1. What is the projected Compound Annual Growth Rate (CAGR) of the Personal Credit Repair Service?

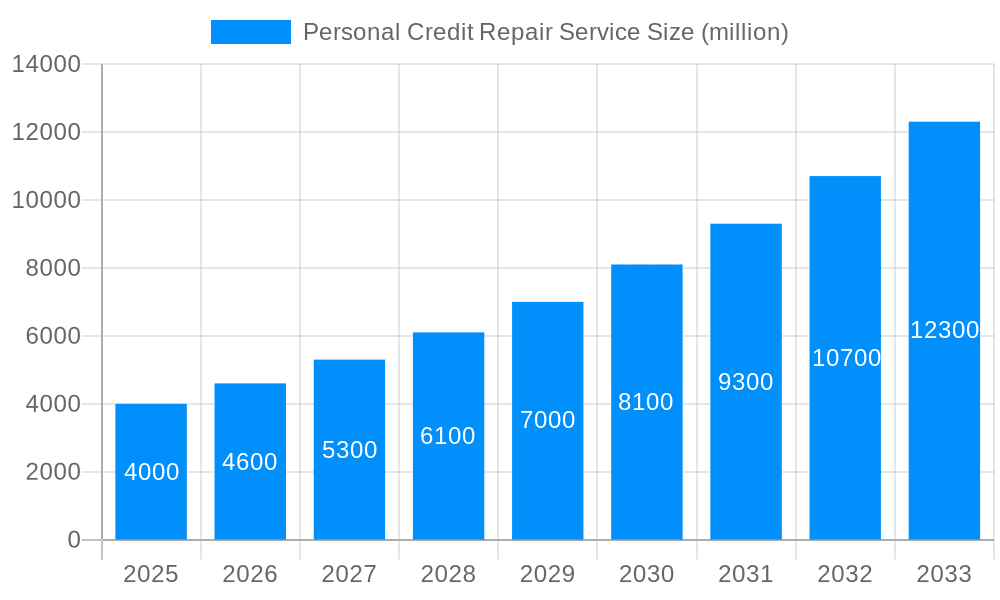

The projected CAGR is approximately 14.71%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Personal Credit Repair Service

Personal Credit Repair ServicePersonal Credit Repair Service by Type (Online Service, Offline Service), by Application (Personal, Family), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The personal credit repair service market is experiencing robust growth, driven by increasing consumer debt, stricter lending standards, and a rising awareness of the importance of credit scores for financial well-being. The market's expansion is fueled by the rising number of individuals seeking to improve their creditworthiness for major life events like home purchases, auto loans, and securing better interest rates. Online services are gaining significant traction, offering convenience and accessibility compared to traditional offline options. While the exact market size for 2025 is unavailable, a reasonable estimate based on industry reports and a conservative CAGR of 15% (a common rate for rapidly growing service sectors) applied to a 2019 base of approximately $2 billion (a plausible figure given the size of related markets) would put the 2025 market size at around $4 billion. This reflects a significant surge in demand, particularly for services addressing specific credit issues such as late payments, collections, and inaccurate reporting. The market is segmented by service type (online versus offline) and application (personal versus family), with the personal segment dominating owing to individual needs for credit improvement.

