1. What is the projected Compound Annual Growth Rate (CAGR) of the Open Storage Open Source Software?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Open Storage Open Source Software

Open Storage Open Source SoftwareOpen Storage Open Source Software by Type (/> File Systems, Object Storage, Block Storage, Others), by Application (/> Public Cloud, Private Cloud, Hybrid Cloud), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

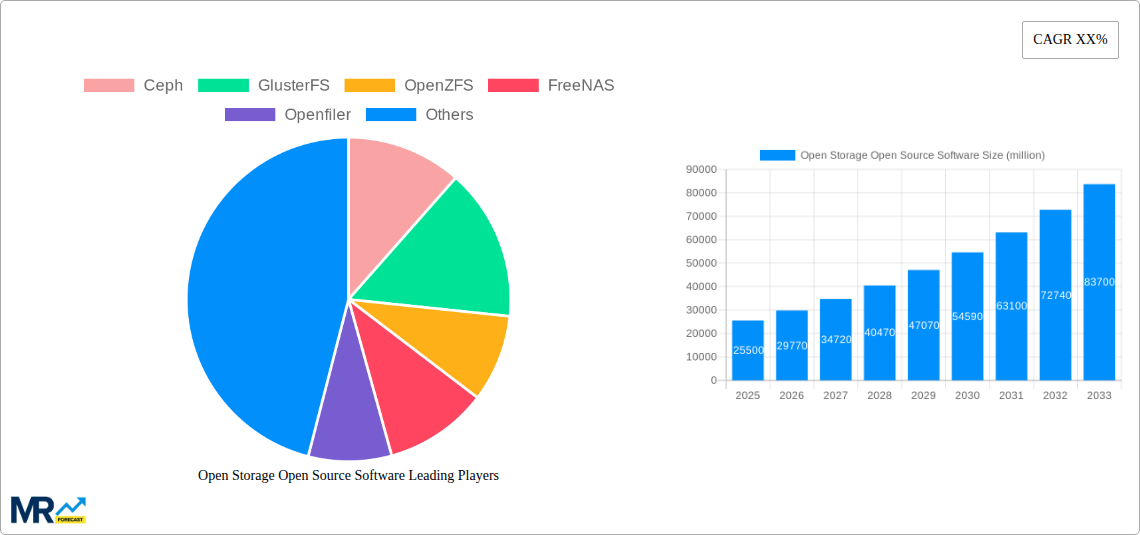

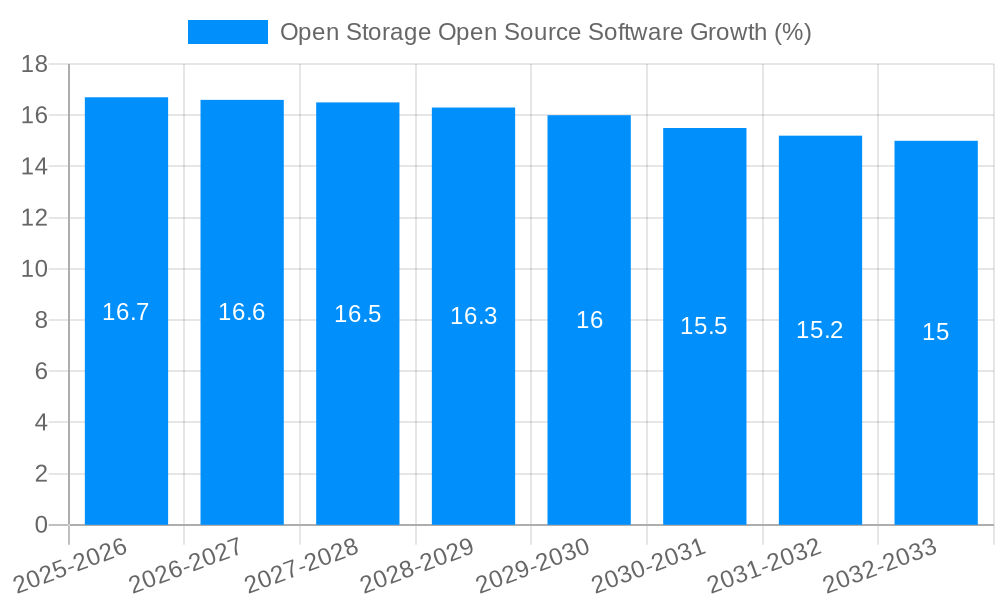

The Open Storage Open Source Software market is poised for substantial expansion, projected to reach an estimated market size of $25,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 16.5% during the forecast period of 2025-2033. This dynamic growth is primarily fueled by the increasing adoption of cloud computing across enterprises, the escalating need for scalable and cost-effective data storage solutions, and the inherent flexibility and customization offered by open-source software. Key drivers include the proliferation of big data analytics, the demand for efficient data management in the age of AI and machine learning, and the desire to avoid vendor lock-in prevalent with proprietary storage systems. The market is experiencing significant traction as organizations seek to optimize their IT infrastructure, reduce operational expenses, and gain greater control over their data storage environments.

The market landscape is segmented across various storage types, with File Systems, Object Storage, and Block Storage leading the charge. Public Cloud, Private Cloud, and Hybrid Cloud deployments are all contributing to the widespread adoption of open-source storage solutions, reflecting the diverse needs of modern businesses. Leading companies like Ceph, GlusterFS, OpenZFS, MinIO, and Scality RING are at the forefront, driving innovation and offering competitive solutions. While the market benefits from strong growth drivers, it faces certain restraints such as the perceived complexity of implementation and management for some organizations, and the need for skilled personnel to deploy and maintain these systems. However, the continuous advancements in features, ease of use, and community support are steadily mitigating these challenges, further solidifying the positive outlook for the open-source storage software market.

