1. What is the projected Compound Annual Growth Rate (CAGR) of the Real Estate Crowdfunding Investment?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Real Estate Crowdfunding Investment

Real Estate Crowdfunding InvestmentReal Estate Crowdfunding Investment by Application (Commercial & Industrial, Residential, Others), by Type (Equity, Lending), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

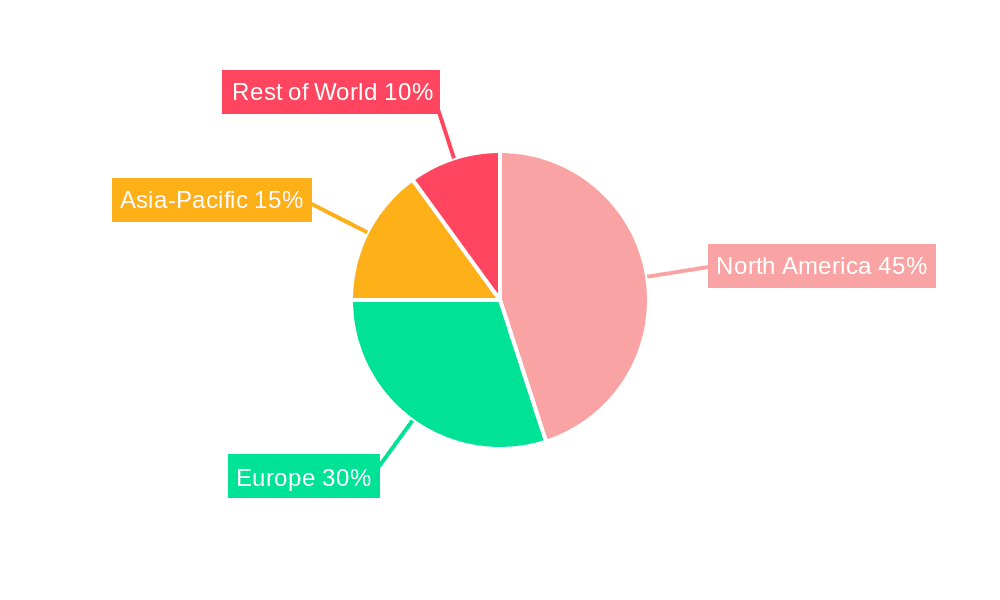

The real estate crowdfunding investment market is experiencing robust growth, driven by increasing accessibility to alternative investments, technological advancements facilitating online platforms, and a desire for diversification among investors. The market's expansion is fueled by both commercial and residential projects, with commercial projects currently holding a larger share due to higher investment amounts and potential returns. Equity crowdfunding dominates the market type, reflecting investor interest in direct ownership stakes and potential capital appreciation. However, lending platforms are also gaining traction, offering attractive risk-adjusted returns through debt financing of real estate ventures. The North American market, particularly the United States, is currently the largest regional segment, driven by a mature financial ecosystem and high investor participation. However, significant growth potential exists in emerging markets like Asia-Pacific and parts of Europe, where increasing internet penetration and a growing middle class are creating new investor pools. Regulatory clarity and investor education initiatives will play crucial roles in shaping the market's future trajectory. Restraints such as market volatility, illiquidity inherent in real estate investments, and potential regulatory hurdles in certain regions could impact growth.

