1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmacy And Drug Store Franchises?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pharmacy And Drug Store Franchises

Pharmacy And Drug Store FranchisesPharmacy And Drug Store Franchises by Application (Consumers Aged 65 and Older, Consumers Aged 55 to 64, Consumers Aged 45 to 54, Consumers Aged 35 to 44, Consumers Aged 25 to 34, Consumers Aged 25 and Younger), by Type (Prescription Drugs, OTC Drugs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

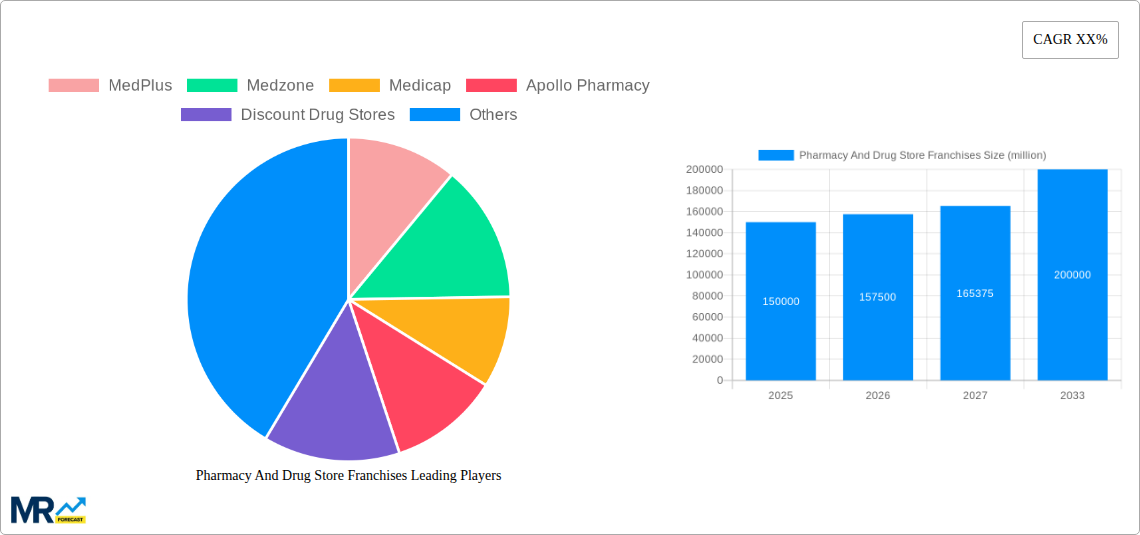

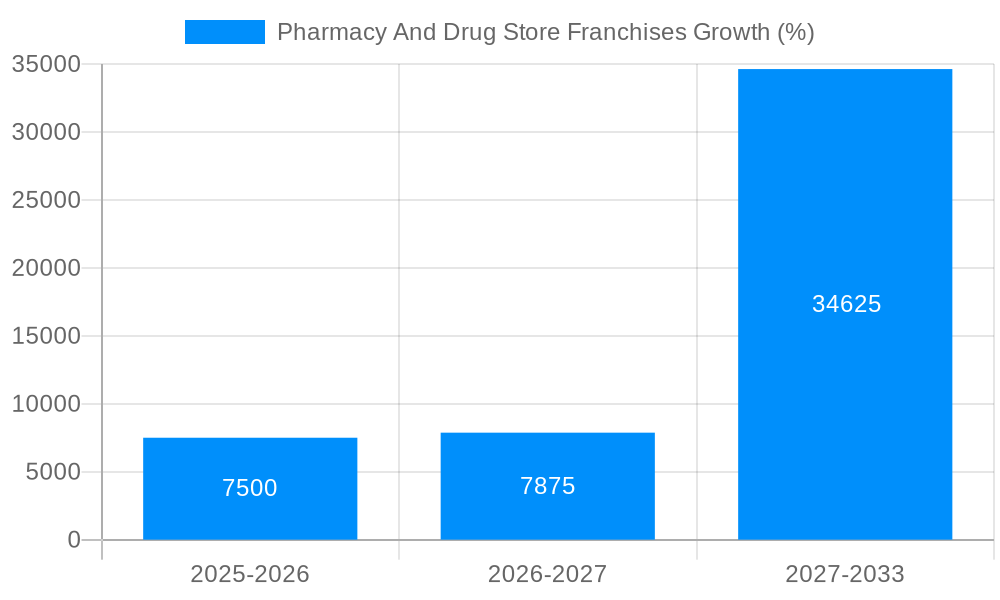

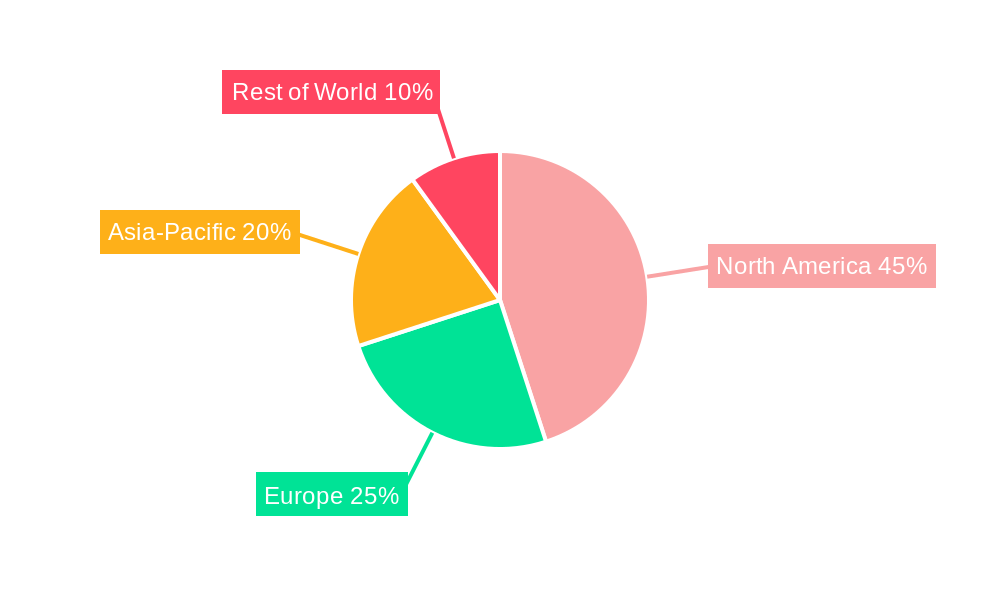

The pharmacy and drug store franchise market, currently exhibiting a 5% CAGR, presents a robust investment opportunity. The market's segmentation reveals significant growth potential across various age demographics, with the 55-64 and 65+ age groups representing substantial revenue streams due to higher prescription drug usage. The market is driven by factors such as an aging global population necessitating increased healthcare access, rising prevalence of chronic diseases leading to greater demand for prescription and over-the-counter medications, and the convenience and brand recognition offered by established franchise models. Competition is fierce, with both large multinational chains like CVS, Walgreens, and Shoppers Drug Mart, and smaller regional and independent players vying for market share. While increasing healthcare costs and stringent regulations present challenges, innovative business models focusing on personalized services, telehealth integration, and home delivery are mitigating these restraints. Emerging trends point toward an increasing emphasis on preventative healthcare, personalized medicine, and the integration of technology to enhance customer experience and efficiency, all of which create further opportunities within the market. The geographic distribution of market share reflects developed economies such as North America and Europe holding larger proportions, but with emerging markets in Asia-Pacific (particularly India and China) exhibiting significant growth potential.

The forecast for 2025-2033 anticipates continued expansion, fueled by the aforementioned drivers and the expanding global middle class with increased disposable income for healthcare services. Successful franchisees will be those who adapt to changing consumer preferences and regulatory landscapes, focusing on providing superior customer service, convenience, and personalized healthcare solutions. This requires