The open storage open source software market is poised for remarkable expansion, driven by a confluence of technological advancements and evolving enterprise demands. XXX The projected market valuation in the base year of 2025 is anticipated to reach \$15.3 million, with a robust growth trajectory expected to see it climb to \$58.7 million by the end of the forecast period in 2033. This significant surge is underpinned by several key trends. Firstly, the increasing adoption of cloud-native architectures, particularly in the public and private cloud segments, is creating a substantial demand for flexible, scalable, and cost-effective storage solutions. Open source software, with its inherent adaptability and lack of vendor lock-in, perfectly aligns with these requirements. Secondly, the explosion of data across all industries, from AI and machine learning to IoT and big data analytics, necessitates advanced storage capabilities that can handle massive volumes and diverse types of data efficiently. Open source solutions like Ceph and GlusterFS are proving instrumental in managing these complex data landscapes. Furthermore, the growing emphasis on data security and compliance is also fueling the adoption of open source storage, as organizations seek greater transparency and control over their data infrastructure. The historical period of 2019-2024 witnessed a steady foundational growth, with the market maturing from niche applications to broader enterprise adoption. The base year of 2025 marks a pivotal point, where the market begins to accelerate, fueled by increasingly sophisticated solutions and a deeper understanding of their benefits by businesses. This acceleration is further amplified by the continuous innovation within the open source community, leading to improved performance, enhanced features, and broader ecosystem support. The forecast period of 2025-2033 is characterized by the mainstreaming of open source storage, with its integration becoming standard practice across various industries.

