1. What is the projected Compound Annual Growth Rate (CAGR) of the Parallel Artificial Membrane Permeability Assay?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Parallel Artificial Membrane Permeability Assay

Parallel Artificial Membrane Permeability AssayParallel Artificial Membrane Permeability Assay by Type (Caco-2 Cultures, Gastrointestinal Tract, Blood–brain Barrier, Skin), by Application (Drug Discovery, Cosmetic Research, Toxicology Research, Drug Delivery Research), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Parallel Artificial Membrane Permeability Assay (PAMPA) market is experiencing robust growth, driven by the increasing demand for efficient and cost-effective drug discovery and development tools. The market's expansion is fueled by several key factors: the rising prevalence of chronic diseases necessitating new drug development, the increasing adoption of high-throughput screening methods in pharmaceutical and cosmetic research, and the growing need for accurate prediction of drug absorption and permeability. The diverse applications of PAMPA across various research areas, including drug discovery, cosmetic research, toxicology studies, and drug delivery research, contribute significantly to its market size. Segments like Caco-2 cultures and the blood-brain barrier assays are particularly significant due to their relevance in assessing drug bioavailability and central nervous system penetration. While the exact market size for 2025 requires further investigation, considering the global scale of pharmaceutical and biotechnology research, a reasonable estimate based on typical market growth within this niche would place it in the range of $250-300 million. This estimation factors in the reported CAGR and the sustained high demand for reliable in-vitro permeability assays. The market is expected to show a steady growth trajectory over the next decade, driven primarily by technological advancements in assay design and the increasing integration of PAMPA within larger drug development pipelines.

Competition in the PAMPA market is relatively fragmented, with several key players offering a range of services and products. These companies are focused on providing high-quality assays, supporting services, and efficient data analysis tools. Continued technological advancements, such as improved membrane models and automated systems, are expected to drive innovation and market expansion. However, limitations such as the inability to fully replicate in-vivo conditions and the potential for inter-assay variability represent challenges. Overcoming these challenges through standardized protocols and enhanced experimental design will be crucial for maintaining the market's positive growth momentum. Geographic expansion, particularly in emerging markets with growing pharmaceutical industries, represents a significant growth opportunity for existing and new market entrants.

The parallel artificial membrane permeability assay (PAMPA) market is experiencing robust growth, projected to reach USD 250 million by 2025 and exceeding USD 500 million by 2033. This significant expansion is driven by the increasing demand for efficient and high-throughput drug discovery and development tools. The pharmaceutical and cosmetic industries are increasingly adopting PAMPA as a crucial preliminary screening tool, enabling faster and cost-effective evaluation of drug candidates and cosmetic ingredients. The assay's ability to rapidly assess permeability across various biological barriers, including the gastrointestinal tract, blood-brain barrier, and skin, offers a significant advantage over traditional in vivo models. This is particularly important during the early stages of drug development where rapid screening of numerous compounds is vital to identify promising candidates. The historical period (2019-2024) witnessed a steady rise in PAMPA adoption, fueled by advancements in assay technology and a growing awareness of its benefits. This positive trend is expected to continue throughout the forecast period (2025-2033), with significant contributions from both established pharmaceutical giants and emerging biotech companies. The market is also witnessing increased interest in PAMPA applications beyond drug discovery, including cosmetic research, toxicology studies, and drug delivery research. This diversification of applications will further propel market growth and solidifies PAMPA's position as an indispensable tool in multiple sectors. The growing adoption of artificial intelligence and machine learning algorithms for data analysis in PAMPA assays is enhancing the efficiency and predictive power of the technology, contributing to its market expansion. Furthermore, the increasing outsourcing of preclinical research to contract research organizations (CROs) is further contributing to market growth.

The escalating demand for rapid and cost-effective drug discovery and development is the primary driver propelling the growth of the parallel artificial membrane permeability assay market. Traditional in vivo methods are time-consuming, expensive, and often require the use of animals. PAMPA offers a high-throughput alternative, allowing researchers to screen hundreds or even thousands of compounds in a significantly shorter time frame. This translates into reduced development costs and accelerated time-to-market for new drugs and cosmetic products. The increasing prevalence of chronic diseases globally is also fueling the demand for innovative drug therapies. The need to identify and develop effective drugs quickly necessitates the use of efficient screening technologies, with PAMPA emerging as a critical component. Moreover, the growing emphasis on regulatory compliance and the need for robust preclinical data to support drug approvals are driving the adoption of validated and reliable methods like PAMPA. Finally, continuous advancements in assay technology, including the development of more sophisticated artificial membranes that better mimic biological barriers, are improving the accuracy and predictive power of PAMPA. These ongoing technological advancements are ensuring that PAMPA remains a cutting-edge tool in drug discovery and development.

