1. What is the projected Compound Annual Growth Rate (CAGR) of the Paid Membership Supermarket?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Paid Membership Supermarket

Paid Membership SupermarketPaid Membership Supermarket by Type (Own Product, Purchased Product), by Application (Online Sales, Offline Sales), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

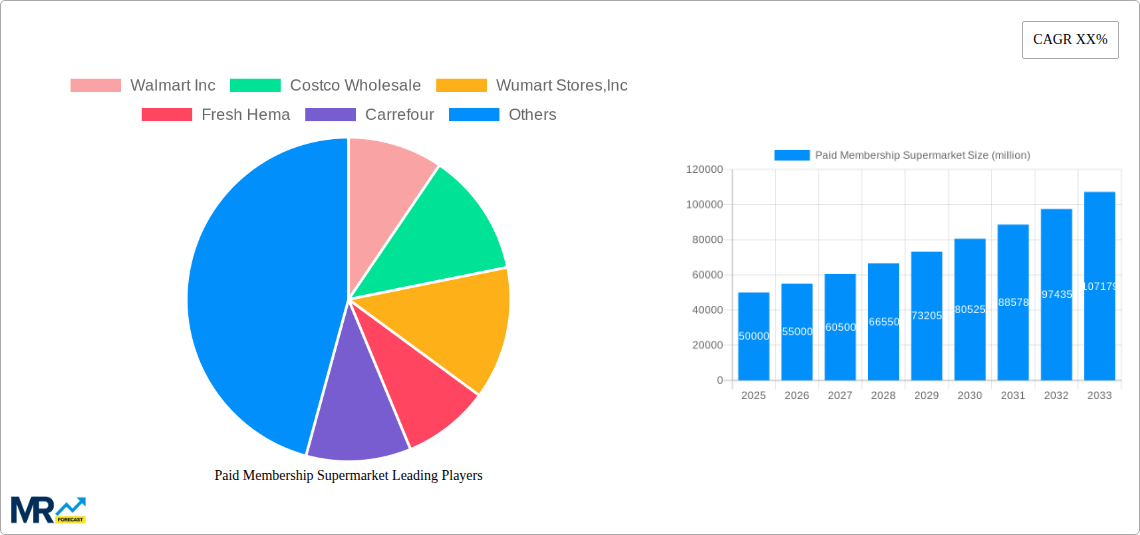

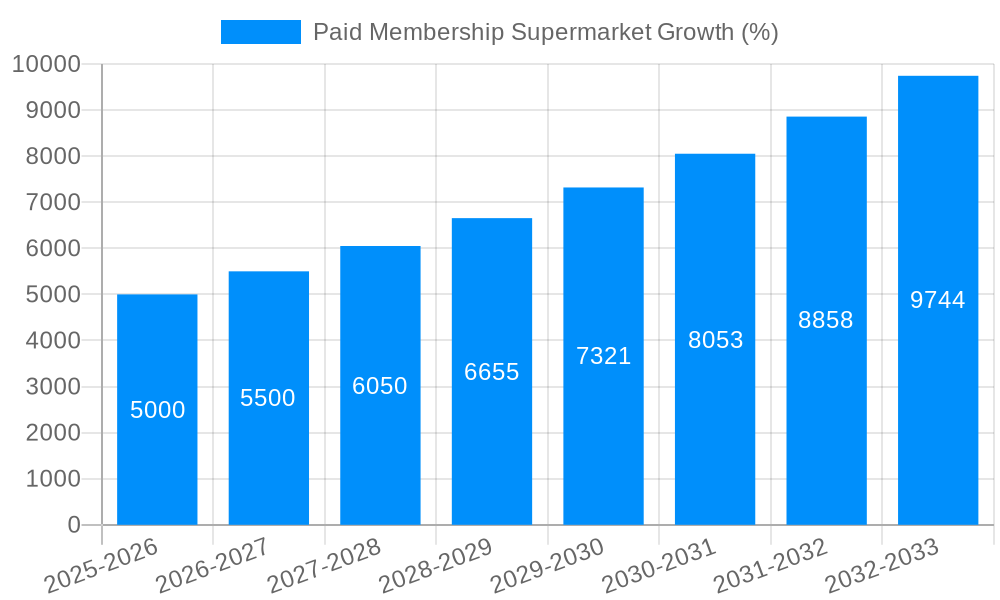

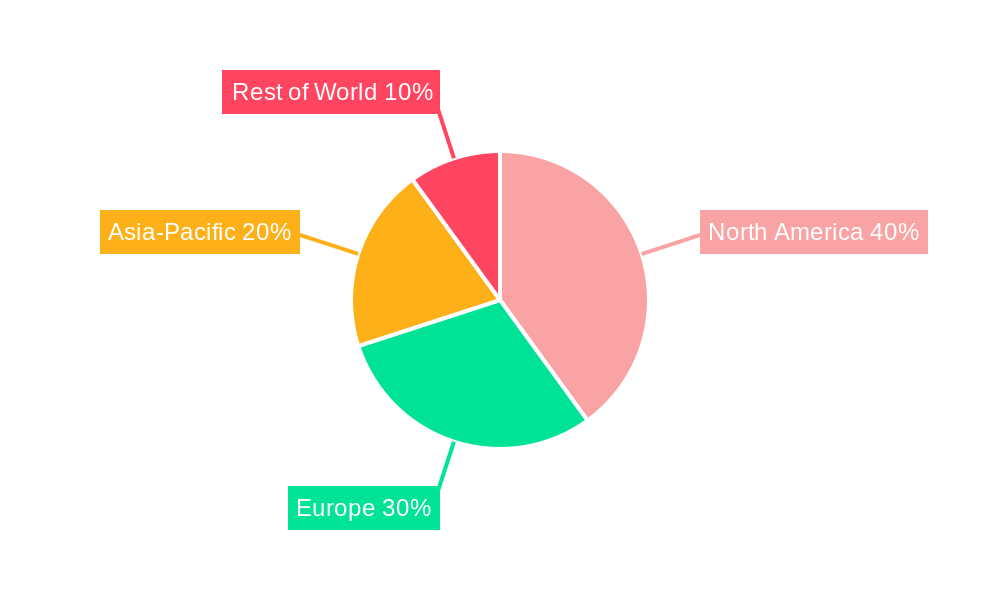

The paid membership supermarket market, while exhibiting significant growth potential, faces a complex landscape. The market size (XXX), with a CAGR of XX%, and a value of unit million, demonstrates substantial expansion, driven primarily by increasing consumer demand for convenience, value-added services (like exclusive discounts and priority access), and the growing popularity of online grocery shopping. Key trends shaping this market include the integration of technology (e.g., advanced inventory management, personalized recommendations, and seamless omnichannel experiences), the rise of private-label brands offering competitive pricing, and a heightened focus on sustainability and ethical sourcing. However, the market faces significant restraints including intense competition from established players like Walmart Inc., Costco Wholesale, and Carrefour, who are aggressively expanding their membership programs. High initial membership fees can be a barrier to entry for price-sensitive consumers, while operational challenges associated with managing inventory and logistics for both online and offline sales (segmented by application) across diverse product types (own and purchased products) significantly impact profitability. Geographic variations also exist, with North America and Asia Pacific (particularly China and India) representing key growth regions due to high population density and rising disposable incomes. The competitive landscape includes a mix of large multinational corporations and regional players, highlighting varied business models and customer acquisition strategies.

The market segmentation by product type (own vs. purchased) reveals distinct competitive dynamics. Companies like Costco excel with their own-brand products, achieving high profit margins while offering competitive pricing. Conversely, supermarkets offering a broader range of purchased products face tighter profit margins and are more susceptible to fluctuating supplier costs. Regional variations further complicate this picture, with consumer preferences and regulatory environments differing significantly across regions like North America (with a focus on convenience and speed), Europe (with an emphasis on sustainability and quality), and Asia Pacific (characterized by diverse consumer segments and rapid technological adoption). The study