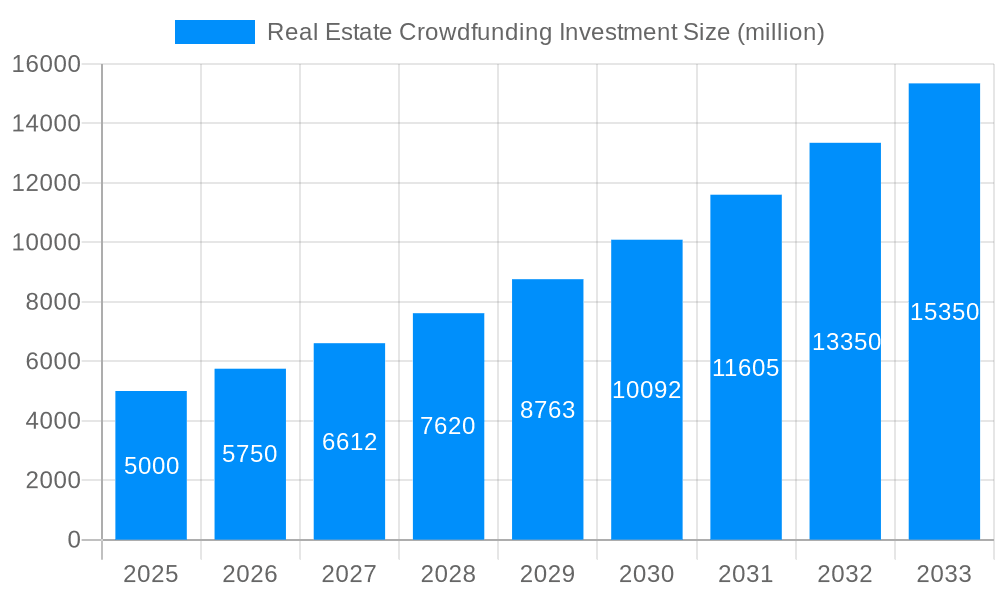

The forecast period (2025-2033) anticipates continued expansion, driven by ongoing technological innovations and increasing investor sophistication. The estimated CAGR, while not explicitly provided, is projected to be around 15% based on industry benchmarks and considering the aforementioned growth drivers. This assumes a steady increase in both the number of investors and average investment sizes. Segmentation analysis reveals that commercial and industrial applications continue to attract substantial investment, reflecting the potential for higher returns. The leading companies, including DiversyFund, CrowdStreet, and Fundrise, are expected to consolidate their market positions while simultaneously facing competition from new entrants and technological innovations. Geographical expansion will be a key strategy for market players, with a focus on regions with untapped potential and supportive regulatory environments. A detailed analysis of market trends across various regions will provide a more granular view of growth opportunities and challenges.

The real estate crowdfunding investment market experienced significant growth between 2019 and 2024, driven by increasing technological advancements, shifting investor preferences towards alternative investments, and a desire for higher returns compared to traditional investment avenues. The market witnessed a surge in both equity and lending-based crowdfunding platforms, facilitating access to previously exclusive real estate investment opportunities for a broader range of investors. During the historical period (2019-2024), the market demonstrated a Compound Annual Growth Rate (CAGR) exceeding 15%, reaching a market valuation of approximately $XXX million by the base year (2025). This growth was fueled by the increasing popularity of online platforms, streamlined investment processes, and the diversification benefits offered by real estate investments, particularly for smaller investors who lacked access to larger-scale projects before the advent of crowdfunding. The base year (2025) marks a pivotal point, with the market poised for further expansion. The forecast period (2025-2033) predicts continued strong growth, projected to reach $YYY million by 2033. Key drivers behind this continued growth include increasing institutional investor participation, expanding regulatory frameworks fostering investor confidence, and the ongoing development of innovative technological solutions for risk management and due diligence. The market shows significant potential for further disruption and expansion, particularly in niche segments like sustainable development and fractional ownership, which is predicted to contribute to the overall market expansion throughout the forecast period. Specific market trends observed indicate a rising preference for residential real estate investments, and a growing engagement of millennial investors seeking exposure to the sector.

Several key factors propel the growth of real estate crowdfunding investments. Firstly, the lowered barrier to entry is significant. Previously, real estate investment required substantial capital, limiting participation to high-net-worth individuals. Crowdfunding platforms democratize access, allowing smaller investors to participate in larger-scale projects, thereby fostering a more inclusive investment landscape. Secondly, the increased transparency and efficiency offered by online platforms streamline the investment process. Investors can easily browse investment opportunities, conduct due diligence, and manage their portfolios through user-friendly interfaces, contributing to a smoother and more accessible experience. Thirdly, the potential for diversification is a powerful driver. Real estate, historically considered a less liquid asset class, offers diversification benefits when compared with other investment products, helping to reduce overall portfolio risk. Crowdfunding further enhances this by allowing investors to diversify across multiple projects and asset classes. Finally, the potential for higher returns, especially when compared to traditional savings accounts or low-yield bonds, is a compelling factor, although it is important to acknowledge that higher returns generally come with higher risk. These combined factors create a compelling proposition for a growing base of investors seeking higher returns and diversification in their portfolios.

