1. What is the projected Compound Annual Growth Rate (CAGR) of the Equity Crowdfunding Platforms?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Equity Crowdfunding Platforms

Equity Crowdfunding PlatformsEquity Crowdfunding Platforms by Type (Startups Businesses, Small Businesses, Medium Businesses), by Application (Cultural Industries, Technology, Product, Healthcare, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

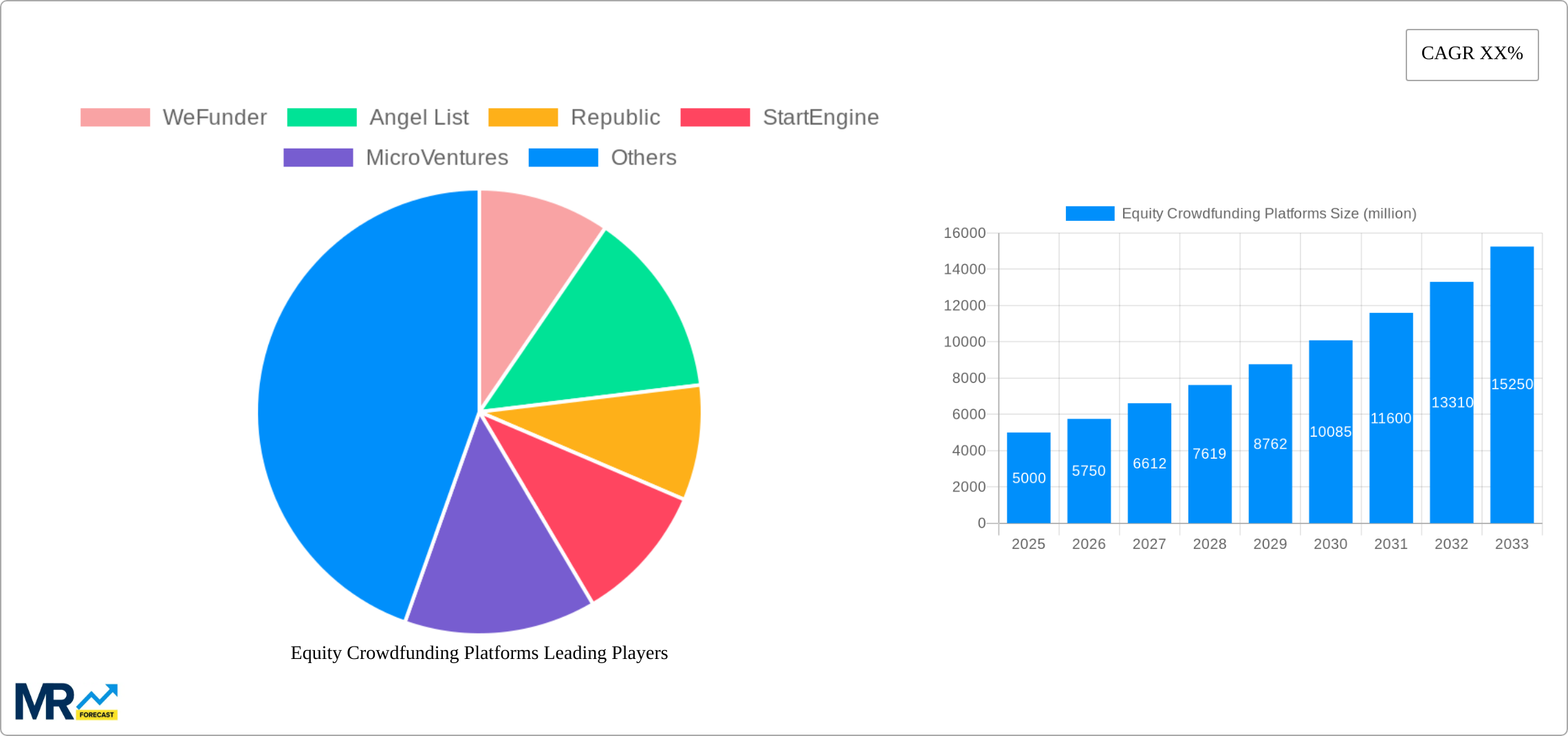

The equity crowdfunding market, encompassing platforms connecting startups and small-to-medium-sized businesses (SMBs) with investors, is experiencing robust growth. While precise market sizing data is unavailable, considering the considerable number of active platforms and the increasing investor interest in alternative investment vehicles, a conservative estimate for the 2025 market size would be $5 billion USD. This is driven by several factors: a growing preference among investors for diversification beyond traditional markets, the increasing accessibility of equity crowdfunding platforms, and the substantial funding needs of numerous startups and SMBs, especially in rapidly expanding sectors like technology and healthcare. Furthermore, regulatory changes in several key regions, including the US and parts of Europe, are fostering a more favorable environment for equity crowdfunding, leading to broader participation from both investors and businesses. The market is segmented based on the size and type of business raising funds (Startups, SMBs, Medium Businesses) and the industry they belong to (Technology, Healthcare, Cultural Industries, etc.). Platforms like WeFunder, Republic, and StartEngine are prominent players, but a fragmented competitive landscape suggests ample opportunities for both existing platforms and new entrants.

