1. What is the projected Compound Annual Growth Rate (CAGR) of the Lawyer Liability Insurance?

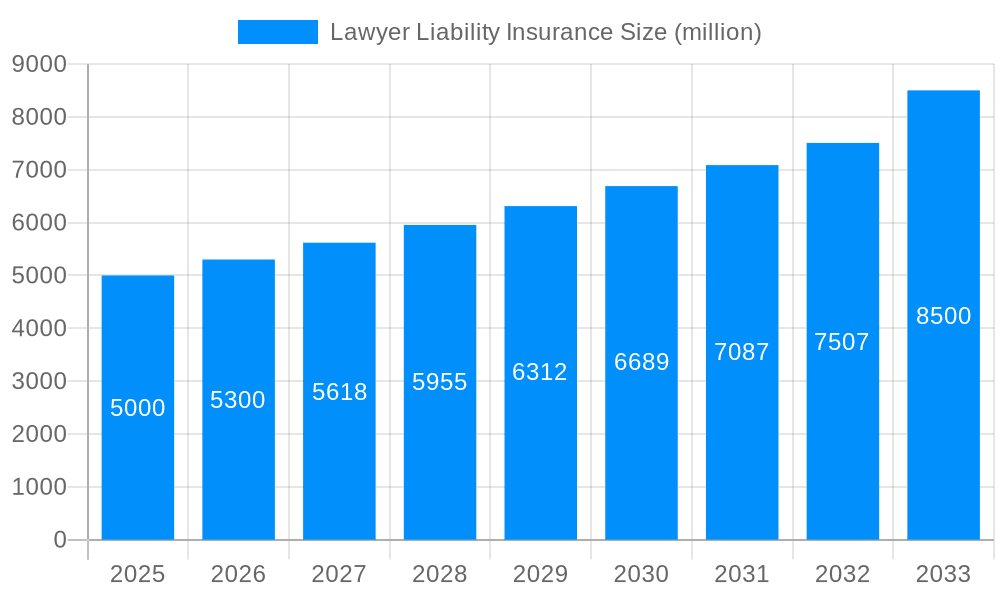

The projected CAGR is approximately 6.04%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Lawyer Liability Insurance

Lawyer Liability InsuranceLawyer Liability Insurance by Type (D&O Insurance, E&O Insurance), by Application (Coverage: Up to $1 Million, Coverage: $1 Million to $5 Million, Coverage: $5 Million to $20 Million, Coverage: Over $20 Million), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The Lawyer Liability Insurance market is poised for substantial expansion, driven by escalating litigation against legal professionals and the increasing adoption of comprehensive risk management strategies. Valued at $291.86 billion in 2024, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.04%, reaching an estimated $500 billion by 2033. This growth trajectory is underpinned by several key factors, including heightened regulatory scrutiny, the inherent complexity of legal practices leading to more frequent and severe claims, and growing awareness among law firms regarding the financial implications of malpractice. Insurers are responding with innovative product development, including specialized policies for niche legal areas and integrated risk mitigation services. Geographic expansion into emerging markets with developing legal sectors further fuels this upward trend. Challenges, however, include economic downturns impacting legal spending and intense insurer competition. The market is segmented by insurance type (Directors & Officers (D&O) and Errors & Omissions (E&O)) and coverage amount, catering to the diverse needs of legal professionals across varying practice sizes and risk profiles.

