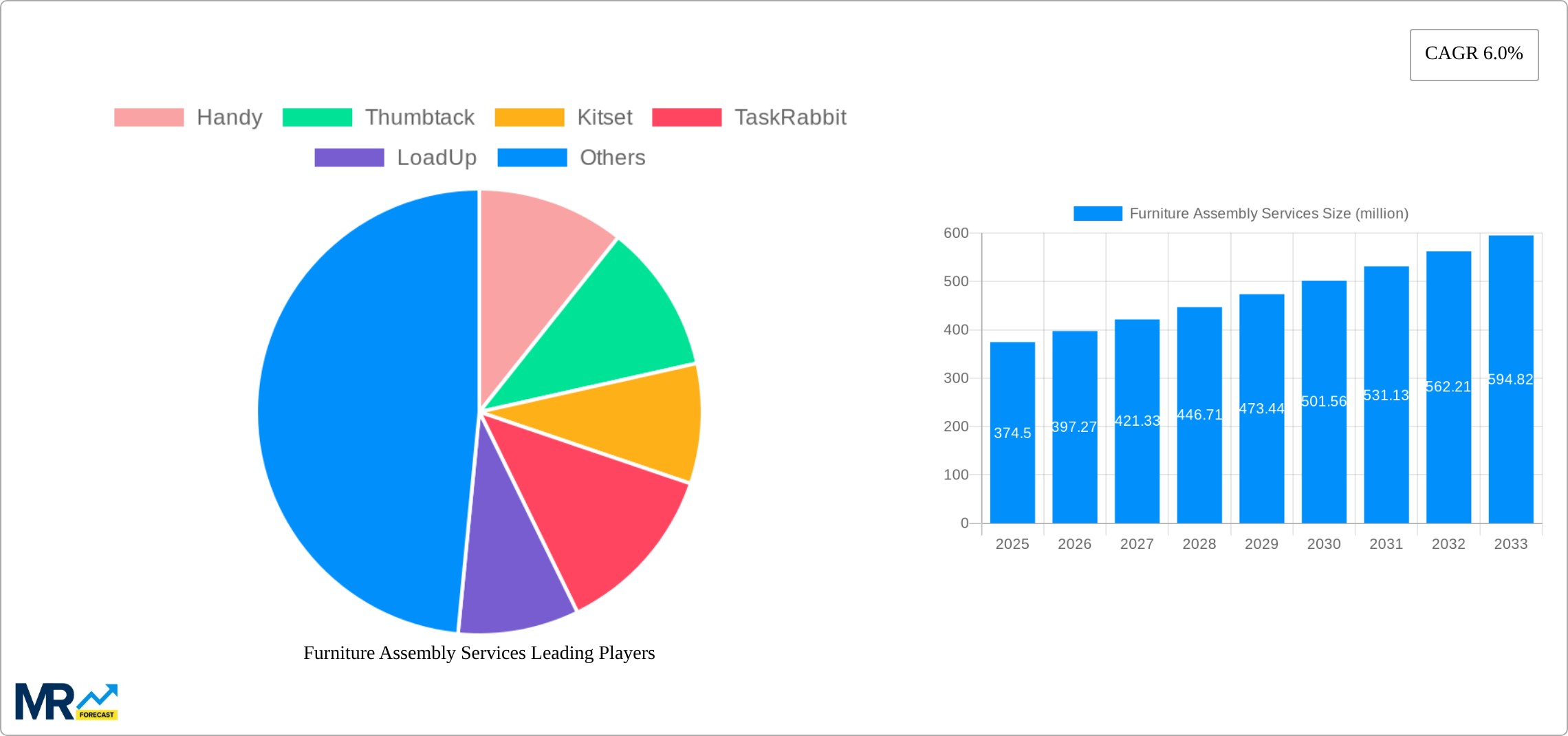

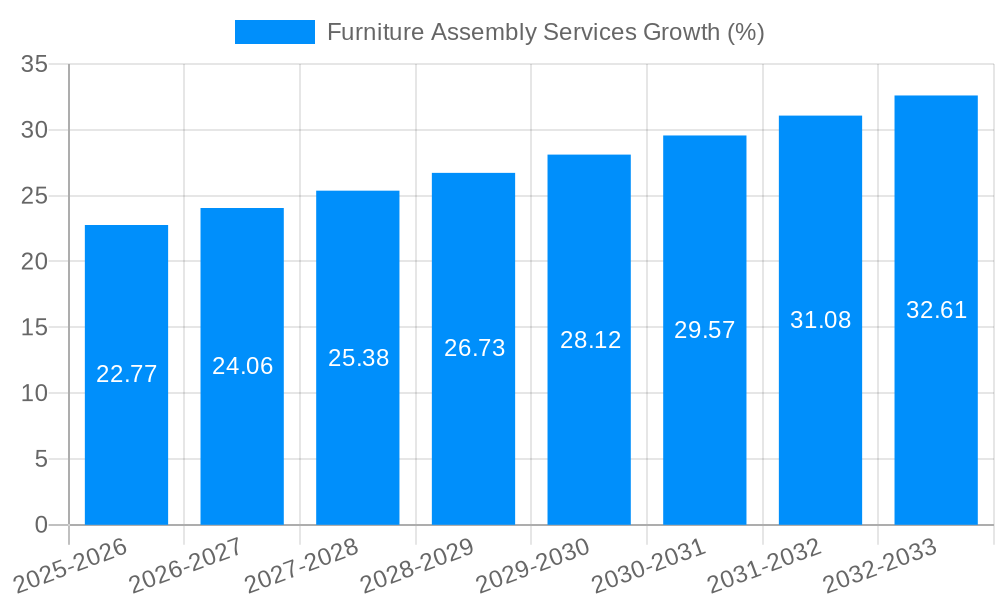

1. What is the projected Compound Annual Growth Rate (CAGR) of the Furniture Assembly Services?

The projected CAGR is approximately 6.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Furniture Assembly Services

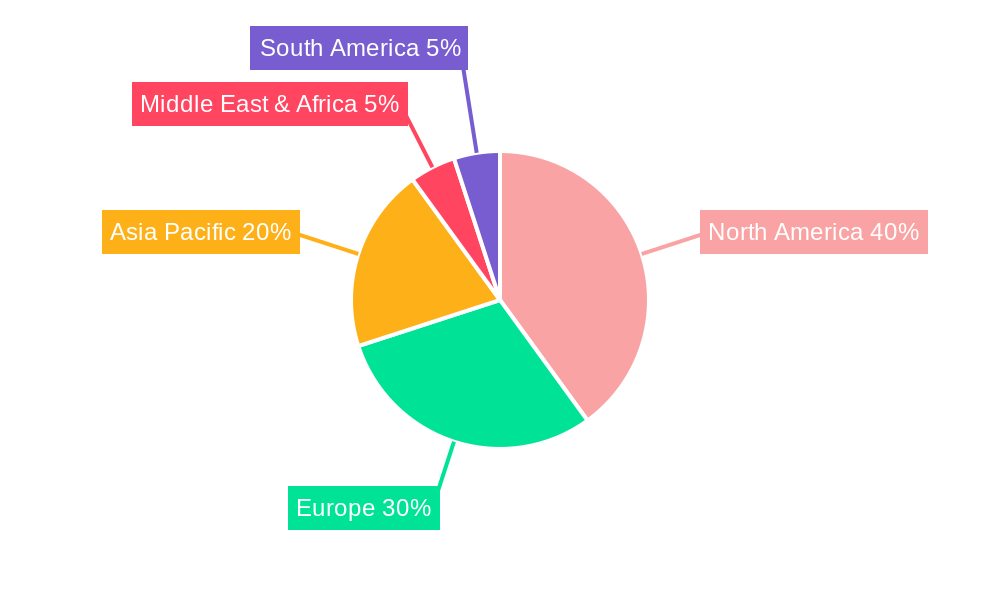

Furniture Assembly ServicesFurniture Assembly Services by Type (Small Furniture, Medium Furniture, Large Furniture), by Application (Commercial, Residential), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global furniture assembly services market, valued at $374.5 million in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for ready-to-assemble (RTA) furniture, particularly among younger demographics and busy professionals, fuels the need for convenient and professional assembly services. E-commerce's expansion and the surge in online furniture purchases further contribute to market growth, as consumers often lack the time or expertise for self-assembly. The rising disposable incomes in developing economies, coupled with the preference for modern and stylish furniture, also contribute to this growth. Market segmentation reveals significant demand across both residential and commercial applications, with the residential segment currently dominating due to the increasing popularity of online furniture shopping and the need for quick and professional assembly services in private homes. The large furniture segment is likely to see the fastest growth due to the higher complexity and difficulty in assembling such pieces. Competitive landscape analysis indicates a mix of established players (IKEA, Home Depot) and specialized on-demand service providers (Handy, TaskRabbit), highlighting the market's diverse service offerings and strong potential for growth.

The market is also witnessing several emerging trends. The increasing adoption of technology, such as mobile apps and online booking platforms, significantly enhances accessibility and service efficiency. Many companies are leveraging digital marketing strategies for better reach. Expansion of service offerings beyond basic assembly to include furniture installation, repair, and even interior design consultations presents a significant avenue for growth. However, potential restraints include fluctuations in raw material prices impacting furniture costs and therefore demand, and the increasing labor costs which can affect the pricing of assembly services. Geographic expansion to underserved markets, particularly in emerging economies, remains a key strategic initiative for many companies in the industry. The forecast period (2025-2033) anticipates a continued upward trajectory, reflecting the sustained demand for efficient and professional furniture assembly services. The 6% CAGR suggests a steady, reliable growth pattern, making this sector attractive for investors and businesses alike.

