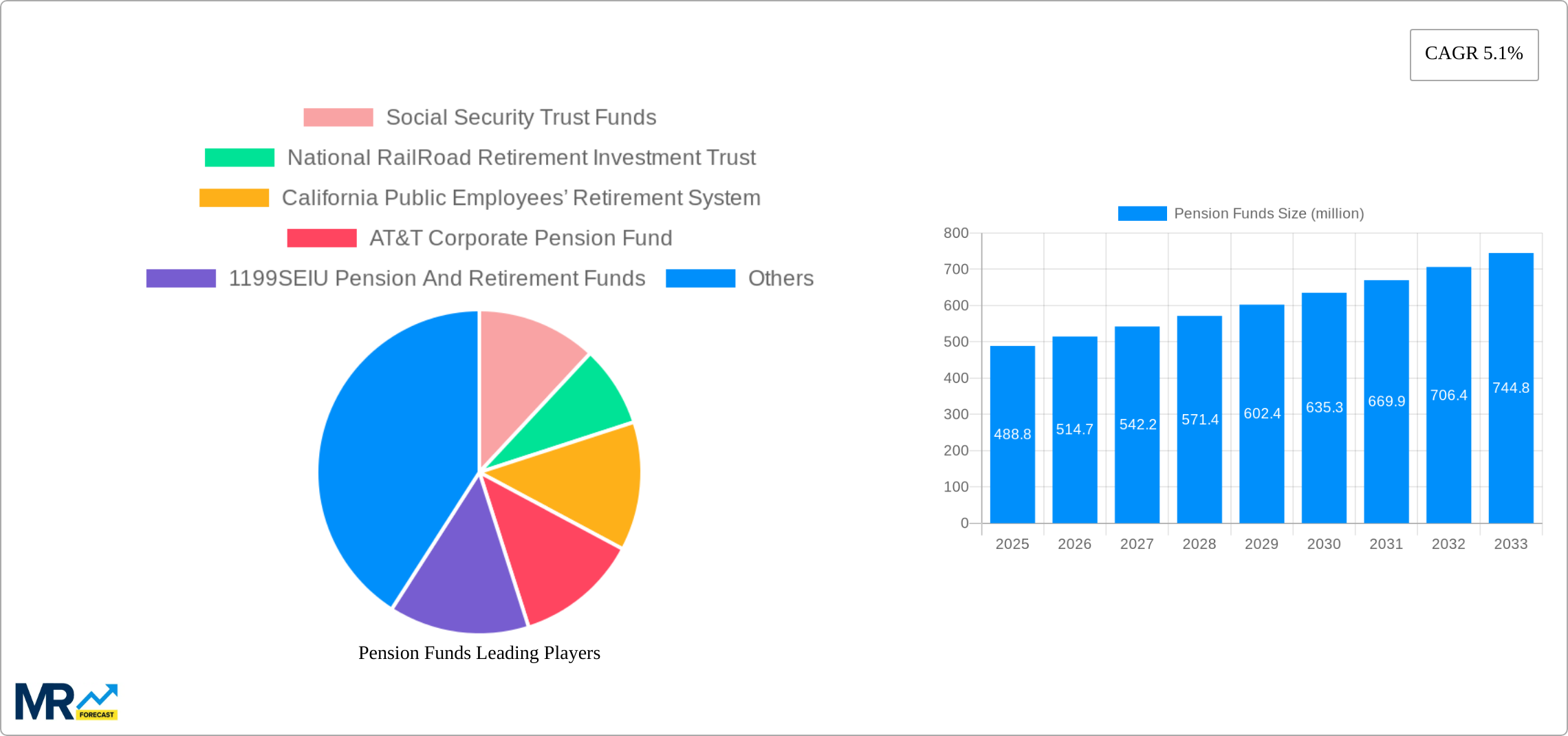

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pension Funds?

