1. What is the projected Compound Annual Growth Rate (CAGR) of the Ready to Assemble Furnitures?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ready to Assemble Furnitures

Ready to Assemble FurnituresReady to Assemble Furnitures by Type (Office RTA Furniture, Residential RTA Furniture, World Ready to Assemble Furnitures Production ), by Application (Independent Specialist Retailers, Independent Furniture Chains, Others (Online), World Ready to Assemble Furnitures Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

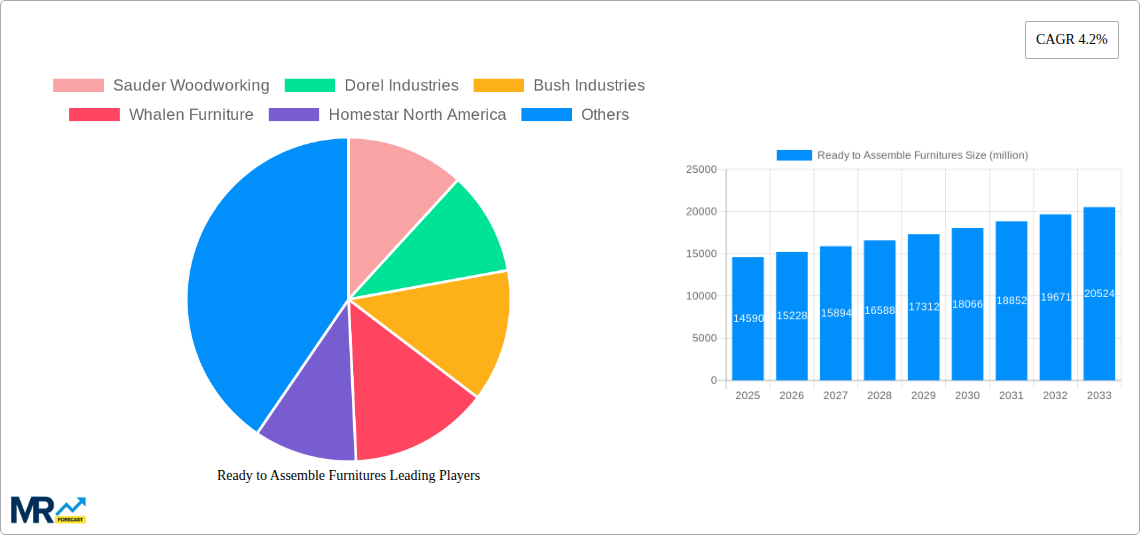

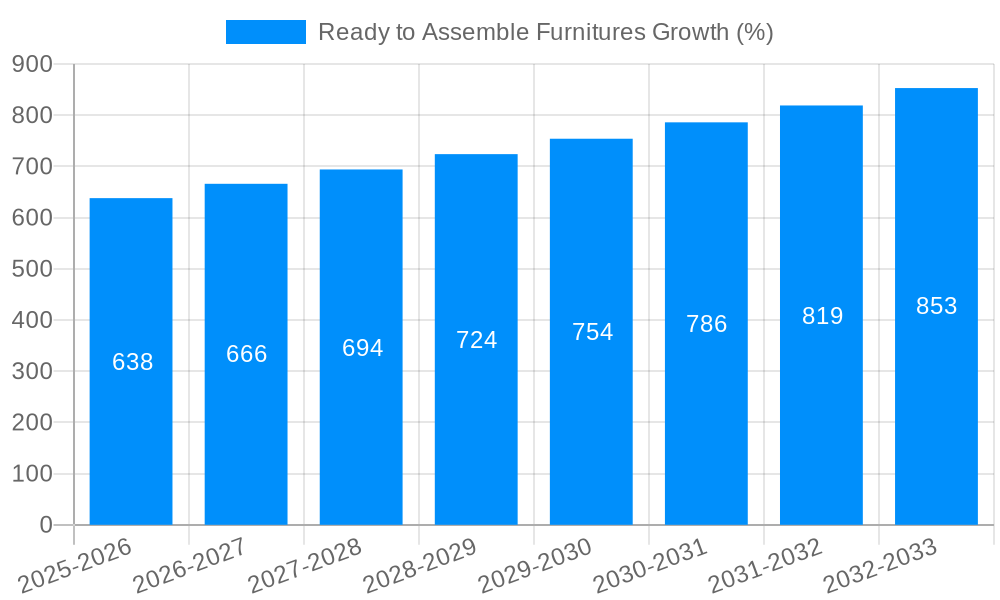

The Ready-to-Assemble (RTA) furniture market, valued at $19.47 billion in 2025, is experiencing robust growth driven by several key factors. The increasing popularity of e-commerce and online furniture retail significantly contributes to this expansion, offering consumers convenient access to a wide variety of affordable options. Furthermore, the rising demand for space-saving furniture solutions in urban areas and smaller homes fuels the growth of RTA furniture, particularly among younger demographics. The convenience of assembly, often perceived as faster and cheaper than professional installation, also plays a significant role. While the market segmentation is diverse, with strong representation from both office and residential sectors across independent retailers, chains and online platforms, growth is particularly notable in online sales channels, reflecting current consumer shopping habits. Leading manufacturers like IKEA, Sauder, and Dorel Industries maintain significant market share, but the competitive landscape remains dynamic with smaller players and new entrants constantly emerging. Future growth will likely be shaped by factors like evolving consumer preferences, technological advancements in materials and design, and the continuous expansion of e-commerce platforms.

