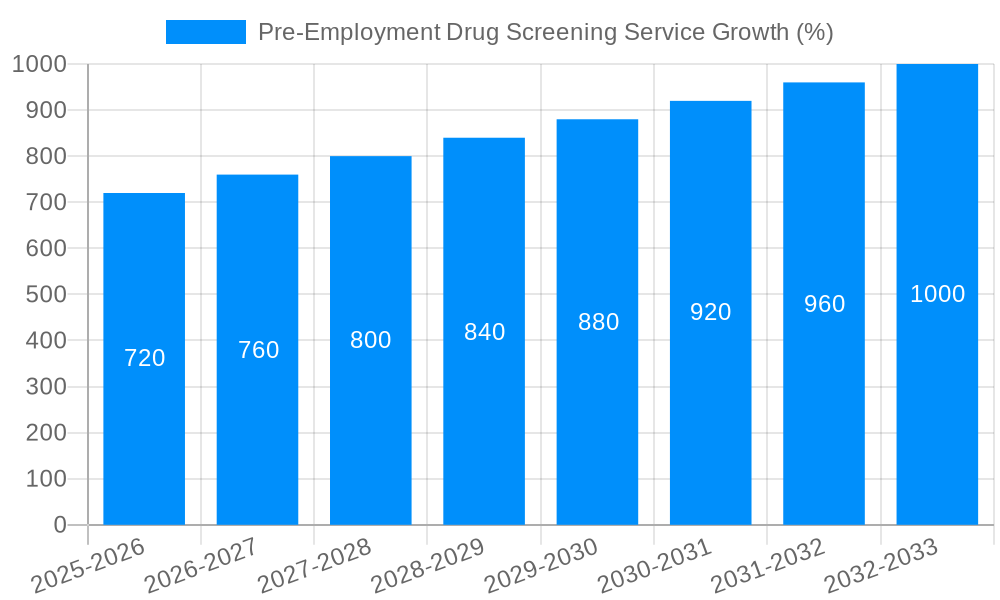

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pre-Employment Drug Screening Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pre-Employment Drug Screening Service

Pre-Employment Drug Screening ServicePre-Employment Drug Screening Service by Type (Urine Drug Test, Hair Drug Test, Saliva Test, Others), by Application (SMEs, Large Enterprise), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The pre-employment drug screening service market is experiencing robust growth, driven by increasing concerns about workplace safety and productivity. Companies are increasingly utilizing drug testing to mitigate risks associated with impaired employees, fostering a safer work environment and improving overall efficiency. The market is segmented by testing type (urine, hair, saliva, others) and application (SMEs, large enterprises). Urine drug testing currently dominates the market due to its established reliability and cost-effectiveness, although saliva and hair testing are gaining traction for their convenience and extended detection windows. Large enterprises are the primary adopters of these services due to their larger workforce and stricter regulatory compliance needs. However, the growing awareness of the importance of a drug-free workplace is driving adoption among SMEs as well. The market's expansion is also fueled by technological advancements in drug testing methodologies, leading to faster, more accurate, and convenient testing options.

