1. What is the projected Compound Annual Growth Rate (CAGR) of the Real Estate Agency and Brokerage Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Real Estate Agency and Brokerage Service

Real Estate Agency and Brokerage ServiceReal Estate Agency and Brokerage Service by Type (Residential Building Brokers, Commercial Buildings Brokers, Self Storage Brokers), by Application (Online, Offline), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

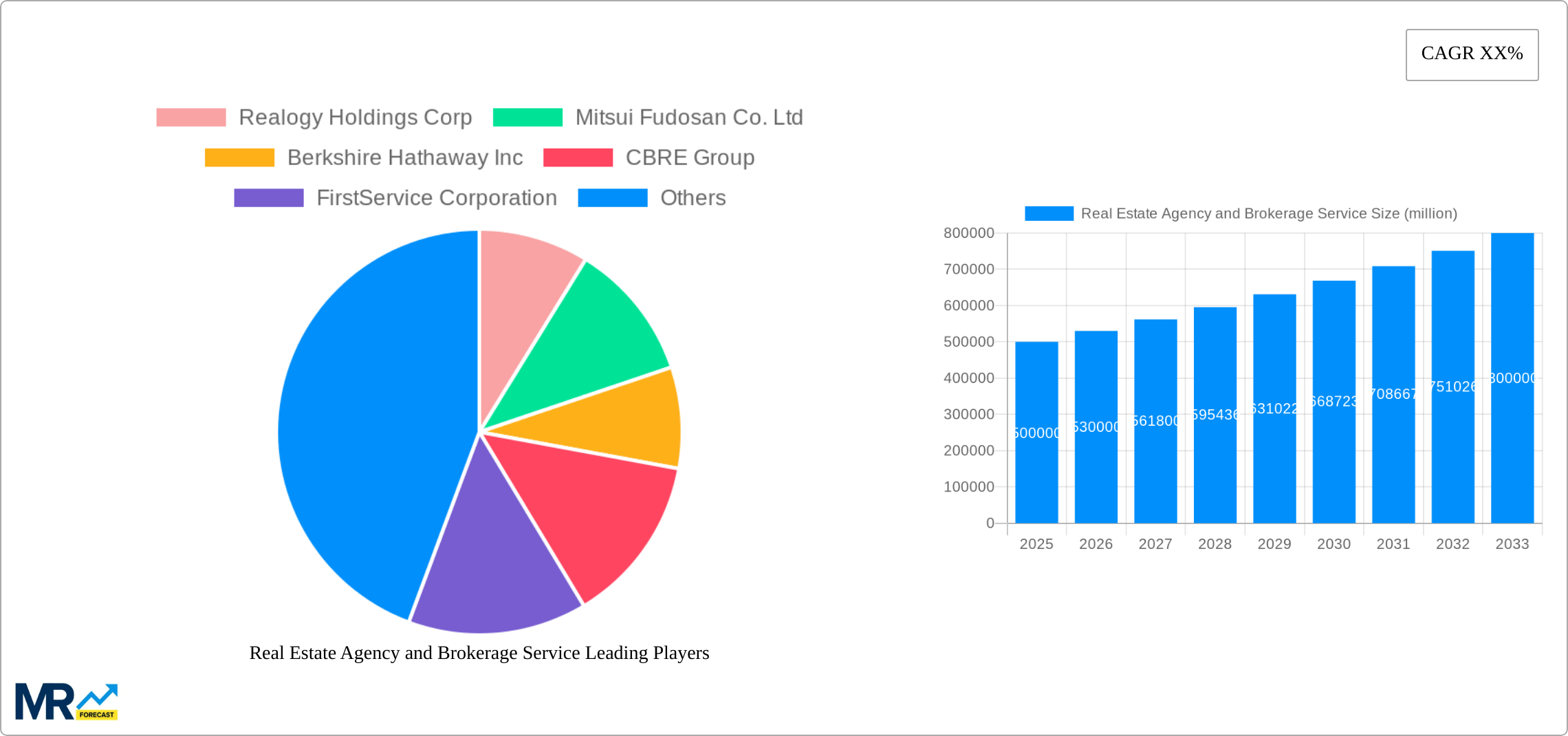

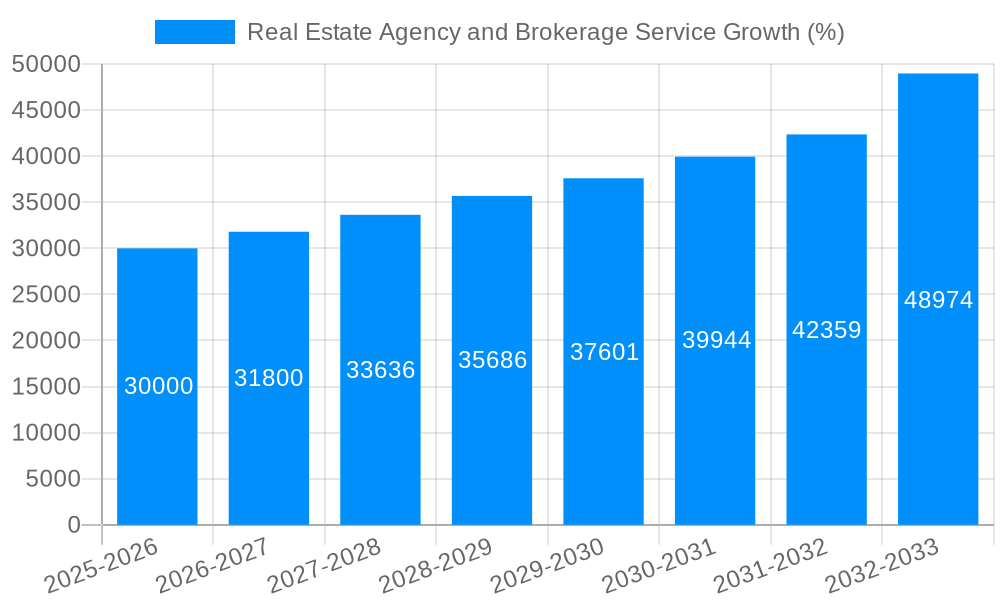

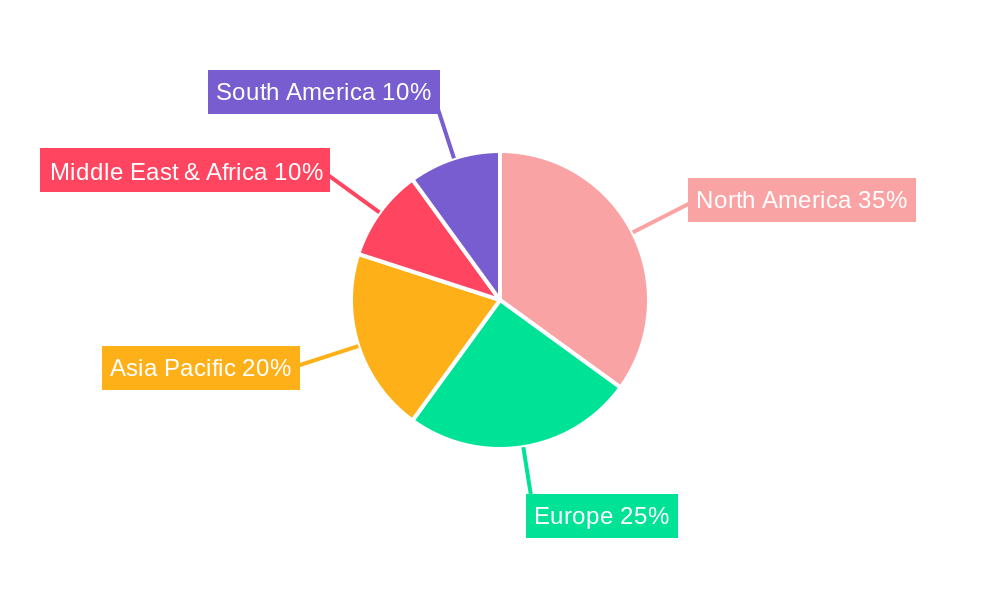

The global real estate agency and brokerage services market is experiencing robust growth, driven by factors such as increasing urbanization, rising disposable incomes, and a growing preference for professionally managed real estate transactions. The market is segmented by property type (residential, commercial, and self-storage) and transaction method (online and offline). While the offline channel still dominates, online platforms are rapidly gaining traction, fueled by technological advancements and evolving consumer behavior. This shift towards digitalization offers significant opportunities for brokers to expand their reach and enhance efficiency. The market's considerable size, estimated at $500 billion in 2025, indicates substantial investment potential. A Compound Annual Growth Rate (CAGR) of 6% is projected for the forecast period (2025-2033), implying a market value exceeding $800 billion by 2033. Key players like Realogy Holdings Corp, CBRE Group, and Jones Lang LaSalle Inc. are leveraging technological innovations and strategic acquisitions to maintain market leadership. However, regulatory hurdles, economic fluctuations, and competition from independent agents pose challenges to sustained growth. Regional variations exist, with North America and Asia Pacific expected to lead in market share due to strong economic growth and substantial infrastructure development. The self-storage segment is showing particularly promising growth, driven by increasing demand for flexible storage solutions.

