1. What is the projected Compound Annual Growth Rate (CAGR) of the Package Testing Services?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Package Testing Services

Package Testing ServicesPackage Testing Services by Type (/> ISTA (International Safe Transit Association) Tests, ASTM (American Society for Testing and Materials) Tests, TAPPI (Technical Association of the Pulp and Paper Industry) Tests, WHO Tests, Others), by Application (/> Food & beverage, Personal care & Cosmetics, Homecare, Pharmaceutical, Chemical & fertilizers, E-commerce, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

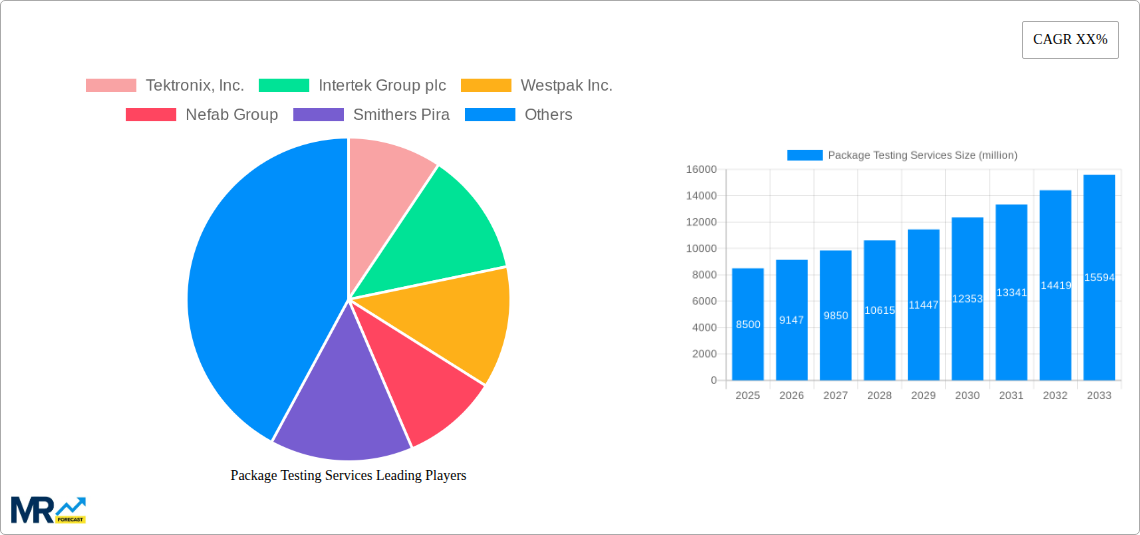

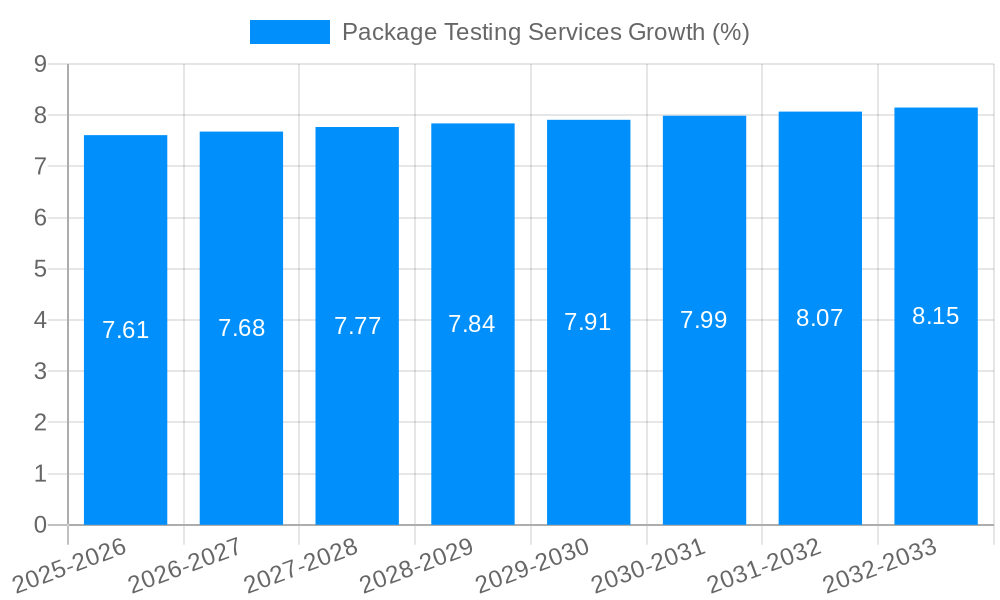

The global package testing services market is poised for significant expansion, projected to reach an estimated USD 8,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% through 2033. This growth is primarily fueled by the escalating complexity of global supply chains, the increasing demand for e-commerce, and the unwavering commitment of manufacturers to product integrity and consumer safety. As businesses navigate intricate international distribution networks and cater to a discerning online customer base, ensuring packages withstand the rigors of transit becomes paramount. This drives investment in comprehensive