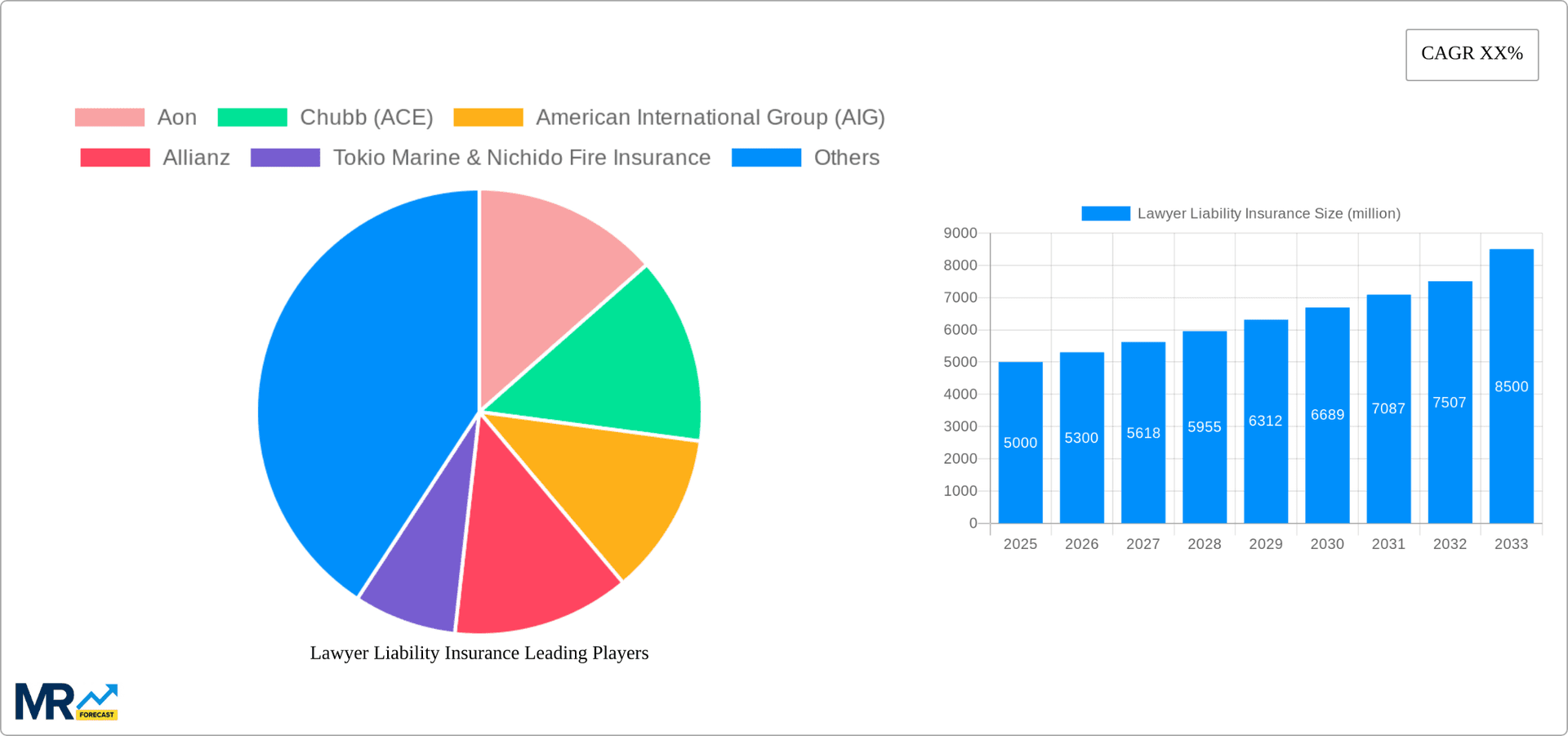

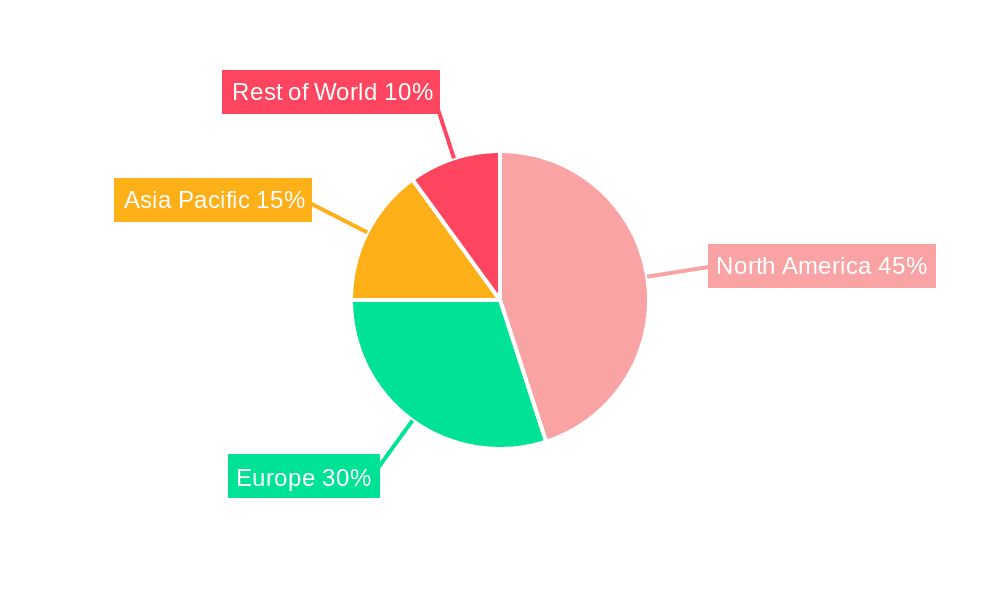

Key contributors to the Lawyer Liability Insurance market include established global insurers such as Aon, Chubb, AIG, and Allianz, recognized for their significant market share and extensive distribution capabilities. The competitive landscape is characterized by aggressive pricing, product innovation, and a strong emphasis on customer service and risk management expertise. While North America and Europe currently lead in market share due to mature legal sectors and high litigation rates, the Asia-Pacific region is anticipated to witness significant growth, driven by increasing legal activity and economic development. This presents substantial opportunities for insurers to broaden their reach and address the burgeoning demand in these areas. Technological advancements, particularly in predictive analytics and risk assessment, are also reshaping the industry, enhancing underwriting accuracy and customer engagement.

