1. What is the projected Compound Annual Growth Rate (CAGR) of the Outdoor Advertising?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Outdoor Advertising

Outdoor AdvertisingOutdoor Advertising by Type (Digital, Traditional), by Application (Large Enterprise, SME), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

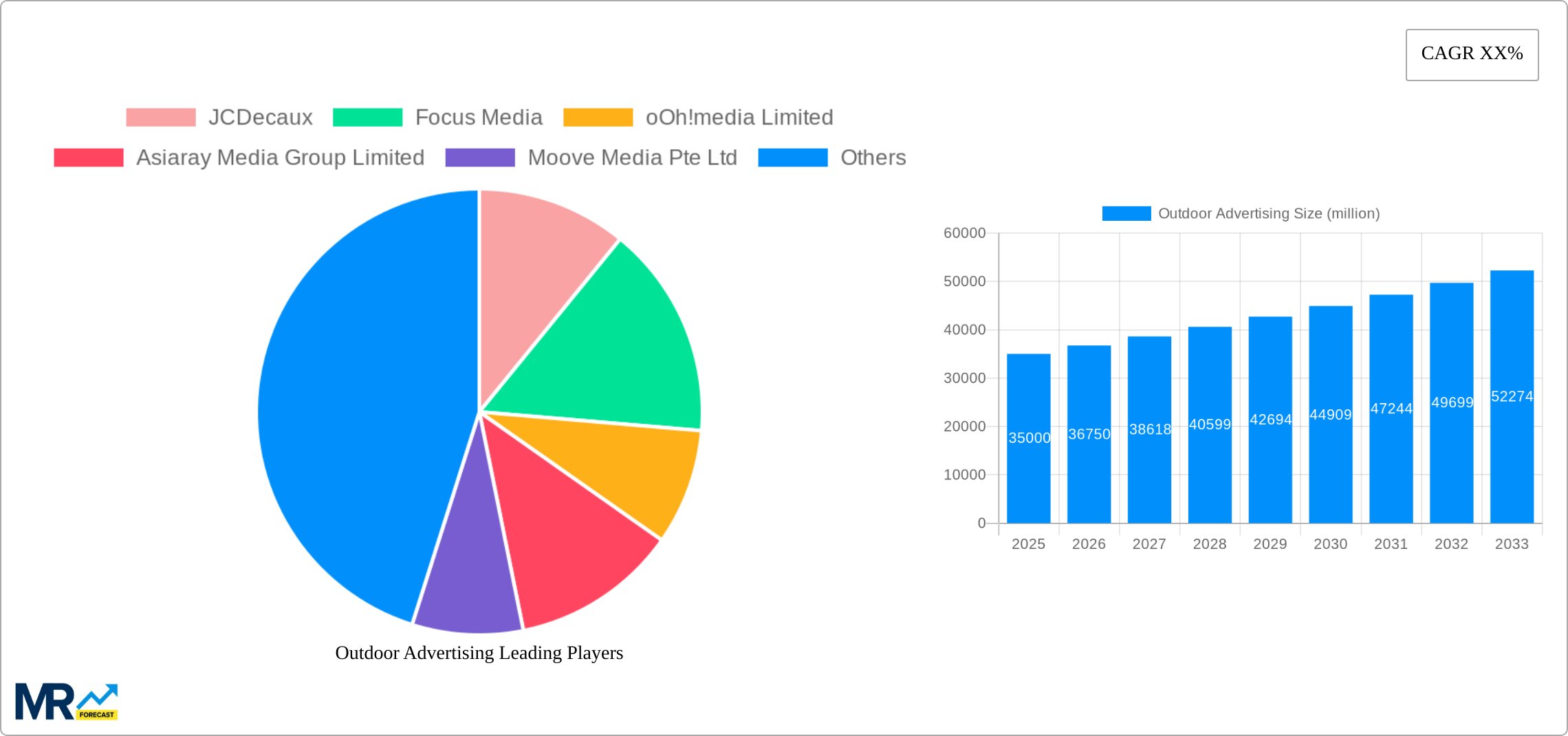

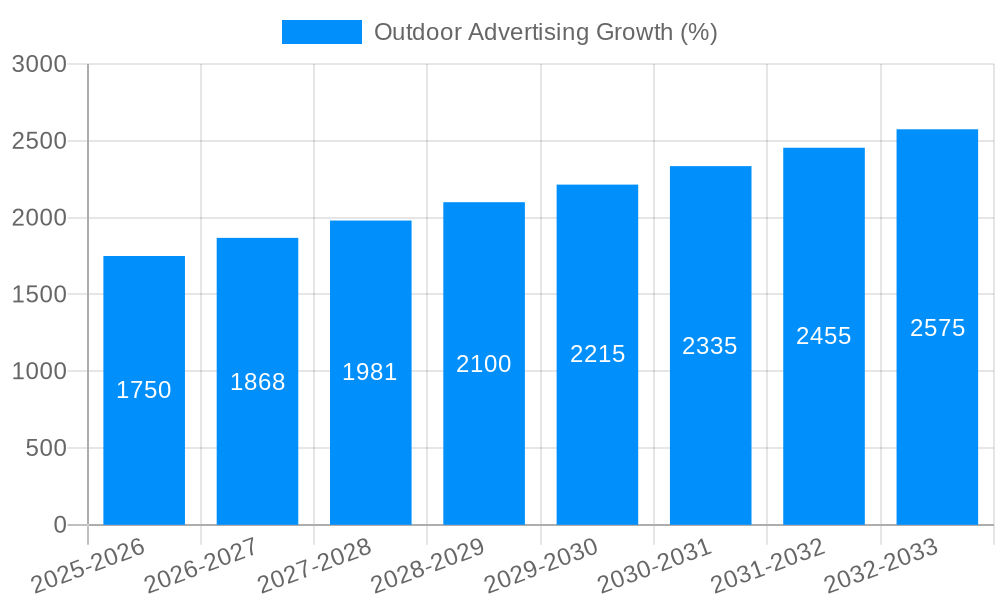

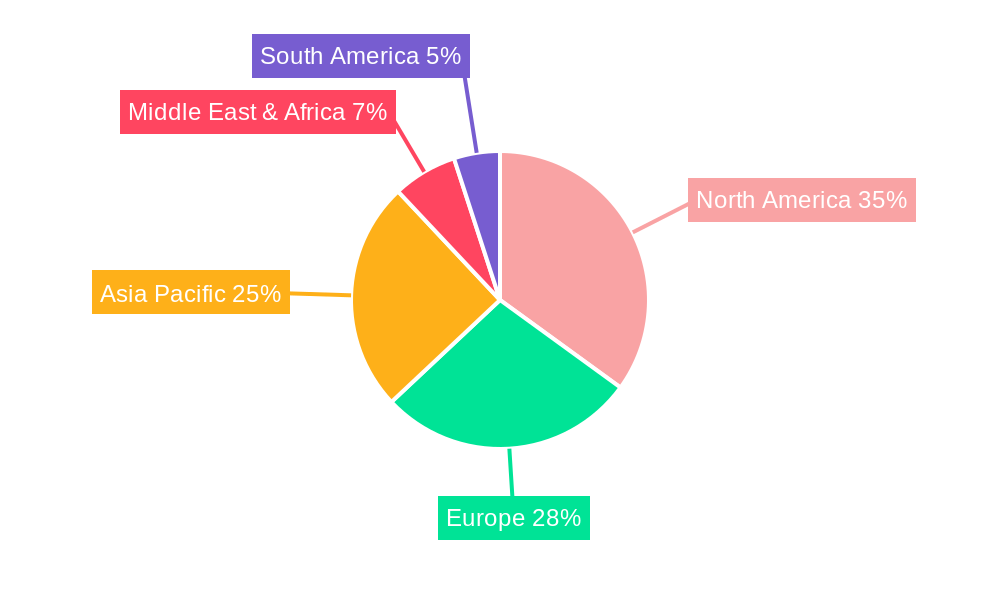

The global outdoor advertising market is experiencing robust growth, driven by increasing urbanization, rising digital integration, and the need for brands to engage consumers in physical spaces. The market, estimated at $35 billion in 2025, is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of 5% through 2033, reaching approximately $50 billion. Key drivers include the expansion of digital outdoor advertising formats such as interactive billboards and programmatic buying, which allow for targeted and data-driven campaigns. Furthermore, the increasing use of innovative technologies like augmented reality and smart displays is enhancing the effectiveness and appeal of outdoor advertising. While traditional formats like billboards and posters remain significant, digital channels are gaining considerable market share, particularly among large enterprises seeking measurable results. The rise of programmatic advertising is streamlining the buying process and making it more efficient for advertisers. However, challenges persist, including regulatory hurdles in certain regions regarding the placement and size of outdoor advertising displays, as well as competition from other media channels. The market is segmented geographically, with North America and Asia Pacific currently holding the largest market shares, influenced by high population densities and strong economic activity in key regions such as the United States, China, and India. The SME segment is also witnessing significant growth, as smaller businesses increasingly adopt outdoor advertising to reach local audiences.

