1. What is the projected Compound Annual Growth Rate (CAGR) of the Optical Cross Connect Equipment?

The projected CAGR is approximately 11.94%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Optical Cross Connect Equipment

Optical Cross Connect EquipmentOptical Cross Connect Equipment by Type (FXC, WXC, WSXC), by Application (Communication, Light Energy, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

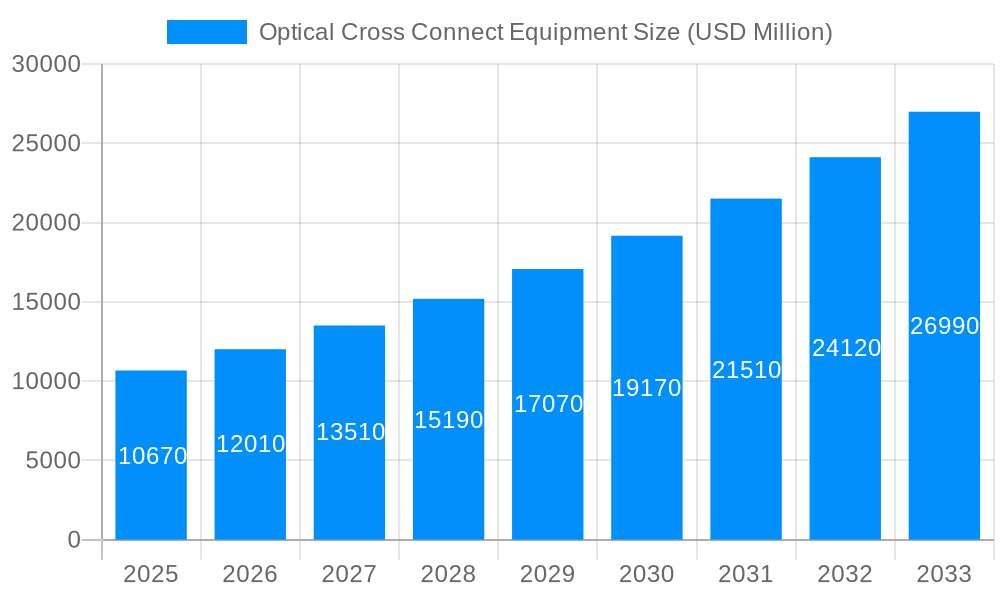

The Optical Cross Connect (OXC) Equipment market is poised for substantial growth, projected to reach USD 10.67 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 11.94% through 2033. This significant expansion is fueled by the escalating demand for high-speed data transmission and increased network traffic, driven by the proliferation of 5G deployment, cloud computing adoption, and the growing popularity of bandwidth-intensive applications like video streaming, online gaming, and IoT. The market's evolution is also significantly influenced by ongoing advancements in optical networking technology, including the development of more efficient and flexible optical switching solutions, and the increasing need for efficient wavelength management in increasingly complex networks. Emerging trends such as the integration of AI and machine learning for network automation and optimization are also set to redefine the OXC landscape, enabling more intelligent and responsive network infrastructures.

The market is segmented into Fixed Wavelength Cross-Connect (FXC), Wavelength Cross-Connect (WXC), and Wavelength Selective Cross-Connect (WSXC) types, with applications spanning Communication, Light Energy, and Other sectors. The Communication segment, encompassing telecommunications and data centers, is expected to remain the dominant end-use industry due to the continuous upgrade cycles and capacity expansion requirements. Geographically, Asia Pacific, particularly China, is anticipated to lead the market in terms of both size and growth, owing to its extensive investments in telecommunications infrastructure and rapid adoption of new technologies. North America and Europe also represent significant markets, driven by their established technological infrastructure and ongoing network modernization efforts. Restraints such as high initial investment costs and the complexity of integrating new OXC solutions into existing legacy networks may present challenges, but are expected to be mitigated by the clear benefits in terms of scalability, flexibility, and cost-efficiency offered by advanced OXC technologies.