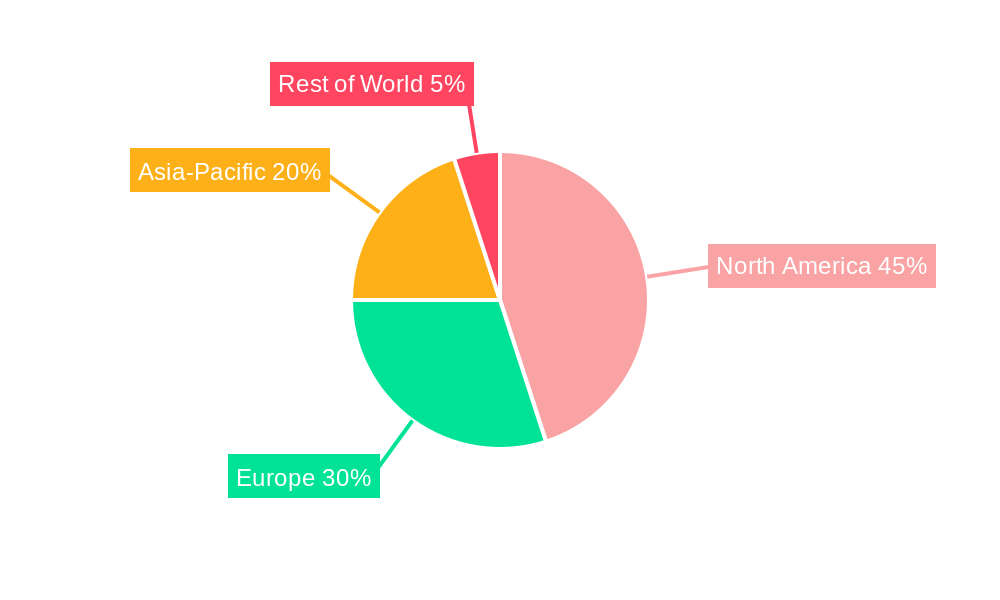

The North American market currently holds a substantial share, boosted by high consumer spending and established retail infrastructure. However, Asia-Pacific is poised for considerable growth due to rapid urbanization and rising disposable incomes. Europe also presents a significant market, particularly in regions with high population density and a preference for cost-effective furnishing options. While potential restraints like concerns about product quality and assembly complexity exist, the overall market outlook remains positive, with projected continued growth driven by consistent consumer demand and ongoing innovations within the RTA furniture industry. The focus on sustainable and eco-friendly materials is also emerging as a critical market differentiator, influencing both production practices and consumer purchasing decisions.

The Ready-to-Assemble (RTA) furniture market is experiencing robust growth, driven by evolving consumer preferences and advancements in manufacturing and distribution. Over the study period (2019-2033), the market has shown a significant upward trajectory, with production exceeding several million units annually. The increasing popularity of RTA furniture is largely attributed to its affordability, convenience, and space-saving attributes. Consumers, particularly millennials and Gen Z, are increasingly drawn to the ease of assembly and cost-effectiveness, making it a compelling alternative to fully assembled furniture. This trend is further amplified by the rise of e-commerce and the seamless integration of online shopping into daily life. The ability to order furniture online and assemble it at home eliminates the need for expensive delivery and assembly services, further contributing to the market's growth. However, the market isn't without its nuances. While residential RTA furniture maintains a significant market share, the office segment is witnessing accelerated growth due to the increasing popularity of home offices and flexible workspaces. This segment is expected to see substantial gains in the coming years, particularly as remote work models continue to gain traction globally. Furthermore, the market is characterized by a diverse range of players, from established giants like IKEA to smaller, specialized retailers catering to niche markets. This competitive landscape fosters innovation and provides consumers with a wide variety of choices and price points, ensuring continued market dynamism. The forecast period (2025-2033) projects continued expansion, with projections reaching several million units, fueled by sustained consumer demand, technological advancements in design and materials, and the ongoing evolution of the e-commerce landscape. The base year of 2025 serves as a critical benchmark to assess the market's current status and trajectory before the forecast period's expansion takes hold.

