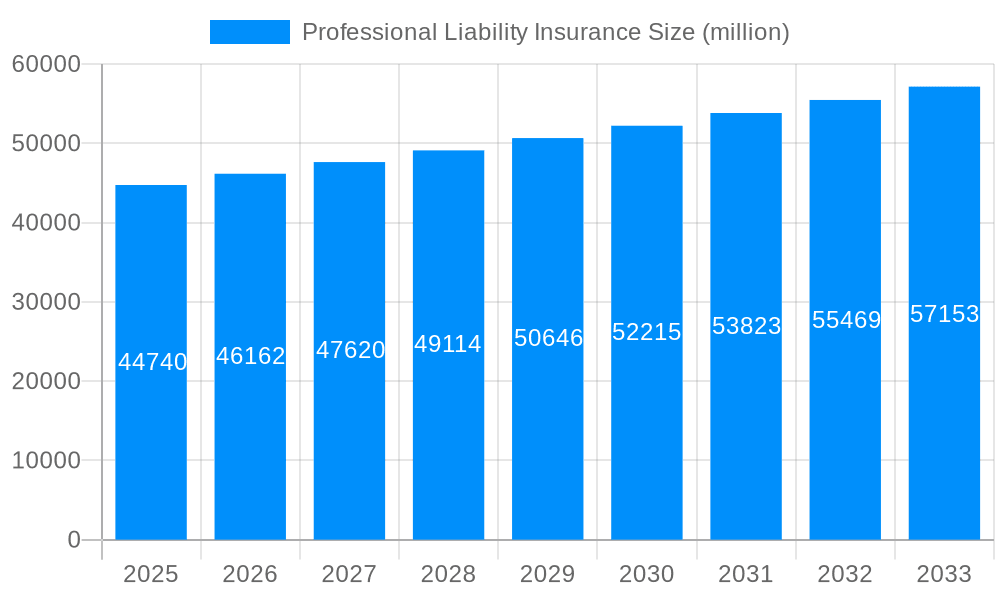

1. What is the projected Compound Annual Growth Rate (CAGR) of the Professional Liability Insurance?

The projected CAGR is approximately 3.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Professional Liability Insurance

Professional Liability InsuranceProfessional Liability Insurance by Type (Medical Liability, Lawyer Liability, CPA Liability, Construction & Engineering Liability, Other Liability), by Application (Up to $1 Million, $1 Million to $5 Million, $5 Million to $20 Million, Over $20 Million), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global professional liability insurance market, valued at $44,740 million in 2025, is projected to experience steady growth, driven by increasing regulatory scrutiny across various professions and a rising awareness of potential risks. The 3.3% CAGR indicates a consistent demand for comprehensive coverage as professionals in fields like medicine, law, and engineering face mounting liability concerns. The market segmentation reveals significant opportunities across various liability types, with medical liability likely holding the largest share due to the high-risk nature of medical practice and potential for costly malpractice lawsuits. Further growth drivers include the expanding complexities of professional practices, increasing interconnectedness of global businesses leading to transborder liability issues, and the growing adoption of technology, which introduces new risk profiles. The market is segmented by type of liability (medical, lawyer, CPA, construction & engineering, and other) and by policy coverage limits ($1M, $1M-$5M, $5M-$20M, and over $20M), allowing insurers to tailor products to specific needs. Larger coverage limits are likely to see faster growth due to escalating claim costs.