period (2019-2033), encompassing the historical (2019-2024), base (2025), and forecast (2025-2033) years, provides a comprehensive overview of market evolution. Successful players in this sector must effectively manage their supply chains, leverage technology for personalized experiences, and cultivate strong brand loyalty to overcome the challenges posed by high competition and consumer price sensitivity. The inclusion of players like Wumart Stores, Fresh Hema, and Yaodi Agricultural in the analysis indicates the significant presence of regional players particularly in the Asian market, each possessing unique strengths and strategies within their respective geographical markets.

The paid membership supermarket model is experiencing explosive growth, driven by a confluence of factors including changing consumer preferences, technological advancements, and the strategic maneuvering of major players. The market, currently valued in the tens of billions, is projected to experience substantial growth in the coming years, potentially reaching hundreds of billions within the next decade. This expansion is fueled by a rising demand for value-added services, exclusive discounts, and the convenience offered by both online and offline platforms. Consumers are increasingly willing to pay a membership fee for curated product selections, superior quality, and loyalty programs that offer tangible benefits beyond simple price reductions. The success of pioneers like Costco Wholesale has demonstrated the viability of this model, prompting other major retailers such as Walmart, Carrefour, and emerging Asian giants like Wumart Stores and Fresh Hema to enter or expand their presence in this lucrative sector. This competitive landscape is accelerating innovation, leading to enhanced digital experiences, personalized offers, and an ever-widening array of membership tiers catering to diverse consumer needs and budgets. The strategic integration of technology, such as advanced inventory management systems and personalized recommendation engines, further contributes to the sector's expansion. Furthermore, the increasing focus on sustainability and ethical sourcing within the food industry is also influencing consumer choices, with many opting for membership-based supermarkets that prioritize these aspects. This trend is particularly prominent in developed economies but is also rapidly gaining traction in emerging markets where disposable incomes are increasing and consumer expectations are evolving. The rise of private labels and own-brand products further strengthens the profitability of this model, allowing these retailers to enhance their margins and offer competitive pricing within their membership ecosystem. Therefore, the overall trend is one of sustained, rapid growth, characterized by intense competition and continuous innovation.

