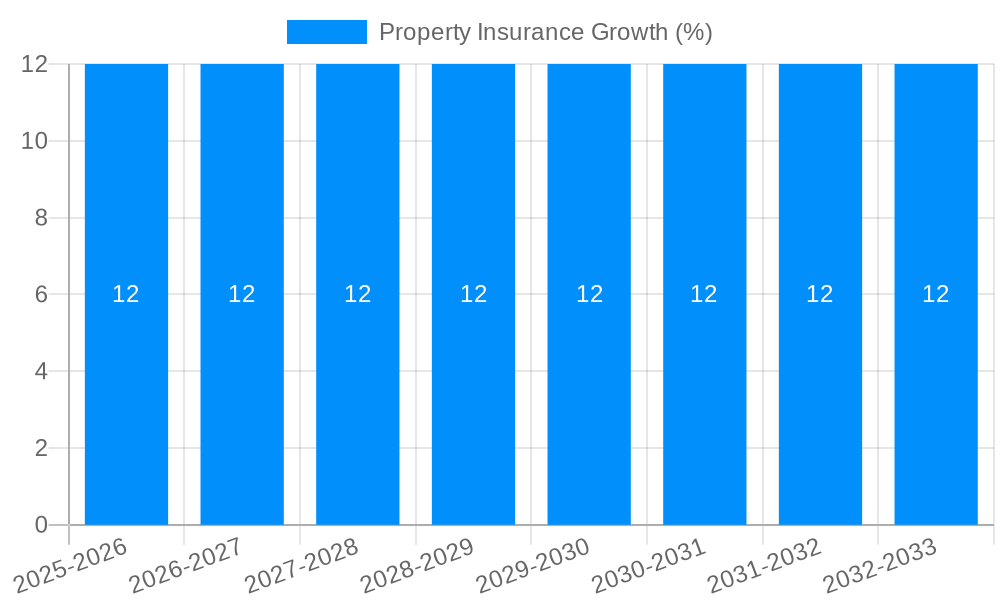

1. What is the projected Compound Annual Growth Rate (CAGR) of the Property Insurance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Property Insurance

Property InsuranceProperty Insurance by Type (/> Omeowners Insurance, Renters Insurance, Flood Insurance, Erthquake Insurance, Other), by Application (/> Personal, Enterprise), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

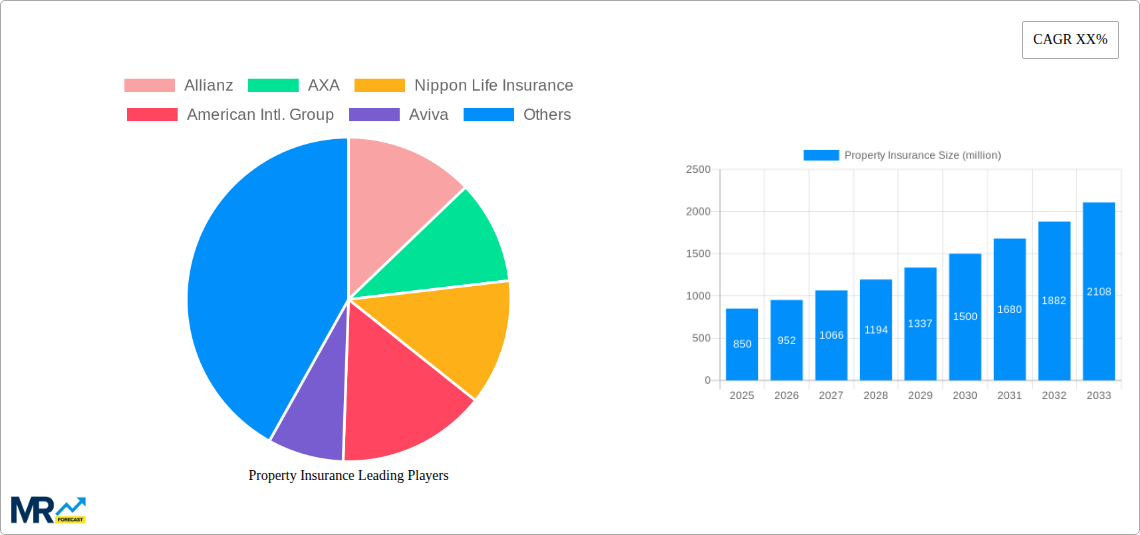

The global property insurance market is experiencing robust growth, driven by factors such as increasing urbanization, rising construction activities, and a growing awareness of property risks. The market's value, while not explicitly stated, can be reasonably estimated based on the provided timeframe (2019-2033), a common CAGR for this sector (let's assume 5% for illustrative purposes), and the presence of major global players like Allianz, Axa, and others. This suggests a substantial market size, potentially in the hundreds of billions of dollars, with a significant projected expansion over the forecast period (2025-2033). Key trends influencing this growth include the increasing adoption of Insurtech solutions improving efficiency and customer experience, the growing demand for parametric insurance for faster claim settlements, and the rising prevalence of natural disasters fueling demand for robust coverage. However, regulatory hurdles, economic downturns, and the potential for increased competition among existing players and new entrants pose challenges to sustained market growth. Segmentation within the market likely includes commercial and residential property insurance, with further sub-segmentation based on property type (e.g., residential buildings, commercial buildings, industrial properties) and coverage types (e.g., fire, flood, earthquake). The competitive landscape is dominated by large multinational insurers, but regional players also play a significant role.