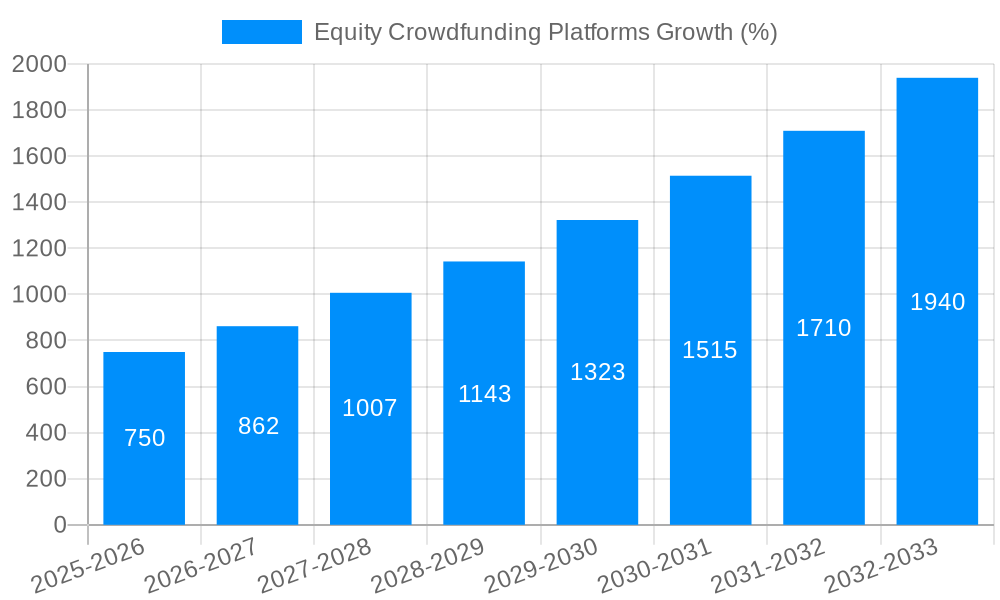

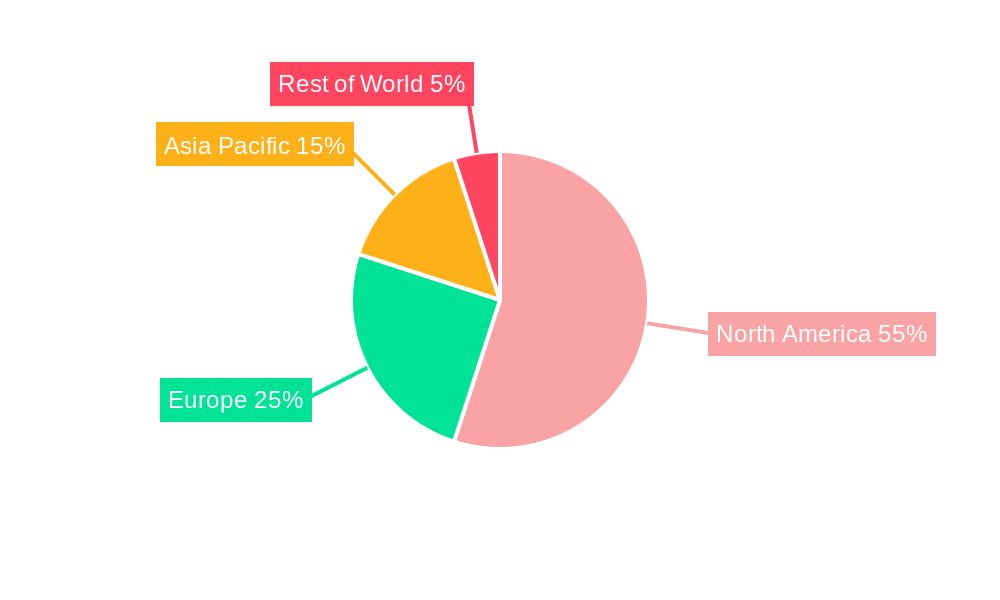

Significant regional variations exist within the equity crowdfunding market. North America currently dominates, driven by mature regulatory frameworks and a large base of both investors and entrepreneurs. However, Europe and Asia-Pacific are exhibiting strong growth potential, fueled by increasing technological adoption and a growing number of early-stage businesses seeking funding. While challenges remain, such as investor education and regulatory hurdles in certain emerging markets, the overall trajectory of the equity crowdfunding market remains positive. A Compound Annual Growth Rate (CAGR) of 15% from 2025-2033 is a reasonable projection, suggesting considerable market expansion over the forecast period. This growth will be heavily influenced by ongoing technological advancements that streamline the investment process, improved investor education initiatives, and the continued success of established platforms in attracting both issuers and investors.