The projected CAGR is approximately 5.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pension Funds

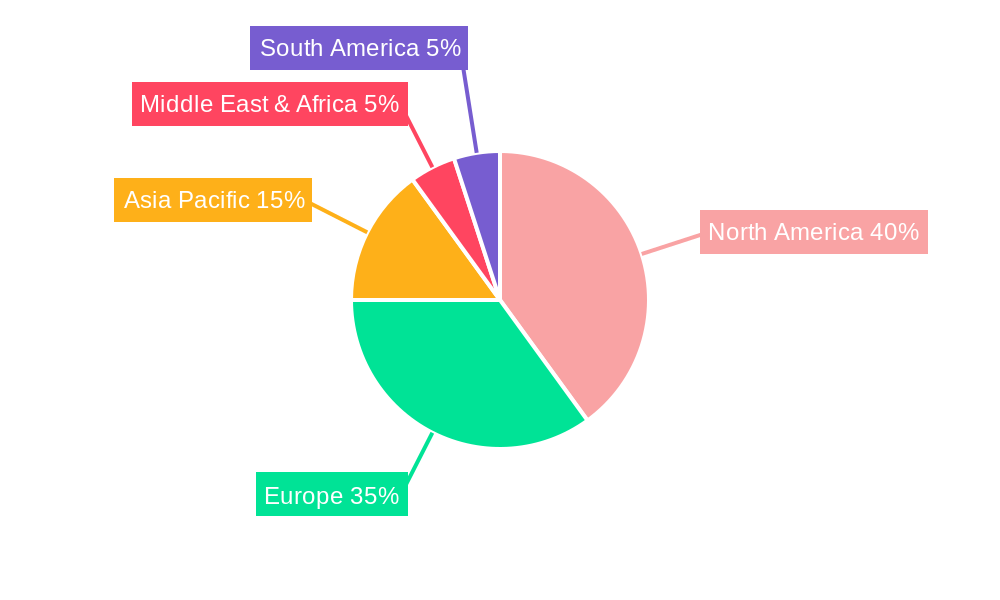

Pension FundsPension Funds by Application (Low-income Group, High-income Group), by Type (Distributed Contribution, Distributed Benefit, Reserved Fund), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