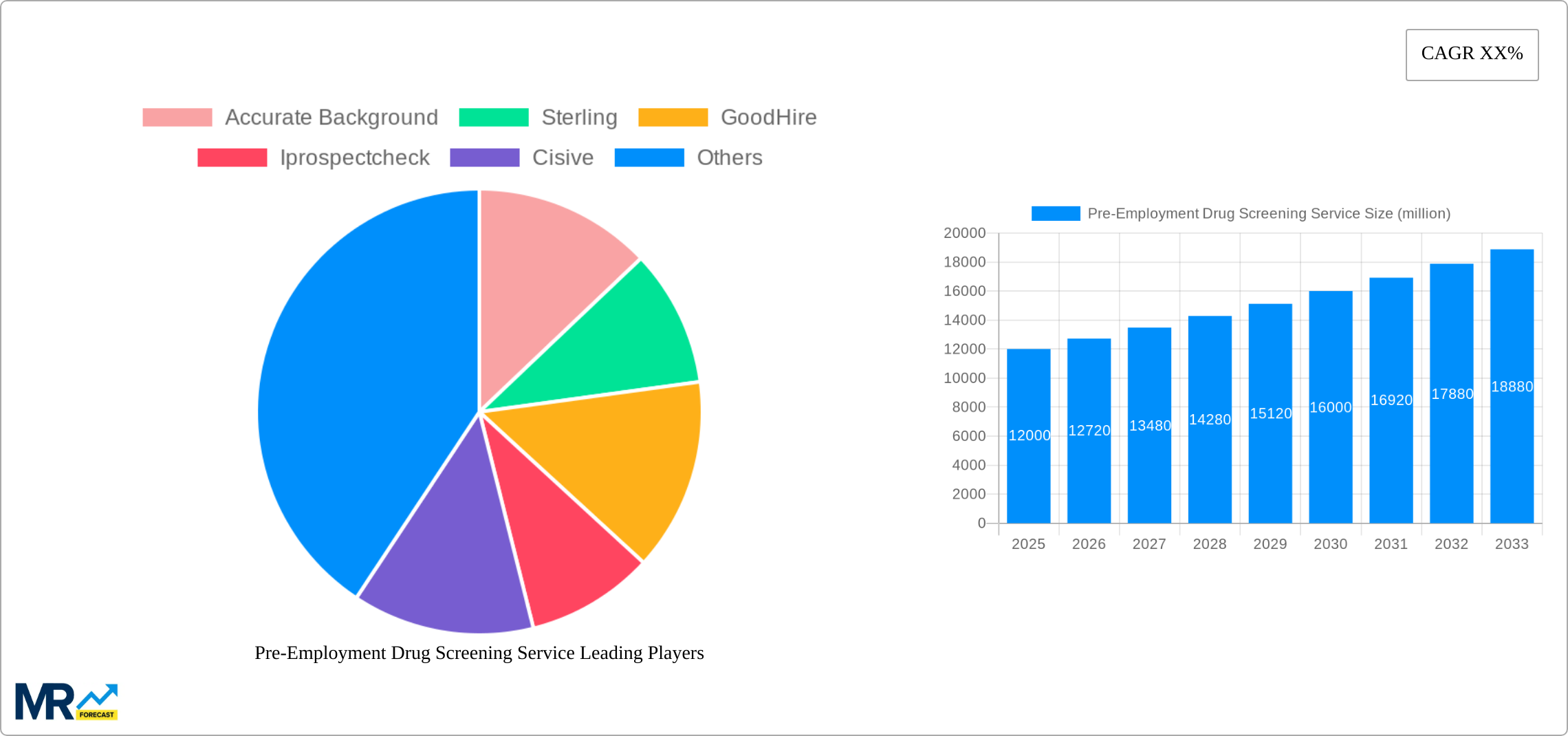

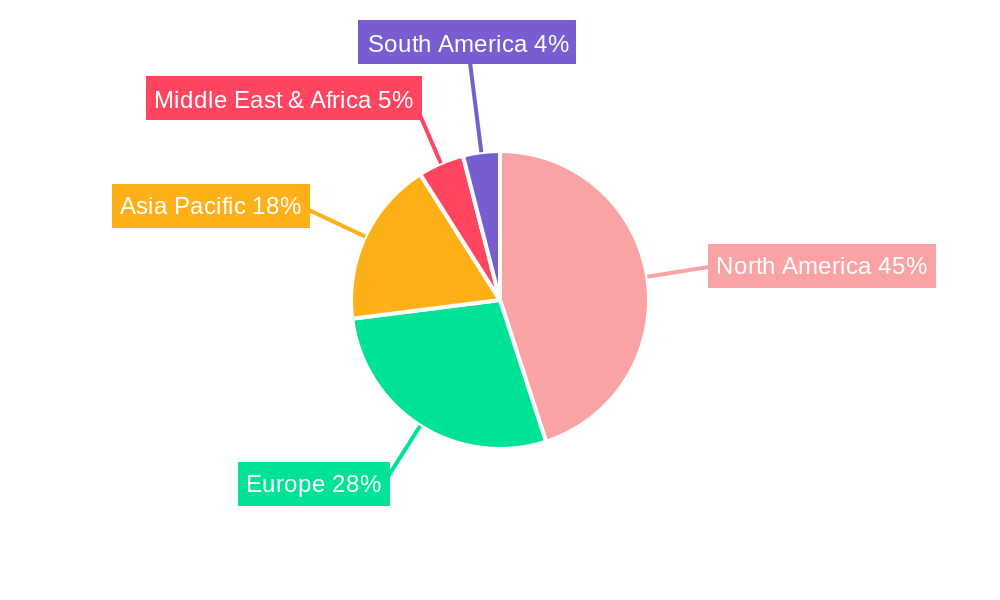

Geographic distribution shows North America currently holding a significant market share due to stringent regulations and high awareness. However, Asia-Pacific is projected to witness substantial growth in the coming years due to increasing industrialization and a growing workforce. Europe also presents a significant market, driven by robust regulatory frameworks. While the market faces constraints such as the cost of testing and potential legal challenges surrounding privacy concerns, the overall positive impact on workplace safety and productivity is expected to overcome these hurdles, maintaining a strong and consistent CAGR. Competitive landscape analysis reveals a mix of established players and emerging companies offering a diverse range of services, creating a dynamic and competitive market environment. Companies are constantly innovating and adapting to provide comprehensive and cost-effective solutions, strengthening their position in the market. This competitive environment drives innovation and forces companies to continuously improve their testing methods and customer service to gain an edge.

The pre-employment drug screening service market, valued at approximately $XX billion in 2025, is projected to experience substantial growth, reaching an estimated $YY billion by 2033. This robust expansion reflects a multitude of factors, including heightened employer concerns regarding workplace safety and productivity, coupled with evolving legal frameworks and technological advancements within the drug testing industry. The market's trajectory is shaped by the increasing adoption of sophisticated screening methods beyond traditional urine tests, including hair follicle and oral fluid analyses, which offer extended detection windows and enhanced accuracy. Furthermore, the rise of digital platforms and streamlined reporting systems has optimized efficiency and reduced administrative burdens for both employers and testing providers. The historical period (2019-2024) witnessed a steady growth trend, primarily driven by the large enterprise segment, as these organizations prioritize robust screening protocols to maintain high performance standards. The forecast period (2025-2033) anticipates accelerated growth fueled by the increasing adoption of drug screening across diverse industries and a broader acceptance of advanced testing technologies amongst SMEs. The base year (2025) provides