1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Product E-commerce?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pet Product E-commerce

Pet Product E-commercePet Product E-commerce by Type (/> Vertical E-commerce, Comprehensive E-commerce, Community E-commerce), by Application (/> Under 20 Years Old, 20-40 Years Old, 40-60 Years Old, Above 60 Years Old), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

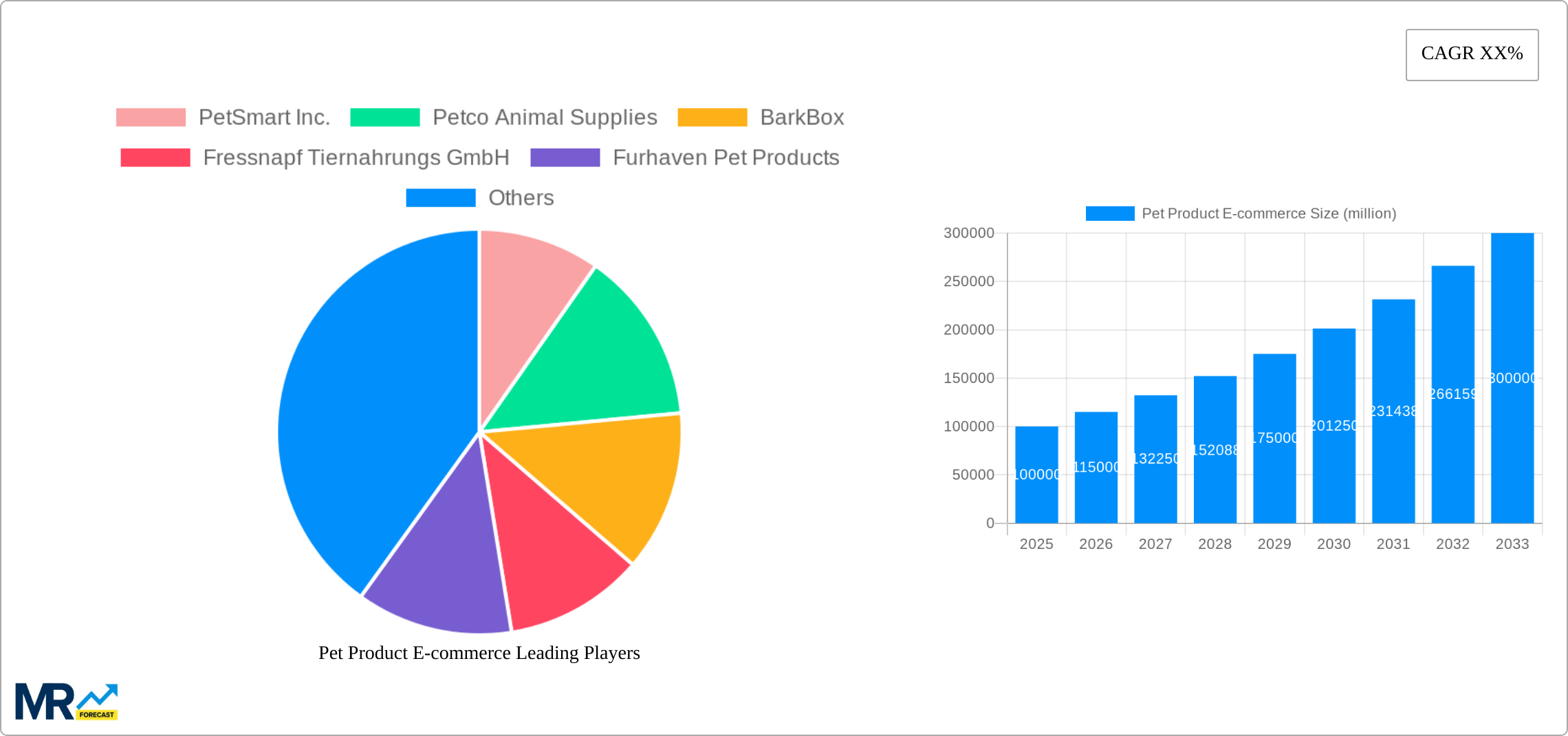

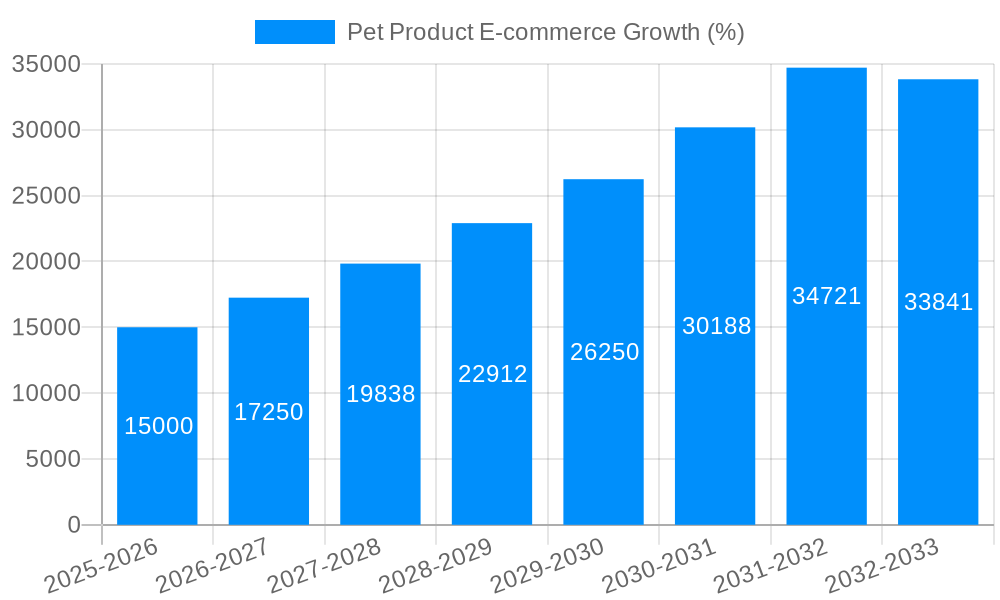

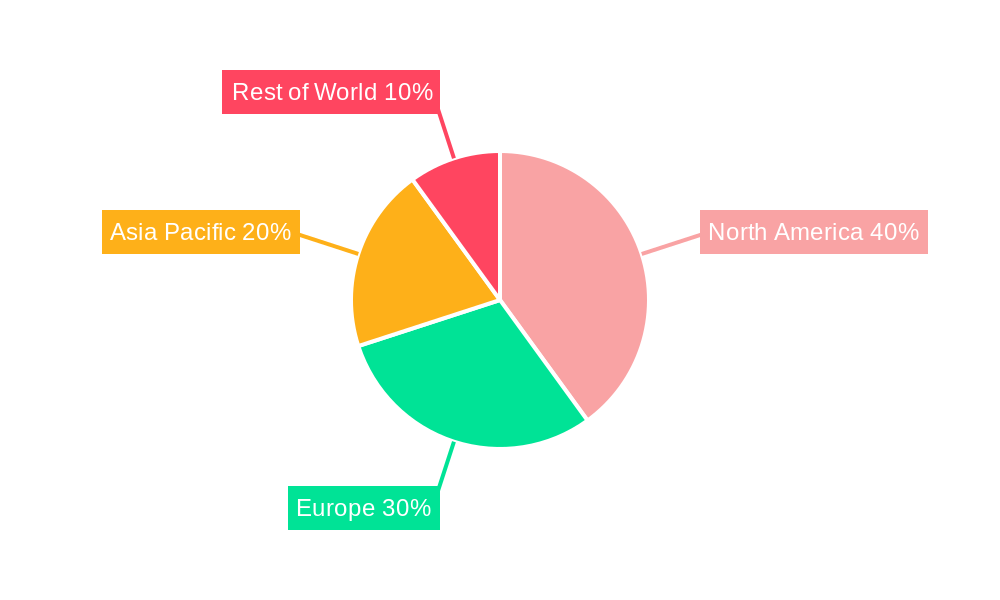

The global pet product e-commerce market is experiencing robust growth, driven by increasing pet ownership, rising disposable incomes, and the convenience offered by online shopping. The market, estimated at $100 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching approximately $300 billion by 2033. This expansion is fueled by several key trends, including the rise of specialized pet product e-commerce platforms offering curated selections and personalized experiences, the increasing adoption of subscription boxes for pet food and supplies, and the growing integration of technology, such as AI-powered recommendation engines, within online pet stores. The market segmentation reveals significant opportunities across various demographics and product categories. The 20-40 age group represents a substantial customer base, while the vertical e-commerce segment (focused on specific pet needs like food or toys) and comprehensive e-commerce (offering a broad range of products) are both witnessing strong growth. Geographical variations exist, with North America and Europe currently dominating the market, but significant growth potential is evident in the Asia-Pacific region, particularly in countries like China and India, driven by rising middle-class incomes and increasing pet ownership. However, challenges remain, including concerns about product authenticity, delivery logistics in remote areas, and the need for robust customer service to address issues related to online purchases.

The competitive landscape is highly dynamic, with established players like PetSmart, Petco, and Amazon competing with specialized online retailers and smaller niche brands. The success of players in the market will hinge on their ability to offer competitive pricing, efficient logistics, a seamless customer experience, and a personalized approach to cater to the diverse needs of pet owners. The increasing adoption of mobile commerce and the expansion of social media marketing present significant opportunities for brands to enhance their reach and engage with potential customers. Furthermore, a strong emphasis on responsible pet ownership and sustainability is influencing consumer purchasing decisions, creating opportunities for eco-friendly and ethically sourced pet products within the e-commerce space. This ongoing evolution underscores the need for constant innovation and adaptation for businesses seeking to thrive in this rapidly growing market.

