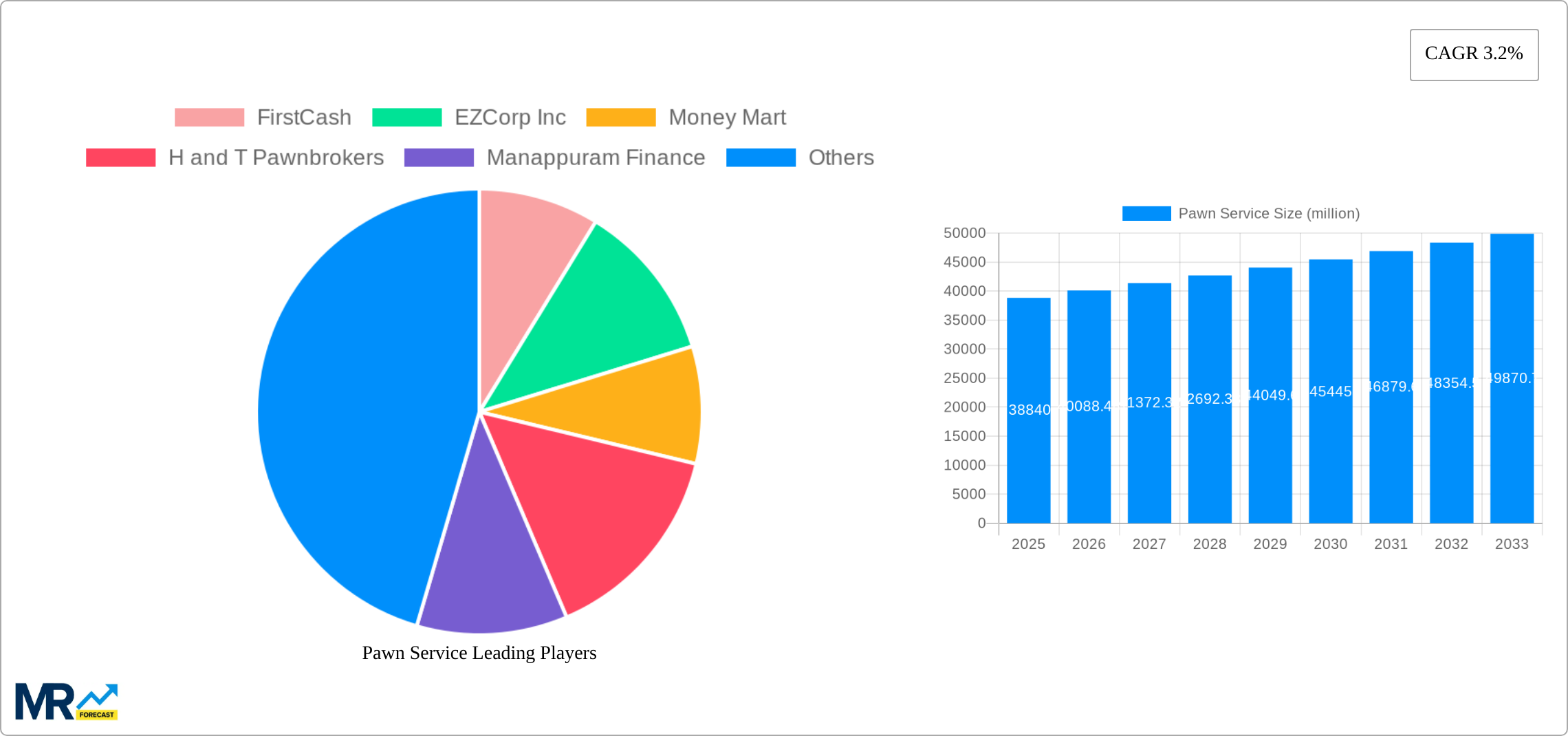

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pawn Service?

The projected CAGR is approximately 3.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Pawn Service

