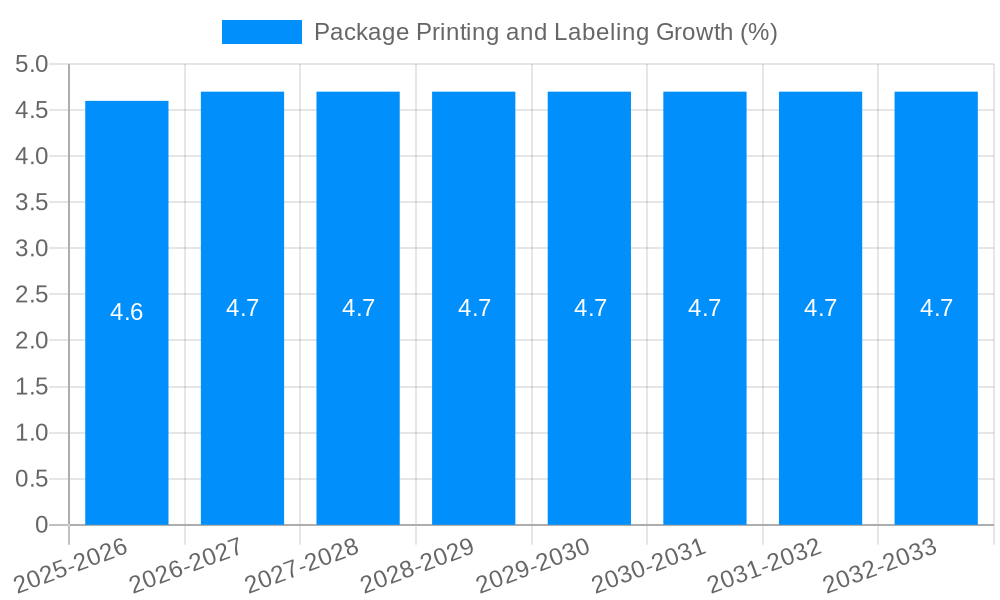

1. What is the projected Compound Annual Growth Rate (CAGR) of the Package Printing and Labeling?

The projected CAGR is approximately 4.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Package Printing and Labeling

Package Printing and LabelingPackage Printing and Labeling by Type (Flexographic Printing, Digital Printing, Offset Printing, Screen Printing, Thermal Transfer Printing, Embossing and Debossing, World Package Printing and Labeling Production ), by Application (Food and Beverage, Cosmetics, Electrical Products, World Package Printing and Labeling Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