The furniture assembly services market is experiencing robust growth, projected to reach multi-million unit volumes by 2033. Driven by increasing urbanization, hectic lifestyles, and a surge in e-commerce furniture purchases, the demand for professional assembly services has skyrocketed. The historical period (2019-2024) showcased a significant upward trend, with the base year (2025) already reflecting substantial market size in the millions. This growth is particularly evident in residential settings, fueled by a preference for convenience and the avoidance of self-assembly frustrations. However, the commercial sector is also showing increasing adoption, particularly as businesses seek to streamline office setup and refurbishment processes. Key market insights reveal a strong correlation between e-commerce furniture sales and assembly service demand. The rise of flat-pack furniture, while offering affordability, simultaneously elevates the need for professional expertise. This trend is further intensified by a growing demographic of renters and homeowners who lack the time, tools, or skills for self-assembly. Market segmentation based on furniture size (small, medium, large) and application (residential, commercial) allows for tailored service offerings and targeted marketing strategies. The forecast period (2025-2033) promises continued expansion, potentially driven by technological advancements such as virtual assembly guides and improved service platforms. The study period (2019-2033) provides a comprehensive overview of the market’s evolution, highlighting its transition from a niche service to a mainstream consumer need. The estimated year (2025) serves as a benchmark for future projections, indicating a healthy trajectory for sustained growth in the coming years.

Several key factors contribute to the burgeoning furniture assembly services market. Firstly, the escalating popularity of online furniture shopping is a major catalyst. Consumers often lack the necessary skills or tools for assembling flat-pack furniture, leading to a significant demand for professional assistance. Secondly, the fast-paced nature of modern life leaves many individuals with limited time and energy for DIY projects. Outsourcing assembly becomes an attractive option, offering convenience and stress reduction. Thirdly, the increasing urbanization and smaller living spaces often present logistical challenges for assembling larger furniture pieces. Professionals possess the expertise and equipment to navigate these limitations efficiently. The rise of the gig economy has also played a pivotal role, providing a readily available pool of skilled workers who can cater to this growing demand. Furthermore, businesses, particularly in the commercial sector, are increasingly outsourcing furniture assembly to save time, ensure quality, and reduce the risk of damage during installation. Finally, the growing awareness of potential injuries associated with self-assembly also drives customers towards professional services, prioritizing safety and minimizing liability risks.

Despite the significant market growth potential, the furniture assembly services sector faces several challenges. Firstly, maintaining consistent service quality across a diverse workforce can be difficult. Ensuring that all assemblers possess the necessary skills and adhere to high standards of workmanship presents an ongoing operational challenge. Secondly, fluctuating demand, particularly seasonal peaks, necessitates effective workforce management and scheduling strategies to avoid overstaffing or service disruptions. Thirdly, pricing competitiveness remains crucial, with numerous players vying for market share. The need to balance competitive pricing with profitable operations requires careful cost management and efficiency improvements. Fourthly, effective marketing and customer acquisition are paramount, as consumers increasingly rely on online platforms and reviews to select service providers. Finally, the sector is susceptible to economic downturns and consumer spending patterns. Economic uncertainties can significantly impact demand, requiring adaptability and strategic planning to weather these fluctuations.

The residential segment within the furniture assembly services market is projected to dominate across multiple regions.

North America: The high disposable income levels and the strong adoption of online furniture shopping in countries like the US and Canada contribute significantly to this segment's growth. The increasing preference for convenience among homeowners fuels the demand for professional assembly services.

Europe: Similar to North America, the large population base, increasing urbanization, and the growth of e-commerce in countries like the UK, Germany, and France create a large market for residential furniture assembly.

Asia-Pacific: Rapid urbanization and growing middle classes in countries such as China, India, and Japan are driving significant demand. Although the market is still developing in some areas, the potential for growth is substantial.

Residential Segment Dominance:

The residential segment's dominance stems from several factors:

This strong demand in the residential sector, coupled with favorable market conditions in key regions, will drive significant growth within the furniture assembly services market throughout the forecast period. The significant market size in millions of units underscores the extensive reach and significant potential of this segment.

Several factors are accelerating growth in the furniture assembly services industry. The rise of e-commerce furniture sales continues to be a major driver, as consumers increasingly prefer online shopping for convenience and selection. Simultaneously, the growing popularity of flat-pack furniture directly increases the demand for assembly services. Furthermore, increasing urbanization and the resulting smaller living spaces present logistical challenges for self-assembly, further boosting demand for professional help. Finally, the expanding gig economy offers a flexible and accessible labor pool to meet the growing service needs, enabling scalable service delivery and faster response times.

This report provides a comprehensive overview of the furniture assembly services market, analyzing key trends, drivers, challenges, and growth opportunities. It delves into market segmentation, examining the significant contributions of the residential sector across major regions. The report also profiles leading players in the industry, highlighting their strategic initiatives and market positioning. By incorporating historical data, current market estimations, and future projections, this report offers valuable insights for businesses, investors, and industry stakeholders seeking to understand and capitalize on the significant growth potential within this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.0%.

Key companies in the market include Handy, Thumbtack, Kitset, TaskRabbit, LoadUp, Zoofy, CMS, IKEA, Hire A Hubby, Takl, Mr. Handyman, HomeAdvisor, The Home Depot, Six Moving, Apollo Assembly, Fratelli Barri, Triangle Assembly, .

The market segments include Type, Application.

The market size is estimated to be USD 374.5 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Furniture Assembly Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Furniture Assembly Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.