The competitive landscape is characterized by both large multinational corporations and smaller, specialized agencies. Success hinges on adapting to technological advancements, providing superior customer service, and specializing in niche markets. The increasing demand for sustainability and environmentally conscious practices in the real estate sector also presents opportunities for brokers who can offer expertise in green building and energy-efficient properties. Moreover, the growing trend towards PropTech (property technology) solutions is transforming how real estate transactions are conducted, leading to greater transparency and efficiency. Factors such as interest rate changes, government policies impacting the housing market, and global economic conditions will continue to influence market dynamics. A strategic focus on building strong client relationships, leveraging data analytics, and embracing technological innovations will be crucial for success in this dynamic and competitive market.

The global real estate agency and brokerage service market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. The period from 2019 to 2024 (historical period) showcased a steady expansion, laying the groundwork for the accelerated growth anticipated between 2025 (base year and estimated year) and 2033 (forecast period). Several factors are contributing to this upward trajectory. Technological advancements, particularly the rise of online platforms and proptech solutions, are transforming how properties are marketed and transactions are conducted. This digitization streamlines processes, enhances efficiency, and expands market reach. Furthermore, demographic shifts, including urbanization and a growing global population, are increasing demand for both residential and commercial properties. The market is witnessing a surge in demand for specialized brokerage services, such as those catering to luxury properties or specific commercial sectors (e.g., industrial warehouses, retail spaces). Fluctuations in interest rates and overall economic