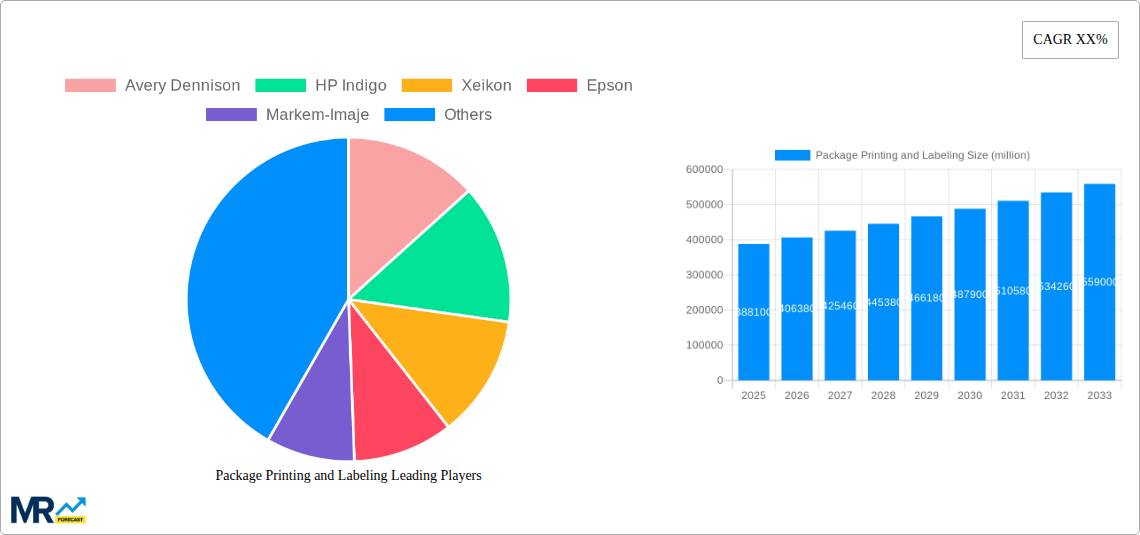

The global package printing and labeling market is experiencing robust growth, projected to reach a substantial USD 388.1 billion in 2025. This expansion is driven by a compound annual growth rate (CAGR) of 4.6% from 2019 to 2033, indicating sustained demand and innovation within the sector. The market is characterized by the increasing adoption of advanced printing technologies such as digital printing and flexographic printing, which offer enhanced customization, faster turnaround times, and improved sustainability. The burgeoning e-commerce sector, coupled with evolving consumer preferences for visually appealing and informative packaging, is a significant catalyst. Furthermore, stringent regulatory requirements for product information and traceability are bolstering the demand for high-quality labels and packaging solutions. The food and beverage sector continues to be the dominant application segment, owing to the sheer volume of packaged goods, followed closely by the cosmetics industry, which relies heavily on aesthetic appeal for brand differentiation. Electrical products also represent a growing application, driven by the need for clear labeling of technical specifications and safety information.

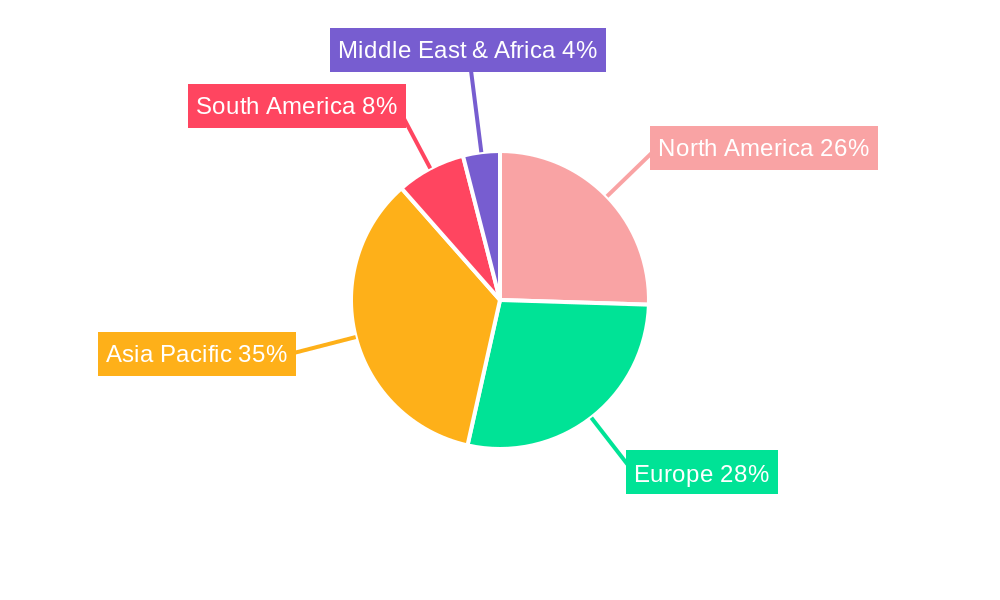

The market landscape is dynamic, with key players like Avery Dennison, HP Indigo, and Xeikon investing heavily in research and development to offer cutting-edge solutions. Trends towards sustainable printing materials, such as biodegradable inks and recycled paper, are gaining momentum as manufacturers and consumers alike prioritize environmental responsibility. However, the market also faces certain restraints, including the fluctuating costs of raw materials and the capital-intensive nature of some advanced printing technologies. Geographically, Asia Pacific, led by China and India, is emerging as a high-growth region, fueled by rapid industrialization and a growing middle class. North America and Europe remain significant markets, driven by mature economies and a strong focus on brand premiumization and regulatory compliance. The ongoing evolution of smart packaging, incorporating QR codes and RFID technology for enhanced supply chain visibility and consumer engagement, presents a significant future growth avenue.

This report offers an in-depth analysis of the global package printing and labeling market, providing critical insights and strategic guidance for stakeholders. The study encompasses a comprehensive examination of market dynamics, technological advancements, and emerging trends from 2019 to 2033, with a base year of 2025. The market is projected to experience robust growth, driven by evolving consumer demands, increasing product customization, and the growing importance of brand visibility and regulatory compliance.