testing protocols that go beyond basic durability, encompassing environmental factors, material integrity, and regulatory compliance. The imperative to minimize product damage, reduce return rates, and uphold brand reputation further solidifies the indispensable role of specialized package testing services.

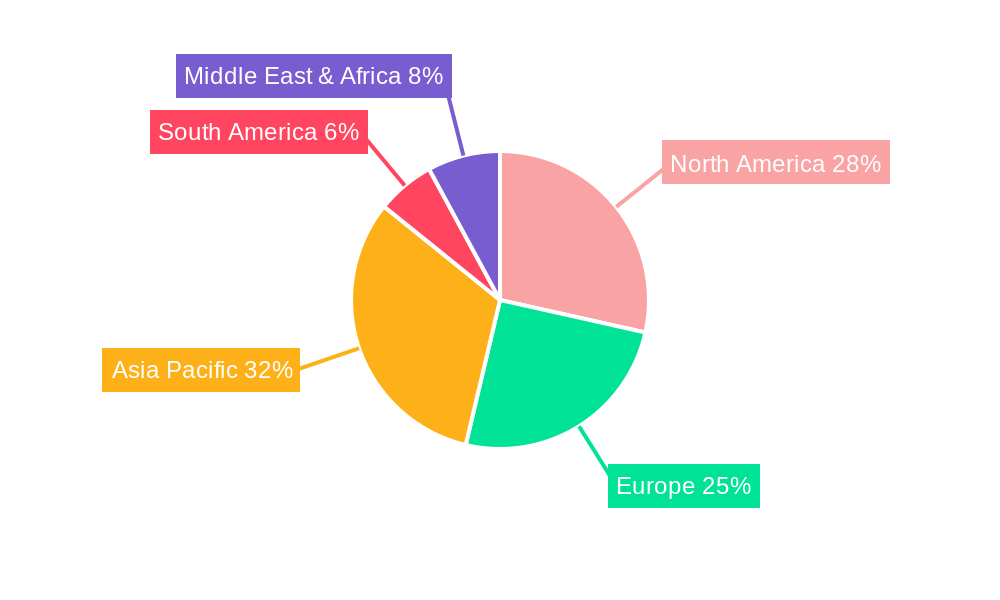

Key market drivers include the stringent regulatory landscapes governing various industries, such as pharmaceuticals and food & beverage, which mandate rigorous testing to ensure product safety and efficacy. Furthermore, the growing emphasis on sustainability and the development of innovative packaging materials necessitate thorough testing to validate their performance and environmental impact. Emerging economies, particularly in the Asia Pacific region, are witnessing a surge in manufacturing and e-commerce activities, presenting substantial growth opportunities for package testing providers. While the market benefits from these positive trends, potential restraints include the cost of advanced testing equipment and the availability of skilled personnel. However, the continuous evolution of testing standards and the increasing adoption of automation are expected to mitigate these challenges, paving the way for sustained market advancement.