The global lawyer liability insurance market is experiencing dynamic shifts, driven by evolving legal landscapes and heightened risk awareness. The historical period (2019-2024) witnessed steady growth, primarily fueled by increasing litigation against lawyers and a growing demand for comprehensive risk mitigation strategies. The estimated market size in 2025 is projected to reach several billion dollars, reflecting a substantial expansion from previous years. The forecast period (2025-2033) anticipates continued growth, albeit at a potentially moderated pace, influenced by factors such as economic conditions and regulatory changes. This report analyzes the market based on various coverage levels, identifying significant trends in demand for higher coverage limits, especially in the $5 million to $20 million and over $20 million segments. The increasing complexity of legal practices and the rising costs associated with defending malpractice claims are major drivers behind this trend. Furthermore, the market demonstrates a strong preference for comprehensive policies that cover a broad spectrum of potential liabilities, including errors and omissions (E&O) and directors and officers (D&O) insurance. This reflects a proactive approach among law firms seeking to protect their financial stability and reputation. The competitive landscape is characterized by a mix of large multinational insurers and specialized niche players, each vying for market share through diverse product offerings and innovative risk management solutions. The rise of technology and its impact on legal practices is also creating new areas of liability, thus impacting the demand for specialized insurance products to address these emerging risks.

Several key factors are propelling the growth of the lawyer liability insurance market. The rising frequency and severity of malpractice claims are a primary driver. Complex legal cases and increased scrutiny from regulatory bodies contribute to this increased risk. Economic downturns can also exacerbate this, as clients are more likely to seek recourse in times of financial strain. The globalization of legal practices and increased cross-border transactions necessitate broader coverage, pushing demand for higher policy limits. Furthermore, heightened awareness among law firms regarding their exposure to liability is leading to greater adoption of insurance as a risk mitigation strategy. This proactive approach is particularly evident in larger firms and those specializing in high-stakes litigation. The evolving regulatory landscape, including stricter compliance requirements, also contributes to the market's expansion as firms seek insurance to cover potential penalties and legal costs associated with non-compliance. Finally, the increasing sophistication of insurance products tailored to specific legal specialties is catering to the unique risk profiles of different law firms, further boosting market growth.

Despite the positive growth trajectory, the lawyer liability insurance market faces several challenges. Fluctuations in the global economy can significantly impact the demand for insurance, particularly during economic downturns. Increased competition among insurers can lead to price wars, impacting profitability. The accurate assessment and pricing of risk remain a challenge, given the complexity of legal liability and the potential for unpredictable claims. Regulatory changes and evolving legal precedents can also pose challenges for insurers in adapting their products and pricing strategies. Furthermore, the difficulty in obtaining accurate data on claims frequency and severity can hinder precise risk modeling and pricing. Another significant challenge lies in managing the increasing cost of defending claims, particularly those involving complex litigation and extensive discovery processes. This can impact insurers' profitability and their ability to offer competitive premiums. Finally, the emergence of new and unforeseen legal risks associated with technological advancements, such as cybersecurity breaches and data privacy violations, adds another layer of complexity to risk assessment and insurance coverage.

The North American market, particularly the United States, is expected to dominate the lawyer liability insurance market throughout the forecast period (2025-2033) due to its large and sophisticated legal sector and the high frequency of legal disputes. Within this market, the segment offering coverage between $5 million and $20 million is poised for significant growth.

The European market is also projected to experience substantial growth, although at a slightly slower pace than North America. Asia-Pacific, while currently smaller, presents significant long-term potential given the rapid expansion of its legal sector. Other regions, such as Latin America and the Middle East, are anticipated to exhibit more moderate growth rates. The $1 million to $5 million coverage segment also shows steady growth, fueled by smaller to medium-sized law firms seeking adequate protection against potential liabilities. The "up to $1 million" coverage segment will continue to exist, but its growth rate will likely be slower than higher coverage segments as firms grow and their liability risk increases.

The lawyer liability insurance market is experiencing significant growth, driven by several key factors. Increased litigation against lawyers, coupled with a heightened awareness of professional liability risks, is prompting firms to seek greater insurance coverage. The rising complexity of legal cases and the substantial cost of defending malpractice claims further fuel the demand for comprehensive insurance solutions. Moreover, technological advancements and evolving regulatory environments are introducing new areas of liability, emphasizing the need for specialized insurance products.

This report offers a thorough analysis of the lawyer liability insurance market, covering its past performance, present state, and future projections. It details market trends, growth drivers, challenges, and key players, providing a comprehensive overview of this dynamic sector. The inclusion of detailed segmentation, geographic analysis, and competitive landscape assessments make this a valuable resource for insurers, law firms, and other stakeholders involved in the legal profession.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.04% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.04%.

Key companies in the market include Aon, Chubb (ACE), American International Group (AIG), Allianz, Tokio Marine & Nichido Fire Insurance, AXA Group, Travelers Companies, Assicurazioni Generali, Marsh & McLennan Companies (MMC), Liberty Mutual Insurance, Aviva, Zurich Insurance, Sompo Insurance, Munich Re, Hiscox, Beazley Insurance, Old Republic Insurance, Ping An Insurance, Taishan Property&Casualty Insurance, Dubon Property&Casualty Insurance, Cathay Insurance, Taiping Life Insurance, .

The market segments include Type, Application.

The market size is estimated to be USD 291.86 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Lawyer Liability Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Lawyer Liability Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.