1. What is the projected Compound Annual Growth Rate (CAGR) of the Printed Media?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Printed Media

Printed MediaPrinted Media by Type (Newspaper, Megazine, Others), by Application (Individual, Enterprise), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

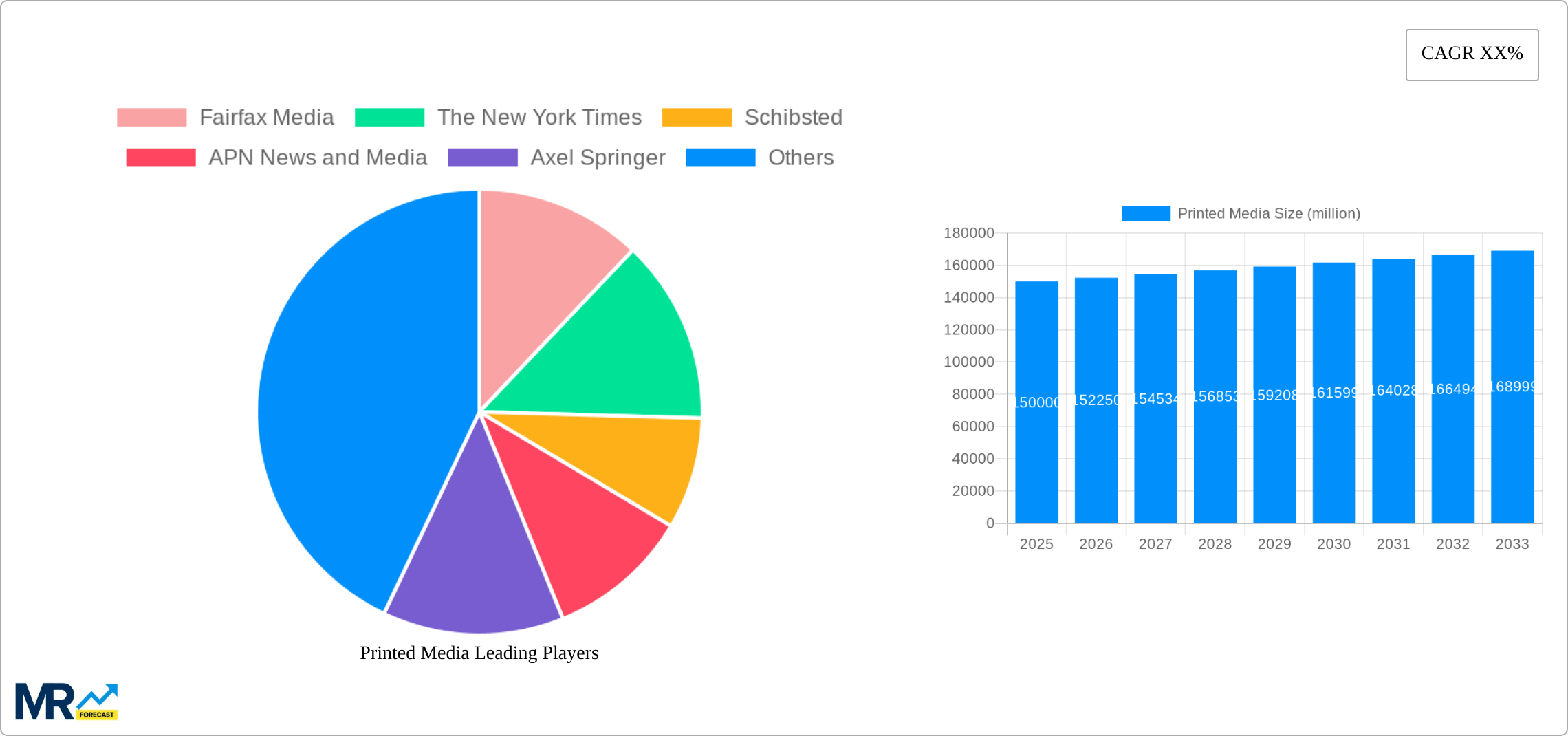

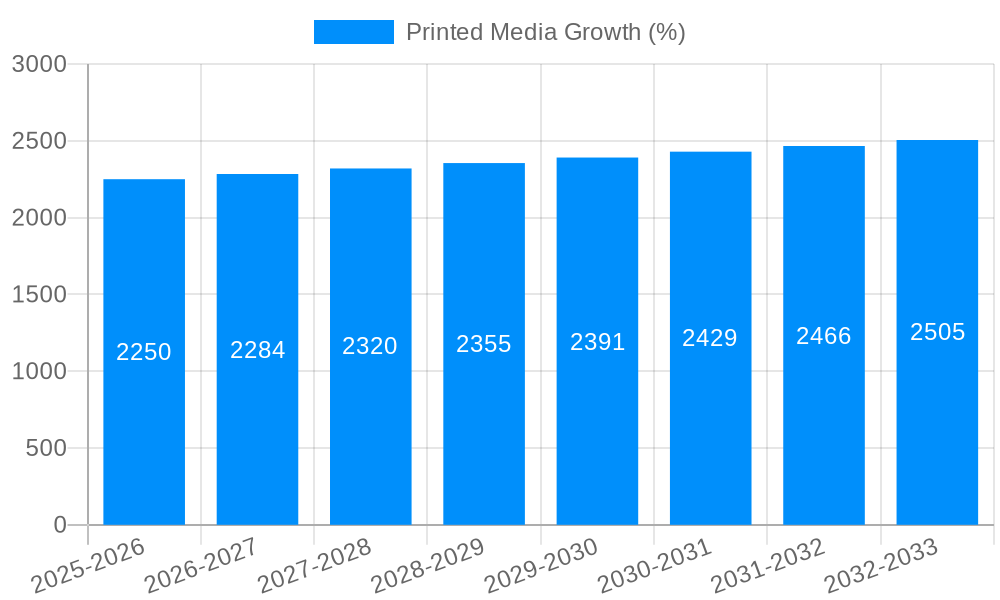

The printed media market, encompassing newspapers, magazines, and other print publications, is undergoing a significant transformation. While facing persistent challenges from the rise of digital media, the industry demonstrates resilience, particularly in niche segments and specific geographic regions. The market size in 2025 is estimated at $150 billion, reflecting a gradual decline from its peak but exhibiting a more stable trajectory than previously anticipated. A compound annual growth rate (CAGR) of 1.5% is projected from 2025 to 2033, indicating a slow but steady growth driven by targeted advertising campaigns, specialized publications catering to specific interests (like luxury goods or regional news), and a resurgence of print as a tangible and trustworthy medium in an era of misinformation. Key drivers include the enduring value placed on physical copies for certain demographics, the need for specialized print materials in industries like legal and financial services, and the continued success of targeted print advertising campaigns. Trends point towards a shift towards higher-quality printing, customized content, and increased integration with digital platforms, creating a hybrid print-digital model. Constraints include