Several key factors are propelling the growth of the RTA furniture market. Firstly, the cost-effectiveness of RTA furniture is a major driver. Manufacturing and shipping costs are significantly lower compared to fully assembled furniture, leading to lower retail prices that attract budget-conscious consumers. Secondly, the convenience factor is undeniable. Online ordering and home delivery eliminate the hassle and expense of in-store purchases and professional assembly. This is especially appealing to busy professionals and individuals living in urban areas with limited storage space. Thirdly, the rise of e-commerce has played a crucial role in the market's expansion. Online retailers offer a wide selection of RTA furniture with detailed descriptions, images, and customer reviews, facilitating informed purchasing decisions. The seamless online shopping experience, combined with convenient delivery options, significantly contributes to the market's accessibility and growth. Moreover, the increasing popularity of minimalist and compact living spaces further fuels demand for RTA furniture. Their flat-pack design facilitates easy storage and transportation, making them ideal for small apartments and homes. Finally, continuous innovation in materials and designs enhances the quality and aesthetics of RTA furniture, overcoming past perceptions of inferior quality. This evolution is attracting a broader range of consumers, who are increasingly seeking stylish and functional pieces for their homes and offices.

Despite the significant growth potential, the RTA furniture market faces certain challenges. One key restraint is the perceived difficulty of assembly. While instructions are generally provided, some consumers may find the assembly process time-consuming or frustrating, leading to negative reviews and potentially deterring purchases. This is especially true for more complex furniture items. Secondly, concerns about the quality and durability of RTA furniture persist in some segments of the market. While advancements in materials and manufacturing have greatly improved quality, certain perceptions still remain. Addressing these concerns through enhanced quality control measures and robust marketing campaigns is crucial for sustained growth. Furthermore, competition within the market is intense, with a wide range of players vying for market share. Maintaining a competitive edge requires constant innovation in design, materials, and marketing strategies. Finally, logistical challenges, such as efficient packaging and timely delivery, can impact customer satisfaction and brand reputation. Addressing these logistical hurdles through optimized supply chains and reliable delivery partners is essential for fostering positive consumer experiences. Addressing these challenges proactively is critical for ensuring the continued expansion and success of the RTA furniture market.

The Residential RTA Furniture segment is poised to dominate the market in the forecast period (2025-2033).

High Demand: The growing popularity of compact living, coupled with the increasing preference for affordable and convenient furnishing solutions, is fueling significant demand for residential RTA furniture.

E-commerce Boom: The substantial growth in online furniture sales directly contributes to the dominance of this segment. The ease of browsing, comparing prices, and ordering from the comfort of one's home significantly boosts sales in the residential sector.

Diverse Product Offerings: The RTA market offers a vast range of residential furniture, including beds, wardrobes, desks, and shelving units, catering to diverse needs and preferences.

Cost-Effectiveness: Residential RTA furniture significantly reduces costs compared to fully assembled alternatives, making it an attractive option for a wider range of consumers, particularly those with tighter budgets.

Demographic Trends: Millennials and Gen Z, known for their preference for online shopping and cost-effectiveness, represent a significant consumer base for residential RTA furniture.

Geographically, North America and Europe are expected to be key regions driving market growth due to established e-commerce infrastructure, high disposable incomes, and a significant focus on convenient, affordable living solutions.

Mature Markets: North America and Europe represent mature markets with established distribution networks and a high level of consumer awareness concerning RTA furniture.

Technological Advancements: These regions are at the forefront of technological advancements in furniture design, materials, and manufacturing processes, leading to improved quality and appeal of RTA products.

Strong E-commerce Penetration: The high penetration of e-commerce in these regions directly facilitates the expansion of the RTA furniture market. Online platforms provide seamless access to a wide selection of products and convenient purchasing options.

Consumer Preferences: Consumers in North America and Europe are increasingly adopting minimalist living styles, favoring space-saving and readily assembled furniture pieces.

In summary, the convergence of strong demand, booming e-commerce, diverse product offerings, cost-effectiveness, and favorable demographic trends positions the residential RTA furniture segment, particularly within North America and Europe, as the dominant force in the global RTA market. The projected growth in these areas confirms this dominance for the foreseeable future.

Several factors are catalyzing growth within the RTA furniture industry. The increasing adoption of online shopping and the convenience it offers are pivotal. Cost-effectiveness, particularly crucial in times of economic uncertainty, remains a significant attraction. Moreover, technological advancements in design and materials are leading to improved quality and aesthetics, broadening the appeal of RTA furniture beyond its traditionally price-conscious consumer base. Finally, the growing trend toward smaller living spaces further fuels demand for space-saving and easy-to-assemble options.

This report provides a comprehensive analysis of the Ready-to-Assemble (RTA) furniture market, covering historical data, current trends, and future projections. It details key market drivers, challenges, and growth catalysts, offering insights into the competitive landscape and major players. The report also segments the market by type (office and residential) and application (retail channels), providing detailed regional and country-level analyses. The extensive forecast period provides a clear picture of the future trajectory of the RTA furniture market, offering valuable insights for businesses and investors.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sauder Woodworking, Dorel Industries, Bush Industries, Whalen Furniture, Homestar North America, IKEA, Flexsteel (Home Styles), Simplicity Sofas, Prepac, South Shore, .

The market segments include Type, Application.

The market size is estimated to be USD 19470 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Ready to Assemble Furnitures," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ready to Assemble Furnitures, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.