Here's a comprehensive report description for Optical Cross Connect Equipment, incorporating the requested details:

The global Optical Cross Connect (OXC) equipment market is poised for substantial expansion, projected to reach an impressive USD 8.75 billion by 2033, a significant leap from its estimated USD 3.5 billion valuation in 2025. This robust growth trajectory is underpinned by a confluence of factors, primarily driven by the escalating demand for higher bandwidth and more agile network infrastructures. The historical period from 2019 to 2024 witnessed steady adoption, laying the groundwork for accelerated progress. The study period encompassing 2019-2033, with a base year of 2025, highlights a dynamic evolution in network architectures, compelling the deployment of advanced OXC solutions. The proliferation of 5G networks, the burgeoning adoption of cloud computing, and the continuous surge in data traffic generated by video streaming, IoT devices, and AI applications are creating an insatiable appetite for efficient optical signal routing. Traditional circuit switches and manual patch panels are proving increasingly inadequate in meeting these demands, paving the way for sophisticated OXC equipment that offers automated, dynamic, and scalable connectivity. The market is seeing a clear shift towards more intelligent and programmable optical switching, enabling network operators to reconfigure their networks on-demand, optimize resource utilization, and reduce operational costs. The forecast period of 2025-2033 is anticipated to be characterized by innovation in optical switching technologies, including advancements in wavelength switching (WXC) and wavelength selective switching (WSXC), which offer granular control over optical signals at the wavelength level. This granular control is crucial for efficiently managing complex optical networks and supporting a diverse range of services with varying bandwidth requirements. The increasing complexity of optical networks, driven by higher data rates and the need for flexible service provisioning, will necessitate these advanced OXC solutions. Furthermore, the integration of software-defined networking (SDN) principles into OXC architectures is emerging as a significant trend, enabling centralized control and programmability of the optical layer. This integration promises to unlock new levels of automation and agility in optical network management, further fueling market expansion. The market is also witnessing a gradual diversification of applications, extending beyond core communication networks into emerging areas such as data centers and even the nascent field of light energy management, suggesting a broader impact of OXC technologies in the coming years.

The surge in demand for optical cross connect equipment is primarily propelled by the insatiable global appetite for enhanced network connectivity and the ever-increasing volume of data traffic. The widespread rollout and ongoing evolution of 5G mobile networks represent a monumental catalyst, demanding significantly higher bandwidth and lower latency than previous generations. This necessitates a more robust and flexible optical backhaul and core network infrastructure, where OXC solutions play a critical role in efficiently routing vast amounts of data. Furthermore, the exponential growth of cloud computing services, coupled with the proliferation of data centers, creates a constant need for high-speed, scalable, and reconfigurable interconnections. OXC equipment enables data centers to dynamically allocate bandwidth, optimize traffic flow, and reduce operational expenditures associated with manual cabling. The burgeoning Internet of Things (IoT) ecosystem, with its millions of connected devices generating continuous streams of data, further exacerbates the strain on existing network capacities. OXC solutions are instrumental in managing this complex web of connections and ensuring seamless data transmission. Moreover, the increasing adoption of bandwidth-intensive applications such as high-definition video streaming, online gaming, and virtual and augmented reality experiences are collectively driving the need for advanced optical networking capabilities. As these applications become more mainstream, the demand for efficient and dynamic optical signal management will only intensify, making OXC equipment an indispensable component of modern telecommunication infrastructure.

