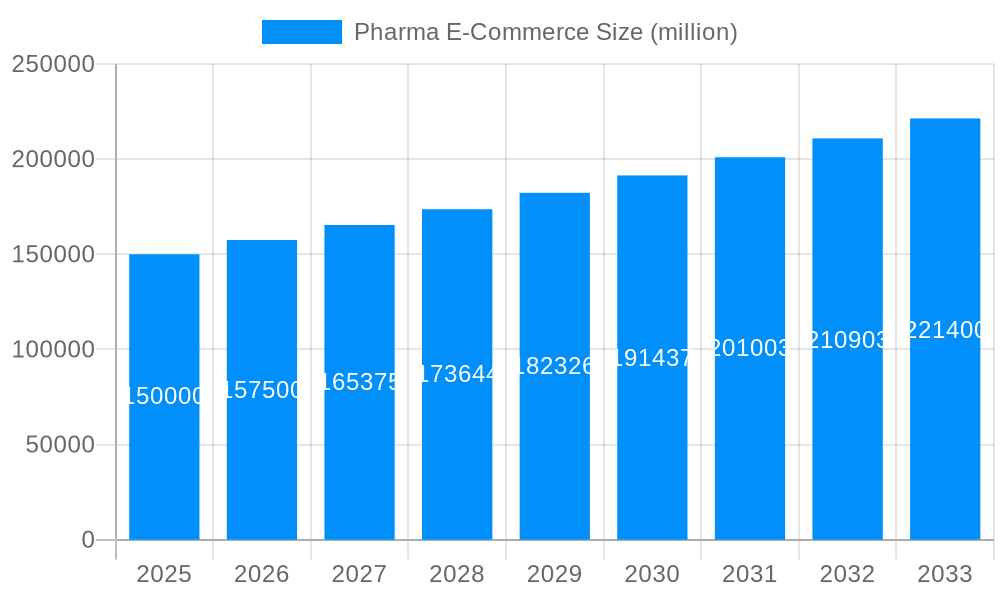

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharma E-Commerce?

The projected CAGR is approximately 5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pharma E-Commerce

Pharma E-CommercePharma E-Commerce by Application (Direct Sales, Distributors, Online), by Type (Rx, OTC), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