a crucial benchmark for projecting future market dynamics, highlighting the market's current robust position and indicating significant growth potential in the years to come. The study period (2019-2033) allows for a comprehensive analysis of the market's evolution, encompassing both historical trends and future projections. This detailed analysis reveals the market's dynamic nature and its responsiveness to shifts in regulatory environments, technological innovations, and employer demands. The estimated year (2025) serves as the pivotal point from which the forecast period projections are derived. This allows for a realistic projection of future market growth, taking into account current market conditions and emerging trends. Competition in this market is intense, with a range of established players and emerging technology companies vying for market share. The market is segmented by test type (urine, hair, saliva, others), application (SMEs, large enterprises), and geography, offering various opportunities for growth and specialization.

Several key factors are driving the expansion of the pre-employment drug screening service market. The paramount concern for employers is maintaining a safe and productive work environment. Drug use among employees can lead to accidents, decreased efficiency, and increased absenteeism, resulting in significant financial losses for businesses. Consequently, stringent drug screening policies have become an integral part of many organizations’ hiring processes across diverse industries, including manufacturing, transportation, and healthcare. Furthermore, evolving legal regulations and industry standards in many jurisdictions mandate pre-employment drug testing in specific sectors, compelling companies to comply and adopt comprehensive screening programs. The rise of sophisticated testing methodologies, offering enhanced accuracy, extended detection windows, and reduced invasiveness, is also a significant driver. These advancements are making drug screening more cost-effective and less disruptive to the hiring process, thereby encouraging wider adoption. Finally, the increasing availability of online platforms and digital reporting systems has simplified the entire process, improving efficiency and reducing administrative overhead for employers and service providers. This technological advancement is making drug testing more accessible and affordable for businesses of all sizes, further contributing to the market's overall growth.