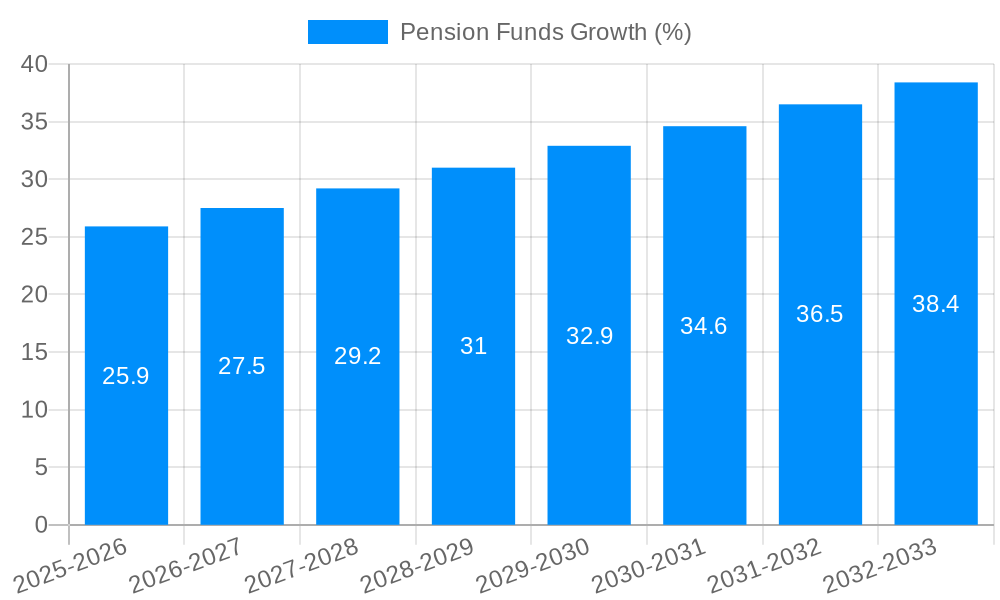

The global pension funds market, currently valued at $488.8 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.1% from 2025 to 2033. This expansion is driven by several key factors. Aging populations in developed nations necessitate larger pension fund allocations to meet retirement needs, while increased government regulations and the growing awareness of the importance of long-term financial planning are pushing both individuals and corporations to actively contribute to these funds. Furthermore, the diversification of investment strategies employed by pension funds, including shifts towards alternative assets such as private equity and infrastructure, is contributing to their overall growth trajectory. The market is segmented by application (low-income and high-income groups), reflecting varying levels of participation and contribution capacity. The type of pension fund also plays a significant role, with distributed contribution and distributed benefit schemes representing different models of retirement savings and payouts. Reserved funds, often set aside for specific contingencies, also constitute a notable segment. Geographic distribution reveals strong presence in North America and Europe, with emerging markets in Asia-Pacific showing significant growth potential. Competition amongst established players, including Social Security Trust Funds, national retirement investment trusts, and large corporate pension funds, is expected to intensify as the market matures.

The competitive landscape features both large, established players and a diverse range of smaller, specialized funds. This dynamic environment is shaping the development of innovative investment strategies and technological solutions aimed at improving efficiency, transparency, and accessibility. While challenges remain, including concerns about fund solvency in the face of evolving economic conditions and fluctuating market performance, the overall outlook for the pension funds market remains positive. Growth is anticipated to be driven by sustained demographic shifts, government policies promoting retirement savings, and the ongoing development of sophisticated investment management practices. The increasing adoption of technology, including data analytics and artificial intelligence, promises to further optimize fund management and enhance returns. Continued growth in emerging economies is expected to contribute to the expansion of this global market over the forecast period.

The global pension funds market is experiencing a period of significant transformation, driven by demographic shifts, evolving investment strategies, and regulatory changes. Over the historical period (2019-2024), we observed moderate growth, with assets under management (AUM) fluctuating due to market volatility and varying investment returns across different fund types. The base year 2025 shows a consolidation of this trend, with some sectors exhibiting stronger performance than others. For instance, funds catering to high-income groups demonstrated resilience against market downturns, primarily due to their more diversified investment portfolios. In contrast, funds focusing on low-income groups experienced challenges in meeting their obligations, particularly those with a predominantly defined benefit structure. Looking ahead to the forecast period (2025-2033), the market is projected to see sustained, albeit moderate growth, primarily fueled by increasing contributions from both employers and employees, coupled with anticipated long-term market recovery. However, this growth trajectory will be influenced by various factors, including the effectiveness of government reforms aimed at bolstering the solvency of pension systems, the ongoing impact of low interest rates on investment returns, and the increasing adoption of sophisticated investment strategies like ESG (environmental, social, and governance) investing. The estimated AUM for 2025 is projected to be in the trillions, with a compound annual growth rate (CAGR) expected to be within the range of 3-5% during the forecast period, though this projection is subject to ongoing economic and political uncertainties. The shift towards defined contribution plans is also noteworthy, as individuals are increasingly responsible for managing their own retirement savings. This trend, however, poses challenges for low-income groups who might lack the financial literacy and resources to manage their investments effectively. Therefore, while overall growth is anticipated, understanding the nuanced performance across different segments and addressing potential systemic risks remains crucial.

Several key factors are driving growth within the pension funds market. Firstly, the aging global population is leading to an increased demand for retirement income security, necessitating larger pension fund reserves. This is particularly pronounced in developed economies with longer life expectancies. Secondly, the rise in government regulations designed to ensure the long-term solvency and stability of pension plans is creating a more secure investment environment, attracting greater participation from both institutional and individual investors. Thirdly, the increasing adoption of sophisticated investment strategies, including alternative investments such as private equity and real estate, offers pension funds greater diversification and potential for higher returns. Technological advancements, such as the use of big data analytics and AI in portfolio management, also play a significant role in improving investment outcomes. Furthermore, the growth of ESG investing is becoming a major driver, as pension funds increasingly incorporate environmental, social, and governance considerations into their investment decisions. This reflects a growing awareness of the long-term sustainability implications of investments and a desire to align investments with societal values. Finally, the ongoing consolidation within the pension fund management industry is leading to greater efficiency and economies of scale, further bolstering growth.

