1. What is the projected Compound Annual Growth Rate (CAGR) of the POS Software for Jewelry Retailers?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

POS Software for Jewelry Retailers

POS Software for Jewelry RetailersPOS Software for Jewelry Retailers by Type (Cloud-based, On-premises), by Application (Small and Medium Enterprises (SMEs), Large Enterprises), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

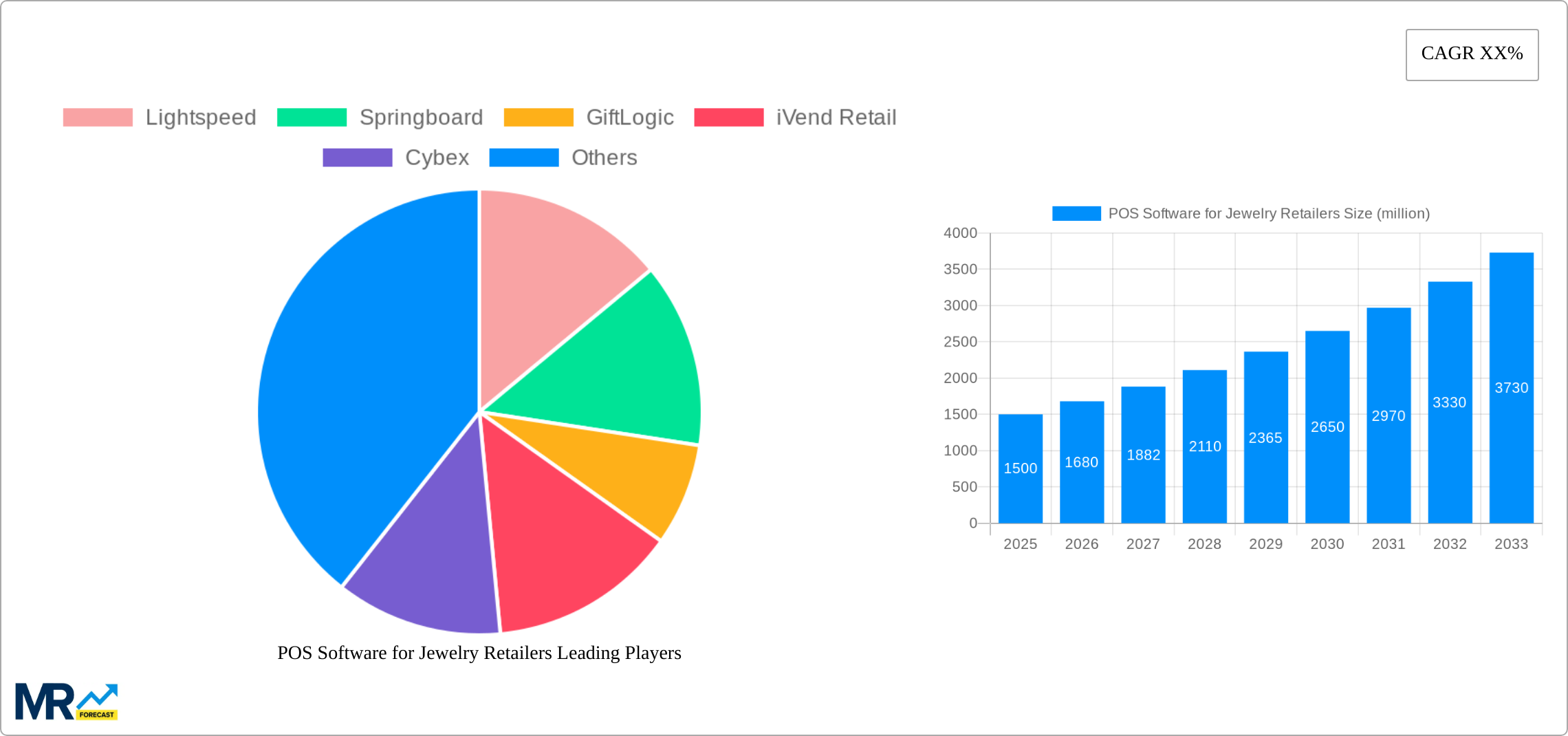

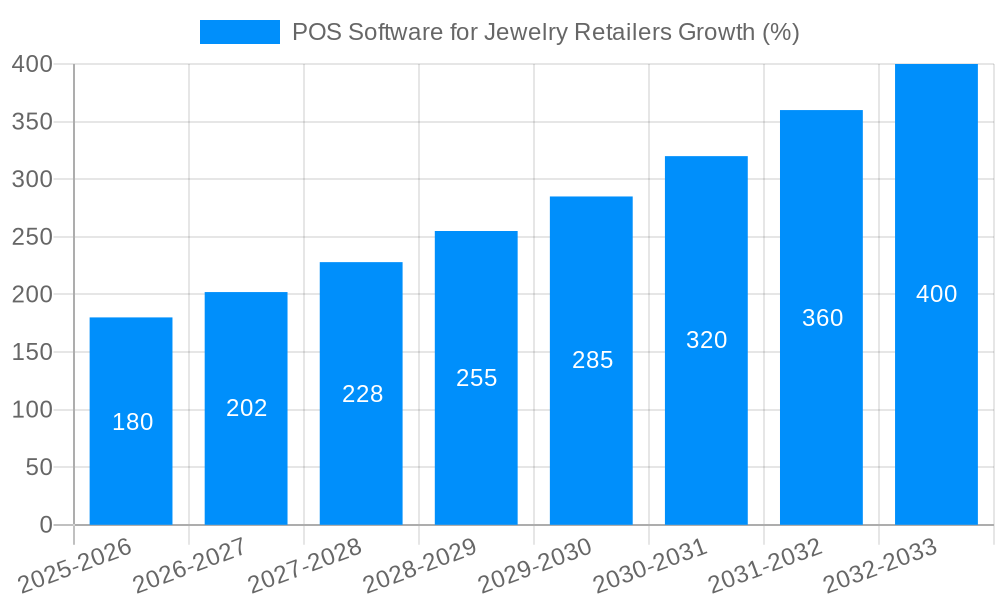

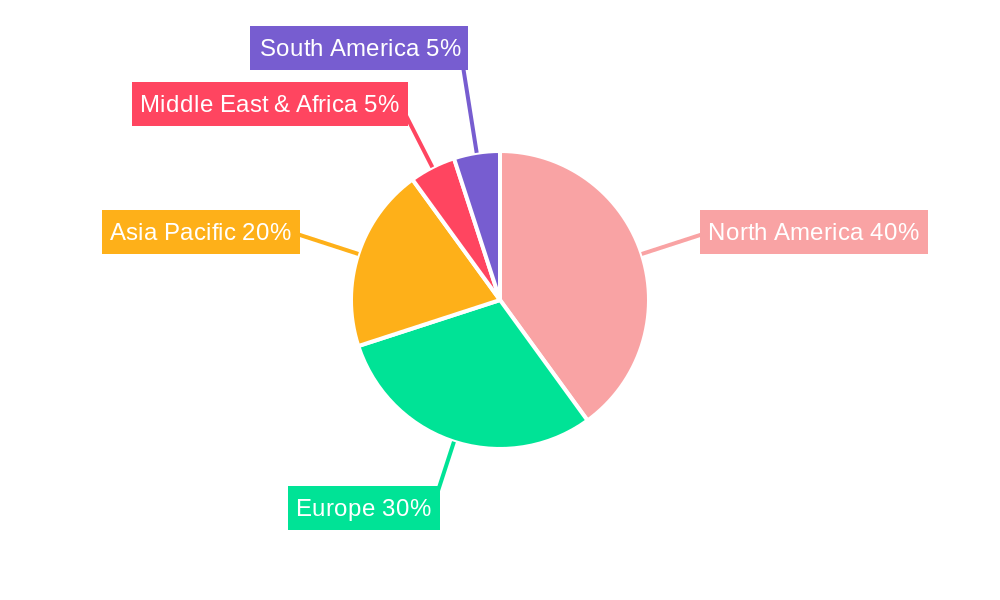

The global market for Point of Sale (POS) software specifically designed for jewelry retailers is experiencing robust growth, driven by the increasing adoption of technology in the retail sector and the need for enhanced inventory management, customer relationship management (CRM), and sales analytics. The market, estimated at $2.5 billion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 12% from 2025 to 2033, reaching approximately $7 billion by 2033. This growth is fueled by several key trends, including the rising popularity of omnichannel retailing, the increasing demand for integrated POS systems with e-commerce platforms, and the growing adoption of cloud-based solutions offering scalability and cost-effectiveness. Furthermore, the increasing sophistication of POS systems, incorporating features like advanced reporting, loyalty programs, and mobile payment processing, is driving adoption amongst both small and medium-sized enterprises (SMEs) and large jewelry retailers. However, the market faces some restraints, including the high initial investment cost for sophisticated systems and the need for ongoing training and support for staff. The market is segmented by deployment type (cloud-based and on-premises) and business size (SMEs and large