The global pet product e-commerce market is experiencing explosive growth, projected to reach several hundred million units by 2033. This surge is driven by a confluence of factors, including increasing pet ownership, rising disposable incomes in developing economies, and the ever-expanding reach and convenience of online shopping. The market's evolution is characterized by a shift towards specialized vertical e-commerce platforms focusing on niche pet needs, alongside the continued dominance of comprehensive marketplaces like Amazon and Walmart. Consumers, especially those aged 20-40, are increasingly adopting online channels for purchasing pet food, toys, accessories, and healthcare products. This demographic's tech-savviness and busy lifestyles make online shopping a highly attractive option. Furthermore, the rise of subscription services, personalized recommendations, and the integration of technology like AI-powered chatbots for customer service are reshaping the customer experience. The historical period (2019-2024) witnessed significant adoption, laying the foundation for the impressive forecast period (2025-2033). The estimated market value for 2025 already points towards substantial growth, and this upward trajectory is expected to continue, with various market segments exhibiting dynamic expansion. The increasing adoption of mobile commerce and the expansion into emerging markets are also key contributing factors to this growth. The competition is intensifying, with both established players and new entrants vying for market share, leading to innovation in product offerings and customer service. This report analyzes these trends in detail, providing valuable insights for businesses operating in this dynamic sector.

Several powerful forces are driving the rapid expansion of the pet product e-commerce market. The increasing humanization of pets is a major factor, leading owners to spend more on premium products and services. Convenience is another key driver; online shopping eliminates the need for trips to physical stores, offering a significant advantage for busy individuals. The rise of mobile commerce, fueled by widespread smartphone adoption, allows consumers to browse and purchase pet products anytime, anywhere. Furthermore, the growing popularity of subscription boxes and personalized recommendations caters to the specific needs and preferences of pet owners, fostering customer loyalty and repeat purchases. The broader trend of e-commerce dominance across various sectors also contributes to this growth, with pet products naturally following suit. Targeted marketing campaigns and influencer collaborations on social media further amplify brand awareness and drive sales. Finally, the technological advancements in logistics and delivery services, including faster shipping and efficient last-mile delivery options, ensure a seamless shopping experience, further solidifying the preference for online purchasing.

Despite the significant growth potential, the pet product e-commerce market faces several challenges. One major hurdle is the logistical complexity of shipping perishable goods like pet food, requiring careful temperature control and specialized packaging. Concerns regarding product authenticity and quality are also prevalent, with the risk of counterfeit products being sold online. Competition from established brick-and-mortar stores and the emergence of new players in the online space creates a highly competitive landscape. Maintaining high levels of customer service, particularly addressing issues related to returns and damaged products, is crucial for building customer trust. Cybersecurity and data privacy concerns are also important considerations in an online environment. Furthermore, the need to effectively manage inventory levels and supply chain disruptions, especially during peak seasons, poses a significant logistical challenge. Addressing these challenges effectively will be crucial for sustained growth in this dynamic market.

The North American market, particularly the United States, currently holds a dominant position in the global pet product e-commerce landscape, driven by high pet ownership rates and high disposable incomes. However, Asia-Pacific regions are experiencing rapid growth, fueled by rising pet ownership and increasing internet penetration. Within segments, the 20-40 age demographic exhibits the strongest online purchasing power. This group is digitally savvy and embraces online convenience, resulting in higher online spending compared to other age groups.

This dominance is expected to persist throughout the forecast period (2025-2033), although the rapid growth in other regions, notably Asia-Pacific, will likely lead to a gradual shift in market share distribution. The 20-40 age group's continued adoption of online purchasing habits and increasing disposable income will strengthen their influence on market trends.

Several factors are poised to accelerate growth within the pet product e-commerce sector. The expansion of mobile commerce, offering unparalleled convenience to pet owners, is a key catalyst. Furthermore, the increasing adoption of subscription services, coupled with personalized product recommendations, enhances customer loyalty and repeat purchases. Technological advancements in logistics and delivery, including faster shipping and improved last-mile delivery solutions, contribute to a smoother shopping experience. Finally, targeted marketing strategies, leveraging social media and influencer collaborations, amplify brand awareness and drive sales, further fueling market expansion.

This report offers a comprehensive analysis of the pet product e-commerce market, covering market size, growth drivers, challenges, key players, and future trends. The detailed segmentation allows for a granular understanding of various market segments, and the historical data provides a strong foundation for forecasting future growth. The report is invaluable for businesses seeking to understand and navigate this dynamic and rapidly expanding market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include PetSmart Inc., Petco Animal Supplies, BarkBox, Fressnapf Tiernahrungs GmbH, Furhaven Pet Products, Walmart, Amazon, Alibaba, JD, Guangcheng(Shanghai)Information Technology, eBay, Fruugo Oy.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Pet Product E-commerce," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pet Product E-commerce, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.