1. What is the projected Compound Annual Growth Rate (CAGR) of the Product Crowdfunding Platforms?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Product Crowdfunding Platforms

Product Crowdfunding PlatformsProduct Crowdfunding Platforms by Type (Reward-based Crowdfunding, Equity-based Crowdfunding, Debt-based Crowdfunding, Donation-based Crowdfunding), by Application (Individual, Startup Company), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

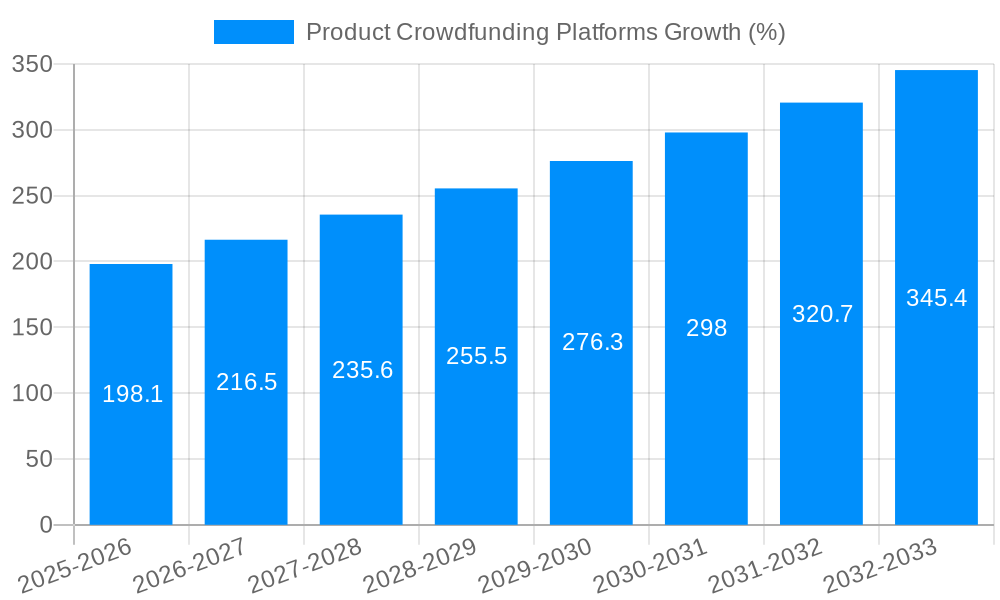

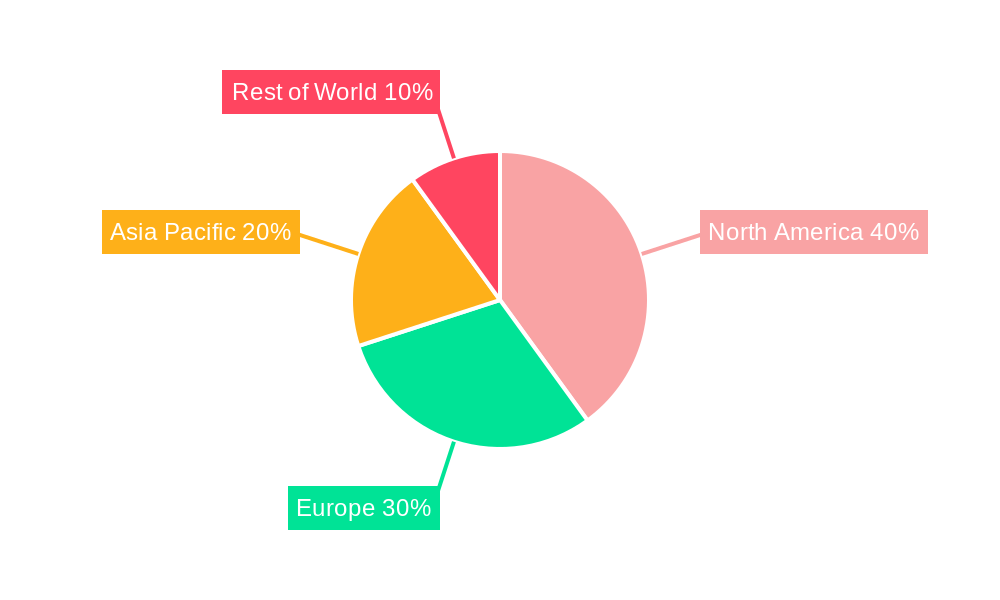

The global product crowdfunding platforms market, valued at $4294.8 million in 2025, exhibits significant growth potential. While the precise Compound Annual Growth Rate (CAGR) isn't provided, considering the expanding popularity of crowdfunding, particularly for product launches, a conservative estimate of 15-20% CAGR over the forecast period (2025-2033) is reasonable. This growth is driven by several factors: increasing entrepreneurial activity and a preference for alternative funding sources among startups; the rising accessibility of online platforms; and enhanced consumer engagement through social media and influencer marketing, facilitating wider campaign reach and increased funding success. The market is segmented by crowdfunding type (reward-based, equity-based, debt-based, donation-based) and application (individual creators, startup companies). Reward-based crowdfunding, leveraging the promise of early access to products or unique rewards, remains a dominant segment. The geographic landscape shows North America and Europe as leading regions, but significant growth opportunities exist in Asia-Pacific, driven by increasing internet penetration and a burgeoning startup ecosystem.

However, the market also faces challenges. Increased competition among crowdfunding platforms necessitates continuous innovation in features and services to attract both creators and investors. Regulatory uncertainties surrounding crowdfunding in different jurisdictions can hinder expansion. Furthermore, the success of crowdfunding campaigns hinges heavily on effective marketing and campaign management, requiring creators to invest significant time and resources. Overcoming these challenges requires platforms to focus on improving user experience, enhancing security measures, and providing creators with comprehensive support and guidance. This includes offering educational resources, marketing tools, and transparent reporting mechanisms. The future will see increased integration of technologies such as blockchain and artificial intelligence to enhance platform security, transparency, and efficiency, further shaping the market's trajectory.