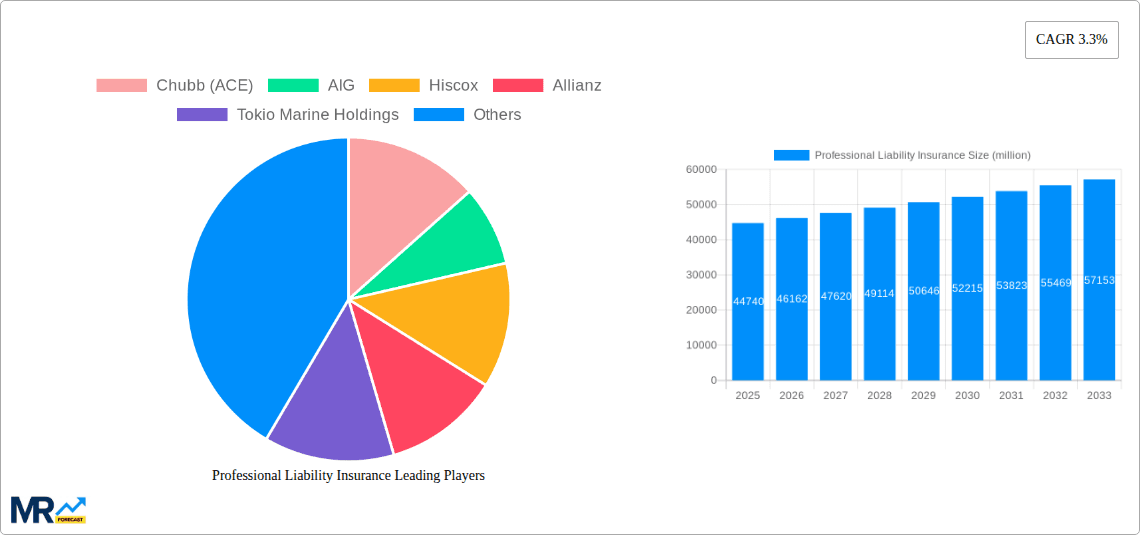

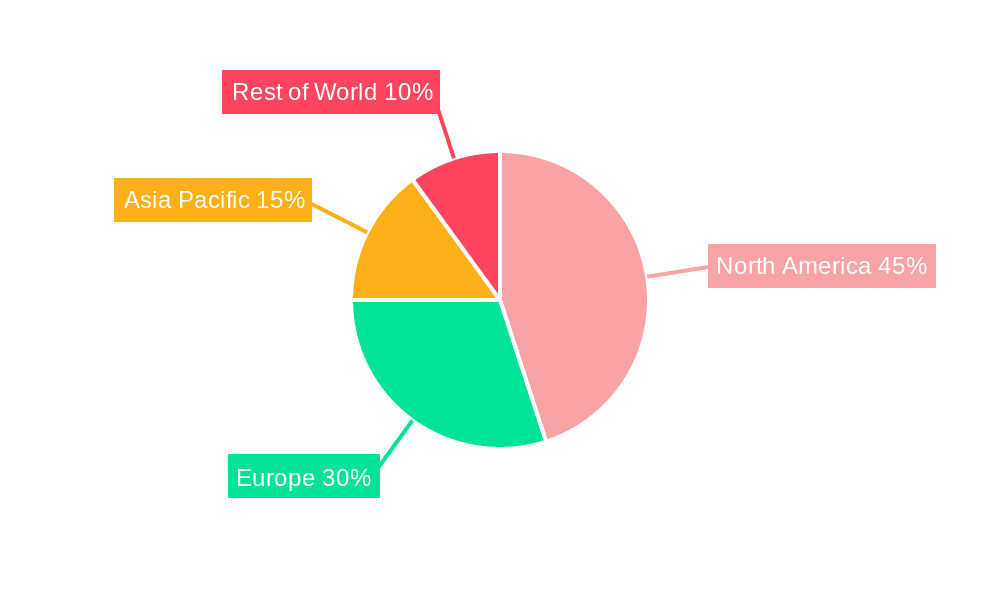

Growth within the market is influenced by several factors. Increasing numbers of lawsuits and rising settlement amounts directly impact the demand for professional liability insurance. Conversely, market restraints include economic downturns, which can lead to reduced spending on insurance and increased competition among insurers forcing pricing pressure. Geographic variations in regulatory frameworks and risk profiles contribute to regional disparities in market penetration. North America and Europe are likely to maintain a dominant market share due to their established economies and stringent professional regulations, but faster growth may be observed in regions with rapidly developing professional sectors, like Asia-Pacific. Key players such as Chubb, AIG, and Hiscox are shaping market dynamics through strategic partnerships, product innovation, and geographic expansion.

The professional liability insurance market, valued at billions in 2025, is poised for significant growth throughout the forecast period (2025-2033). Driven by increasing regulatory scrutiny, heightened litigation risks, and the expanding complexity of professional services across various sectors, demand for robust protection is surging. The historical period (2019-2024) witnessed a steady rise in premiums, reflecting a hardening market and insurers' efforts to manage escalating claims costs. This trend is expected to continue, though perhaps at a moderated pace, as insurers refine their underwriting practices and implement more sophisticated risk assessment models. The market is witnessing a shift towards specialized insurance products tailored to specific professional niches, reflecting the increasing diversity of professional risks. Furthermore, technological advancements are reshaping the industry, with the adoption of digital platforms for policy management and claims processing streamlining operations and enhancing customer experience. Key market insights reveal a growing preference for higher coverage limits, particularly within sectors like medical and legal practices, as professionals seek comprehensive protection against potentially devastating financial losses from malpractice lawsuits. The competitive landscape remains dynamic, with established players such as Chubb, AIG, and Allianz vying for market share alongside niche insurers specializing in specific professional fields. This competition is driving innovation and the development of more competitive pricing and policy options for businesses of all sizes, from those needing up to $1 million in coverage to those requiring policies exceeding $20 million. The market is also witnessing the rise of Insurtech companies that leverage technology to offer more efficient and transparent insurance solutions.