rising production costs, declining readership among younger generations, and the ongoing competition from digital alternatives. Segmentation reveals that the newspaper segment remains the largest, followed by magazines, with the 'others' category showing promising growth, fueled by specialized publications. The enterprise application segment contributes substantially to overall revenue, owing to businesses' continued reliance on print materials for legal documents, marketing collateral, and internal communications.

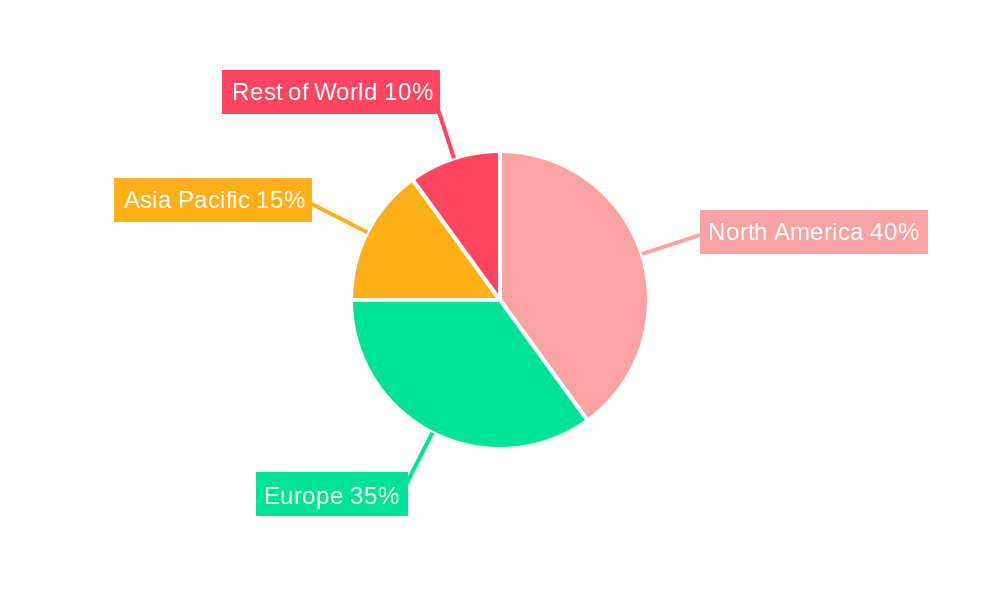

The geographic distribution of the printed media market is uneven. North America and Europe continue to hold the largest market shares, though experiencing gradual declines. However, growth opportunities are emerging in regions like Asia-Pacific, particularly in developing economies with increasing literacy rates and a growing middle class. Companies such as Fairfax Media, The New York Times, and Schibsted are strategically navigating the evolving landscape by diversifying their offerings, investing in digital platforms, and focusing on premium print content. This approach allows them to leverage the strengths of the print format while capitalizing on the opportunities presented by digital technologies. Successful players are integrating print with digital strategies, fostering engagement across platforms, and focusing on highly-segmented audience segments to maintain profitability. The long-term outlook for printed media suggests a niche but sustainable market, characterized by adaptation, innovation, and a shift towards specialized content and a premium offering.

