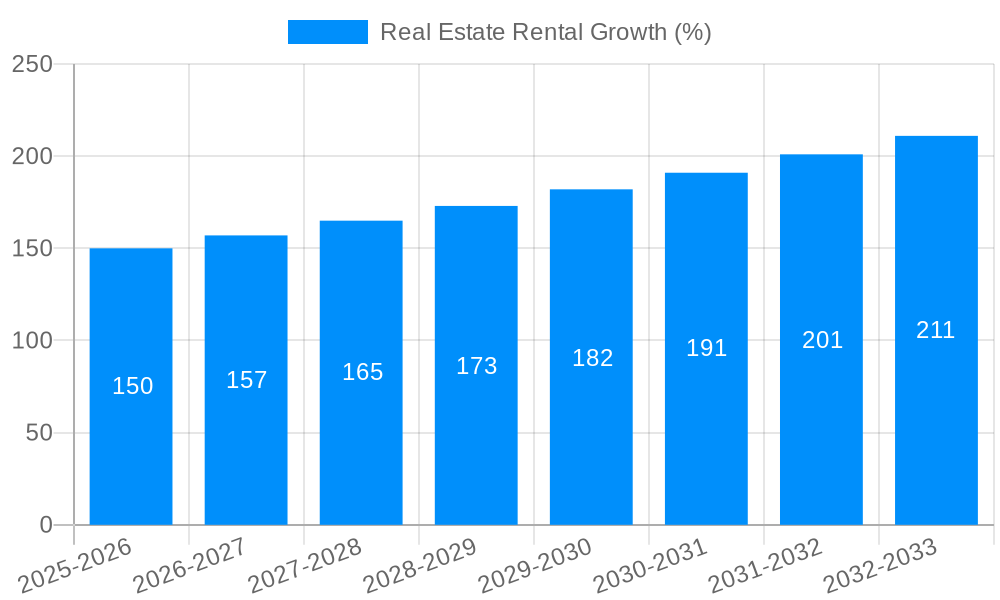

The global real estate rental market is experiencing robust growth, driven by several key factors. Urbanization continues to accelerate, leading to increased demand for rental properties in densely populated areas. Simultaneously, changing lifestyles and preferences, including a rise in remote work and a greater emphasis on flexibility, are fueling the adoption of rental housing over homeownership. Furthermore, the ongoing expansion of the millennial and Gen Z populations, both significant rental cohorts, contributes significantly to market expansion. Technological advancements, such as online property listing platforms and streamlined rental processes, are also boosting market efficiency and accessibility. While rising interest rates and inflation pose challenges, affecting both rental rates and affordability, the underlying demand remains strong, particularly in key markets with robust job growth and attractive amenities. The market is segmented by property type (online vs. offline rentals) and usage (residential vs. non-residential), with the residential segment currently dominating.

