1. What is the projected Compound Annual Growth Rate (CAGR) of the Pet Insurance for Dogs and Cats?

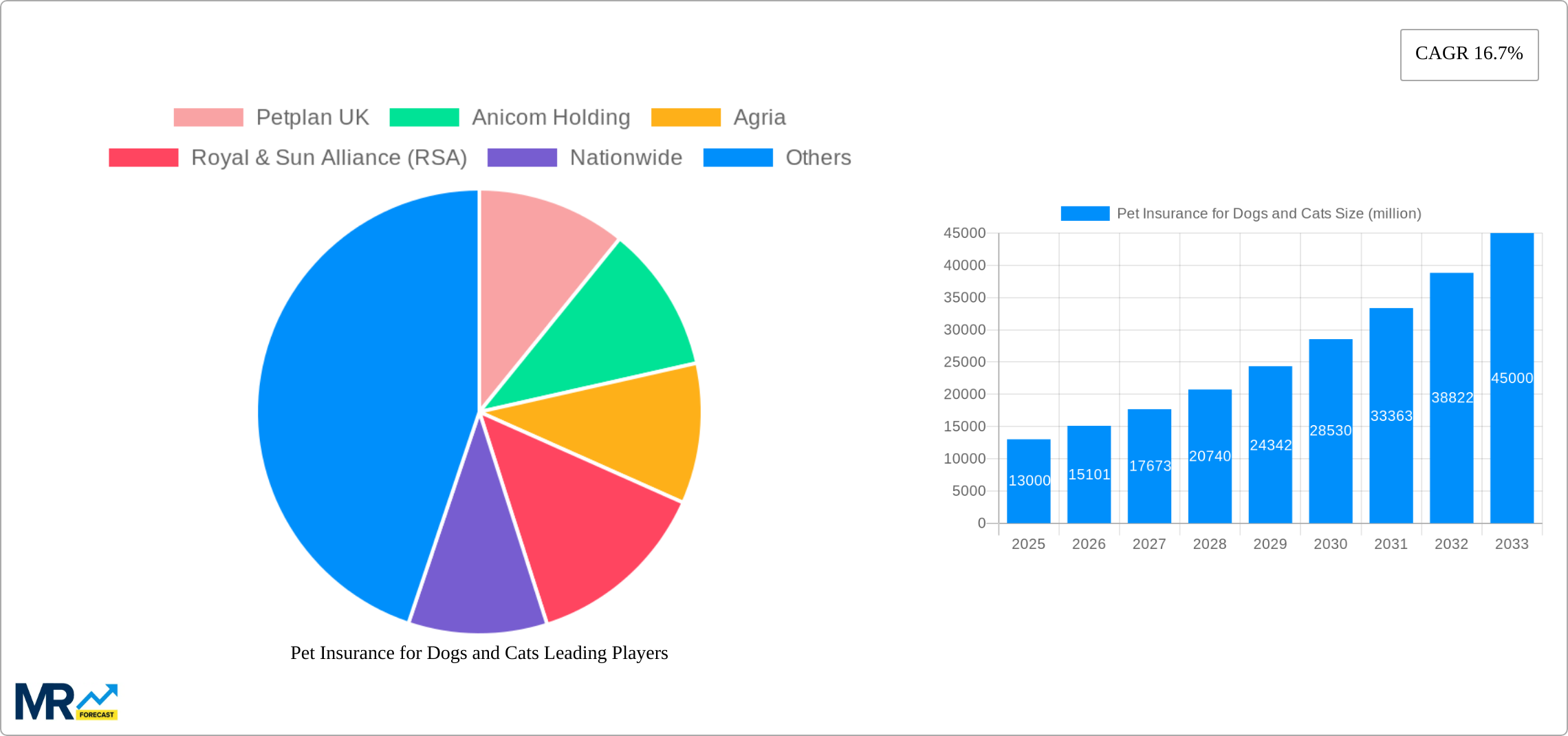

The projected CAGR is approximately 16.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pet Insurance for Dogs and Cats