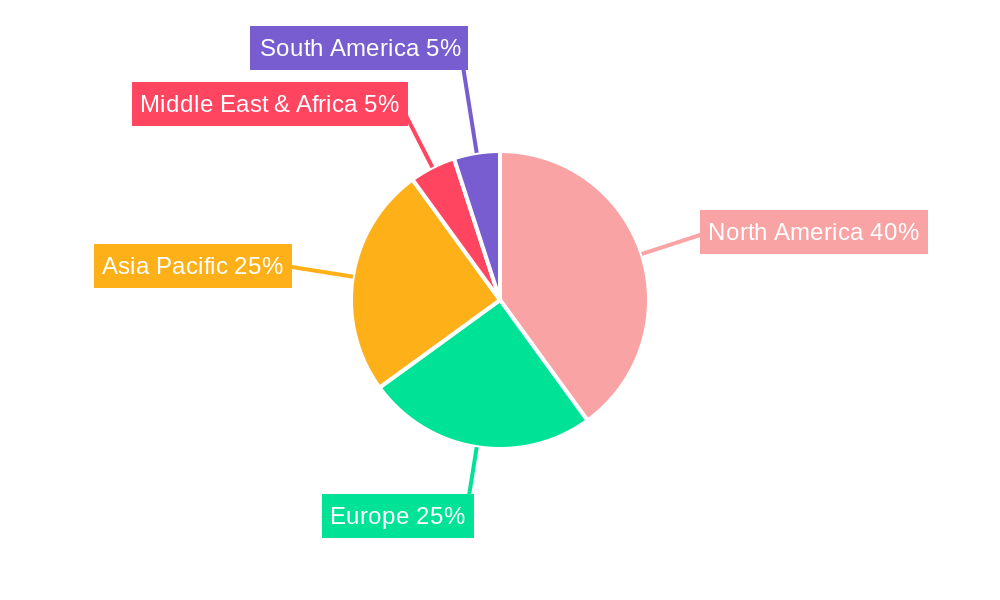

Pawn ServicePawn Service by Type (Real Estate, Automotive, Jewelry, Electronics, Collectibles, Others), by Application (Pawn Service Charges, Merchandise Sales, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

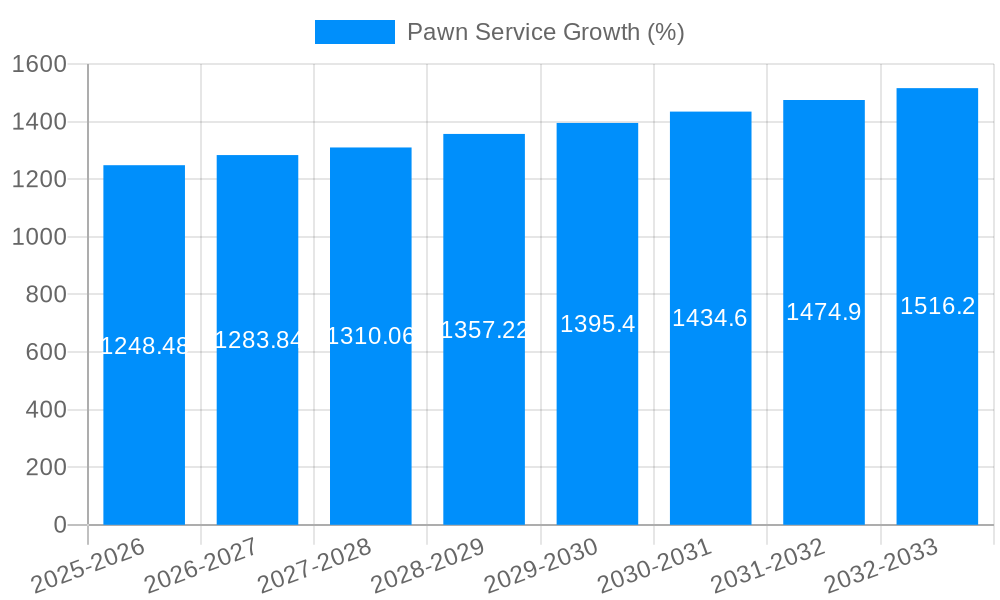

The global pawn service market, valued at $38.84 billion in 2025, is projected to experience steady growth, driven by a compound annual growth rate (CAGR) of 3.2% from 2025 to 2033. This growth is fueled by several key factors. Increasing financial insecurity and the need for quick access to cash, especially among lower- and middle-income households, are significant drivers. The rise of online pawnbroking platforms offers greater convenience and accessibility, expanding the market reach beyond traditional brick-and-mortar locations. Furthermore, diversification of pledged assets beyond traditional jewelry and electronics, encompassing collectibles and even real estate in some markets, contributes to market expansion. The market segmentation reveals a significant portion attributed to pawn service charges, reflecting the core business model, with merchandise sales contributing a substantial secondary revenue stream.

However, the market faces certain constraints. Stringent regulations and licensing requirements in various jurisdictions can limit market expansion and create barriers to entry for new players. Economic downturns and fluctuations in consumer spending patterns also impact demand for pawn services. Competition among established players, including both large international corporations and smaller local businesses, is intense, leading to price wars and impacting profitability in certain segments. Nevertheless, the ongoing need for accessible short-term financing, coupled with the increasing adoption of innovative technology, suggests a positive outlook for the pawn service market's sustained growth throughout the forecast period. Geographical distribution indicates robust activity in North America and Asia-Pacific regions, which are expected to retain significant market share in the coming years.