The historical period (2019-2024) likely saw fluctuating growth, influenced by global economic conditions and major insurance events. The base year of 2025 provides a benchmark for projecting future growth based on the aforementioned drivers and restraints. The involvement of companies like Cardinal Health (known for healthcare distribution) suggests diversification within the property insurance sector, indicating the presence of niche players or specialized offerings. The forecast period (2025-2033) promises further market expansion, but companies must address emerging challenges and leverage technological advancements to maintain a competitive edge and capture growth opportunities. The continued rise of climate-related risks presents both a significant challenge and opportunity, requiring innovative risk assessment and mitigation strategies. Successfully navigating these factors will be crucial for companies to thrive in this dynamic market.

The global property insurance market exhibited robust growth during the historical period (2019-2024), exceeding $XXX million in 2024. This expansion is projected to continue throughout the forecast period (2025-2033), reaching an estimated value of $YYY million by 2033. The market's trajectory is influenced by several interconnected factors, including the increasing frequency and severity of natural catastrophes, the rising value of insurable assets globally, and evolving regulatory landscapes pushing for enhanced risk mitigation strategies. Growth in emerging economies, characterized by rapid urbanization and infrastructure development, is a significant driver. These developing nations represent lucrative yet challenging markets, presenting opportunities for insurers to expand their footprint while grappling with factors like incomplete risk assessment data and underdeveloped insurance penetration rates. The market is seeing a significant shift towards digitalization, with insurers increasingly adopting technologies like AI and machine learning for improved risk assessment, claims processing, and customer service. This digital transformation fosters efficiency and enhances the overall customer experience, contributing to market growth. The demand for specialized property insurance products, catering to specific risks like cyberattacks or climate-related events, is also on the rise. Insurers are responding by developing innovative products and services to meet the evolving needs of their client base, further shaping the market's dynamic growth. Competition remains fierce, with established players constantly innovating and newcomers challenging the status quo with disruptive business models. This competitive landscape fosters innovation and efficiency, benefiting policyholders in the long run. The market shows a clear tendency toward consolidation, with mergers and acquisitions playing a significant role in shaping the industry structure.

Several key factors are driving the growth of the property insurance market. The escalating frequency and intensity of natural disasters, from hurricanes and wildfires to floods and earthquakes, are compelling property owners to seek comprehensive coverage. Rising urbanization and population growth in vulnerable areas exacerbate this risk, fueling demand for insurance protection. The increasing value of assets, particularly in rapidly developing economies, increases the potential financial losses associated with property damage, encouraging higher insurance uptake. Stringent government regulations, aimed at promoting risk management and ensuring adequate insurance coverage, play a vital role in market expansion. These regulations can mandate insurance for specific types of properties or enforce stricter building codes, ultimately benefiting the insurance industry. The ongoing digital transformation within the insurance sector, characterized by the implementation of advanced technologies like AI and big data analytics, is streamlining operations, improving risk assessment, and enhancing customer service, thereby attracting more customers. Finally, the growing awareness among consumers about the importance of insurance protection against potential financial losses related to property damage is a major driver for the market's expansion.

Despite the positive growth outlook, the property insurance market faces several challenges. The increasing frequency and severity of catastrophic events, coupled with climate change, pose significant risks to insurers, leading to higher payouts and potentially impacting profitability. Accurate risk assessment in the face of these unpredictable events remains a major hurdle. Data insufficiency in emerging markets, particularly for risks related to less-developed infrastructure, complicates accurate risk evaluation and pricing, impacting insurers' ability to operate effectively. The rising costs of reinsurance, which help insurers manage their own risk exposures, can also strain profitability. Fraudulent claims pose a considerable challenge to insurers, requiring sophisticated detection mechanisms and increasing operational costs. Regulatory changes, while sometimes beneficial, can create uncertainty for insurers and require costly adaptations. Intense competition among insurance providers further complicates the industry landscape, putting pressure on pricing and profit margins. Finally, the evolving needs of customers, including the demand for customized and technologically advanced products and services, necessitates continuous innovation and investment from insurers.