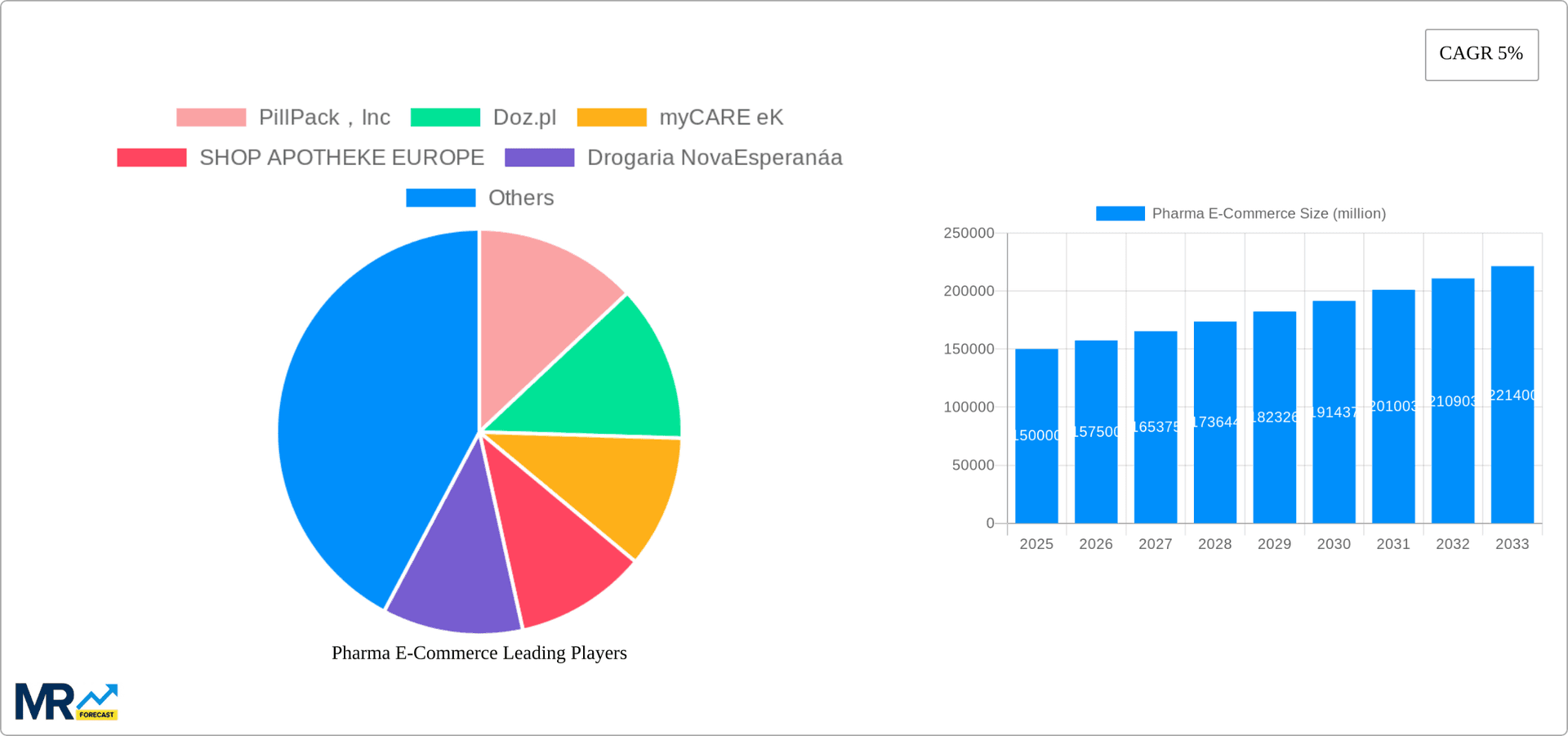

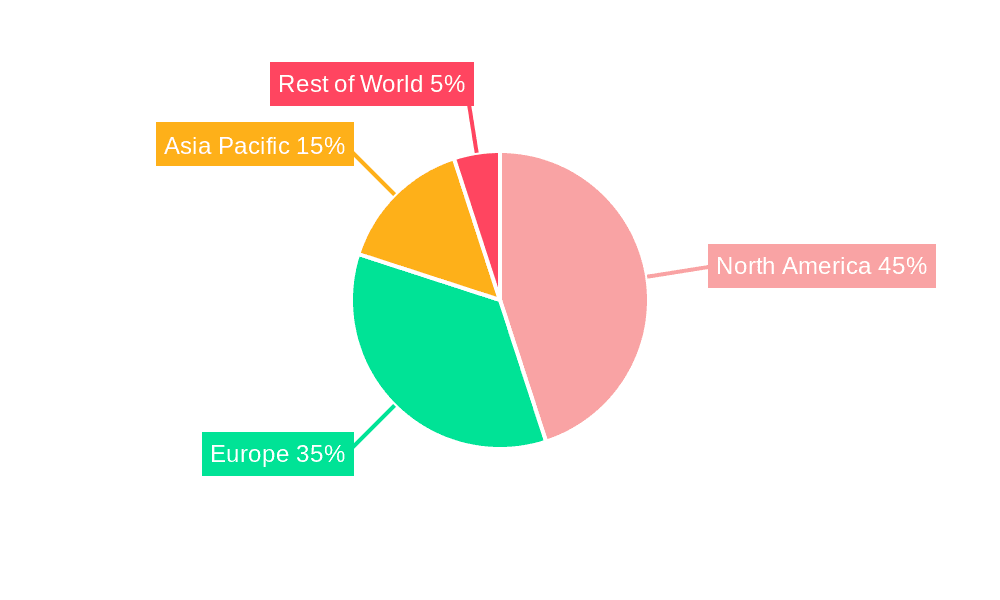

The global pharma e-commerce market is experiencing robust growth, driven by increasing internet penetration, rising smartphone adoption, and a growing preference for convenient online healthcare services. The market's 5% CAGR suggests a steady expansion, with significant opportunities for both established players and new entrants. The market segmentation reveals a diverse landscape, with direct sales, distributors, and online channels all contributing to overall sales. Similarly, both Rx (prescription) and OTC (over-the-counter) medications are significant revenue drivers, indicating the broad appeal of online pharmacies. Key players like PillPack, SHOP APOTHEKE EUROPE, and Walgreens Boots Alliance are leading the charge, leveraging their established brands and extensive distribution networks to capture market share. Geographical expansion is also a significant factor, with North America and Europe currently dominating the market, but regions like Asia-Pacific exhibiting high growth potential due to rapidly evolving digital infrastructure and rising healthcare expenditure. The market faces challenges such as stringent regulations governing online drug sales, concerns over data security and patient privacy, and the need for robust logistics and delivery systems to ensure timely and reliable medication delivery. However, innovative solutions such as telehealth integration and personalized medication management tools are expected to mitigate these challenges and fuel further market growth.

The forecast period of 2025-2033 presents significant opportunities for market expansion. Based on a 5% CAGR and a 2025 market size (estimated at $150 billion based on industry reports and common market sizes for similar sectors), the market is projected to reach approximately $200 billion by 2030 and surpass $250 billion by 2033. The continued rise of mobile health applications, coupled with advancements in digital health technologies such as AI-powered drug discovery and personalized medicine, will further propel market growth. However, maintaining consumer trust and ensuring regulatory compliance will remain crucial for long-term success. Competition will intensify as both large pharmaceutical companies and smaller, specialized online pharmacies vie for market share. Success will depend on factors like customer experience, delivery speed and reliability, and the ability to leverage technology to personalize the patient journey.