Despite the substantial growth potential, several challenges hinder the widespread adoption of real estate crowdfunding. Firstly, regulatory uncertainty remains a significant obstacle. The relatively nascent nature of the industry means regulatory frameworks are still evolving across different jurisdictions, potentially leading to inconsistent standards and legal complexities. This can discourage both investors and platform operators. Secondly, liquidity concerns pose a challenge. Unlike publicly traded securities, real estate investments typically have lower liquidity, meaning investors may face difficulties in quickly selling their stakes. The ability to easily liquidate investments is a key factor influencing investor participation. Thirdly, risk assessment remains crucial. Accurate risk assessment is vital, particularly when dealing with illiquid assets. Ensuring adequate due diligence and transparency regarding project risks is necessary to build investor confidence. Finally, the lack of standardization across platforms creates challenges for investors comparing opportunities and understanding the varying fees and terms. Addressing these challenges will involve establishing robust regulatory frameworks, fostering transparency, developing standardized risk assessment methodologies, and promoting efficient secondary market mechanisms for liquidity.

The North American market, particularly the United States, is currently dominating the real estate crowdfunding investment landscape, driven by a robust technology infrastructure, established regulatory frameworks (albeit still evolving), and a large pool of both individual and institutional investors. However, European markets, particularly in the UK and Germany, are experiencing rapid growth. Asia is also exhibiting increasing potential, with China and other emerging markets slowly growing their crowdfunding sectors. Within segments, the Residential sector is leading the charge in terms of both equity and lending-based crowdfunding. This is driven by the broad appeal and consistent demand for residential properties.

Residential Dominance: The strong growth in the residential segment stems from several factors: consistent demand for housing across various economic climates, the relatively straightforward nature of residential projects compared to commercial ones, and the appealing proposition of fractional ownership of residential properties. This translates into a more easily understandable investment for a wider range of investors, and also often lower risk profiles.

Commercial and Industrial Growth: While currently smaller than the residential sector, the commercial and industrial segments are showing significant potential. As investor sophistication grows, institutional investors are increasingly participating in these larger-scale projects which offer higher potential returns but also carry higher risk.

Equity vs. Lending: Both equity and lending models are experiencing growth, but the equity model might see faster growth in the forecast period because of the higher potential for returns though it's also associated with a higher level of risk. The lending model offers comparatively lower risks but also lower potential returns.

The landscape is dynamic; the relative dominance of specific regions and segments will shift with evolving market trends and technological advancements.

Several factors are set to accelerate the growth of the real estate crowdfunding industry. These include the continued advancement of technology, leading to more user-friendly platforms and improved risk management tools; expanding regulatory clarity and standardization, enhancing investor confidence; increased participation from institutional investors, providing additional capital and legitimacy; and the rise of innovative investment models like fractional ownership and sustainable real estate projects, attracting a broader range of investors concerned about environmental, social, and governance (ESG) factors.

This report provides a comprehensive analysis of the real estate crowdfunding investment market, encompassing historical data, current market trends, and future projections. It offers valuable insights into driving forces, challenges, key players, and growth catalysts, enabling informed decision-making for investors, platform operators, and other stakeholders in the industry. The report covers various segments (residential, commercial, equity, lending) and provides a geographical analysis, highlighting key regions and countries. The detailed data and market analysis offer a complete overview of this dynamic and rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of XX% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include DiversyFund, Crowdestate, Groundbreaker Technologies, CrowdStreet, Fundrise, RealCrowd, EstateGuru, RM Technologies, AHP Servicing, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Real Estate Crowdfunding Investment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Real Estate Crowdfunding Investment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.