The printed media landscape has undergone a dramatic shift since 2019. While the digital revolution has undeniably impacted circulation and advertising revenue, printed media remains a significant force, albeit a smaller one than in the past. The study period (2019-2033) reveals a complex picture. The historical period (2019-2024) witnessed a sharp decline in print readership and advertising across numerous publications, particularly newspapers. However, the estimated year (2025) shows a degree of stabilization, with certain niche publications and formats demonstrating surprising resilience. The forecast period (2025-2033) suggests a slow, but likely steady, decline in overall volume, estimated at a reduction of X million units, with the rate of decline slowing compared to the preceding years. This is driven by several factors: a core readership that remains loyal to the tactile experience of print, a resurgence of interest in high-quality print magazines targeting specific demographics, and innovative business models that blend print with digital strategies. The overall market size, while contracting, is still substantial, estimated to be Y million units in 2025. Key market insights point towards the increasing importance of specialized publications (e.g., high-end magazines, local newspapers, and trade publications) catering to niche audiences. These publications are often less susceptible to the competition from digital media, benefiting from stronger reader loyalty and higher advertising rates compared to mass-market publications. The rise of 'print-on-demand' technologies has also enabled smaller publishers to enter the market with tailored products, further diversifying the printed media landscape and partially offsetting the decline of larger traditional players.

Several factors are contributing to the continued, albeit reduced, relevance of printed media. Firstly, nostalgia and the tangible experience play a significant role. Many readers value the physicality of holding a newspaper or magazine, finding it more engaging and less distracting than digital alternatives. Secondly, certain demographics remain less digitally inclined, ensuring a consistent readership base for print. Thirdly, the rise of "slow media" and a backlash against the constant bombardment of digital information creates a space for print's considered and curated content. Print, especially in specialized segments, allows for higher-quality design and production values, attracting readers willing to pay a premium for a superior aesthetic experience. High-quality paper stock, exquisite photography, and unique formats differentiate these offerings from digital media. Moreover, the tactile experience of print is increasingly viewed as a luxury and a break from the always-on digital world. This is reflected in the increasing success of high-end, lifestyle magazines. Finally, strategic partnerships and mergers among publishers have allowed for greater diversification and a more resilient approach to navigating the changing media environment, leading to increased efficiency and a stronger market presence for some segments.

The printed media industry faces significant headwinds. The most prominent is the ongoing migration of readers and advertisers to digital platforms. This shift has resulted in a dramatic decline in advertising revenue, a critical income stream for most print publications. Rising production costs, including paper, ink, and printing, further exacerbate financial pressures. Distribution costs, particularly for newspapers, remain high and are difficult to reduce significantly. Competition from free or low-cost digital news sources also impacts the ability of print media to command higher prices. Furthermore, the evolving consumer behavior, a younger generation growing up in a digitally native environment, and demographic shifts create a long-term challenge to maintaining substantial readership. Finally, the challenge of attracting and retaining talented journalists and editorial staff, particularly in the face of reduced budgets, is a significant ongoing concern. This contributes to quality inconsistencies and potential loss of valuable journalistic expertise.

While the overall printed media market is declining, certain segments and regions show greater resilience. Focusing on the Newspaper segment and its Individual application reveals key market dynamics:

Paragraph: The Newspaper segment, specifically its individual application, continues to demonstrate a larger market share compared to other types of printed media, such as magazines or "others" (e.g., brochures). This is primarily due to the enduring habit of daily newspaper consumption among older demographics and the continued relevance of local news sources for a wide range of individuals. The dominance of this segment varies regionally, with some countries experiencing steeper declines than others. The focus on hyperlocal news and enhanced print designs (e.g., high-quality printing, improved design layouts) is a significant growth strategy for survival in these regions.

The shift from broadsheet to tabloid formats in some markets further demonstrates the adaptation occurring within this segment. Targeted advertising and new business models incorporating digital components are crucial to the continued presence of print newspapers.

Growth in the printed media industry will be driven by several factors: niche specialization (catering to underserved audiences), innovative business models blending print and digital strategies, strategic partnerships & mergers, improved print quality and design, and successful targeting of loyal reader bases through high-quality content and a unique print experience.

This report provides a detailed analysis of the printed media market, including historical data, current market dynamics, and future forecasts. The report identifies key trends, driving forces, challenges, and opportunities within the industry, offering insights into regional variations and segment-specific performance. A comprehensive analysis of leading players and significant developments provides a holistic understanding of the evolving printed media landscape. The forecast, based on robust methodology and market research, offers valuable guidance for industry stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Fairfax Media, The New York Times, Schibsted, APN News and Media, Axel Springer, Tamedia, Lee Enterprises, Mecom Group, Postmedia Network Canada, RCS Media Group, Sanoma, Singapore Press Holdings, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Printed Media," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Printed Media, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.