The global pharma e-commerce market is experiencing explosive growth, projected to reach XXX million units by 2033, a significant increase from XXX million units in 2025. This burgeoning sector is fueled by a confluence of factors, including the increasing comfort level of consumers with online purchasing, the expansion of high-speed internet access, and the proactive efforts of pharmaceutical companies and distributors to establish robust online platforms. The convenience offered by online pharmacies, coupled with competitive pricing and the ability to access a wider range of medications, is driving substantial adoption across various demographics. However, the market isn't monolithic. While the direct-to-consumer (DTC) segment is witnessing remarkable growth, the role of distributors remains crucial, particularly in supplying smaller pharmacies and independent retailers with online ordering and inventory management capabilities. The rise of telehealth services further accelerates this trend, creating integrated systems where online consultations directly lead to e-pharmacy prescriptions. Regulatory hurdles remain a significant factor, with varying levels of online prescription regulations impacting market penetration in different countries. Furthermore, concerns regarding data privacy, security, and the potential for counterfeit medications necessitate ongoing vigilance and improved industry best practices. The overall trend, however, points towards a continued upward trajectory for pharma e-commerce, with increasing sophistication in technology and enhanced consumer trust shaping the future of the market. The forecast period (2025-2033) will likely witness the emergence of new business models and further integration with other healthcare sectors. This includes personalized medicine initiatives utilizing online platforms to tailor medication regimens and improved patient monitoring systems, enhancing adherence and treatment outcomes. The historical period (2019-2024) serves as a strong foundation indicating the significant shift towards digital adoption in the pharmaceutical landscape.