Several powerful forces are collectively propelling the growth of the open storage open source software market. Foremost among these is the undeniable economic advantage offered by open source solutions. Eliminating expensive licensing fees associated with proprietary storage systems allows organizations, particularly small and medium-sized enterprises (SMEs) and even large enterprises looking to optimize costs, to invest more in critical infrastructure and innovation. The inherent flexibility and customizability of open source software are also major catalysts. Businesses can tailor storage solutions to their specific needs, integrating them seamlessly with existing infrastructure and future-proofing their investments. This adaptability is crucial in today's rapidly evolving technological landscape. Moreover, the collaborative nature of open source development fosters rapid innovation and bug fixing. A global community of developers continuously contributes to improving performance, security, and functionality, ensuring that open source storage solutions remain at the forefront of technological advancements. This vibrant ecosystem also provides extensive community support, often rivaling or exceeding that of commercial vendors. Finally, the increasing demand for highly scalable and resilient storage to support big data analytics, AI/ML workloads, and cloud-native applications is a significant driver. Open source solutions like Ceph, HDFS, and MinIO are specifically designed to handle these demanding workloads, offering distributed, fault-tolerant storage architectures.

Despite its burgeoning potential, the open storage open source software market faces several significant challenges and restraints that could temper its growth. One of the primary hurdles is the perception of complexity and the requirement for specialized in-house expertise. Implementing and managing open source storage solutions often demands a deeper understanding of underlying technologies and system administration skills compared to plug-and-play proprietary systems. This can be a barrier for organizations with limited IT resources or technical staff. Secondly, while community support is robust, it can sometimes be fragmented or lack the guaranteed service level agreements (SLAs) offered by commercial vendors. For mission-critical applications, the absence of guaranteed immediate support can be a significant concern, leading some enterprises to opt for more predictable, albeit more expensive, commercial offerings. Another restraint is the ongoing concern regarding the maturity and stability of certain open source projects, particularly newer or less widely adopted ones. While established projects like Ceph and OpenZFS have proven their mettle, organizations may still hesitate to deploy less tested solutions for critical production environments. Furthermore, the integration with existing enterprise systems and the potential for compatibility issues can also pose challenges, requiring careful planning and execution. Lastly, while cost savings are a major advantage, the total cost of ownership (TCO) can be underestimated if implementation, training, and ongoing maintenance costs are not thoroughly accounted for.

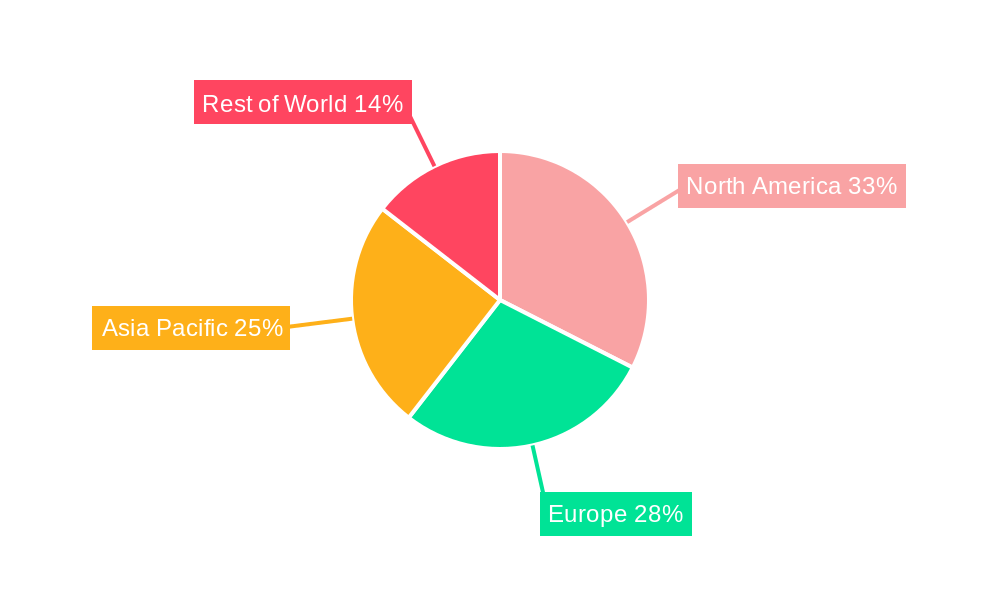

The North America region is poised to be a dominant force in the open storage open source software market, driven by its advanced technological infrastructure, high adoption rates of cloud computing, and a strong presence of innovative technology companies. The United States, in particular, serves as a hub for open source development and adoption, with a significant concentration of companies leveraging these solutions for their data management needs. The region's robust ecosystem of startups and established enterprises actively experimenting with and deploying cutting-edge technologies like AI, big data analytics, and IoT further fuels the demand for scalable and flexible storage.