The product crowdfunding platforms market, encompassing giants like Kickstarter and Indiegogo alongside niche players like Crowd Supply and WADIZ, experienced significant growth throughout the historical period (2019-2024). Driven by a confluence of factors including increased internet penetration, evolving consumer behavior favoring direct-to-consumer models, and the democratization of access to capital for startups and individuals, the market witnessed a substantial surge in funding campaigns and platform usage. This trend is projected to continue, with the estimated market value in 2025 reaching several billion dollars. The market's evolution isn't solely about quantity; it’s increasingly characterized by diversification. We're seeing a shift beyond the classic reward-based models toward a more nuanced landscape incorporating equity-based, debt-based, and donation-based crowdfunding. This evolution reflects both the expanding needs of project creators and the evolving investment appetites of funders. Further, the rise of sophisticated platform features – improved analytics, enhanced risk mitigation tools, and streamlined payment processing – contributes to a more efficient and transparent crowdfunding ecosystem. The forecast period (2025-2033) anticipates robust growth, potentially exceeding tens of billions of dollars by 2033, fueled by increasing adoption across diverse industries and geographies. However, potential regulatory hurdles and competition from alternative funding sources represent key uncertainties in the market's long-term trajectory. The market is witnessing a surge in innovation, with new platforms offering specialized services and catering to specific niches, further fueling this growth and competition. The overall trend showcases a dynamic, evolving market with significant potential for expansion across multiple segments.

Several key factors are driving the growth of product crowdfunding platforms. Firstly, the decreasing costs and increased accessibility of online tools and technology have empowered individuals and startups to launch and manage crowdfunding campaigns with relative ease. Secondly, the growing preference among consumers for unique and innovative products, often found through crowdfunding platforms, fuels demand and participation. Thirdly, the enhanced transparency and community engagement fostered by these platforms foster trust and build stronger connections between creators and backers. The shift towards a more direct-to-consumer model also contributes significantly; bypassing traditional retail channels, creators can achieve higher profit margins and directly interact with their target audience. Moreover, the diverse funding models available (reward-based, equity-based, debt-based, donation-based) cater to a broader range of project needs and investor preferences. Finally, successful crowdfunding campaigns often serve as a powerful validation of a product or service, improving credibility and attracting further investment. The cumulative effect of these forces has resulted in a substantial increase in the volume and value of crowdfunding campaigns globally, propelling the growth of the platform market itself.

