1. What is the projected Compound Annual Growth Rate (CAGR) of the Personal Credit Repair Service?

The projected CAGR is approximately 14.71%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Personal Credit Repair Service

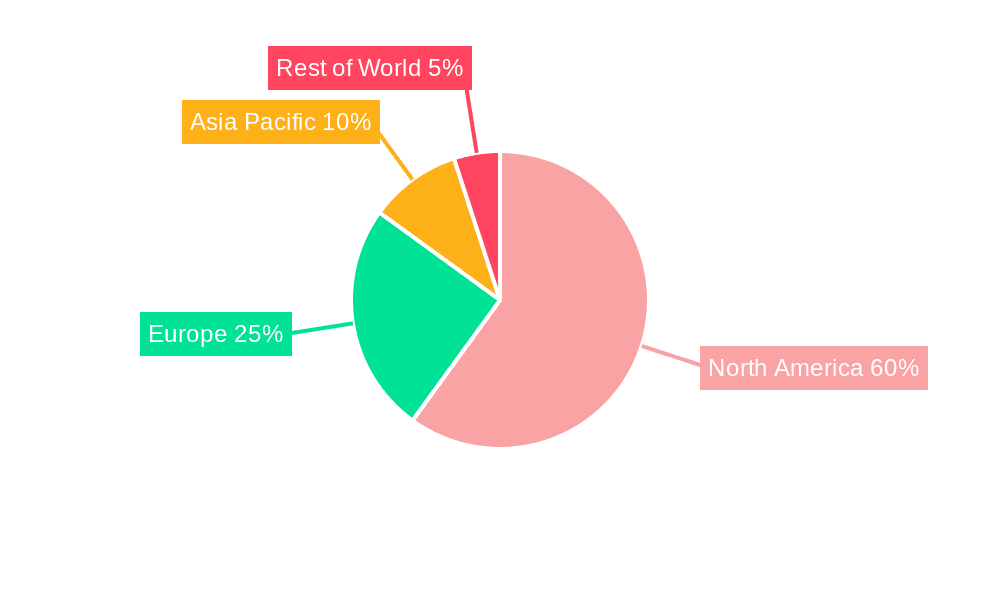

Personal Credit Repair ServicePersonal Credit Repair Service by Type (Online Service, Offline Service), by Application (Personal, Family), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