The competitive landscape is fragmented, with both large multinational companies like JCDecaux, Clear Channel, and Ströer, and regional players actively competing. Successful companies are focusing on innovation, data analytics, and strategic partnerships to stay ahead. Strategic acquisitions and mergers are further shaping the market dynamics. Growth in the digital segment is expected to continue outpacing traditional formats, although traditional forms will maintain a substantial presence due to their broad reach and cost-effectiveness in specific contexts. Future growth will hinge on the continued adoption of digital technologies, strategic expansion into emerging markets, and the ability of companies to provide measurable and impactful advertising solutions. This market analysis highlights the significant potential of outdoor advertising, a field poised for sustained growth driven by technological advancements and evolving consumer engagement strategies.

The global outdoor advertising market, valued at $XXX million in 2024, is poised for significant growth, reaching $XXX million by 2033, exhibiting a CAGR of X% during the forecast period (2025-2033). Key market insights reveal a dramatic shift towards digital formats, driven by technological advancements and increased advertiser demand for measurable results. Traditional billboards, while still holding a substantial market share, are increasingly being integrated with digital capabilities, such as dynamic content updates and interactive features. The rise of programmatic buying is streamlining the purchasing process, allowing advertisers to target specific demographics and locations with greater precision. Furthermore, the convergence of outdoor advertising with other media channels, particularly mobile, is enhancing engagement and measurement capabilities. This is evident in the increasing popularity of location-based advertising and augmented reality (AR) experiences which overlay digital content onto the real-world environment viewed through a smartphone camera. The SME segment