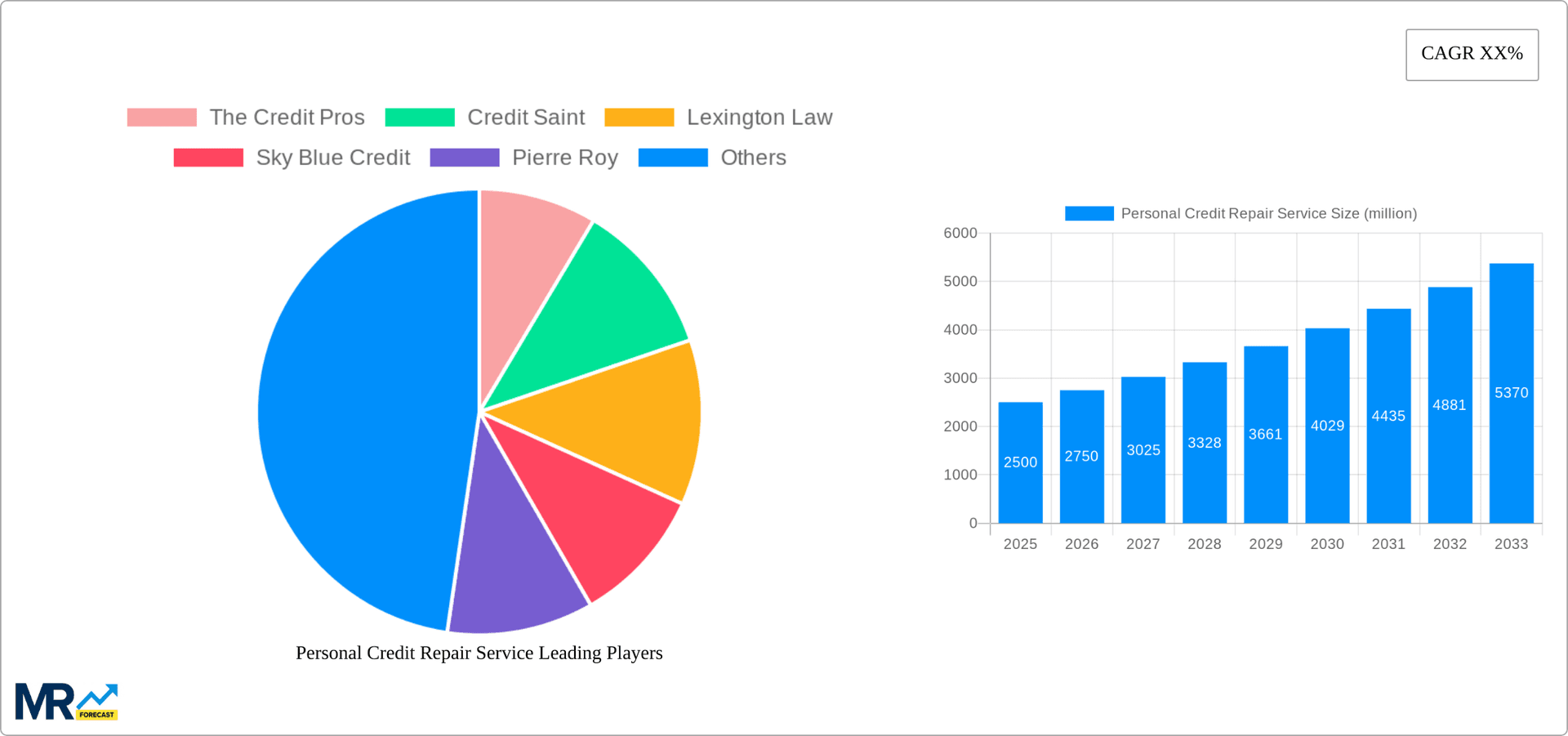

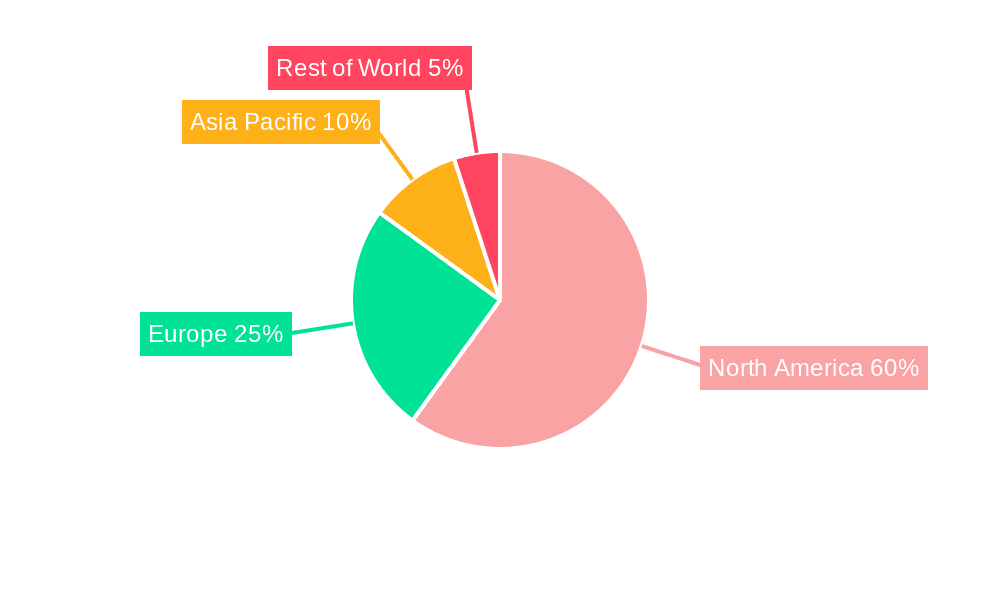

The competitive landscape is fragmented, with numerous established players and emerging companies vying for market share. Key players leverage different strategies, including technology-driven platforms, specialized expertise, and diverse marketing approaches. Regional variations exist, with North America and Europe currently holding significant market shares due to higher credit card penetration and established financial systems. However, Asia-Pacific is projected to witness substantial growth owing to rapid economic expansion and increasing credit awareness. The market faces restraints such as stringent regulations governing credit repair practices, the potential for fraudulent operations, and consumer misconceptions about credit repair processes. Nevertheless, the overall market outlook remains positive, with opportunities for expansion through technological innovation, personalized service offerings, and strategic partnerships. Future growth will be influenced by evolving consumer behavior, advancements in credit scoring methodologies, and the broader economic climate.