enterprises), with cloud-based solutions gaining significant traction due to their flexibility and accessibility. Geographically, North America and Europe currently hold the largest market share, driven by high technological adoption and a mature retail landscape, but Asia-Pacific is expected to witness significant growth in the coming years due to the expanding retail sector and increasing disposable incomes. Key players such as Lightspeed, Springboard, and SAP are actively shaping the market through continuous innovation and strategic partnerships.

The competitive landscape is characterized by a mix of established players and emerging niche vendors. Established players like SAP leverage their extensive enterprise resource planning (ERP) solutions to offer comprehensive POS solutions. Meanwhile, smaller, specialized vendors focus on providing tailored solutions catering to the specific needs of the jewelry retail industry. This includes features like specialized inventory tracking for precious metals and gemstones, advanced security features to mitigate theft, and tools optimized for handling high-value transactions. The increasing demand for integrated solutions that connect POS systems with other business operations, including CRM, supply chain management, and marketing automation, is further shaping the market. This trend is driving mergers and acquisitions within the industry, as companies seek to expand their capabilities and offer a more comprehensive suite of products and services to their clients. The future growth of the POS software market for jewelry retailers will be heavily influenced by technological advancements, evolving customer expectations, and the ongoing digital transformation of the retail sector.

The global POS (Point of Sale) software market for jewelry retailers is experiencing significant growth, projected to reach multi-million unit sales by 2033. The period from 2019 to 2024 (Historical Period) witnessed a steady increase in adoption, driven by the increasing need for efficient inventory management, enhanced customer relationship management (CRM), and streamlined sales processes. The base year for this analysis is 2025, with the forecast period extending to 2033. Key market insights reveal a strong preference for cloud-based solutions, particularly among SMEs, due to their scalability, accessibility, and cost-effectiveness. Large enterprises, however, often opt for on-premises solutions for greater control and data security. The market is also witnessing a shift towards integrated POS systems that offer functionalities beyond basic sales transactions, incorporating features like loyalty programs, advanced analytics, and omnichannel integration. This integration allows jewelry retailers to better understand customer preferences, optimize inventory levels, and personalize the shopping experience, leading to increased sales and improved customer retention. The rising adoption of mobile POS (mPOS) systems further enhances operational efficiency and enables sales beyond traditional brick-and-mortar locations. Competition within the market is intensifying, with established players and new entrants constantly innovating to offer more sophisticated and feature-rich solutions. Furthermore, the increasing use of data analytics within POS systems provides valuable insights into sales trends, customer behavior, and inventory performance, enabling data-driven decision-making. This trend is expected to continue driving market growth in the coming years. The report analyzes data from 2019-2024 and projects growth to 2033, offering invaluable insights for businesses and investors.