shows particularly strong growth potential as businesses recognize the cost-effectiveness and targeted reach of outdoor advertising, especially within localized campaigns. Finally, innovative formats like interactive kiosks and smart benches are blurring the lines between traditional and digital outdoor advertising, paving the way for a more immersive and engaging consumer experience. The historical period (2019-2024) showcased significant volatility, reflecting global events' impact, but the market demonstrates resilience and a continuing upward trajectory. The estimated year 2025 provides a pivotal baseline for future projections, showing a stabilized market post-pandemic.

Several factors are driving the expansion of the outdoor advertising market. Firstly, the increasing urbanization and population density in major cities worldwide create a captive audience for advertisers. High foot traffic in densely populated areas ensures high visibility for outdoor advertisements, making it a cost-effective strategy for businesses to reach a mass audience. Secondly, the technological advancements in digital outdoor advertising, such as LED displays, interactive screens, and programmatic buying, offer advertisers greater targeting capabilities and real-time performance measurement. This ability to track campaign effectiveness and tailor messaging based on audience engagement is a significant draw for companies. Thirdly, the integration of outdoor advertising with other marketing strategies creates a synergistic effect, amplifying the reach and impact of campaigns. For example, combining outdoor ads with online campaigns that use location-based targeting or geofencing can significantly boost engagement and brand recall. Finally, the ongoing growth of the digital economy and the rising disposable income of consumers in several regions are fueling the demand for outdoor advertising. Businesses are increasingly allocating larger portions of their budgets to outdoor advertising, recognizing its ability to engage consumers in public spaces.