This report provides a comprehensive analysis of the global Package Testing Services market, offering insights into its evolution, growth drivers, challenges, and future trajectory. The study leverages historical data from 2019-2024 and projects market trends from 2019-2033, with a detailed focus on the base and estimated year of 2025 and the forecast period of 2025-2033. The market is segmented by test types, applications, and geographical regions, with an in-depth examination of leading players and their significant contributions. The valuation of the market is presented in millions of units, reflecting the substantial economic impact of this critical industry.

The global Package Testing Services market is experiencing robust and dynamic growth, driven by an increasing emphasis on product safety, regulatory compliance, and the burgeoning e-commerce landscape. XXX insights reveal a market poised for sustained expansion, fueled by evolving consumer expectations and manufacturers' commitment to delivering undamaged goods. Historically, package testing was often viewed as a supplementary, post-production activity. However, the study period of 2019-2024 has witnessed a paradigm shift, with package testing becoming an integral part of the product development lifecycle. This transition is largely attributed to the rise of complex global supply chains, where products are subjected to a myriad of environmental and physical stresses during transit and handling. The e-commerce boom, in particular, has become a significant catalyst, as the direct-to-consumer model necessitates packaging that can withstand rigorous shipping processes without compromising product integrity. Furthermore, increasing regulatory scrutiny across various industries, from pharmaceuticals to food and beverage, mandates stringent testing protocols to ensure compliance and consumer safety, directly impacting the demand for specialized package testing services. The estimated market value in 2025 reflects this accelerated growth, projected to reach several hundred million units in total value. The forecast period of 2025-2033 is expected to see this growth continue, with technological advancements and the adoption of more sophisticated testing methodologies further propelling the market forward. The market's trajectory is also influenced by a growing awareness of sustainability, with testing services increasingly incorporating environmental impact assessments into their methodologies. This holistic approach to packaging validation is becoming a key differentiator in the market.

Several potent forces are actively propelling the global Package Testing Services market forward. The relentless expansion of e-commerce stands as a primary driver, necessitating robust packaging solutions that can withstand the rigors of individual parcel shipping and the inherent unpredictability of last-mile delivery. Companies are increasingly investing in comprehensive testing to minimize transit damages, reduce return rates, and enhance customer satisfaction, thereby protecting their brand reputation. Furthermore, stringent regulatory mandates across diverse sectors, including pharmaceutical, food and beverage, and hazardous materials, are compelling manufacturers to adhere to rigorous packaging standards. Compliance with these regulations, often dictated by bodies like the International Safe Transit Association (ISTA) and American Society for Testing and Materials (ASTM), directly translates into a sustained demand for accredited testing services. The growing globalized nature of supply chains, with products traversing vast distances through multiple modes of transportation, also amplifies the need for thorough package validation. This complexity exposes packages to a wider array of environmental stresses such as temperature fluctuations, humidity, vibration, and shock, all of which are meticulously assessed through specialized testing. Finally, a proactive approach to risk mitigation, aiming to prevent costly product recalls, insurance claims, and reputational damage, encourages businesses to invest in preventive testing rather than reactive damage control.

Despite the robust growth trajectory, the Package Testing Services market faces several inherent challenges and restraints that can temper its expansion. A significant hurdle is the substantial initial investment required for setting up and maintaining state-of-the-art testing laboratories, including specialized equipment and skilled personnel. This high capital expenditure can be a barrier for smaller testing providers or for companies looking to insource their testing capabilities, thereby consolidating the market towards larger, well-established players. Moreover, the diverse and evolving nature of global shipping regulations and industry standards necessitates continuous adaptation and investment in updating testing methodologies and certifications, adding to operational costs. The cost of comprehensive package testing itself can also be a deterrent for some businesses, particularly small and medium-sized enterprises (SMEs) or those operating on thin profit margins, leading them to opt for less rigorous or even inadequate testing protocols. Another challenge lies in the availability of skilled labor. The specialized nature of package testing requires technicians and engineers with a deep understanding of physics, materials science, and the intricacies of various testing procedures. A shortage of such qualified professionals can impede the scalability of testing services and affect the quality of results. Finally, the economic downturns and global supply chain disruptions, such as those experienced during recent years, can temporarily dampen demand as businesses cut back on discretionary spending, including testing services, in an effort to conserve resources.