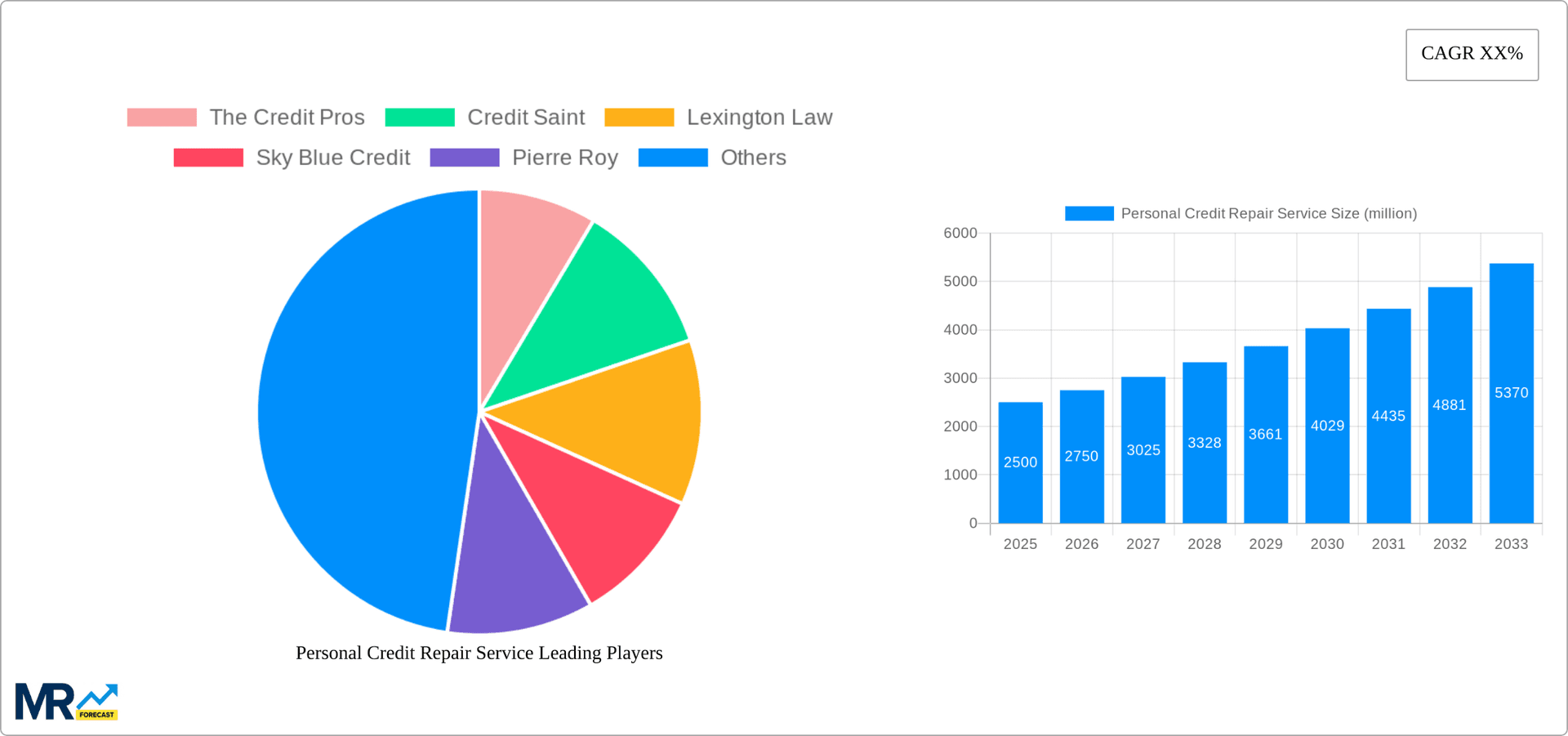

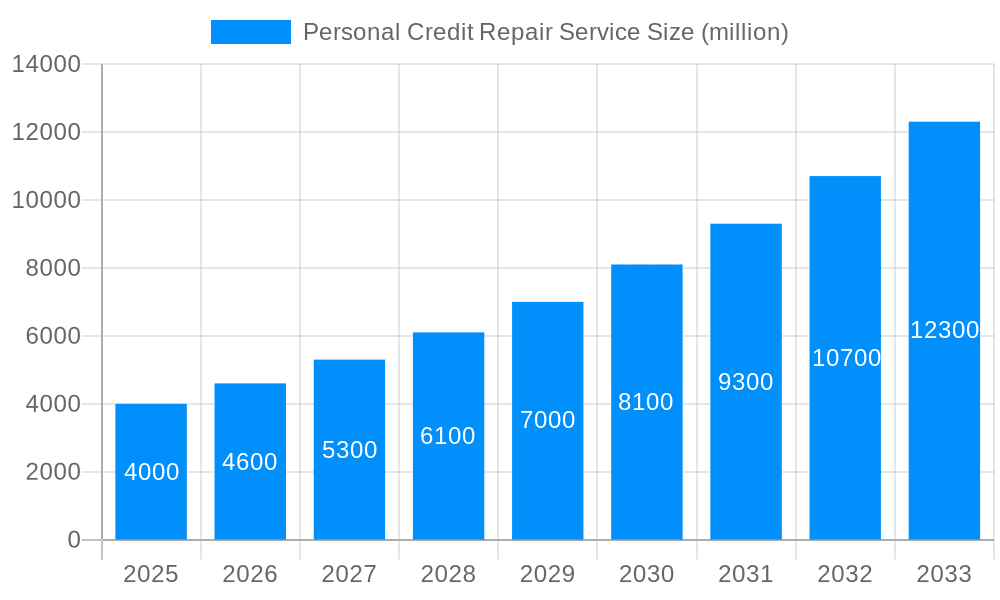

The personal credit repair service market is experiencing robust growth, driven by increasing consumer debt, stricter lending criteria, and a growing awareness of the importance of credit scores for financial well-being. The market is segmented by service delivery (online vs. offline) and user type (personal vs. family). While precise market sizing data is unavailable, a reasonable estimate based on industry reports and the stated CAGR suggests a 2025 market size of approximately $2.5 billion USD for the personal credit repair segment alone. This estimate considers the substantial market penetration of online services and the rising demand for professional assistance in navigating complex credit repair processes. The significant number of companies operating in this sector further indicates a vibrant and competitive marketplace. Growth is propelled by the increasing adoption of online credit repair platforms offering convenience and accessibility, along with the expanding awareness of credit repair services through targeted digital marketing campaigns.

However, challenges remain. The market faces regulatory scrutiny and consumer skepticism regarding the effectiveness of credit repair services. Furthermore, competition is fierce, leading to price wars and the need for providers to constantly innovate and differentiate their offerings. Future growth will likely depend on factors such as regulatory changes, the evolving economic landscape, consumer trust, and the continuous development of user-friendly and effective online platforms. Geographic expansion into emerging markets, particularly in Asia and parts of Africa where financial literacy and credit awareness are on the rise, represents a considerable opportunity for continued expansion. Focusing on tailored services that address specific credit challenges and transparent pricing strategies will be crucial for sustained success in the personal credit repair sector.

The personal credit repair service market, valued at $XXX million in 2025, is projected to experience significant growth throughout the forecast period (2025-2033). The historical period (2019-2024) witnessed a steady increase in demand, driven primarily by rising consumer debt, stricter lending criteria, and increased awareness of credit scores' impact on financial well-being. The market's growth is fueled by a confluence of factors, including the increasing accessibility of online credit repair services, growing consumer financial literacy, and the rise of innovative technological solutions aimed at simplifying the credit repair process. This trend is further amplified by the increasing number of individuals seeking to improve their creditworthiness for major financial decisions like purchasing a home or obtaining a car loan. While the online segment currently dominates, offline services remain crucial, particularly for individuals requiring personalized guidance and support. The family application segment is showcasing robust growth as families strive for collective financial health. The competitive landscape is dynamic, with established players and new entrants vying for market share through strategic partnerships, technological advancements, and aggressive marketing campaigns. The industry is characterized by both consolidation and diversification, leading to a more sophisticated and nuanced service offering. Future growth will be significantly influenced by regulatory changes, technological innovations, and evolving consumer preferences.