conditions naturally impact market dynamics, yet the long-term outlook remains positive. The market is witnessing consolidation, with larger players acquiring smaller firms to enhance their market share and service offerings. This consolidation is leading to a more competitive landscape, driving innovation and pushing service quality upwards. The increasing use of data analytics and AI-driven tools is refining market predictions and allowing brokers to better serve their clients. This precision is attracting more investors and strengthening confidence in the sector's sustained growth. Finally, global expansion into emerging markets presents considerable opportunities for existing players and new entrants, broadening the overall market potential considerably.

Several key factors are fueling the expansion of the real estate agency and brokerage service market. Firstly, rapid urbanization and population growth in many parts of the world are creating significant demand for both residential and commercial real estate. This increased demand necessitates the services of experienced brokers who can navigate complex transactions and match buyers with suitable properties. Secondly, the increasing prevalence of online platforms and PropTech innovations are improving efficiency and transparency within the industry. These technologies allow for broader property listings, quicker transactions, and a more streamlined client experience. Thirdly, the growing sophistication of financial instruments and investment strategies in real estate is encouraging institutional investors to enter the market, creating opportunities for brokers specializing in commercial real estate. The rise of remote work and flexible work arrangements are also reshaping the commercial real estate landscape, with demand for specific types of office spaces and co-working facilities shifting. Finally, regulatory changes and evolving government policies aimed at stabilizing and improving the real estate sector in various countries are contributing to a more stable and predictable market environment.