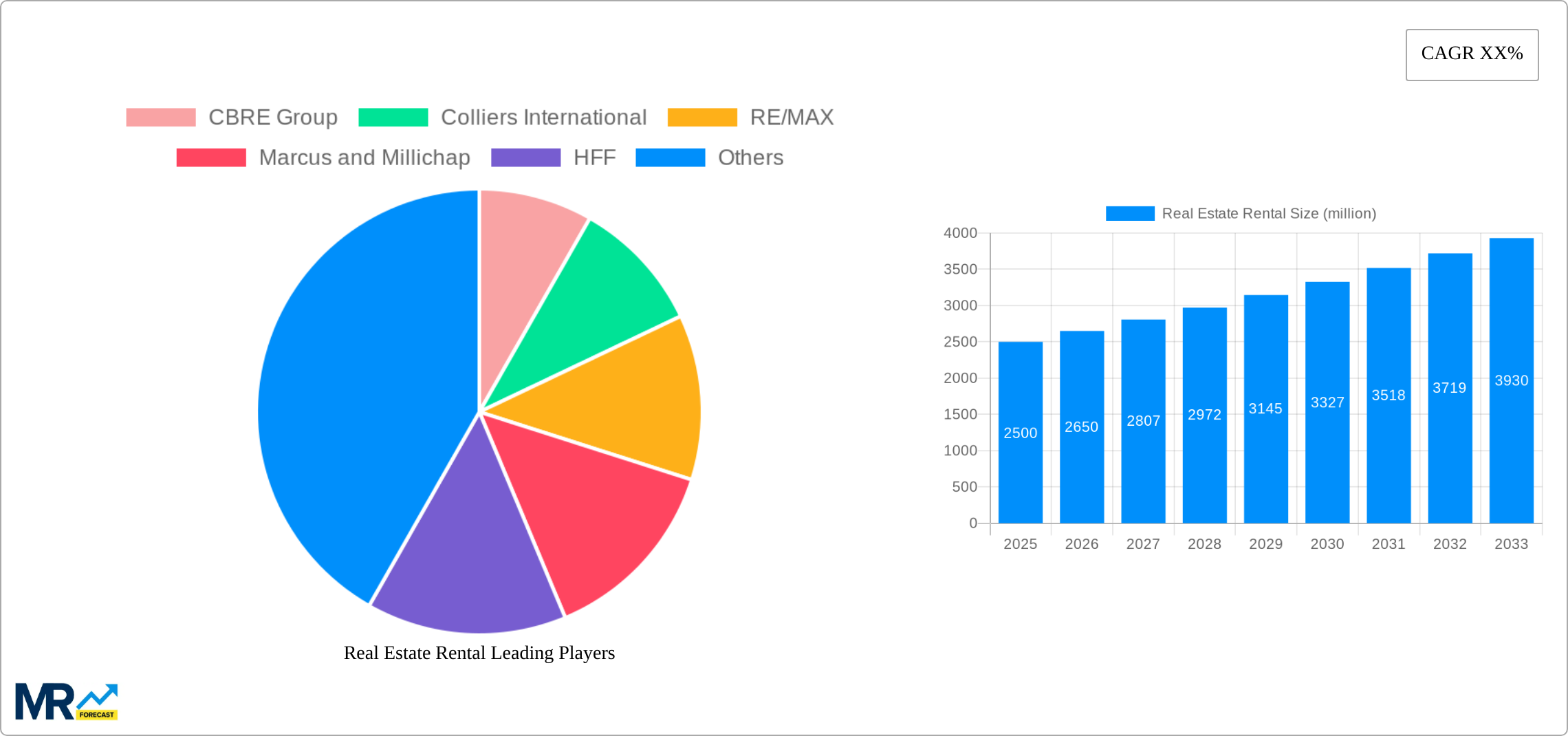

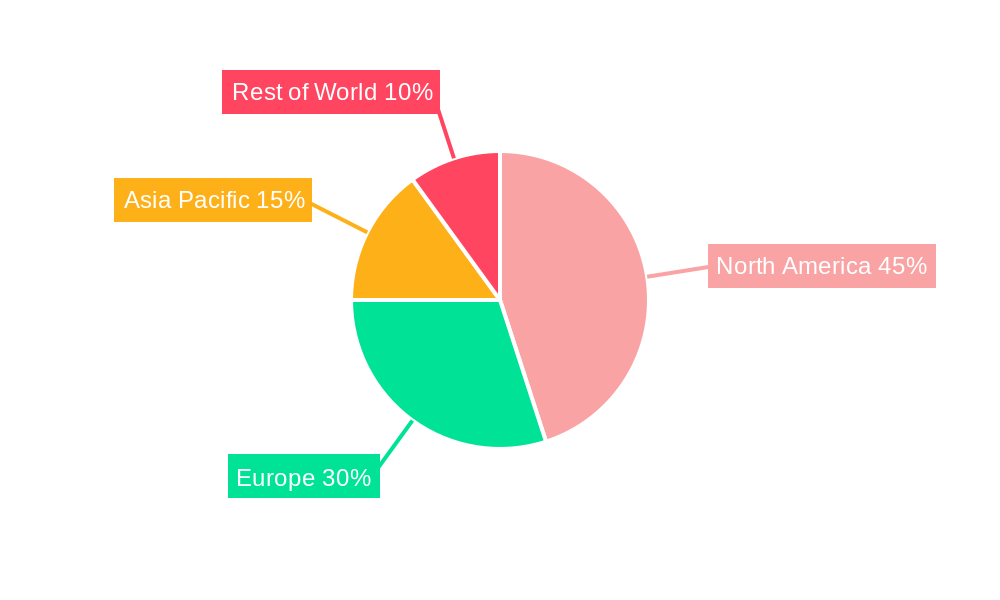

Significant regional variations exist within the real estate rental market. North America, particularly the United States, holds a substantial share, benefiting from a large population and a dynamic economy. Europe and Asia-Pacific also exhibit strong growth potential, driven by urbanization and increasing disposable incomes. Emerging economies in Asia and Latin America present further opportunities, although economic stability and infrastructure development remain crucial considerations. Competition amongst major players like CBRE Group, Colliers International, RE/MAX, Marcus and Millichap, and HFF is intense, spurring innovation and improved service offerings to attract and retain tenants and property owners. Looking forward, the market's trajectory suggests sustained growth, though the pace will likely be modulated by macroeconomic conditions and evolving societal preferences. Strategic investments in property management technologies, enhanced tenant experiences, and sustainable building practices will be critical for companies aiming to thrive in this competitive landscape.