Several key factors are driving the rapid expansion of the paid membership supermarket sector. Firstly, the increasing prevalence of value-conscious consumers is a significant driver. Membership models offer perceived value through exclusive discounts, bulk-buying options, and loyalty programs, making them attractive to budget-minded shoppers. Secondly, the growing demand for convenience plays a crucial role. Many paid membership supermarkets offer streamlined shopping experiences, whether online or offline, appealing to busy consumers seeking efficiency. This is further amplified by the integration of sophisticated online platforms, offering features like home delivery, click-and-collect, and personalized recommendations. Thirdly, the strategic use of data analytics enables these retailers to understand consumer preferences better, tailor offerings, and enhance loyalty programs effectively. This personalization strengthens customer engagement and retention. The fourth force is the shift towards healthier and more sustainable consumption patterns. Many paid membership supermarkets are emphasizing organic, locally sourced, and ethically produced products, aligning with growing consumer demand for responsible consumption. Finally, the competitive landscape itself acts as a driver, prompting continuous innovation and improvements in services and offerings across the board. This results in a more dynamic and customer-centric market, fostering greater adoption among consumers. The interplay of these factors creates a powerful momentum behind the continued growth of the paid membership supermarket sector.

Despite the significant growth potential, the paid membership supermarket sector faces several challenges and restraints. Firstly, the initial membership fee can be a barrier to entry for price-sensitive consumers, particularly those with limited disposable income. Overcoming this hurdle often requires strong value propositions and strategic marketing efforts to demonstrate the long-term financial benefits. Secondly, maintaining profitability requires careful management of operating costs, including inventory management, logistics, and staff costs. High operating expenses can erode margins, potentially making the model unsustainable. Thirdly, competition is intensifying as established and emerging players enter the market. Maintaining a competitive edge requires constant innovation and a keen understanding of evolving consumer preferences. Furthermore, the management of supply chains and maintaining product quality and availability are crucial. Disruptions to supply chains can significantly impact operations and customer satisfaction. Finally, effectively balancing the needs of online and offline shoppers presents a significant logistical challenge. Integrating these two channels seamlessly requires substantial investment in technology and infrastructure. The effectiveness of customer service and addressing potential grievances also requires strategic attention to maintain the reputation and customer loyalty vital for this model's success.

The paid membership supermarket sector shows significant growth potential across various regions, with specific segments experiencing more rapid expansion. While North America currently dominates the market due to the established success of players like Costco, rapid growth is being witnessed in Asia, particularly in China. This is driven by increasing disposable incomes and a burgeoning middle class. The online sales segment is exhibiting particularly strong growth globally, driven by the convenience and accessibility it offers. This is further fueled by advancements in e-commerce infrastructure and digital payment systems.

Key Regions: North America (USA & Canada), China, and increasingly in Western Europe. North America enjoys early market penetration, while China benefits from a large and rapidly growing middle class increasingly adopting online shopping and premium food options. Western Europe shows gradual adoption, but significant untapped potential remains in many countries.

Dominant Segment: Online Sales. While offline sales remain crucial, the online segment offers unmatched scalability and reach. The ability to target consumers directly, leverage data analytics for personalized offers, and manage inventory efficiently makes online sales a key driver of growth. Furthermore, the convenience of home delivery and click-and-collect services further contributes to its dominance. This segment also allows for expansion into new markets with lower initial capital investment in physical infrastructure, thereby reducing barriers to entry for new players. The successful integration of online and offline channels, creating an omnichannel experience, is vital for sustained success in this sector. However, offline sales remain crucial for providing hands-on experiences and personalized interactions for specific products and demographic segments.

Further Considerations: The “Own Product” segment offers higher profit margins due to reduced reliance on third-party suppliers and greater control over quality and pricing, making it strategically crucial for long-term profitability. However, the "Purchased Product" segment caters to a broader range of consumer preferences and often forms the backbone of sales volume, generating vital revenue streams. The optimal strategy often lies in a balanced approach, strategically incorporating both segments to cater to diverse consumer demands.

Several factors are poised to further accelerate growth within the paid membership supermarket industry. These include:

Recent significant developments include:

This report provides a comprehensive analysis of the paid membership supermarket sector, offering valuable insights into market trends, driving forces, challenges, key players, and future growth prospects. The data presented is designed to assist businesses and investors in navigating this dynamic and rapidly expanding market. The report uses data in the millions of units to illustrate market size and growth potential, offering a detailed analysis of key segments and regional markets. It serves as a valuable resource for strategic decision-making and investment planning within the paid membership supermarket industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Walmart Inc, Costco Wholesale, Wumart Stores,Inc, Fresh Hema, Carrefour, Yaodi Agricultural, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Paid Membership Supermarket," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Paid Membership Supermarket, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.