The global pawn service market exhibited robust growth throughout the historical period (2019-2024), exceeding XXX million units. This upward trajectory is projected to continue throughout the forecast period (2025-2033), driven by a confluence of factors including increasing consumer demand for short-term, readily accessible credit, economic instability in certain regions, and the evolving role of pawn shops as legitimate financial service providers. The estimated market value in 2025 sits at XXX million units, showcasing a steady climb. While traditional pawnbroking remains central, the industry is undergoing a significant transformation. Digital platforms and online lending options are starting to emerge, blurring the lines between traditional brick-and-mortar operations and more tech-savvy approaches. This digitalization isn't just changing how transactions are conducted; it's also influencing the types of collateral accepted, with a growing trend toward accepting a wider range of assets, beyond the traditional jewelry and electronics. Furthermore, the shift in consumer behavior, particularly among younger demographics who are more comfortable with online transactions, is pushing pawnbrokers to adapt and innovate their business models, leading to a more competitive and dynamic market landscape. This evolution, coupled with strategic expansion into underserved markets and the incorporation of value-added services, is solidifying the pawn service industry's position as a significant player in the global financial services sector. The market is witnessing increasing consolidation with larger players acquiring smaller firms, further shaping the competitive landscape and influencing future growth trajectories. The growing awareness of pawn shops as a viable alternative to traditional lending institutions among financially marginalized populations has also contributed significantly to the market’s expansion.

Several key factors are fueling the growth of the pawn service market. Firstly, the persistent economic uncertainty and fluctuating income levels in various parts of the world have led to increased demand for quick and accessible credit options. Pawn shops offer a relatively straightforward and immediate solution compared to traditional banking institutions, particularly for individuals with poor credit history or limited access to formal financial services. Secondly, the expanding acceptance of pawn shops as a legitimate and regulated financial service provider is also contributing to the industry's growth. This shift in perception is driven by increased transparency and regulatory compliance within the sector, enhancing consumer confidence. Furthermore, the diversification of accepted collateral beyond traditional items like jewelry and electronics, now encompassing things like collectibles and even certain types of real estate in some regions, has broadened the market’s appeal. The innovation within the sector, particularly the rise of online pawnbroking platforms, also contributes to its growth, making access to services even more convenient. Finally, effective marketing and targeted advertising campaigns by prominent players are contributing to increased brand awareness and wider adoption of pawn services among diverse population segments.

Despite the robust growth, the pawn service industry faces several challenges. Regulatory hurdles vary considerably across different regions, creating inconsistencies and complexities for businesses operating internationally. This regulatory landscape, often characterized by stringent requirements around interest rates, loan terms, and collateral valuation, presents operational and financial burdens. Furthermore, the industry's reputation, still associated by some with negative connotations, presents a persistent challenge, requiring ongoing efforts to build consumer trust and foster positive brand perception. Competition is also intensifying, not only from established players but also from emerging fintech companies offering similar short-term loan services. The high risk of default and the need for robust loss mitigation strategies also pose significant operational challenges. The potential for fraud and the need for secure storage and handling of valuable collateral add to the overall operational complexity and cost. Finally, fluctuations in the value of collateral, particularly in response to market trends for certain commodities like precious metals or electronics, presents a significant challenge in accurately assessing collateral value and managing risks associated with loan defaults.

The jewelry segment is expected to dominate the pawn service market throughout the forecast period. This dominance stems from the consistent liquidity and inherent value associated with precious metals and gemstones. Jewelry's consistent demand in both primary and secondary markets makes it a reliable collateral for pawnbrokers, leading to higher transaction volumes compared to other segments.

Geographically, emerging economies in Asia, particularly India and China, are poised to witness significant growth in the jewelry pawnbroking segment. These regions have strong cultural traditions associated with gold and other precious metals, alongside a robust informal economy where pawn shops often fill a crucial financial gap.

While other segments, like electronics and automotive, contribute to the market, their inherent depreciation and susceptibility to technological obsolescence make them comparatively less reliable and less desirable as collateral. The relatively high transaction costs associated with these segments (e.g., verification and appraisal) also contribute to their lower market share compared to jewelry.

The pawn service industry's growth is further catalyzed by the increasing financial inclusion initiatives in several developing nations. These initiatives aim to provide access to financial services to underserved populations, and pawn shops frequently fill this void by providing quick, accessible loans to individuals without traditional banking access. The ongoing technological advancements, specifically the introduction of online platforms and digital lending solutions, are streamlining operations, reducing costs, and expanding market reach. Finally, stricter regulations and better compliance across the sector are enhancing consumer confidence, contributing to the overall growth.

This report provides a detailed analysis of the pawn service market, projecting significant growth driven by increasing demand for quick credit, technological advancements, and expanding financial inclusion efforts. The report offers invaluable insights for businesses looking to enter this dynamic market or for existing players seeking to optimize their strategies. It provides in-depth segment analysis, emphasizing the dominance of the jewelry segment and regional breakdowns highlighting key growth opportunities in emerging markets.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.2% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.2%.

Key companies in the market include FirstCash, EZCorp Inc, Money Mart, H and T Pawnbrokers, Manappuram Finance, Cash Canada, Maxi-Cash, Daikokuya, Grüne, Speedy Cash, Aceben, Sunny Loan Top, China Art Financial, Huaxia Pawnshop, Boroto, Muthoot Finance, .

The market segments include Type, Application.

The market size is estimated to be USD 38840 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Pawn Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Pawn Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.