Despite its growth potential, the outdoor advertising industry faces several challenges. One significant hurdle is the high cost of acquiring prime advertising locations, especially in major metropolitan areas. This cost can limit the accessibility of outdoor advertising for smaller businesses and startups. Furthermore, the industry faces competition from other digital media channels, such as social media and online video advertising, which often offer more targeted and granular audience segmentation. Maintaining and updating traditional billboards can also prove expensive, particularly with the need for regular maintenance and replacements due to weathering and vandalism. The ever-changing regulatory landscape and permits needed for outdoor advertising campaigns in different regions also present logistical and financial obstacles. Finally, measuring the effectiveness of outdoor advertising campaigns can sometimes be more complex compared to other digital channels, although digital outdoor platforms are helping mitigate this. Addressing these challenges will be key to ensuring the continued growth and sustainability of the outdoor advertising market.

The Asia-Pacific region is expected to dominate the outdoor advertising market throughout the forecast period (2025-2033), fueled by rapid urbanization, increasing disposable incomes, and a burgeoning digital economy. Within this region, countries like China and India are projected to lead in growth due to their vast populations and expanding infrastructure.

High Growth in Digital Outdoor: The digital segment is experiencing the fastest growth, driven by the increasing adoption of advanced technologies like LED displays, programmatic advertising, and interactive screens. This allows for dynamic content updates, targeted advertising, and real-time performance measurement, making it highly attractive to advertisers.

Large Enterprise Dominance: Large enterprises, with their substantial marketing budgets and complex campaign requirements, currently constitute the largest share of the outdoor advertising market. Their preference for large-scale campaigns and prime locations contributes to the segment's market dominance.

SME Segment's Upward Trajectory: While large enterprises are dominant, the SME segment showcases significant growth potential. The cost-effectiveness of hyper-local outdoor advertising solutions and the ease of implementation for smaller campaigns are driving increased adoption among small and medium-sized businesses. Their reliance on geographic-specific advertising strategies makes the adoption of outdoor advertising a very efficient choice for them. They are increasingly utilizing digital formats to tailor their message to their local clientele.

The dominance of these factors establishes a clear trajectory for growth across the Asia-Pacific region, significantly propelled by the digital revolution in outdoor advertising and the strategic adoption of the medium by both large corporations and increasingly, small- and medium-sized enterprises.

Several factors contribute to the accelerated growth of the outdoor advertising industry. The increasing adoption of digital technologies allows for targeted advertising, measurable results, and dynamic content, enhancing the appeal to advertisers. The integration of outdoor advertising with other marketing channels amplifies the impact of campaigns, while the expansion of urbanization and improved infrastructure provide more opportunities for prominent ad placements. The rise in programmatic buying streamlines advertising processes, increasing efficiency. Overall, these elements combine to create a powerful synergy that fuels the market's consistent and robust growth.

The comprehensive report on the outdoor advertising market provides a detailed analysis of market trends, drivers, challenges, and leading players. It offers valuable insights into the key segments dominating the market and highlights the significant developments shaping the industry's future. The report covers the historical period (2019-2024), the base year (2025), the estimated year (2025), and projects the market's growth until 2033, providing a comprehensive view of the market's evolution and future potential. It also includes detailed competitive landscapes and profiles of key market players, helping businesses make informed strategic decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include JCDecaux, Focus Media, oOh!media Limited, Asiaray Media Group Limited, Moove Media Pte Ltd, Mediacorp Pte Ltd., Dentsu Inc., Beijing Bashi Media, Quotient Technology, Ströer, OUTFRONT Media (CBS), Lamar Advertising Company, Clear Channel Outdoor Holdings, Inc., Kesion, IPG, QBF, SiMei Media, Guangdong Guangzhou Daily Media Co., Ltd., Publicis Groupe, Havas SA, Chengdu B-ray Media Co., Ltd., .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Outdoor Advertising," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Outdoor Advertising, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.