Despite the robust growth prospects, the optical cross connect equipment market faces several significant challenges and restraints that could temper its expansion. One of the primary hurdles is the substantial initial capital investment required for deploying advanced OXC solutions. The sophisticated nature of these technologies, often involving highly integrated optical components and complex control systems, translates into high upfront costs for network operators, particularly smaller players or those in emerging markets with limited budgets. This financial barrier can slow down the widespread adoption of OXC, especially when compared to more conventional, albeit less capable, switching solutions. Another key challenge lies in the technical complexity and the need for skilled personnel. Implementing and managing dynamic optical networks with OXC requires a deep understanding of optical physics, networking protocols, and advanced software management. The scarcity of adequately trained engineers and technicians capable of operating and maintaining these sophisticated systems can be a significant bottleneck for widespread deployment. Furthermore, interoperability issues and standardization remain concerns within the industry. While efforts are underway, ensuring seamless compatibility between OXC equipment from different vendors and across diverse network environments can be challenging. This lack of universal standardization can lead to vendor lock-in and complicate network upgrades or expansions. Security concerns associated with highly interconnected and programmable optical networks also present a restraint. The increased automation and remote management capabilities of OXC introduce potential vulnerabilities that must be addressed through robust security protocols and measures, which can add to the overall cost and complexity of deployment. Finally, the rapid pace of technological evolution in the telecommunications sector means that deployed OXC solutions may face obsolescence sooner than anticipated, prompting operators to carefully consider the long-term viability and upgrade paths of their investments.

The Asia-Pacific region, with a particular focus on China, is projected to be a dominant force in the global optical cross connect equipment market. This dominance is fueled by a confluence of factors, including massive investments in telecommunications infrastructure, the rapid deployment of 5G networks, and a strong government push towards digital transformation. China, as the world's largest telecommunications market, is at the forefront of these advancements, with its major telecommunication carriers heavily investing in next-generation optical networks. The sheer scale of its network build-out, encompassing dense urban areas and expansive rural regions, necessitates the deployment of advanced routing and switching solutions like OXC to manage the colossal data traffic generated.

Within the Segments of the market, the Communication application is poised to lead the charge. This segment encompasses the core networking infrastructure for telecommunication providers, including mobile network operators, internet service providers, and backbone network providers. The relentless demand for higher bandwidth, lower latency, and increased network agility to support services like 5G, fiber-to-the-home (FTTH), and cloud connectivity directly translates into a sustained and growing need for OXC equipment. The evolution of these communication networks is intrinsically linked to the capabilities offered by OXC.

Let's delve deeper into why these regions and segments are set to dominate:

Asia-Pacific (APAC) Dominance:

Communication Application Leadership:

Segment of Type: Wavelength Selective Switching (WSXC)

The optical cross connect equipment industry is experiencing significant growth catalysts. The relentless demand for higher bandwidth, driven by the proliferation of 5G networks, cloud computing, and an explosion of data-intensive applications, is a primary driver. The need for increased network agility and dynamic resource allocation to efficiently manage this data flow is paramount. Furthermore, the ongoing expansion of data center infrastructure globally necessitates robust and scalable optical interconnectivity solutions, a role OXC equipment is perfectly suited to fill. The push for network automation and reduced operational costs also encourages the adoption of intelligent, software-controlled OXC systems, making them an attractive investment for network operators seeking to optimize their infrastructure.

This report provides a comprehensive overview of the optical cross connect equipment market, encompassing detailed analysis of market trends, growth drivers, and the challenges that shape its landscape. It offers granular insights into the key regions and countries poised for dominance, particularly highlighting the significant influence of the Asia-Pacific region, with China leading the charge. The report meticulously examines the segmentation of the market by type (FXC, WXC, WSXC) and application (Communication, Light Energy, Other), identifying the Communication segment and Wavelength Selective Switching (WSXC) as key areas of growth. Furthermore, it delves into the leading players within the industry and chronicles significant technological developments and industry milestones. This detailed coverage equips stakeholders with the critical intelligence needed to navigate this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.94% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.94%.

Key companies in the market include Huawei, Sercalo Microtechnology, Optiwave Systems, Fujitsu, 3M, Corning, Sun Telecom, Dawnergy, Shanghai Robay Telecom Technology, YOFC, Hengtong Optic-Electric, FiberHome, ZTT Group, YUDA Communication, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A and volume, measured in K.

Yes, the market keyword associated with the report is "Optical Cross Connect Equipment," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Optical Cross Connect Equipment, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.