Despite the positive outlook, the real estate agency and brokerage service market faces several challenges. Economic downturns and fluctuations in interest rates can significantly dampen buyer demand and impact transaction volumes. Stringent regulatory compliance requirements and increasing legal complexities can add to the operational costs and administrative burden on brokerage firms. The rise of PropTech also presents both opportunities and challenges; while technology improves efficiency, it also raises concerns about data security and the potential displacement of traditional brokers. Competition within the market is fierce, particularly with the emergence of online platforms and discount brokers offering potentially lower fees. Maintaining a strong reputation and building client trust in a digitally driven world is paramount, requiring continuous effort and investment in building relationships. Lastly, geopolitical instability and macroeconomic uncertainties can create volatility and uncertainty in the real estate market, making it difficult to predict short-term trends accurately.

The market shows strong growth across various regions, but certain areas and segments are leading the way. North America and Asia-Pacific are expected to account for a significant share of global revenue due to rapid urbanization, robust economic growth in specific regions, and significant investment in real estate.

Residential Building Brokers: This segment will continue to dominate the market due to consistent high demand driven by population growth and shifting demographics. The segment's growth is fueled by the necessity of experienced brokers to guide buyers and sellers through complex transactions, especially in competitive markets. High-value residential properties are particularly lucrative for this segment.

Commercial Buildings Brokers: This sector is expected to witness considerable expansion fueled by increasing investments in commercial real estate, driven both by institutional investors and growing businesses. Specialized expertise within niche sectors (like industrial properties or data centers) is becoming crucial, leading to further market segmentation. The ongoing shift towards flexible workspaces is further diversifying the commercial real estate market, creating new opportunities for brokers who specialize in this area.

Online Application: The online segment is showing substantial growth, largely due to its improved efficiency and ease of access. Online platforms offer a wider reach for brokers, enabling them to market properties to a broader audience. The capability for global reach and 24/7 access enhances this segment's appeal to both buyers and sellers.

Specific geographic areas: Within countries, large metropolitan areas with high population density and strong economic activity will continue to be key market drivers. These areas offer higher property values and increased transaction volume, making them attractive markets for brokers.

The convergence of these factors suggests a complex and rapidly evolving landscape where technological advancements, demographic changes, and economic conditions all play pivotal roles in determining market dominance.

Several factors will act as growth catalysts for the industry. Firstly, the increasing use of big data analytics and artificial intelligence in property valuation, market trend prediction, and client relationship management enhances efficiency and accuracy. Secondly, government initiatives to improve transparency and streamline regulatory processes within the real estate sector can further stimulate growth. Thirdly, continuous innovation within PropTech and the integration of new technologies continue to redefine the way real estate transactions are carried out, boosting the sector's overall appeal. Finally, continued investment from both private equity and venture capital firms is expected to further accelerate innovation and expansion within the industry.

This report provides a detailed analysis of the real estate agency and brokerage service market, offering insights into market trends, growth drivers, challenges, key players, and future outlook. The report’s comprehensive coverage allows for informed decision-making for investors, businesses, and industry professionals seeking to navigate the complexities of this dynamic market. It forecasts market size and provides region-specific breakdowns, offering a granular perspective on the evolving landscape. The analysis of key segments and players offers a competitive advantage for strategic planning and business development within the real estate industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Realogy Holdings Corp, Mitsui Fudosan Co. Ltd, Berkshire Hathaway Inc, CBRE Group, FirstService Corporation, Sekisui House, Savills plc, Jones Lang LaSalle Inc, Colliers International, Shimizu Corporation, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Real Estate Agency and Brokerage Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Real Estate Agency and Brokerage Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.