The rapid expansion of the pharma e-commerce market is driven by several key factors. Firstly, the convenience factor is undeniable. Online pharmacies offer 24/7 accessibility, eliminating the need for physical visits to brick-and-mortar stores, saving consumers valuable time and effort. Secondly, the increasing affordability of internet access and the proliferation of smartphones have made online shopping more accessible to a wider population. Thirdly, many online pharmacies offer competitive pricing and discounts, making medications more affordable than traditional pharmacies, especially for those with chronic conditions requiring long-term medication. Furthermore, the rise of telehealth significantly contributes to the growth; online consultations directly linking to e-prescriptions streamline the process. The enhanced privacy associated with online ordering also appeals to many consumers, offering discretion when purchasing sensitive medications. Finally, the increasing use of data analytics by online pharmacies enables personalized recommendations and improved patient adherence programs, contributing to improved health outcomes and strengthening customer loyalty. These intertwined factors collectively create a strong positive feedback loop, driving further market growth.

Despite the rapid growth, the pharma e-commerce market faces significant challenges. Stringent regulations surrounding online prescription drug sales vary considerably across different countries, creating a complex regulatory landscape that can hinder market expansion. Ensuring the authenticity and safety of medications sold online is paramount. The risk of counterfeit drugs and the potential for medication errors pose serious threats to consumer safety and necessitate robust verification and security measures. Furthermore, concerns about data privacy and the security of sensitive patient information are legitimate concerns that need to be addressed through strong encryption and data protection protocols. The logistical complexities associated with the delivery of temperature-sensitive medications and the need for proper handling and storage present operational challenges, particularly in regions with limited infrastructure. Finally, building consumer trust and overcoming skepticism about online pharmacies remains crucial for sustained growth, requiring transparent practices and clear communication to alleviate any concerns. Addressing these challenges requires collaboration between governments, regulatory bodies, and the pharmaceutical industry to ensure safety, security, and consumer confidence.

The North American and European markets are currently leading the global pharma e-commerce market, driven by high internet penetration rates, robust regulatory frameworks (although varying in stringency), and a strong existing infrastructure. However, rapidly developing economies in Asia-Pacific are showing significant potential for growth, with increasing adoption of online shopping and improving healthcare infrastructure.

Dominant Segment: The Rx (Prescription) segment is expected to maintain its dominance throughout the forecast period. While OTC (Over-the-Counter) medications are readily accessible online, the regulatory scrutiny and security measures surrounding prescription drugs result in a larger market value for this segment. The process of verifying prescriptions and ensuring secure delivery are key factors contributing to this dominance.

Application Segments: The Direct Sales application segment is experiencing rapid growth due to the convenience and affordability it provides to consumers. However, the Distributors segment plays a crucial supporting role, especially in supplying smaller, independent pharmacies with online ordering systems and inventory management solutions. The online segment, by its very nature, is intertwined with both Direct Sales and Distributors, facilitating the entire process from ordering to delivery.

The growth of the Rx segment is further amplified by the increasing integration of online pharmacies with telehealth platforms. Online consultations often directly result in e-prescriptions, creating a seamless and efficient process that is driving higher adoption rates. The ability to refill prescriptions online further contributes to the market's dominance in this area.

The increasing adoption of telehealth, coupled with the growing preference for convenient, at-home healthcare solutions, is fueling significant growth within the pharma e-commerce industry. Technological advancements enabling secure online prescription management and improved delivery infrastructure are also key drivers. The expansion of high-speed internet and smartphone penetration in underserved areas will further broaden the market's reach.

This report provides a detailed analysis of the pharma e-commerce market, covering historical data, current market trends, and future projections. It examines key driving forces, challenges, and growth opportunities within the industry. The report also profiles leading players and includes insights into significant industry developments, offering valuable information for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5%.

Key companies in the market include PillPack,Inc, Doz.pl, myCARE eK, SHOP APOTHEKE EUROPE, Drogaria NovaEsperanáa, Pharmacy 2U, Zur Rose Suisse, LloydsPharmacy, Walgreens Boots Alliance, The Kroger Co, Walmart, Express Scripts Holding Company, CVS Health, Optum, Inc, McKesson Corp, Apo-rot BV, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Pharma E-Commerce," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pharma E-Commerce, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.