1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Sitting and Sleep-In Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pet Sitting and Sleep-In Services

Pet Sitting and Sleep-In ServicesPet Sitting and Sleep-In Services by Type (Day Care Service, Overnight Service), by Application (Cat, Dog, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

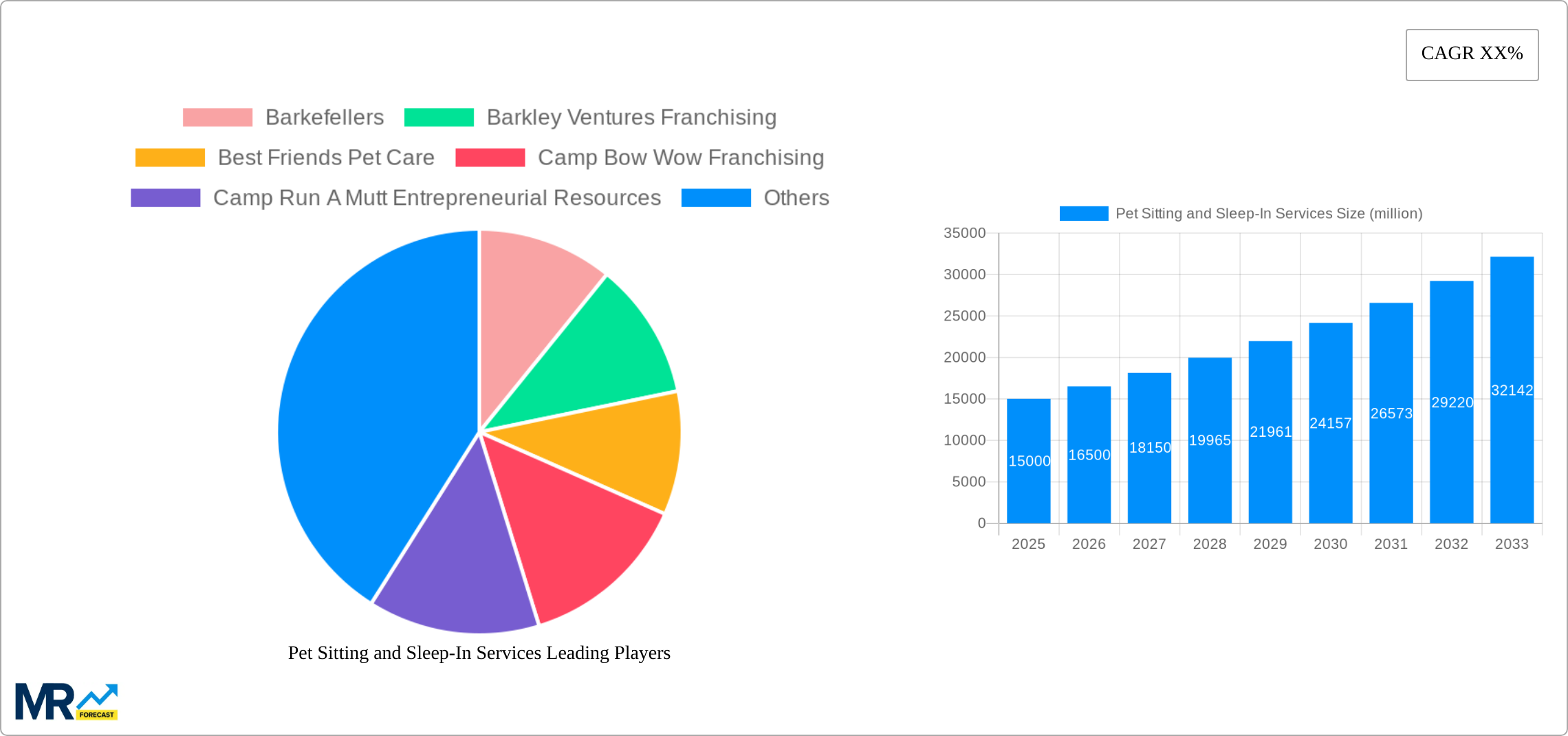

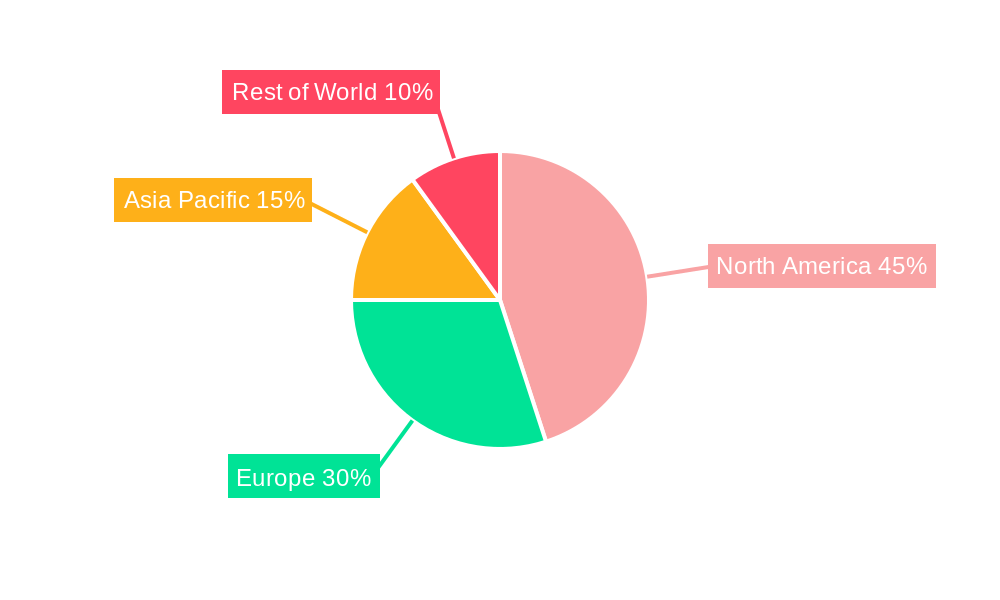

The pet sitting and sleep-in services market is experiencing robust growth, driven by increasing pet ownership, particularly among millennials and Gen Z, coupled with a rising disposable income allowing for greater spending on pet care. The convenience and personalized attention provided by these services are key factors fueling demand. While day care services currently hold the largest segment share, overnight services are showing significant growth potential as pet owners seek reliable care even during extended absences. Cats and dogs remain the dominant application segments, but the "others" category is witnessing expansion due to the increasing popularity of exotic pets and a wider acceptance of providing professional care for a broader range of animals. The market is geographically diverse, with North America and Europe representing significant revenue pools, though Asia-Pacific is projected to experience the highest growth rate over the forecast period, driven primarily by rising middle classes in countries like China and India. Competition is moderately intense, with a mix of both large corporate players like PetSmart and numerous smaller, localized businesses, some operating as franchises. Constraints on market growth include pricing pressures from independent operators and the need for rigorous safety and liability insurance to maintain consumer confidence.

Looking ahead to 2033, the market is expected to continue its upward trajectory, fueled by technological advancements such as pet-tech apps that streamline booking and management. Expansion into niche services, such as specialized care for senior or medically compromised pets, presents further opportunities. However, maintaining consistent service quality across various providers and addressing concerns regarding pet safety and ethical treatment remain critical challenges for industry participants. Strategic partnerships between larger pet care providers and smaller independent operators could emerge as a significant trend, aiming to consolidate market share and provide comprehensive service offerings to a wider customer base. Overall, the market shows promising prospects for substantial growth driven by evolving consumer preferences and an expanding ecosystem of service providers.

