1. What is the projected Compound Annual Growth Rate (CAGR) of the Private Business Valuation Service?

The projected CAGR is approximately 7.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Private Business Valuation Service

Private Business Valuation ServicePrivate Business Valuation Service by Type (Income Approach, Market Approach, Asset-Based Approach), by Application (Mergers and Acquisitions, Fundraising, Financial Reporting, Tax Compliance, Intellectual Property Valuation, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

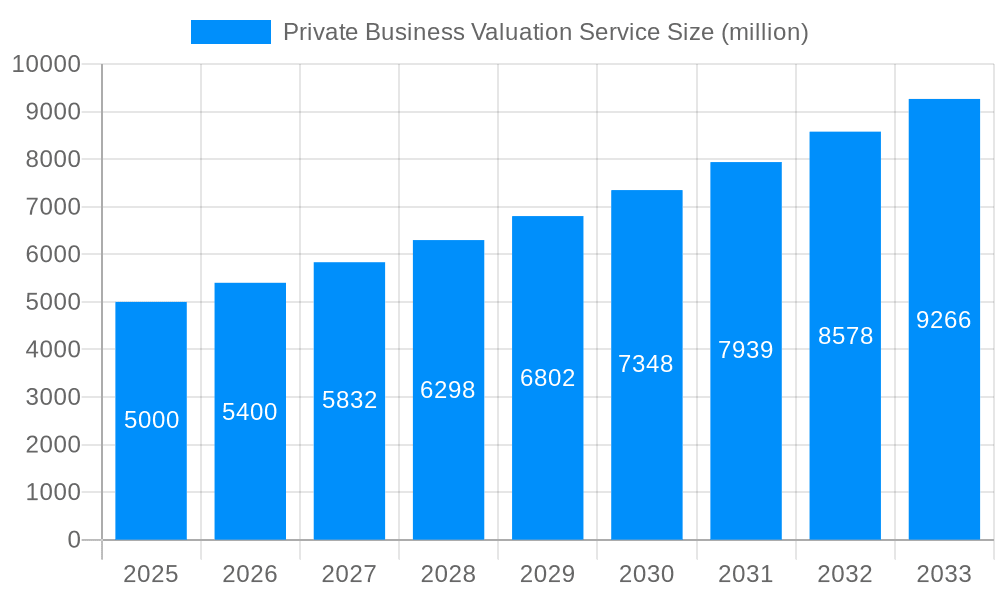

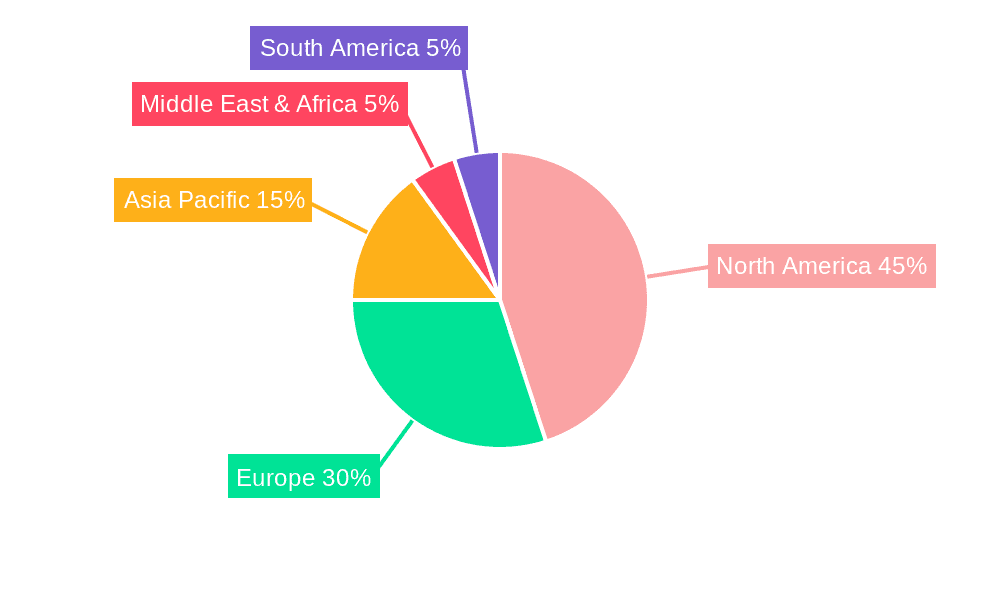

The Private Business Valuation Services market is projected for significant expansion, propelled by escalating mergers and acquisitions (M&A), increased fundraising activities by private enterprises, and stringent regulatory mandates for financial reporting and tax compliance. Key valuation methodologies employed include income, market, and asset-based approaches, tailored to meet the diverse requirements across various sectors. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 7.9% from a base year of 2025. This upward trend is further reinforced by the growing demand for intellectual property valuation and the expanding application of valuation services in specialized areas such as succession planning and estate tax assessments. The market's segmentation encompasses M&A transactions, securing funding rounds, ensuring accurate financial reporting, tax compliance, and intellectual property valuation. North America and Europe currently dominate market share due to mature economies and established regulatory frameworks. However, the Asia-Pacific region is emerging as a critical growth area, driven by rapid economic development and a burgeoning entrepreneurial ecosystem. The proliferation of specialized valuation software platforms further highlights the market's sophistication and the increasing need for efficient and accurate valuation processes.