The global package printing and labeling market is undergoing a significant transformation, driven by a confluence of factors that are reshaping how products are presented to consumers. From 2019 to 2024, the market witnessed steady expansion, fueled by the burgeoning e-commerce landscape and a heightened focus on product differentiation. As we move through the forecast period of 2025-2033, with 2025 serving as the base and estimated year, the industry is poised for accelerated growth, with global package printing and labeling production anticipated to reach hundreds of billions of dollars. A key trend shaping this trajectory is the undeniable rise of digital printing technologies. This shift is motivated by the inherent flexibility and cost-effectiveness of digital solutions, particularly for short-run, variable data printing, and on-demand production. Brands are increasingly leveraging digital printing to create personalized packaging, enabling them to connect with consumers on a more individual level and respond rapidly to market shifts. This is particularly evident in sectors like Food and Beverage and Cosmetics, where aesthetic appeal and timely product launches are paramount. The demand for sustainable packaging solutions is also a powerful force. Consumers and regulatory bodies are increasingly scrutinizing the environmental impact of packaging, prompting manufacturers to adopt eco-friendly inks, recyclable materials, and innovative, low-waste printing processes. This focus on sustainability is not merely an ethical consideration but is rapidly becoming a competitive advantage. Furthermore, the integration of smart technologies into packaging, such as QR codes, NFC tags, and augmented reality (AR) enabled labels, is gaining traction. These advancements allow for enhanced consumer engagement, supply chain traceability, and the provision of rich product information, transforming packaging from a passive element into an interactive touchpoint. The intricate interplay between these trends — digitalization, sustainability, and smart integration — is fundamentally redefining the value proposition of package printing and labeling, creating new opportunities for innovation and market leadership.

Several powerful forces are propelling the global package printing and labeling market forward, ensuring its continued expansion and innovation throughout the forecast period of 2025-2033. The escalating demand for consumer goods across diverse sectors, particularly Food and Beverage, Cosmetics, and Electrical Products, forms a foundational driver. As global populations grow and disposable incomes rise in emerging economies, the consumption of packaged goods escalates, directly translating into a higher volume of printing and labeling requirements. Furthermore, the dynamic nature of consumer preferences is a significant catalyst. Modern consumers are increasingly discerning, seeking visually appealing, informative, and contextually relevant packaging. This drives the need for high-quality printing, sophisticated labeling solutions, and the ability to quickly adapt designs to capture fleeting market trends. Brand owners are investing heavily in packaging as a crucial element of their marketing strategy, recognizing its role in attracting attention on crowded retail shelves and conveying brand identity. The burgeoning e-commerce sector has also profoundly influenced market dynamics. The unique demands of online retail, including the need for robust, transit-ready packaging and eye-catching product presentation that can withstand the digital gaze, have spurred innovation in printing and labeling. This includes the development of specialized inks for direct-to-consumer shipping and enhanced security features to combat counterfeiting. Moreover, the increasing stringency of regulatory requirements across industries, particularly concerning product safety, authenticity, and traceability, necessitates sophisticated labeling solutions. This includes the implementation of serialization and track-and-trace technologies, which demand advanced printing capabilities to ensure compliance and consumer trust.

Despite the robust growth trajectory of the global package printing and labeling market, several challenges and restraints can impede its full potential during the study period of 2019-2033, with a base year of 2025. One of the most significant hurdles is the escalating cost of raw materials, including inks, substrates, and adhesives. Fluctuations in global commodity prices, geopolitical instability, and supply chain disruptions can lead to increased production costs, impacting profit margins for manufacturers and potentially being passed on to end-users, thereby dampening demand, especially in price-sensitive segments. Another considerable challenge is the intense competition within the market. The presence of numerous established players and emerging entrants, coupled with the commoditization of certain printing techniques, exerts downward pressure on pricing, making it difficult for smaller companies to compete and for larger players to achieve premium margins. The rapid pace of technological advancement also presents a double-edged sword. While innovation drives growth, the need for continuous investment in new machinery, software, and skilled labor to keep pace with evolving digital printing technologies can be a substantial financial burden, particularly for small and medium-sized enterprises (SMEs). Furthermore, the growing emphasis on sustainability, while a key growth driver, also poses challenges. The transition to eco-friendly materials and processes can be complex and costly, requiring significant research and development, and potentially leading to higher initial investments. Adherence to increasingly stringent environmental regulations across different regions can also add to operational complexities and costs. Lastly, the global economic uncertainties and potential recessions, particularly in the forecast period of 2025-2033, could lead to reduced consumer spending on non-essential goods, thereby impacting the demand for packaged products and, consequently, the package printing and labeling sector.

The global package printing and labeling market is poised for significant growth, with certain regions and segments demonstrating exceptional dominance and contributing substantially to the overall market value, which is projected to reach hundreds of billions of dollars by 2033.

Key Dominating Segments:

Digital Printing (Type): Digital printing technologies are emerging as the undisputed frontrunner in the package printing and labeling sector. The market is witnessing a paradigm shift from traditional analog methods to digital solutions due to their unparalleled flexibility, cost-effectiveness for short runs, and capability for variable data printing (VDP). This allows for mass customization, personalization, and on-demand production, catering to the evolving demands of brand owners for unique and engaging packaging. The ability to produce vibrant, high-resolution graphics and implement intricate designs without the need for expensive plate-making processes makes digital printing highly attractive. Companies like HP Indigo and Xeikon are at the forefront of this revolution, offering advanced digital presses that empower businesses to respond rapidly to market trends and consumer preferences. The ease of making design modifications and the reduced lead times further solidify digital printing's dominance, especially in sectors requiring frequent product updates or limited edition runs. The projected growth of digital printing is intrinsically linked to the increasing demand for personalized and experiential packaging.