Despite the considerable growth potential, the pre-employment drug screening service market faces certain challenges. Concerns regarding employee privacy and potential for discrimination are paramount. Stringent regulations and legal frameworks governing data privacy and employee rights are increasingly impacting testing practices, requiring organizations to ensure compliance and adopt ethical and transparent procedures. The cost of drug testing can be a significant barrier, particularly for small and medium-sized enterprises (SMEs) with limited budgets. Balancing the need for comprehensive screening with cost constraints remains a crucial challenge for many businesses. Moreover, the constant evolution of drug use patterns necessitates continuous updates to testing methods and protocols to ensure accuracy and effectiveness. Maintaining currency with emerging drug trends and technological advancements represents an ongoing challenge for testing providers. Additionally, the potential for false positives and the need for robust quality control measures are critical considerations that impact the reliability and credibility of drug testing results. Addressing these challenges necessitates collaborative efforts among employers, testing providers, and policymakers to ensure ethical, efficient, and reliable drug screening practices.

The large enterprise segment is poised to dominate the pre-employment drug screening service market throughout the forecast period. Large corporations, with their extensive workforces and stringent safety protocols, typically prioritize comprehensive drug testing programs to mitigate risks associated with employee substance abuse. These organizations often have dedicated human resources departments and the financial resources required to implement robust drug screening procedures, fueling the high demand within this segment.

High adoption rate: Large enterprises prioritize workplace safety and productivity, leading to a higher adoption rate of pre-employment drug screening services.

Sophisticated testing requirements: These organizations often require more advanced testing methods, such as hair follicle and oral fluid analysis, driving demand for sophisticated service providers.

Budgetary capacity: Large enterprises possess the necessary budgetary capacity to invest in comprehensive drug screening programs.

Regulatory compliance: Large enterprises are typically subject to stricter regulatory requirements related to drug testing, necessitating the use of compliant service providers.

Technological advancements: The adoption of advanced technologies in drug screening is also more prominent among larger enterprises.

Geographically, North America is expected to maintain a significant market share, driven by stringent regulatory compliance requirements and a high prevalence of pre-employment drug testing across various industries. The strong emphasis on workplace safety and productivity in North America contributes significantly to the market’s growth. This region's established testing infrastructure and the presence of several leading drug screening companies also contributes to the dominance of this region.

Stringent regulations: North America has stringent regulations governing workplace safety and drug testing, driving the demand for pre-employment drug screening services.

High adoption rates: Businesses in North America have consistently high adoption rates of pre-employment drug screening services.

Advanced technologies: The region is at the forefront of developing and implementing advanced drug testing technologies, further contributing to the market growth.

Established infrastructure: North America possesses a well-established infrastructure for drug testing, encompassing testing facilities, laboratories, and experienced personnel.

Strong presence of key players: Many leading providers of pre-employment drug screening services are based in North America, enhancing competition and fostering innovation.

The pre-employment drug screening service industry's growth is significantly propelled by the rising awareness of workplace safety, the increasing adoption of advanced testing technologies like hair and saliva testing, and the streamlining of processes through digital platforms. Stringent government regulations in specific sectors further mandate drug screening, driving market expansion.

This report provides a comprehensive analysis of the pre-employment drug screening service market, encompassing market size estimations, growth forecasts, key drivers, challenges, and leading players. The study provides in-depth segment analysis, considering test type, application (SMEs, large enterprises), and key geographical regions. It also explores technological advancements and regulatory changes impacting the market. The report is a valuable resource for stakeholders seeking to understand the market's dynamics and opportunities for growth.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Accurate Background, Sterling, GoodHire, Iprospectcheck, Cisive, National Drug Screening, AccuSourceHR, ScoutLogic, First Advantage, Checkr, Quest Diagnostics Incorporated, JDP, InCheck, HireRight, Foley, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Pre-Employment Drug Screening Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pre-Employment Drug Screening Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.