The personal credit repair service market is experiencing robust growth, projected to reach multi-million dollar valuations by 2033. The historical period (2019-2024) witnessed a steady increase in demand, fueled by factors such as rising consumer debt, stricter lending criteria, and increased awareness of credit score importance. The estimated market value in 2025 is significant, and the forecast period (2025-2033) anticipates continued expansion driven by technological advancements, shifting consumer behavior, and a growing understanding of the long-term financial benefits of a healthy credit profile. This growth isn't uniform across all service types. While online services offer convenience and accessibility, driving a significant portion of the market, offline services retain a loyal customer base valuing personalized consultations and in-person support. Moreover, the personal application segment holds the largest market share, though the family segment is experiencing substantial growth, indicating a broader adoption of credit repair services within households. The market is witnessing a notable increase in the adoption of sophisticated data analytics and AI-powered solutions by credit repair companies to enhance efficiency and accuracy in handling credit disputes. This technological infusion is further driving market growth and enhancing service quality. Competition is also intensifying, with both established players and new entrants vying for market dominance through strategic partnerships, innovative service offerings, and targeted marketing campaigns. Regulatory scrutiny remains a crucial factor shaping the market dynamics and pushing companies to adopt ethical and transparent business practices.

Several key factors are propelling the growth of the personal credit repair service market. Firstly, the increasing burden of consumer debt across many countries is driving significant demand. Individuals facing financial challenges are actively seeking assistance to improve their credit scores and access better financial products, including loans and mortgages, at more favorable terms. Secondly, the rising awareness of the crucial role credit scores play in securing financial opportunities is encouraging more people to proactively address their credit health. This increased awareness is being fueled by educational initiatives, financial literacy programs, and readily available online resources. Thirdly, the complexities of the credit reporting system often leave consumers feeling overwhelmed and lacking the knowledge or time to navigate the process effectively. Professional credit repair services offer specialized expertise and simplify the often tedious process of disputing inaccurate or negative information. Finally, the increasing accessibility of online credit repair services is democratizing access to these crucial services, making them available to a broader demographic regardless of their geographic location.

Despite the promising growth trajectory, the personal credit repair service market faces significant challenges. Stringent regulations and compliance requirements pose considerable operational hurdles for businesses, requiring substantial investments in legal and technical compliance. Negative perceptions and the potential for fraudulent activities within the industry create a trust deficit, potentially discouraging consumers from engaging with legitimate providers. The market is characterized by intense competition, with many companies vying for customers, creating price pressures and necessitating constant innovation to maintain a competitive edge. Furthermore, the effectiveness of credit repair services can vary significantly depending on the individual's specific credit situation, leading to customer dissatisfaction if unrealistic expectations are not managed effectively. Lastly, the fluctuating economic environment and associated changes in lending practices can indirectly impact the demand for credit repair services, resulting in market volatility.

The online personal credit repair service segment is poised to dominate the market in the forecast period. This is driven by:

Increased accessibility: Online services eliminate geographical barriers, making credit repair accessible to a wider audience.

Convenience and affordability: Online platforms often offer more competitive pricing and greater convenience than traditional offline services.

Technological advancements: The integration of AI and automation improves efficiency and accuracy, leading to faster turnaround times and better results.

Data-driven approach: Online platforms can leverage data analytics to personalize services and optimize strategies for individual clients.

North America and Western Europe are expected to lead geographically due to:

While the personal application segment currently holds the largest market share, the family segment shows significant growth potential:

In summary, the combination of online delivery and the family application segment is projected to create a powerful synergy, driving a significant portion of market growth in the coming years. This segment benefits from the scale and affordability of online services while tapping into the burgeoning demand from families looking to improve their overall financial health.

Several factors will act as catalysts for further market growth. Firstly, advancements in artificial intelligence and machine learning will enhance the efficiency and accuracy of credit repair processes. Secondly, increased financial literacy initiatives will improve consumer awareness of the value of good credit, boosting demand. Thirdly, the continued development and refinement of online platforms will broaden accessibility and convenience. Lastly, strategic partnerships between credit repair companies and financial institutions will expand the reach and impact of these vital services.

(Note: Many companies lack readily accessible, single global websites. The list above reflects the named companies.)

This report provides a detailed analysis of the personal credit repair service market, offering invaluable insights for businesses, investors, and policymakers. The comprehensive scope encompasses market sizing, segmentation, competitive analysis, and growth forecasts, enabling stakeholders to make well-informed decisions in this dynamic and rapidly evolving sector. By analyzing both the current market landscape and future trends, this report empowers informed strategic planning and investment decisions, facilitating success within the personal credit repair industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.71% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 14.71%.

Key companies in the market include The Credit Pros, Credit Saint, Lexington Law, Sky Blue Credit, Pierre Roy, The Credit People, Ovation Credit Repair, Credit Versio, Credito, Investopedia, CreditRepair, SafePort Law, Pinnacle Credit Repair, Credit Firm, MSI Credit, AMB Credit Consultants, Pyramid Credit Repair, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Personal Credit Repair Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Personal Credit Repair Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.