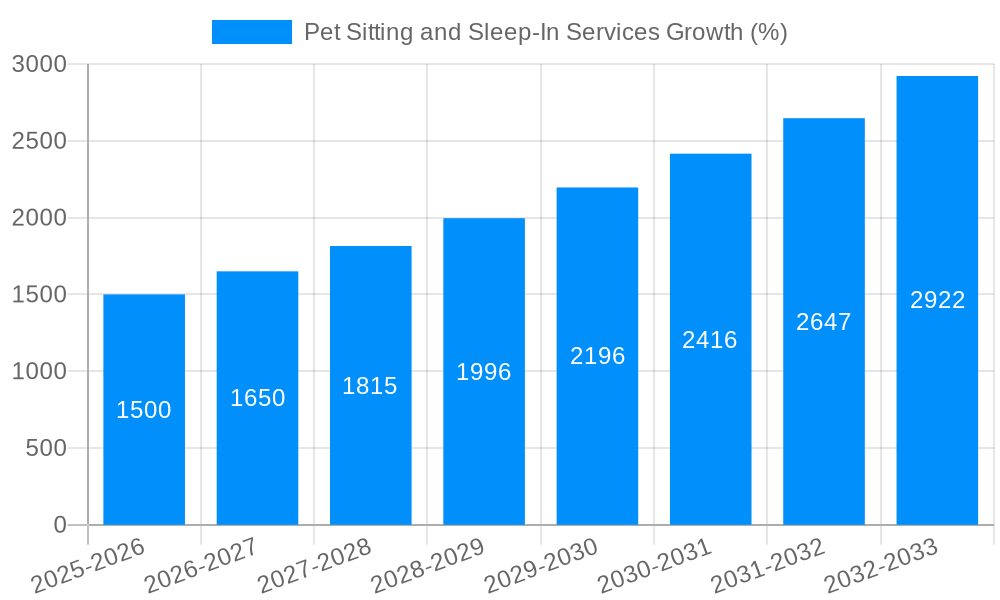

The pet sitting and sleep-in services market is experiencing significant growth, projected to reach multi-million dollar valuations by 2033. Analysis of the historical period (2019-2024) reveals a steady upward trajectory, fueled by increasing pet ownership, changing lifestyles, and a heightened awareness of pet welfare. The estimated market value for 2025 sits at a substantial figure, representing a considerable increase from previous years. This growth is not uniformly distributed; certain segments, such as overnight services for dogs in urban areas, demonstrate exceptionally strong performance. The forecast period (2025-2033) anticipates continued expansion, driven by factors like increased disposable incomes in key demographics, the growing popularity of pet insurance, and the increasing sophistication of services offered, including specialized care for pets with specific needs (e.g., elderly pets, pets with medical conditions). The market is also witnessing a shift towards technology integration, with mobile apps facilitating booking, payment, and communication between pet owners and service providers. This digitalization enhances convenience and transparency, thereby attracting a wider customer base. Moreover, the rise of pet-friendly workplaces and travel options further contributes to the demand for reliable pet sitting and sleep-in solutions. The competitive landscape is dynamic, with a mix of established players and emerging businesses competing on factors such as pricing, service quality, and specialization.

Several key factors are driving the expansion of the pet sitting and sleep-in services market. The increasing humanization of pets is a significant contributor; pets are no longer simply animals but integral members of families. This leads to a greater willingness to invest in their well-being, including professional care during absences. The rise in dual-income households and smaller family sizes means less time is available for pet owners to provide adequate care themselves. The increasing demand for pet-friendly travel options also contributes significantly; pet owners are willing to pay for reliable care while they travel for leisure or business. Furthermore, the growing awareness of the mental and physical health benefits of pet ownership reinforces the need for reliable services that ensure pets remain healthy and happy while their owners are away. Technological advancements, including sophisticated pet monitoring devices and improved communication platforms, facilitate the delivery of high-quality care and increase consumer confidence. Finally, the rise of specialized services, such as in-home pet sitting for exotic animals or specialized care for senior pets, further differentiates the market and caters to the niche demands of a growing customer base.

Despite the significant growth potential, the pet sitting and sleep-in services industry faces several challenges. Finding and retaining qualified and reliable sitters is a significant concern for both service providers and pet owners. Ensuring appropriate insurance coverage and liability protection is crucial to mitigate risks associated with pet injuries or damages. Competition within the market is intensifying, requiring businesses to differentiate themselves through service quality, competitive pricing, and innovative offerings. The industry also faces seasonal fluctuations in demand, with peak periods during holidays and vacation seasons. This necessitates effective workforce management strategies to handle varying levels of demand. Maintaining consistent service quality across a potentially large network of sitters can be challenging, especially for larger franchising operations. Regulatory compliance and licensing requirements vary across jurisdictions, adding complexity to business operations. Finally, building trust and fostering positive relationships with both pet owners and pet sitters is paramount for long-term success. Addressing these challenges effectively is crucial for sustainable growth in this dynamic industry.

The dog segment within the overnight service category is poised to dominate the market. This is largely attributable to several factors.

Geographical Dominance: North America, specifically the United States, is expected to remain a leading market due to the high density of pet owners, the prevalence of dual-income households and the established infrastructure of professional pet care services. However, growing markets in other regions, particularly Europe and certain parts of Asia, are rapidly expanding due to increasing pet ownership rates and changing lifestyles. Urban centers worldwide are also showing high growth due to increased density of pet owners needing professional care.

The pet sitting and sleep-in services industry is experiencing a surge in growth driven by several key factors: increased pet ownership, especially among millennials and Gen Z, the rising prevalence of dual-income households necessitating professional pet care, and the growing awareness of pets' emotional well-being. The increasing adoption of technology, such as pet monitoring devices and mobile booking platforms, is streamlining services and boosting convenience. Finally, the expanding trend of pet insurance enhances pet owners' willingness to utilize premium pet care services.

This report offers a comprehensive analysis of the pet sitting and sleep-in services market, encompassing historical data, current market trends, and future projections. The analysis covers key segments, including day care, overnight services, and applications for various pet types. It also identifies leading players, examines market driving forces, challenges, and growth catalysts, providing valuable insights for businesses and investors in this rapidly growing sector. The report aims to provide a holistic understanding of the industry dynamics and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Barkefellers, Barkley Ventures Franchising, Best Friends Pet Care, Camp Bow Wow Franchising, Camp Run A Mutt Entrepreneurial Resources, Country Comfort Kennels, Country Paws Boarding, Doggy Daycare and Spa, Dogtopia Enterprises LLC, Paradise 4 Paws LLC, Paws Pet Resorts, Pawsitively Heaven Pet Resort, Pawspace, Pet Station Group, PetSmart, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Pet Sitting and Sleep-In Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pet Sitting and Sleep-In Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.