Food and Beverage (Application): The Food and Beverage sector consistently represents the largest and most influential application segment in the package printing and labeling market. The sheer volume of products in this category, coupled with the critical need for brand differentiation, regulatory compliance (e.g., nutritional information, allergen warnings), and tamper-evident seals, drives a perpetual demand for innovative printing and labeling solutions. The visual appeal of packaging plays a crucial role in consumer purchasing decisions, making high-quality graphics and vibrant colors essential. Furthermore, the growing trend of premiumization within the food and beverage industry necessitates sophisticated packaging that conveys quality and exclusivity. Brands are investing in special finishes, tactile effects, and interactive elements to enhance the consumer experience. The increasing demand for convenience foods and beverages, as well as the growing global population, further solidifies the Food and Beverage sector's position as a dominant force. The application of specialized inks for food safety and shelf-life extension also contributes to the segment's prominence.

Key Dominating Regions/Countries:

Asia Pacific: The Asia Pacific region is emerging as a powerhouse in the global package printing and labeling market, driven by its vast population, rapidly growing economies, and expanding manufacturing base. Countries like China, India, and Southeast Asian nations are experiencing unprecedented demand for packaged goods across all sectors, from daily necessities to luxury items. The burgeoning middle class, coupled with increasing urbanization, fuels consumer spending and necessitates sophisticated packaging solutions. Furthermore, the region is a global manufacturing hub for various industries, including electronics, textiles, and consumer goods, all of which require extensive printing and labeling services. Government initiatives promoting industrial growth and the adoption of advanced manufacturing technologies are also contributing to the region's dominance. The increasing adoption of digital printing technologies, driven by cost-effectiveness and the need for faster turnaround times, is a significant factor in Asia Pacific's market leadership. The region's proactive approach to embracing new technologies and its large consumer base create a fertile ground for innovation and expansion in the package printing and labeling sector.

North America: North America, particularly the United States, continues to be a pivotal market for package printing and labeling, characterized by its mature consumer base, strong emphasis on branding, and early adoption of technological innovations. The region boasts a highly developed Food and Beverage and Cosmetics industries, both of which are heavily reliant on sophisticated packaging for product differentiation and consumer engagement. The increasing demand for sustainable and eco-friendly packaging solutions is also a significant driver in North America, with consumers actively seeking products with minimal environmental impact. The robust e-commerce infrastructure in the region further fuels the need for specialized packaging that can withstand shipping and handling, leading to advancements in printing for durability and protective qualities. Moreover, the presence of leading global brands that continuously invest in premium packaging and innovative labeling technologies to maintain a competitive edge solidifies North America's position. The region's strong regulatory framework also mandates precise and compliant labeling for product safety and information, driving the adoption of advanced printing and serialization solutions.

Several key growth catalysts are fueling the expansion of the package printing and labeling industry throughout the study period of 2019-2033, with a base year of 2025. The escalating global demand for consumer goods, particularly in emerging economies, directly translates into increased production volumes and a higher need for packaging and labeling solutions. The growing importance of brand differentiation and consumer engagement is driving investments in visually appealing and interactive packaging, spurring innovation in printing technologies. Furthermore, the rapid growth of the e-commerce sector necessitates specialized packaging for direct-to-consumer shipping, promoting the development of durable and eye-catching labeling. The increasing regulatory landscape, especially concerning product traceability and safety, also demands advanced printing and labeling capabilities, acting as a significant growth catalyst.

This report provides an exhaustive examination of the global package printing and labeling market, meticulously detailing its evolution from 2019 through the projected landscape up to 2033, with 2025 serving as the crucial base and estimated year. The report delves into the intricate market dynamics, highlighting the significant growth drivers such as the ever-increasing demand for consumer goods, the crucial role of branding in consumer purchasing decisions, and the transformative impact of e-commerce. It also addresses the inherent challenges, including fluctuating raw material costs and intense market competition, offering strategic insights for navigating these complexities. The analysis extends to identifying dominant regions and key market segments, such as the ascendance of Digital Printing and the enduring significance of the Food and Beverage application, providing a clear roadmap for market players. Furthermore, the report meticulously outlines the growth catalysts and leading companies shaping the industry, culminating in a comprehensive understanding of current developments and future projections within this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.6%.

Key companies in the market include Avery Dennison, HP Indigo, Xeikon, Epson, Markem-Imaje, Domino Printing Sciences, Brother, Primera Technology.

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Package Printing and Labeling," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Package Printing and Labeling, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.