investment in technology, skilled personnel, and strategically targeted marketing efforts. While the market is competitive, the expanding demand for pharmaceutical products and the advantages of established franchise networks present significant opportunities for businesses demonstrating adaptability, innovation, and a strong commitment to customer care. Analyzing specific regional trends will be key for investors to identify opportunities for maximizing returns in this dynamic market. For example, an understanding of the specific healthcare needs and regulatory environments in rapidly growing markets such as China and India is crucial to success.

The pharmacy and drug store franchise market is experiencing robust growth, driven by several key factors. The aging global population, coupled with rising rates of chronic diseases, is significantly increasing the demand for prescription and over-the-counter (OTC) medications. This trend is particularly pronounced in developed nations, where the proportion of individuals aged 65 and older is substantial and continues to grow. Furthermore, the increasing prevalence of lifestyle diseases like diabetes, hypertension, and cardiovascular conditions necessitates ongoing medication management, further fueling market expansion. The rising disposable incomes in emerging economies are also contributing to increased healthcare spending, leading to greater affordability of pharmaceutical products and services. Technological advancements, such as the rise of telepharmacy and online prescription refills, are streamlining access to medication and enhancing customer convenience. This digital transformation, along with the increasing adoption of sophisticated pharmacy management systems, is optimizing operational efficiency and reducing costs for franchisees. However, the market also faces challenges such as stringent regulations, pricing pressures from generic drugs, and the growing importance of managing healthcare costs effectively. Despite these hurdles, the overall outlook remains positive, with projections suggesting a market value exceeding several billion dollars within the next decade. The global market size for pharmacy and drug store franchises, estimated at $XXX billion in 2025, is projected to reach $YYY billion by 2033, demonstrating substantial growth opportunities for investors and franchisees. This expansion is further fueled by evolving consumer preferences, including a rising demand for personalized medication management services and convenient access to healthcare information.