Several factors are fueling the growth of the professional liability insurance market. The increasing complexity of professional services across various sectors, from medicine and law to engineering and finance, leads to a higher likelihood of errors and omissions, resulting in increased litigation. Stringent regulatory environments and heightened public awareness of professional misconduct are placing greater pressure on professionals to secure adequate liability coverage. The rising cost of litigation, including legal fees and potential damages awarded in malpractice lawsuits, compels professionals to invest in comprehensive insurance policies to mitigate financial risks. The growing number of professionals across various sectors further expands the market's addressable audience. Technological advancements, while presenting new opportunities, also introduce novel risks, necessitating specialized insurance products to address cybersecurity breaches, data privacy violations, and other emerging threats. Furthermore, a hardening insurance market, characterized by increased premiums and stricter underwriting standards, while impacting affordability, underlines the growing recognition of professional liability risks by insurers. This hardening market is a direct response to increasing claim frequency and severity in recent years. The continuing economic growth in several key regions further stimulates demand for professional services, leading to a corresponding increase in the need for liability protection.

Despite the promising growth outlook, the professional liability insurance market faces certain challenges. The increasing frequency and severity of claims represent a significant challenge for insurers, driving up claims costs and potentially impacting profitability. Accurate risk assessment remains crucial, but it can be complex, especially with emerging risks related to technological advancements and evolving professional practices. Competition within the market is intense, with both established players and new entrants vying for market share, which can put pressure on pricing. Regulatory changes and evolving legal landscapes create uncertainty and require insurers to adapt quickly to maintain compliance and offer appropriate coverage. Economic downturns can impact the demand for professional services, potentially affecting the market's growth trajectory. Furthermore, the difficulty in obtaining accurate and timely information about potential risks from policyholders can lead to underestimation of exposures. This underestimation can result in inadequate premiums and increased losses for insurers. Finally, the need for specialized expertise in underwriting different professional fields presents an ongoing challenge for many insurance providers.

The North American market, particularly the United States, is projected to dominate the professional liability insurance market throughout the forecast period. This dominance stems from several factors: a robust economy, a high concentration of professionals across various sectors, and a highly litigious environment. Within the segments, Medical Liability consistently holds a significant share, driven by the inherent risks associated with medical practice and the potentially high costs of malpractice lawsuits. The “$5 Million to $20 Million” application segment is experiencing rapid growth as more businesses seek coverage for higher risk profiles. This reflects a proactive approach by businesses to safeguard their financial health in the face of potential liabilities exceeding lower policy limits. The growing complexity of medical procedures, coupled with increasing patient expectations, elevates the likelihood of errors and associated legal action, further bolstering demand within the medical liability segment. Similarly, the legal profession's inherent exposure to malpractice claims drives significant demand for lawyer liability insurance, contributing substantially to the overall market. The high stakes involved in legal proceedings and the potential for substantial damages in case of professional negligence contribute to the demand for extensive coverage. Therefore, the combination of the North American market with the Medical Liability type and the higher coverage limit applications ($5 Million to $20 Million and above) is expected to be the most dominant area within the professional liability insurance sector. Other regions, such as Europe and Asia-Pacific, are also experiencing growth, but at a potentially slower pace compared to North America.

The professional liability insurance industry's growth is fueled by several key catalysts. The increasing complexity of professional services across diverse sectors, coupled with growing regulatory scrutiny and heightened public awareness of professional misconduct, necessitates robust liability coverage. Technological advancements, while offering opportunities, also introduce new risks, demanding specialized insurance products. The rising cost of litigation and the potential for substantial financial losses from malpractice lawsuits drive the demand for comprehensive protection. A hardening market, while impacting affordability, highlights the increasing recognition of professional liability risks, leading to more comprehensive policies.

This report provides a comprehensive overview of the professional liability insurance market, offering insights into key trends, drivers, challenges, and future growth prospects. The analysis includes detailed market segmentation by type of liability, application, and geographic region. It also features profiles of leading market players and an examination of significant industry developments. This report is designed to assist businesses, professionals, and insurers in navigating the complexities of the professional liability insurance landscape and making informed decisions.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.3%.

Key companies in the market include Chubb (ACE), AIG, Hiscox, Allianz, Tokio Marine Holdings, XL Group, AXA, Travelers, Assicurazioni Generali, Doctors Company, Marsh & McLennan, Liberty Mutual, Medical Protective, Aviva, Zurich, Sompo Japan Nipponkoa, Munich Re, Aon, Beazley, Mapfre, .

The market segments include Type, Application.

The market size is estimated to be USD 44740 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Professional Liability Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Professional Liability Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.