The competitive arena features a blend of established industry leaders and innovative, technology-focused newcomers. Leading firms typically offer integrated services combining advanced software solutions with seasoned valuation expertise. Emerging companies are concentrating on developing cutting-edge software and data-driven tools to boost efficiency and precision. Future market expansion will be contingent upon technological advancements, particularly the integration of artificial intelligence (AI) and machine learning (ML) to refine valuation models and automate operational tasks. Opportunities for further growth exist in expanding into currently underserved markets, especially within developing economies. The continuous evolution of valuation standards and regulatory landscapes will also be instrumental in shaping market dynamics. An ongoing emphasis on transparency and accuracy in business valuation will continue to drive demand for sophisticated services and specialized professionals globally.

The private business valuation service market experienced robust growth between 2019 and 2024, driven by a surge in mergers and acquisitions (M&A) activity, increased fundraising efforts by private companies, and stricter regulatory compliance requirements. The market size exceeded $XXX million in 2024 and is projected to reach $YYY million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of ZZZ% during the forecast period (2025-2033). This growth is fueled by several factors, including the increasing complexity of business structures, the need for accurate valuations for tax purposes, and the rising demand for sophisticated valuation methodologies among both buyers and sellers of private businesses. The market's trajectory is also shaped by technological advancements, with software solutions and online platforms offering more efficient and accessible valuation services. Furthermore, the growing prevalence of private equity investments and venture capital funding has further stimulated demand for precise valuations. The historical period (2019-2024) witnessed significant consolidation within the industry, with larger players acquiring smaller firms to expand their service offerings and geographic reach. The base year for this analysis is 2025, providing a snapshot of the market's current state and setting the stage for future projections. The estimated year for this report is also 2025, aligning with the base year to provide a robust foundation for forecasting future market trends. The study period, encompassing 2019-2033, allows for a comprehensive understanding of market evolution and provides valuable insights for stakeholders. Specifically, the forecast period (2025-2033) reveals promising growth opportunities, with particular emphasis on regions experiencing rapid economic development and increased entrepreneurial activity.

Several factors are driving the expansion of the private business valuation service market. The increasing frequency of mergers and acquisitions necessitates accurate and reliable valuations to ensure fair deal structuring. The growing complexity of business transactions, involving intangible assets and sophisticated financial instruments, demands specialized valuation expertise. Furthermore, stringent regulatory compliance requirements, particularly concerning tax reporting and financial reporting standards, necessitate professional valuation services. The rising number of private equity and venture capital investments further fuels the demand for accurate valuations, as these investors require precise assessments of portfolio companies' worth. Technological advancements, such as the development of sophisticated valuation software and online platforms, are making valuation services more accessible and efficient. This trend contributes to market growth by reducing costs and streamlining the valuation process. Finally, a growing awareness among business owners about the importance of accurate valuation for strategic decision-making, succession planning, and estate planning also serves as a key driver for market growth.

Despite the strong growth trajectory, the private business valuation service market faces certain challenges. The inherent subjectivity involved in valuation methodologies can lead to discrepancies between different valuations, potentially causing disputes and litigation. The scarcity of qualified and experienced valuators, especially in specialized sectors, can constrain market growth. Furthermore, the constantly evolving regulatory landscape and accounting standards pose significant challenges for valuation professionals, requiring continuous learning and adaptation. The economic fluctuations and uncertainties in various markets can also affect the demand for valuation services, especially during periods of economic downturn. Finally, the competitive landscape, with numerous players offering similar services, necessitates continuous innovation and differentiation to maintain a competitive edge.

The Mergers and Acquisitions (M&A) application segment is expected to dominate the private business valuation service market during the forecast period. This is driven by the increasing number of M&A transactions globally, particularly in developed economies.

North America and Europe are anticipated to be the leading regions, due to their mature economies, robust M&A activity, and strong regulatory frameworks. These regions also have a high concentration of qualified valuation professionals and sophisticated valuation methodologies.

Asia-Pacific is expected to show significant growth, fueled by rapid economic expansion, increasing foreign direct investment, and a rising number of private companies seeking funding or engaging in M&A activities.

The Income Approach, widely used in M&A, is also a dominant segment, due to its reliance on future cash flows, a key factor in determining a company's value. This approach is particularly relevant for established businesses with a proven track record of profitability. However, the Asset-Based Approach is gaining traction, especially for businesses with significant tangible assets. The increasing complexity of businesses with significant intellectual property further drives demand for valuation expertise, contributing to this segment's future growth.

The rising number of private equity and venture capital investments, coupled with increased regulatory scrutiny and the growing complexity of business transactions, are primary growth catalysts. The adoption of advanced technologies such as AI and machine learning in valuation models also contributes to enhanced accuracy and efficiency, further boosting market expansion.

(Note: Website links were not provided in the original prompt. I cannot include them here. Conducting a web search for each company would enable you to add those links.)

This report offers a comprehensive analysis of the private business valuation service market, encompassing historical data, current market dynamics, and future projections. It examines various market segments, key drivers, challenges, and leading players, providing valuable insights for businesses, investors, and stakeholders interested in this rapidly growing industry. The report's detailed analysis, along with its forecasts for the coming years, enables informed decision-making and strategic planning in this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.9%.

Key companies in the market include Platform, Equidam, Retiba, Equitest, NIMBO, BizEquity, Alpha Spread, Valutico, Eleusis, Samkhya, GCF Banker Valuation, ValuAdder, MoneySoft, PlanGuru, Riskturn, DealMatrix, SMERGERS, Pulley, ValuSource, .

The market segments include Type, Application.

The market size is estimated to be USD 8.05 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Private Business Valuation Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Private Business Valuation Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.