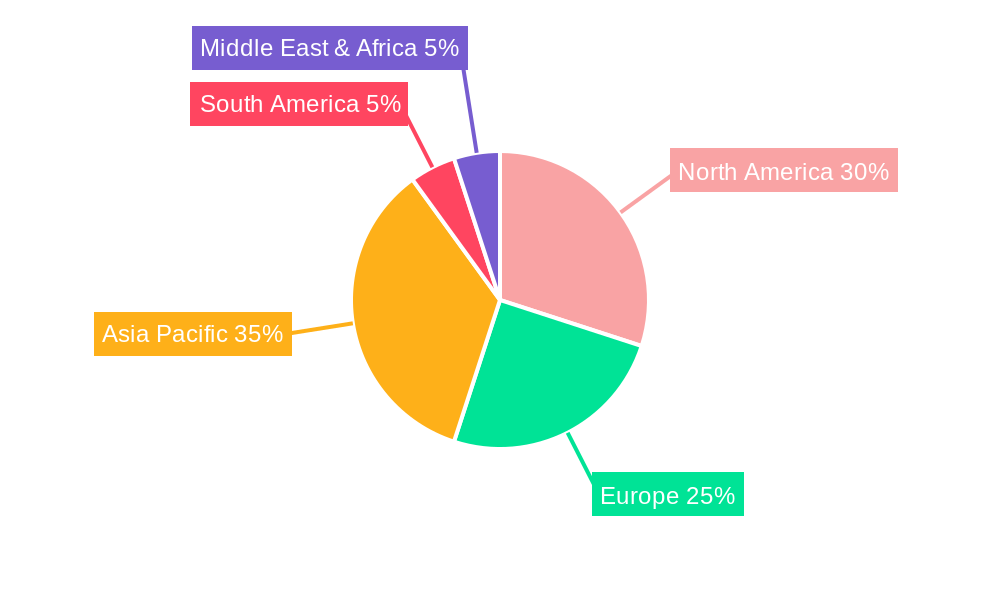

North America: The region's high concentration of insurable assets, robust economic growth, and high insurance penetration rates position it as a key market. Developed regulatory frameworks and high awareness of property insurance contribute to its dominance. The US, in particular, stands out due to its large and diverse property portfolio.

Asia-Pacific: Rapid urbanization, rising disposable incomes, and increasing awareness of insurance in countries like China and India fuel significant growth. While insurance penetration remains relatively low compared to developed regions, the potential for expansion is considerable. The region is experiencing increased investment in infrastructure projects, which leads to a rise in the demand for property insurance.

Europe: A mature market with a relatively high insurance penetration rate, Europe shows consistent growth, driven by factors like growing awareness of climate-related risks and stricter building codes. However, regulatory changes and economic fluctuations can impact market performance.

Commercial Property Insurance: This segment consistently demonstrates strong growth due to the high value of commercial assets and the increasing exposure to risks like cyberattacks and business interruption. Businesses are increasingly recognizing the importance of robust insurance protection to safeguard their operations and assets.

Residential Property Insurance: This remains a significant segment, driven by rising home values and increased awareness of potential risks. The growth is impacted by demographic trends, like aging populations and changing family structures.

In summary, while North America maintains a leading position due to its mature market characteristics, the Asia-Pacific region demonstrates immense potential for growth due to its developing economies and expanding middle class. The Commercial Property Insurance segment shows strong growth across all regions due to the increased risk exposure and the rising value of commercial assets. The interplay of regional economic conditions, technological advancements, and consumer awareness shapes the overall market dynamics.

The property insurance industry is experiencing a surge in growth driven by a confluence of factors. Rising awareness of property risks, spurred by increased natural disasters and economic volatility, is prompting individuals and businesses to secure adequate insurance coverage. Technological advancements, such as AI-driven risk assessment and streamlined claims processing, are improving efficiency and customer satisfaction. Stringent government regulations enforcing higher insurance penetration rates, particularly in developing economies, significantly boost market size. The emergence of specialized property insurance products tailored to evolving risks, like cyberattacks and climate change impacts, further fuels this positive trend.

This report provides a comprehensive analysis of the global property insurance market, covering key trends, drivers, challenges, and leading players. It examines market dynamics across various regions and segments, offering valuable insights into the current state of the industry and future prospects. Detailed data and projections for the study period (2019-2033), including the base year (2025) and estimated year (2025), are included to inform strategic decision-making. The report's focus on both quantitative and qualitative aspects of the market makes it a valuable resource for industry professionals, investors, and researchers. Replace XXX and YYY with actual market values in millions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Allianz, AXA, Nippon Life Insurance, American Intl. Group, Aviva, Assicurazioni Generali, Cardinal Health, State Farm Insurance, Dai-ichi Mutual Life Insurance, Munich Re Group, Zurich Financial Services, Prudential, Asahi Mutual Life Insurance, Sumitomo Life Insurance, MetLife, Allstate, Aegon, Prudential Financial, New York Life Insurance, Meiji Life Insurance, Aetna, CNP Assurances, PingAn, CPIC, TIAA-CREF, Mitsui Mutual Life Insurance, Royal & Sun Alliance, Swiss Reinsurance, Yasuda Mutual Life Insurance, Standard Life Assurance.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Property Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Property Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.