The global Package Testing Services market is characterized by strong regional demand and segment-specific dominance, with certain areas and service types significantly outperforming others. North America, particularly the United States, is poised to maintain its leadership position throughout the forecast period. This dominance is underpinned by a mature industrial base across diverse sectors like pharmaceuticals, food and beverage, and consumer goods, all of which heavily rely on rigorous packaging integrity. The presence of leading manufacturers, coupled with a strong regulatory framework and a high adoption rate of advanced testing standards such as ISTA and ASTM, further solidifies North America's market share. The region also benefits from a well-established network of accredited testing laboratories and a proactive approach to product safety and quality assurance.

Within the segmentation by Application, the Pharmaceutical sector is a key contributor to market dominance. The highly regulated nature of pharmaceutical products, requiring strict adherence to temperature control, sterility, and protection from physical damage during global distribution, drives a perpetual need for specialized and highly validated packaging testing. The potential for catastrophic consequences from compromised pharmaceutical packaging, including patient harm and significant financial losses, makes investment in comprehensive testing a non-negotiable aspect of the supply chain. The global pharmaceutical market's consistent growth, further accelerated by recent health crises, directly fuels the demand for associated packaging testing services.

Another critical segment that is projected to exhibit significant dominance is ISTA (International Safe Transit Association) Tests. ISTA standards are widely recognized and adopted across various industries for ensuring that packaging can withstand the distribution environment. The increasing global trade and the rise of e-commerce have amplified the relevance of ISTA certifications, as they provide a standardized benchmark for package performance. Companies aiming for widespread market reach, especially in the competitive e-commerce space, find ISTA compliance essential for minimizing transit damages and ensuring customer satisfaction. The comprehensive nature of ISTA tests, covering a wide range of environmental and mechanical stresses, makes them a preferred choice for validating packaging robustness.

Furthermore, the E-commerce application segment is a rapidly growing force driving market expansion and dominance. The direct-to-consumer shipping model inherent to e-commerce exposes packages to a higher frequency of handling and a greater risk of damage compared to traditional palletized shipping. Consequently, manufacturers and online retailers are increasingly investing in package testing to ensure their products arrive safely at the customer's doorstep. This not only reduces return rates and associated costs but also enhances customer loyalty and brand perception. The sheer volume of goods shipped via e-commerce globally ensures that this segment will continue to be a major driver of package testing services.

The Package Testing Services industry is experiencing significant growth catalysts that are shaping its future. The relentless expansion of e-commerce, with its direct-to-consumer shipping models, necessitates packaging resilient to a wide range of transit stresses. Stricter regulatory mandates across sectors like pharmaceuticals and food & beverage are driving compliance-driven testing. Furthermore, increased global supply chain complexity exposes products to more varied environmental and physical challenges, demanding robust validation. A growing emphasis on sustainability is also driving the development of eco-friendly packaging solutions, which in turn require specialized testing for their performance and integrity.

This report offers a holistic view of the Package Testing Services market, encompassing detailed analysis of historical trends, current market dynamics, and future projections. It delves into the key drivers, challenges, and opportunities shaping the industry, providing a granular breakdown of market segmentation by test types, applications, and geographical regions. Leading players are identified and profiled, alongside significant developments and strategic initiatives. The report's comprehensive coverage aims to equip stakeholders with the in-depth knowledge and actionable insights necessary to navigate this evolving landscape and make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Tektronix, Inc., Intertek Group plc, Westpak Inc., Nefab Group, Smithers Pira, Cincinnati Sub-Zero Products, LLC, Micom Labs, Bilcare Limited, Element Materials Technology, TUV SUD Group, ANAMA.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Package Testing Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Package Testing Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.