Despite the positive growth outlook, the pension funds market faces several significant challenges. Low interest rate environments persistently impact the ability of defined benefit plans to meet their long-term obligations, as investment returns are compressed. Market volatility, driven by global economic uncertainty and geopolitical events, poses a significant risk to investment portfolios, causing fluctuations in fund values and potentially impacting the retirement security of beneficiaries. Demographic shifts, such as declining birth rates and increased life expectancies in many countries, create an imbalance between contributors and beneficiaries, placing pressure on the solvency of existing pension systems. Furthermore, the increasing complexity of regulatory frameworks adds to the administrative burden and costs for pension fund managers. Finally, the rising cost of healthcare and other retirement-related expenses is increasing the financial strain on pension funds, requiring innovative strategies to manage these escalating costs. Addressing these challenges will require a concerted effort from policymakers, fund managers, and individuals to ensure the long-term sustainability of pension systems.

The Distributed Benefit segment is poised to dominate the market during the forecast period (2025-2033). While defined contribution plans are growing in popularity, defined benefit plans, especially those catering to high-income groups, continue to hold significant market share. This is because defined benefit plans often offer greater security and predictability for retirees, particularly those who prefer a guaranteed income stream. High-income groups, due to their ability to contribute larger amounts, often benefit the most from these plans' long-term accumulation capabilities.

High-income Group Dominance: High-income individuals have greater capacity for higher contributions and often benefit from higher investment returns due to the higher-risk, higher-reward investment strategies employed by their plans. This segment demonstrates significant resilience to market downturns due to its robust asset base and ability to weather economic shocks more effectively.

Geographical Distribution: North America and Europe are expected to continue to be dominant regions for the distributed benefit model due to the established nature of the pension funds landscape and well-developed financial markets in these regions. The presence of large established companies with comprehensive employee benefit plans and a strong legacy of defined benefit schemes contributes to this dominance. However, emerging markets are seeing significant growth in their pension fund sectors, though often at a slower rate of growth due to various economic and regulatory factors.

Market Share: While exact market share percentages for distributed benefit plans within the high-income group vary, industry analysts estimate that this segment accounts for a considerable portion of the overall pension funds market, potentially exceeding 50% in developed countries. This dominance will likely persist throughout the forecast period, driven by the key factors mentioned earlier.

Future Trends: The distributed benefit segment within the high-income group is expected to see steady growth driven by continued high contribution rates, strong investment performance, and regulatory support designed to strengthen the solvency of these plans. However, the inherent risk associated with guaranteed income streams is prompting some innovation within this segment. We anticipate a movement toward more dynamic benefit structures and the incorporation of longevity risk management techniques in an attempt to meet the obligations to retirees with increasing lifespans.

Several factors are driving the growth of the pension funds industry. Increased government regulations promoting retirement savings are boosting contributions. Technological advancements enable better risk management and investment strategies. Growing awareness of the importance of long-term financial security and the rise of ESG investing are also positive catalysts. Finally, ongoing industry consolidation leads to efficiency and reduces operational costs.

This report provides a comprehensive overview of the global pension funds market, analyzing historical trends, current market dynamics, and future projections. It covers key segments, regional breakdowns, leading players, and significant industry developments, offering valuable insights for investors, policymakers, and pension fund professionals alike. The detailed analysis presented in this report facilitates a clear understanding of the growth opportunities, challenges, and future prospects within this critical sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.1%.

Key companies in the market include Social Security Trust Funds, National RailRoad Retirement Investment Trust, California Public Employees’ Retirement System, AT&T Corporate Pension Fund, 1199SEIU Pension And Retirement Funds, National Eletrical Benefit Fund*, .

The market segments include Application, Type.

The market size is estimated to be USD 488.8 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Pension Funds," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pension Funds, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.