Within this region, the Object Storage segment is projected to experience the most substantial growth and dominance. The proliferation of unstructured data, including images, videos, logs, and backups, generated by these advanced applications, makes object storage an ideal solution. Solutions like OpenStack Swift, MinIO, and Scality RING offer immense scalability, cost-effectiveness, and durability for storing and retrieving vast amounts of data. The ability of object storage to handle data at petabyte and exabyte scales makes it indispensable for cloud providers, content delivery networks, and big data analytics platforms, all of which are heavily concentrated in North America.

Another segment set to witness significant traction is File Systems, particularly distributed file systems like Ceph and GlusterFS. As enterprises increasingly adopt hybrid and private cloud environments, the need for unified, scalable, and high-performance file storage solutions becomes paramount. These solutions offer a unified namespace, enabling seamless data access across distributed environments, a critical requirement for modern data-intensive workloads. The strong presence of research institutions and high-performance computing (HPC) facilities in North America also contributes to the demand for advanced file system solutions.

The Public Cloud application segment will also be a major driver of market dominance. Cloud service providers are heavily invested in open source storage technologies to offer cost-effective and scalable storage services to their customers. The inherent scalability and flexibility of open source solutions allow cloud providers to efficiently manage their vast storage infrastructures and offer a wide range of storage tiers and services. This creates a virtuous cycle where the growth of public cloud adoption directly fuels the growth of the open storage open source software market.

The Industry Developments that will underscore this dominance include the continued evolution of distributed storage architectures for enhanced resilience and performance, the integration of open source storage with container orchestration platforms like Kubernetes, and the increasing focus on software-defined storage (SDS) solutions that leverage open source principles for greater agility and control. The commitment of major cloud providers in North America to adopting and contributing to open source storage projects further solidifies the region's leading position.

The open storage open source software industry is propelled by potent growth catalysts. The escalating volume and complexity of data, driven by big data analytics, AI, and IoT, create an insatiable demand for scalable and cost-effective storage solutions, which open source excels at providing. The increasing adoption of cloud-native architectures, both public and private, necessitates flexible and adaptable storage that open source software inherently offers. Furthermore, the drive for cost optimization in IT infrastructure, coupled with the elimination of vendor lock-in, makes open source an attractive alternative to expensive proprietary systems. The continuous innovation cycle within the open source community, leading to enhanced performance, security, and features, also acts as a significant catalyst, ensuring solutions remain competitive and relevant.

This comprehensive report offers an in-depth analysis of the open storage open source software market, providing crucial insights for stakeholders. It meticulously examines market dynamics, including historical trends from 2019-2024, establishing a solid foundation, and forecasting future growth from 2025-2033, with 2025 as the base year. The report dissects key drivers such as cost-effectiveness, flexibility, and community-driven innovation, while also addressing critical challenges like perceived complexity and support concerns. It identifies dominant regions and segments, particularly highlighting North America and the Object Storage segment, and outlines significant developments, providing a roadmap of technological advancements. This analysis is designed to empower businesses with the knowledge to make informed decisions regarding their storage strategies, leveraging the power and potential of open source solutions to meet their evolving data management needs.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Ceph, GlusterFS, OpenZFS, FreeNAS, Openfiler, OpenStack Swift, MinIO, Scality RING, MooseFS, Hadoop Distributed File System (HDFS), Apache Cassandra, Apache HBase, Apache Kafka, Apache Spark, Elasticsearch.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Open Storage Open Source Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Open Storage Open Source Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.