Several key factors are propelling the growth of pharmacy and drug store franchises. The expanding elderly population, as mentioned earlier, represents a large and steadily growing customer base requiring regular medication. The rise of chronic diseases, demanding long-term medication adherence, further strengthens this demand. Increased healthcare awareness and proactive health management among consumers also contribute to higher prescription drug consumption and OTC medication purchases. The convenience factor offered by franchise models plays a significant role, providing consumers with readily accessible locations and familiar brand names. Furthermore, the implementation of advanced technologies, such as automated dispensing systems and electronic health records, enhances efficiency and optimizes operations. Strategic partnerships with healthcare providers and insurance companies are also broadening market access and enhancing customer reach. Finally, the availability of franchise support systems and training programs allows potential franchisees to enter the market with a reduced level of risk, fostering market expansion. These factors combined create a favorable environment for continued and substantial growth within the pharmacy and drug store franchise sector.

Despite the promising growth outlook, the pharmacy and drug store franchise sector faces several significant challenges. Stringent government regulations regarding drug dispensing, storage, and prescription management impose considerable operational complexities and compliance costs. Price competition, particularly from generic drug manufacturers, significantly impacts profit margins and necessitates efficient cost management strategies. The ever-increasing cost of prescription drugs and healthcare services puts pressure on both consumers and franchisees, potentially impacting sales volumes. Maintaining sufficient staffing levels, especially qualified pharmacists, poses another challenge in a competitive labor market. Additionally, the sector is susceptible to disruptions from supply chain issues, which can impact inventory availability and operational continuity. The increasing prevalence of online pharmacies also presents competitive pressure, requiring franchisees to adapt and offer compelling value propositions to retain market share. Finally, maintaining brand reputation and ensuring patient safety are paramount concerns, demanding rigorous quality control measures and adherence to best practices.

The market for pharmacy and drug store franchises is geographically diverse, with significant growth potential across various regions. However, North America (particularly the USA) and Western Europe consistently demonstrate strong market performance due to factors such as an aging population, high healthcare spending, and established healthcare infrastructure. Within specific segments, the age group of consumers aged 65 and older consistently demonstrates the highest demand for prescription and OTC medications, driving a substantial portion of market revenue. This segment is characterized by higher rates of chronic conditions requiring ongoing medication, thus making this demographic the most lucrative for franchise operators. The prescription drug segment, representing a significantly larger market share than OTC drugs, is fueled by the aforementioned rise in chronic diseases and increasing healthcare awareness.

The significant market share held by the 65+ age group is primarily due to their higher propensity for chronic illnesses and associated medication needs. This group's growing population size further contributes to its dominance. Similarly, the prescription drug segment maintains its leadership position due to the sheer volume of prescription medications required to manage chronic conditions. While OTC drugs represent a substantial market, the long-term treatment requirements of many chronic illnesses significantly outweigh the demands for occasional relief provided by OTC medications. This trend is expected to continue, further solidifying the dominance of these segments in the foreseeable future. Future growth will likely be driven by innovations in pharmaceutical treatments and personalized medicine, further increasing the demand for both prescription drugs and specialized pharmacy services.

Several factors are fueling growth in the pharmacy and drug store franchise industry. The expanding elderly population continues to drive demand for prescription and OTC medications. Technological advancements, particularly in telepharmacy and online prescription services, are improving access and convenience for customers. Strategic partnerships between pharmacies and healthcare providers are enhancing patient care and expanding market reach. Finally, increasing consumer awareness of health and wellness is prompting more proactive healthcare management and medication adherence, further boosting sales.

This report provides a comprehensive overview of the pharmacy and drug store franchise market, covering market size, segmentation, growth drivers, challenges, and key players. It offers valuable insights into market trends, enabling informed decision-making for investors, franchisees, and other stakeholders. The report's detailed analysis of key segments and regions facilitates strategic planning and resource allocation, maximizing return on investment in this dynamic market. The inclusion of recent industry developments and future projections empowers readers to navigate the complexities of this evolving landscape and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include MedPlus, Medzone, Medicap, Apollo Pharmacy, Discount Drug Stores, RK Franchise Consultancy, CVS, Rite Aid, Walgreens, Shopper's Drug Mart, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Pharmacy And Drug Store Franchises," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pharmacy And Drug Store Franchises, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.