Pet Insurance for Dogs and CatsPet Insurance for Dogs and Cats by Type (Lifetime Cover Insurance, Non-lifetime Cover Insurance, Accident-only Insurance, Other), by Application (Dogs, Cats), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global pet insurance market for dogs and cats, valued at $13 billion in 2025, is experiencing robust growth, projected to reach approximately $40 billion by 2033, driven by a 16.7% compound annual growth rate (CAGR). This expansion is fueled by several key factors. Increasing pet ownership globally, coupled with rising pet humanization—treating pets as family members—leads to greater willingness to invest in their healthcare. Furthermore, advancements in veterinary care, including more sophisticated treatments and procedures, increase the overall cost of pet healthcare, making insurance a more attractive option for pet owners. The rising awareness of pet insurance benefits, facilitated by proactive marketing campaigns from insurance providers and veterinary clinics, also plays a crucial role. Finally, government regulations in certain regions mandating or incentivizing pet insurance further boost market growth. Segmentation reveals a preference for lifetime cover insurance, with dogs currently holding a larger market share than cats, though the gap is expected to narrow as cat ownership trends change.

Regional disparities exist within the market. North America, particularly the United States, currently dominates, benefiting from high pet ownership rates and established insurance infrastructure. However, significant growth potential exists in emerging markets like Asia-Pacific and parts of Europe, driven by increasing disposable incomes and a growing middle class with the capacity for pet insurance. Competition is intense, with a diverse range of established players, such as Petplan, Agria, and Trupanion, alongside regional insurers and new entrants, constantly innovating with product offerings and customer service strategies to maintain market share. The competitive landscape is further shaped by factors like pricing strategies, coverage options, and digital distribution channels. The market's future is promising, with continuous growth expected based on prevailing trends and the increasing integration of technology in pet healthcare management.

The pet insurance market for dogs and cats is experiencing explosive growth, projected to reach multi-billion dollar valuations within the forecast period (2025-2033). The historical period (2019-2024) witnessed a significant surge in pet ownership globally, fueled by changing lifestyles and increased human-animal bonding. This trend directly translates into rising demand for pet insurance, as owners seek financial protection against unexpected veterinary costs. The market is characterized by a shift towards comprehensive lifetime cover, reflecting a growing willingness among pet owners to invest in their animals' long-term health. Technological advancements are also playing a crucial role, with insurers leveraging data analytics and telemedicine to improve efficiency, personalize offerings, and enhance customer experience. While the market is dominated by established players like Nationwide and Trupanion, several niche players are emerging, offering specialized products and services to cater to specific needs. The increasing awareness of pet health issues and the rising costs associated with veterinary care are major factors driving the market expansion. Furthermore, the incorporation of wellness plans into insurance packages is gaining traction, showcasing a holistic approach to pet care that extends beyond basic accident and illness coverage. Competition is intensifying, with companies focusing on innovative product offerings, competitive pricing, and improved customer service to gain market share. This expansion is not uniform across geographical regions; some markets are showing more rapid growth than others, influenced by factors such as pet ownership rates, disposable income levels, and regulatory frameworks. The estimated market size for 2025 is significant and points towards a continued upward trajectory in the coming years. The market is poised for further diversification, with the emergence of new technologies and the expansion of insurance products and services. The increasing integration of technology into the insurance process simplifies applications, claims processing, and customer interactions. The next decade promises an exciting evolution in this dynamic market.

Several key factors are fueling the rapid growth of the pet insurance market for dogs and cats. Firstly, the increasing humanization of pets is a major driver. Owners view their pets as family members, leading to increased investment in their health and well-being. This translates into higher willingness to purchase insurance as a form of financial protection against unexpected veterinary expenses. Secondly, rising veterinary costs are making pet insurance increasingly attractive. The cost of treatment for serious illnesses or accidents can quickly become exorbitant, leaving pet owners facing difficult financial decisions. Insurance provides a crucial safety net in these situations. Thirdly, increased awareness of pet health issues and the availability of better pet healthcare is boosting demand. Education campaigns and readily available information emphasize preventative care and early detection of health problems. This, in turn, drives pet owners to seek insurance coverage for their animals. Finally, the rise of digital platforms and innovative insurance products is making pet insurance more accessible and convenient. Online applications, simplified claims processes, and flexible payment options are all contributing to increased adoption. The convenience and ease of access offered by digital solutions reduce the barriers to entry for potential customers and allow insurers to expand their reach.