Several key factors are propelling the growth of the personal credit repair service market. Firstly, the ever-increasing burden of consumer debt in many developed and developing nations necessitates professional assistance in managing and improving credit scores. Secondly, the rising awareness of the importance of credit scores in accessing various financial products (loans, mortgages, credit cards) is encouraging more individuals to actively seek credit repair services. Thirdly, technological advancements are making credit repair more accessible and convenient through user-friendly online platforms and automated processes. The proliferation of online resources, including educational materials and comparative tools, also empower consumers to make informed decisions regarding their credit health. Moreover, the growing financial literacy among younger generations contributes to the market's expansion, as they recognize the long-term benefits of improving their credit profiles. Finally, a favorable regulatory environment, coupled with ongoing efforts to protect consumer rights, creates a supportive ecosystem for the credit repair industry to thrive and flourish.

Despite its growth trajectory, the personal credit repair service market faces significant challenges. Regulatory scrutiny and legal complexities surrounding credit repair practices represent a primary concern for companies operating in this sector. Maintaining transparency and adhering to strict ethical guidelines is paramount to avoiding legal issues and maintaining consumer trust. The industry is also plagued by instances of fraudulent or unethical practices, which can negatively impact consumer confidence and damage the reputation of legitimate providers. Competition is fierce, requiring companies to continuously innovate and differentiate their services to stay ahead. Furthermore, acquiring and retaining skilled credit repair professionals is a crucial challenge, particularly as demand for their expertise increases. Finally, the inherent complexities involved in credit repair, including navigating various credit bureaus and legal processes, can create challenges for both service providers and consumers.

Online Service Segment: The online segment is projected to dominate the market due to its convenience, accessibility, and cost-effectiveness. Online platforms can reach a wider customer base and offer competitive pricing compared to traditional offline services. The ease of access and the ability to manage the process remotely greatly enhances user experience. The speed and efficiency of online processes streamline the repair process, improving customer satisfaction. Increased technological advancements consistently improve the efficiency and effectiveness of online credit repair platforms.

Personal Application Segment: The personal application segment is the largest segment, driven by individual concerns regarding credit scores and financial well-being. Individuals seek credit repair services for personal reasons, including purchasing homes, securing loans, obtaining favorable interest rates, and improving their overall financial standing. Personal credit repair addresses individual needs in a targeted and efficient manner.

United States: The United States is expected to remain a key market due to its significant consumer debt levels and relatively developed credit repair industry. The established legal frameworks and consumer awareness concerning credit scores contribute to the market's robust growth within the US. The large consumer base with varying levels of credit health creates ample opportunities for credit repair services.

Other Developed Countries: Other developed countries with substantial consumer debt and credit-based financial systems will experience significant growth in the credit repair services market. These include countries in Western Europe, Canada, and Australia, where there is increasing awareness of the importance of good credit history.

The forecast shows a compelling trend toward greater adoption of online services and a continuing focus on individual needs within developed economies. This reflects the expanding demand for efficient and accessible solutions to manage credit health.

Several factors will continue to stimulate growth in the personal credit repair service industry. Technological advancements will lead to more efficient and automated processes, improving service delivery and customer satisfaction. Increasing financial literacy and the rising awareness of the importance of credit scores will drive greater demand for professional credit repair services. Furthermore, favorable regulatory environments in certain regions will support industry expansion and innovation. Lastly, strategic partnerships between credit repair companies and financial institutions will expand market reach and create new opportunities for growth.

(Note: Hyperlinks could not be provided due to the lack of universally accessible, single website links for all listed companies. Many companies have multiple online presences or lack a central website.)

This report provides a comprehensive analysis of the personal credit repair service market, covering historical trends, current market dynamics, and future growth projections. The report details key market drivers and restraints, profiles leading market players, analyzes various segments (online vs. offline, personal vs. family), and identifies key regional trends. The market forecast, based on rigorous data analysis and expert insights, will enable stakeholders to make informed decisions regarding their investment and business strategies within this dynamic and growing market. It offers valuable insights for credit repair companies, investors, financial institutions, and policymakers alike.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.71% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 14.71%.

Key companies in the market include The Credit Pros, Credit Saint, Lexington Law, Sky Blue Credit, Pierre Roy, The Credit People, Ovation Credit Repair, Credit Versio, Credito, Investopedia, CreditRepair, SafePort Law, Pinnacle Credit Repair, Credit Firm, MSI Credit, AMB Credit Consultants, Pyramid Credit Repair, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Personal Credit Repair Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Personal Credit Repair Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.