The equity crowdfunding platforms market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. The historical period (2019-2024) saw significant adoption, driven by increased accessibility to funding for startups and small to medium-sized businesses (SMBs). The base year, 2025, marks a pivotal point, with the market consolidating and maturing. We are witnessing a shift towards more sophisticated platforms offering a wider range of services, beyond simple capital raising. This includes comprehensive investor relations tools, mentorship programs, and even post-funding support. The estimated market value in 2025 already reflects this evolution, showcasing a move beyond basic crowdfunding to a full-fledged ecosystem supporting entrepreneurs throughout their growth journey. The forecast period (2025-2033) anticipates continued expansion, fueled by technological advancements, regulatory changes favoring crowdfunding, and a growing pool of both investors seeking alternative asset classes and businesses actively pursuing non-traditional financing routes. This trend transcends geographical boundaries, with significant growth projected across diverse regions, reflecting a global shift towards democratized access to capital. The market is also witnessing increasing specialization. Platforms are focusing on niche sectors like technology, healthcare, or cultural industries, providing more targeted services and attracting a more specific investor base. This increased specialization, combined with the ongoing technological advancements, will further propel market growth in the coming years. The increasing sophistication of investors is another key factor. As the market matures, investors are becoming more discerning, demanding more robust due diligence and reporting tools. This drives platforms to enhance their offerings, leading to a more robust and transparent marketplace.

Several key factors are fueling the rapid expansion of equity crowdfunding platforms. Firstly, the increasing accessibility to capital for startups and SMEs is a major driver. Traditional financing methods often present significant hurdles, including stringent requirements and lengthy processes. Equity crowdfunding offers a more streamlined and accessible alternative, allowing businesses to tap into a wider pool of investors. Secondly, the growing interest among investors in alternative investment opportunities is another significant factor. Equity crowdfunding provides a means for investors to diversify their portfolios and gain exposure to high-growth potential companies. This is particularly appealing to individual investors who may not traditionally have access to venture capital or angel investor networks. Technological advancements are also instrumental, with improved platforms providing streamlined processes, enhanced security, and sophisticated analytics. This improved user experience attracts both businesses seeking funding and investors looking for user-friendly interfaces. Finally, evolving regulatory frameworks in many countries are creating a more supportive environment for equity crowdfunding, fostering greater trust and participation in the market. This regulatory clarity reduces uncertainty and encourages both businesses and investors to engage more actively within the ecosystem. These combined forces create a synergistic effect, driving the exponential growth observed in the equity crowdfunding sector.

Despite the significant growth potential, equity crowdfunding platforms face several challenges. Regulatory complexities vary across different jurisdictions, creating inconsistencies and potentially hindering cross-border investments. Maintaining investor confidence is paramount, requiring robust fraud prevention mechanisms and transparent due diligence processes. This necessitates significant investment in compliance and security measures. The liquidity of investments remains a concern, as the exit strategies for investors in equity crowdfunding are often limited. Educating both businesses and investors on the nuances of equity crowdfunding is also critical for broader market adoption. Many potential participants lack awareness or understanding of the platform's functions and associated risks. Competition among platforms is fierce, leading to a race to attract both businesses seeking funding and investors, increasing the need for platforms to continuously innovate and differentiate themselves. Finally, the inherent risks associated with early-stage investments must be clearly communicated to investors, managing expectations and safeguarding against potential losses. Addressing these challenges is vital for sustained growth and market maturity.

The North American market, particularly the United States, is expected to remain a dominant force in the equity crowdfunding landscape throughout the forecast period (2025-2033). This dominance is attributed to several factors: established regulatory frameworks, a high concentration of venture capital activity, a robust entrepreneurial ecosystem, and a large pool of both angel and individual investors. Within this region, Technology is projected to be a leading segment.

Beyond North America, European and Asian markets are showing promising growth, although at a slightly slower pace due to less established regulatory landscapes and varying levels of investor sophistication. However, these regions are experiencing significant changes, and their market share is expected to increase steadily in the coming years. The growth in the technology segment is expected to be mirrored to some extent by growth in other segments such as Healthcare and Cultural Industries, but not at the same pace and possibly driven by regional nuances.

Several factors are poised to accelerate the growth of equity crowdfunding platforms. Regulatory clarity and harmonization across different jurisdictions will reduce barriers to entry for both businesses and investors. Technological advancements, including AI-powered due diligence tools and improved user interfaces, will enhance efficiency and accessibility. The increasing awareness of equity crowdfunding among businesses seeking funding and among individual investors will drive further market expansion. Finally, successful exits and substantial returns for early investors will further reinforce the legitimacy and attractiveness of this funding model.

This report provides a comprehensive analysis of the equity crowdfunding platforms market, covering its current trends, driving forces, challenges, and future prospects. It offers in-depth insights into key market segments, geographic regions, and leading players, providing valuable information for businesses, investors, and industry stakeholders. The report highlights the substantial growth potential of the equity crowdfunding market and identifies key factors that will drive its expansion in the coming years. This analysis aims to provide a thorough understanding of the landscape and the opportunities it presents.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include WeFunder, Angel List, Republic, StartEngine, MicroVentures, Fundable, EquityNet, Localstake, SeedInvest, Crowdfunder, Netcapital, Mainvest, Equifund, Trucrowd, Honeycomb Credit, Buy the Block, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Equity Crowdfunding Platforms," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Equity Crowdfunding Platforms, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.