Despite the significant growth, the pet insurance market faces certain challenges and restraints. One key issue is the high cost of claims. Veterinary care can be expensive, leading to potentially high payouts for insurers. This necessitates careful underwriting and risk assessment to ensure financial sustainability. Another challenge is the prevalence of pre-existing conditions. Insurers often exclude coverage for pre-existing health problems, potentially limiting the scope of protection for some animals. This can lead to customer dissatisfaction and missed opportunities for coverage. Competition among insurers is also intense, particularly in mature markets. Companies are constantly striving to differentiate their offerings through competitive pricing, innovative products, and superior customer service. Furthermore, the lack of insurance penetration in certain regions, particularly in developing countries, represents a significant market limitation. This is due to factors such as lower pet ownership rates, limited consumer awareness of insurance products, and affordability issues. The complexities of insurance regulations in various jurisdictions also pose challenges, demanding careful adherence to compliance standards. Finally, fraudulent claims pose a risk, requiring insurers to implement effective fraud detection and prevention mechanisms.

The pet insurance market is characterized by regional variations in growth rates. North America and Europe currently dominate the market, driven by high pet ownership rates, increased disposable incomes, and a higher awareness of pet insurance benefits. Within these regions, the United Kingdom and the United States consistently rank among the leading markets. However, emerging economies in Asia and other parts of the world demonstrate significant growth potential as pet ownership increases and middle-class incomes rise.

Segments:

Lifetime Cover Insurance: This segment is experiencing the fastest growth, driven by pet owners' increasing desire for comprehensive, long-term protection. The willingness to invest in lifetime coverage reflects the increasing emotional bond between pets and owners, ensuring ongoing veterinary care. This segment will continue to dominate market share as awareness of its benefits increases.

Dogs: The dog insurance segment consistently holds the largest market share. Dogs are often more expensive to care for than cats, with veterinary costs potentially much higher, leading to greater demand for insurance coverage. The higher incidence of certain health problems in dogs also contributes to higher demand.

Geographic Dominance: The North American market, particularly the United States, and the United Kingdom, represent the largest and most mature markets for pet insurance. The high levels of pet ownership and pet humanization in these regions, coupled with well-established insurance infrastructure and consumer awareness, underpin their dominant positions.

The pet insurance industry's growth is further accelerated by several key catalysts. The increasing availability of affordable pet insurance plans tailored to different budgets is making insurance accessible to a wider range of pet owners. Furthermore, the integration of technology in claims processing and customer service streamlines the insurance experience and improves customer satisfaction. Marketing and educational campaigns raise consumer awareness of the benefits of pet insurance, driving adoption. These factors collectively contribute to the rapid expansion of the pet insurance market.

The comprehensive pet insurance market is experiencing rapid growth driven by increasing pet ownership, rising veterinary costs, and a growing awareness of the financial benefits of pet insurance. Several factors contribute to this expansion, including the increasing humanization of pets, the development of innovative insurance products, and advancements in technology which make pet insurance more accessible and convenient for pet owners. The market is expected to continue expanding in the coming years, with several players vying for market share through competitive pricing and innovative product offerings.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 16.7%.

Key companies in the market include Petplan UK, Anicom Holding, Agria, Royal & Sun Alliance (RSA), Nationwide, ipet Insurance, Trupanion, Direct Line Group, Crum & Forster, Petplan North America, PetSure, Petsecure, Japan Animal Club, Petfirst, Pethealth, Petplan Australia, PICC, iCatdog, .

The market segments include Type, Application.

The market size is estimated to be USD 13000 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Pet Insurance for Dogs and Cats," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pet Insurance for Dogs and Cats, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.