Several factors are driving the growth of POS software within the jewelry retail sector. The increasing need for efficient inventory management is paramount. Jewelry, with its high value and often unique items, demands precise tracking and control. POS systems automate this process, minimizing losses due to theft, misplacement, or inaccurate stock counts. Enhanced customer relationship management (CRM) is another significant driver. POS systems enable retailers to collect valuable customer data, enabling targeted marketing campaigns, personalized offers, and improved customer loyalty programs. This fosters stronger customer relationships and ultimately drives sales. Streamlined sales processes are crucial for optimizing operational efficiency. POS systems automate various aspects of sales transactions, including payment processing, receipt generation, and order management, reducing processing time and minimizing errors. The rising popularity of omnichannel retail strategies is also pushing demand for integrated POS solutions. These systems enable seamless transitions between online and offline sales channels, providing customers with a consistent and convenient shopping experience. Finally, the integration of advanced analytics capabilities within POS systems provides retailers with valuable insights into sales trends, customer behavior, and inventory performance, aiding in more effective business decisions.

Despite the significant growth potential, several challenges and restraints hinder the widespread adoption of POS software in the jewelry retail sector. The high initial investment cost associated with purchasing and implementing a sophisticated POS system can be a barrier, especially for smaller businesses with limited budgets. The complexity of integrating a new POS system into an existing infrastructure can also pose challenges, requiring significant time and resources. The need for specialized training for staff to effectively use the new system can also disrupt operations and add to the overall costs. Data security and privacy concerns represent another critical challenge. Jewelry retailers handle sensitive customer data, including financial information and personal details, which necessitates robust security measures to protect against data breaches and cyberattacks. Choosing the right POS system with appropriate features tailored to the specific needs of the business can also prove complex given the variety of systems available in the market. Maintaining and upgrading the POS system requires ongoing investment, potentially impacting profitability. Lastly, resistance to change among some retailers who are accustomed to traditional manual processes can slow down the adoption rate of new technologies.

The North American and European markets are currently dominating the POS software for jewelry retailers landscape, driven by high technology adoption rates and strong growth in the luxury goods sector. However, emerging markets in Asia-Pacific are showing promising growth potential.

Segment Dominance: The cloud-based segment is expected to experience the most significant growth within the forecast period. Its scalability, accessibility, and cost-effectiveness make it highly attractive to both SMEs and large enterprises. While on-premises solutions still maintain a presence, especially within larger organizations prioritizing data security, the convenience and cost benefits of cloud solutions are difficult to match. The SME segment represents a major market driver, as smaller businesses increasingly recognize the benefits of efficient POS systems for enhancing profitability and competitiveness. Large enterprises also represent a significant segment but often have more complex integration requirements.

The increasing adoption of omnichannel retail strategies, fueled by the growth of e-commerce and the demand for seamless shopping experiences, is a key catalyst. Furthermore, the integration of advanced analytics within POS systems provides retailers with valuable insights for optimizing operations, improving inventory management, and personalizing customer interactions, driving market growth. The shift towards mobile POS (mPOS) systems further enhances the efficiency of sales operations and expands the reach of retailers.

This report provides a detailed analysis of the POS software market for jewelry retailers, covering market size, segmentation, growth drivers, challenges, and key players. It offers valuable insights into current trends and future projections, helping businesses and investors make informed decisions. The report also includes a competitive landscape analysis, highlighting the key strengths and weaknesses of leading players in the market. The comprehensive data and detailed analysis make it an essential resource for anyone involved in the jewelry retail sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Lightspeed, Springboard, GiftLogic, iVend Retail, Cybex, ERPLY, Ehopper, LS Nav, RetailPoint, ChainDrive, Clover POS, Cegid, Logic Mate, ARMS, SAP, Visual Retail Plus, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "POS Software for Jewelry Retailers," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the POS Software for Jewelry Retailers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.