The global real estate rental market, valued at an estimated $XXX million in 2025, is poised for significant growth throughout the forecast period (2025-2033). Analyzing data from 2019-2024 (historical period) reveals a consistent upward trajectory, influenced by several key factors. The shift towards flexible living arrangements, fueled by evolving demographics and employment patterns, is a major driver. The increasing preference for renting over owning, particularly among millennials and Gen Z, contributes substantially to the market's expansion. This trend is evident across various segments, including residential rentals (apartments, single-family homes) and non-residential spaces (office buildings, retail spaces, industrial properties). Technological advancements, such as online rental platforms and property management software, are streamlining processes and enhancing efficiency for both landlords and tenants. These platforms offer greater transparency, improved communication, and a more convenient overall experience, further boosting market growth. The rise of co-living spaces and short-term rentals via platforms like Airbnb has also added a new dimension to the rental landscape, catering to diverse needs and lifestyles. Furthermore, urbanization and population growth in major metropolitan areas continue to intensify demand for rental properties, especially in high-density urban centers. While fluctuations in interest rates and economic conditions can impact rental markets, the fundamental drivers mentioned above suggest a sustained period of growth for the foreseeable future. The study period (2019-2033) provides a comprehensive overview of this dynamic market, highlighting both opportunities and challenges. The base year (2025) serves as a crucial benchmark for understanding current market dynamics, informing projections for future years. Companies like CBRE Group, Colliers International, and RE/MAX are significant players, shaping the landscape through their extensive networks and innovative strategies. The report delves into the specific performance of each segment, identifying key market insights and providing granular data to facilitate informed decision-making.

Several powerful forces are driving the expansion of the real estate rental market. The increasing cost of homeownership, coupled with fluctuating interest rates and stringent lending requirements, is making renting a more attractive option for a wider segment of the population. This is particularly true for younger generations who often prioritize flexibility and mobility over long-term commitments. The growth of the gig economy and remote work opportunities also contributes, as individuals seeking flexible living situations and shorter lease terms find renting to be a more suitable option than homeownership. Urbanization, with its concentration of employment opportunities and amenities in city centers, further fuels demand for rental properties. Moreover, the ongoing development of purpose-built rental communities, offering amenities and services previously found only in high-end homeownership, is enhancing the appeal of renting. These communities often include fitness centers, co-working spaces, and concierge services, increasing their attractiveness and command higher rental prices. The continuous evolution of technology, including online platforms for property searching, virtual tours, and digital lease signing, streamlines the rental process, improving efficiency and making it more convenient for both tenants and landlords. These technological innovations are not only improving user experience but also enhancing the overall market transparency. Finally, government policies and regulations related to housing and rental markets, though varying across regions, also play a significant role in shaping the landscape.

Despite the promising outlook, several factors pose challenges to the real estate rental market. Fluctuations in interest rates and economic downturns can directly impact rental demand and investor confidence. During economic recessions, job losses and reduced disposable income can lead to decreased rental affordability and higher vacancy rates. Government regulations, particularly rent control measures in certain regions, can limit rental income for landlords and discourage new investments in rental properties. The availability of affordable housing remains a significant challenge, particularly in densely populated urban areas. The increasing cost of construction and land acquisition can escalate rental prices, making it difficult for low- and middle-income individuals to find suitable accommodation. Competition from alternative housing options, such as co-living spaces and short-term rentals, also impacts the traditional rental market. Furthermore, managing tenant turnover, dealing with property maintenance issues, and ensuring compliance with local regulations add to the operational complexities for landlords and property management companies. Balancing the needs of both landlords and tenants, while navigating the legal and regulatory environment, represents an ongoing challenge for stakeholders in the rental sector. Finally, the emergence of environmental concerns and sustainable building practices necessitate changes in property management and development approaches, adding another layer of complexity.

The residential rental segment is projected to dominate the market throughout the forecast period. This segment exhibits strong growth across several key regions and countries.

North America (US & Canada): The large population base, combined with a preference for renting, particularly among younger demographics, drives significant demand. Robust economic activity, coupled with a shortage of affordable housing in major urban centers, further fuels growth. The online rental market is flourishing.

Europe (Western Europe): Urbanization and a trend towards flexible living arrangements contribute to the strong performance of the residential rental sector. Online and offline channels coexist, with robust activity in both.

Asia-Pacific (China, Japan, India): Rapid urbanization and rising disposable incomes, especially in developing economies, are stimulating significant growth in residential rentals. Online platforms are rapidly gaining popularity, transforming the way people find and rent properties.

Market Dominance by Segment: While both online and offline channels play a role, the online segment is experiencing faster growth, facilitated by technological advancements. The ease of access, broader reach, and enhanced transparency offered by online platforms are attracting a growing number of users. This is reflected across various regions and countries.

In summary: The combination of demographic shifts, economic trends, and technological advancements strongly supports the continued dominance of the residential rental market segment, especially driven by online platforms, offering efficiency and accessibility.

Several factors will propel growth in the real estate rental market. The increasing adoption of technology, including online platforms and property management software, streamlines processes and attracts more users. Continued urbanization and population growth in key metropolitan areas, coupled with growing demand for flexible and convenient housing solutions, will further stimulate growth. Lastly, the emergence of new rental property models, such as co-living spaces and purpose-built rental communities, expands options for renters.

This report provides a detailed analysis of the global real estate rental market, encompassing historical data, current market trends, and future projections. It offers insights into key market drivers, challenges, and opportunities, facilitating informed decision-making for stakeholders across the industry. The report covers key segments, regions, and leading players, providing a comprehensive understanding of the market landscape. The detailed analysis of market segments, including residential and non-residential properties and online versus offline channels, provides valuable insights for targeted strategies.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include CBRE Group, Colliers International, RE/MAX, Marcus and Millichap, HFF, Millichap, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Real Estate Rental," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Real Estate Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.