Despite the substantial growth potential, the product crowdfunding platforms market faces several challenges. Regulatory uncertainty and evolving legal landscapes across different jurisdictions pose a significant hurdle for platform operators and project creators alike. Ensuring compliance with various securities laws and consumer protection regulations is a complex and ongoing concern. Furthermore, the inherent risk associated with crowdfunding – particularly equity-based campaigns – can deter both potential investors and project creators. The need to establish trust and mitigate risks is paramount for the sustainable growth of the market. Competition among platforms is intense, with established players vying for market share against numerous new entrants. This necessitates continuous innovation and the development of unique value propositions to maintain competitiveness. Finally, managing fraud and ensuring the authenticity of projects remains a crucial challenge, requiring robust verification and monitoring systems. Addressing these challenges effectively is crucial for the long-term viability and sustainable growth of the product crowdfunding platforms market.

The North American market, particularly the United States, has historically been the dominant region for product crowdfunding platforms. This is primarily attributable to a highly developed entrepreneurial ecosystem, a significant concentration of venture capital, and a large pool of tech-savvy consumers. However, significant growth is anticipated in Asia and Europe, driven by increasing internet penetration and the growing popularity of crowdfunding across various segments.

Dominant Segment: Reward-based crowdfunding continues to be the most prominent segment, due to its accessibility and relatively lower regulatory burden compared to equity-based or debt-based models. The simplicity and direct connection between creators and backers make this a popular choice for numerous projects. Millions of campaigns are launched annually using reward-based crowdfunding, making it the engine of the market's growth. However, the market for equity-based crowdfunding is expected to show significant increases in the years to come. This segment holds vast potential for growth, especially as regulatory frameworks adapt and sophisticated investors increasingly seek earlier-stage investment opportunities.

Startup Company Application: The segment dominating the application side is Startup Companies. Startups have readily adopted crowdfunding as a critical part of their fundraising and marketing strategies. This is because crowdfunding not only offers access to capital but also helps validate their business ideas and establish a loyal customer base even before the product launch. This creates a symbiotic relationship between startups and crowdfunding platforms. While individual campaigns are plentiful, startups have a demonstrably larger overall impact on platform volume and transaction value. The forecast projects this trend will continue as startups increasingly incorporate crowdfunding into their business models.

Several factors will accelerate the growth of product crowdfunding platforms in the coming years. The increasing sophistication of platform technology, offering improved analytics, enhanced security measures, and more user-friendly interfaces will attract more users. Simultaneously, the expanding regulatory clarity and standardization in several key markets will build greater confidence among both investors and project creators. Furthermore, growing awareness of crowdfunding as a viable funding option and increased integration with social media will further expand the market. The continuing maturation of equity-based crowdfunding and the emergence of hybrid models will also play a key role in boosting market growth.

This report offers a detailed analysis of the product crowdfunding platforms market, covering historical trends, current market dynamics, and future growth projections. It provides an in-depth examination of different crowdfunding models, key players, regional variations, and crucial challenges and opportunities within the sector. The report's data-driven insights and forecasts will be invaluable for businesses operating in the space, investors seeking promising opportunities, and policymakers formulating relevant regulatory frameworks. The analysis encompasses millions of funding transactions and provides a comprehensive perspective on the evolving landscape of product crowdfunding.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Indiegogo, SeedInvest, GoFundMe, Rainfactory, Crowd Supply, Kickstarter, StartEngine, Fundable, Crowdcube, Mightycause, LendingClub, StartSomeGood, Chuffed, Experiment, Makuake, WADIZ, Patreon, Crowdfunder, Zeczec, .

The market segments include Type, Application.

The market size is estimated to be USD 4294.8 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Product Crowdfunding Platforms," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Product Crowdfunding Platforms, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.