1. What is the projected Compound Annual Growth Rate (CAGR) of the Passenger Carrying Vehicle Insurance?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Passenger Carrying Vehicle Insurance

Passenger Carrying Vehicle InsurancePassenger Carrying Vehicle Insurance by Application (Heavy Vehicles, Light Vehicles), by Type (Passenger Accident Insurance, Vehicle Accident Insurance), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

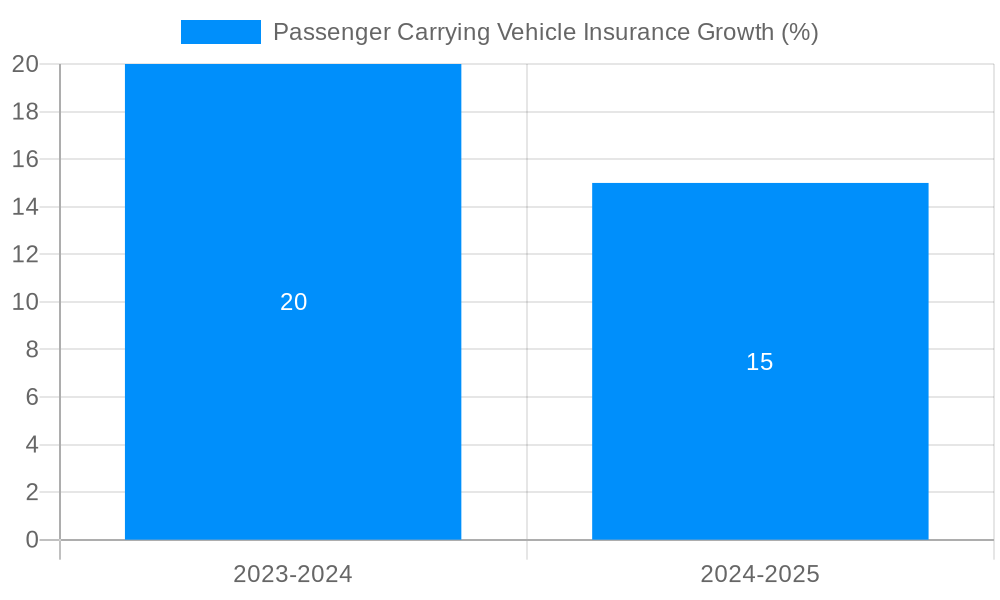

The Passenger Carrying Vehicle Insurance market is projected to grow at a CAGR of XX% during the forecast period (2025-2033). The market is driven by the growing number of passenger vehicles on the road, increasing awareness of insurance coverage, and rising disposable income in developing countries. However, factors such as the high cost of insurance premiums, economic downturn, and regulatory challenges are expected to restrain market growth.