Despite the significant advantages of PAMPA, several challenges and restraints hinder its widespread adoption. One major challenge is the inherent limitations of artificial membranes in accurately mimicking the complex in vivo environment. While PAMPA provides a good approximation of permeability, it cannot fully capture the intricacies of biological barriers, such as the influence of transporters and metabolic enzymes. This limitation can affect the accuracy of permeability predictions, particularly for compounds that interact strongly with these biological factors. Another challenge is the lack of standardization across different PAMPA platforms and protocols. Variations in membrane composition, assay conditions, and data analysis methods can lead to discrepancies in permeability measurements between different laboratories, making comparisons difficult. The need for specialized equipment and expertise to perform PAMPA assays represents a significant barrier for smaller research groups and institutions with limited resources. The relatively high initial investment cost of purchasing equipment and setting up the assay can be prohibitive. Overcoming these challenges requires collaborative efforts to establish standardized protocols, develop more sophisticated artificial membranes, and make the technology more accessible to a broader range of researchers.

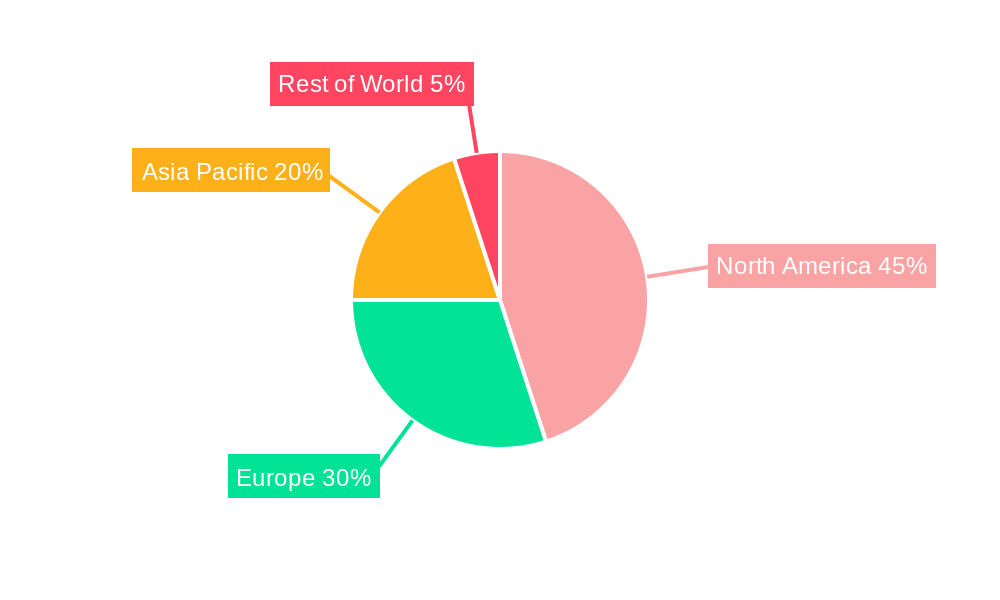

The North American market is projected to dominate the parallel artificial membrane permeability assay market during the forecast period (2025-2033), driven by a high concentration of pharmaceutical and biotechnology companies, robust research and development infrastructure, and significant investments in drug discovery and development. Europe is expected to follow closely, propelled by increasing pharmaceutical R&D investments and the presence of several leading CROs. The Asia-Pacific region is also anticipated to witness substantial growth, particularly in countries like China and India, owing to the rapidly expanding pharmaceutical and biotechnology industries and increasing outsourcing of drug development activities.

The growing adoption of PAMPA in drug delivery research is also significant, as the ability to accurately assess permeability is crucial for designing effective drug delivery systems. This includes targeted drug delivery systems and transdermal patches. Furthermore, the growing application of PAMPA in toxicology research, assessing the potential toxicity of compounds based on their ability to penetrate biological barriers, is expanding the assay’s market reach. The need for accurate, rapid, and cost-effective toxicity assessment fuels this segment.

The parallel artificial membrane permeability assay market is fueled by several catalysts, including the increasing demand for high-throughput screening in drug discovery, the development of advanced artificial membranes mimicking biological barriers more accurately, and the growing adoption of PAMPA in diverse applications beyond drug discovery, such as cosmetic and toxicology research. The rising prevalence of chronic diseases worldwide increases the urgency for developing new drug treatments, further driving market growth.

The parallel artificial membrane permeability assay market is poised for significant growth, driven by the ongoing need for efficient drug discovery and development methods. Technological advancements and the increasing adoption of PAMPA across diverse sectors ensure continued market expansion in the coming years. This report provides a comprehensive overview of market trends, growth drivers, challenges, and key players, offering valuable insights for stakeholders involved in this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Cyprotex, Creative Biolabs, Admescope, Creative Bioarray, Enamine, Sygnature Discovery, Aurigene Pharmaceutical Services, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Parallel Artificial Membrane Permeability Assay," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Parallel Artificial Membrane Permeability Assay, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.