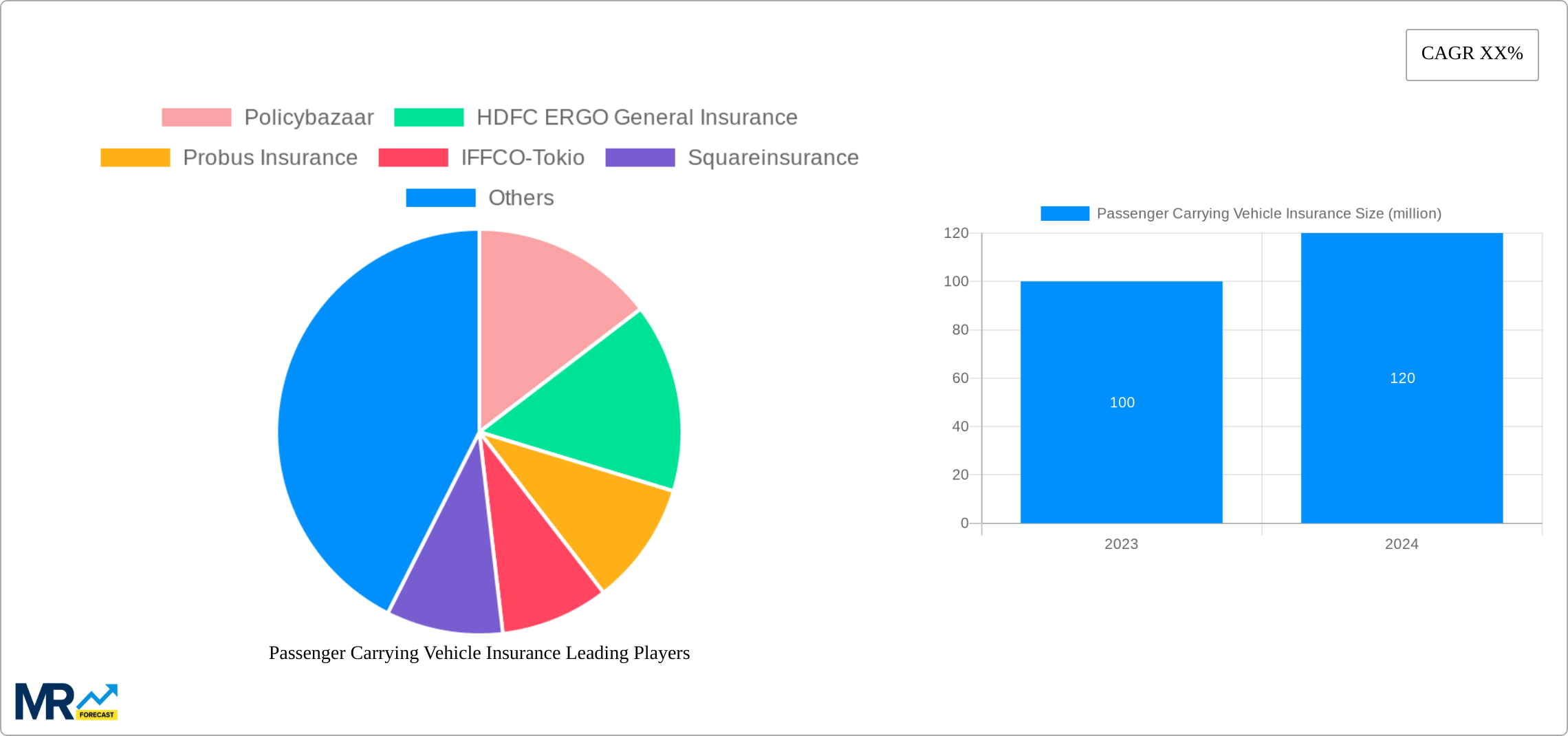

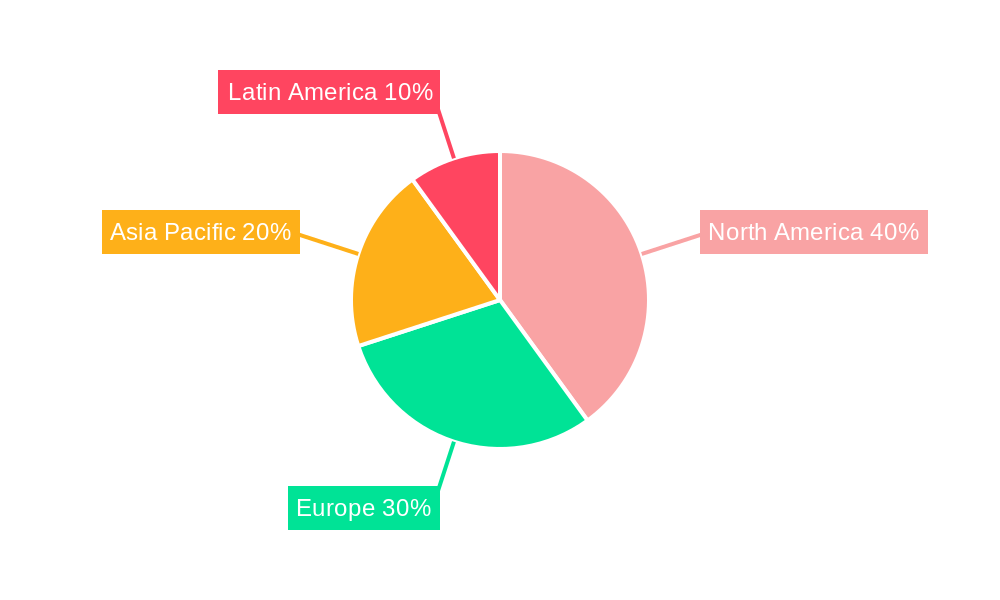

Key trends shaping the market include the increasing popularity of telematics-based insurance, the emergence of usage-based insurance (UBI) models, and the growing adoption of artificial intelligence (AI) in insurance underwriting and claims processing. Regional analysis indicates that North America and Europe are mature markets with high insurance penetration rates, while Asia Pacific and Middle East & Africa are emerging markets with significant growth potential. Prominent companies operating in the Passenger Carrying Vehicle Insurance market include Policybazaar, HDFC ERGO General Insurance, Probus Insurance, IFFCO-Tokio, Squareinsurance, SMC Insurance, Kotak General Insurance, Beemawala, Raheja QBE, and PolicyLobby.

The passenger carrying vehicle insurance market is experiencing steady growth, driven by increasing vehicle ownership rates and stringent government regulations. The global passenger carrying vehicle insurance market size was valued at USD 153.56 billion in 2021 and is expected to grow to USD 214.78 billion by 2028, expanding at a CAGR of 4.5% over the forecast period. Key market insights include:

The passenger carrying vehicle insurance industry is propelled by several key factors:

The passenger carrying vehicle insurance industry also faces some challenges and restraints:

This comprehensive report provides an in-depth analysis of the passenger carrying vehicle insurance industry, covering key market insights, driving forces, challenges, growth catalysts, leading players, and significant developments. It offers a valuable resource for insurance companies, industry stakeholders, investors, and researchers seeking to understand the dynamics and future prospects of this sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Policybazaar, HDFC ERGO General Insurance, Probus Insurance, IFFCO-Tokio, Squareinsurance, SMC Insurance, Kotak General Insurance, Beemawala, Raheja QBE, PolicyLobby.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Passenger Carrying Vehicle Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Passenger Carrying Vehicle Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.